|

市场调查报告书

商品编码

1750572

造影剂市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Contrast Media Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

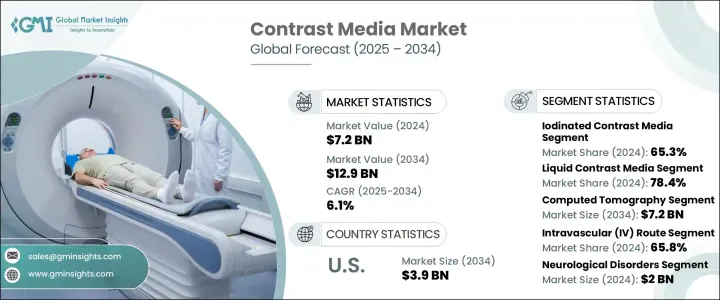

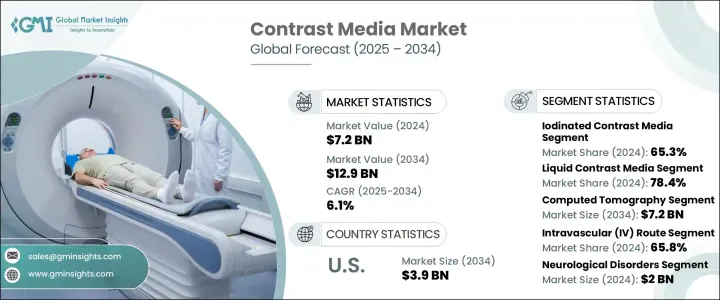

2024年,全球造影剂市场规模达72亿美元,预计年复合成长率为6.1%,到2034年将达到129亿美元,这得益于人们越来越依赖医学影像来诊断和管理各种慢性疾病。随着对精准早期诊断的需求不断增长,MRI、CT、X光和超音波等影像技术也日益发展壮大,所有这些技术都高度依赖造影剂来提高清晰度和细节。医院和诊断中心进行的放射学检查比以往任何时候都多,由于人口增长和慢性病发病率上升,住院和门诊病人数量也在增加。

增强成像有助于识别组织、血管和器官中的细微异常。这对于早期发现并制定更有效的治疗方案尤其重要。先进成像平台的开发和人工智慧的整合也正在塑造这一格局。现代人工智慧驱动的放射学平台能够实现精准的剂量管理和优化的工作流程,在保障病人安全的同时,也能获得更好的诊断结果。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 72亿美元 |

| 预测值 | 129亿美元 |

| 复合年增长率 | 6.1% |

2024年,碘造影剂以65.3%的市占率领先市场。其在CT和X射线检查中的广泛应用,为其强劲增长提供了支撑。其多功能性使其可用于多种诊断方法,包括血管摄影和泌尿道摄影。碘的密度可增强对比度和清晰度,这对于清晰准确的成像结果至关重要。这种可见度的提高使诊断和治疗计划更加可靠。碘基造影剂的特性与标准诊断影像中使用的能量水平高度匹配,使其成为临床环境中的首选。

2024年,液体造影剂市场占有78.4%的份额。其广泛应用主要归功于其实际优势——给药方法简便、吸收迅速以及有效可视化内部结构。这些造影剂常用于CT扫描等高需求诊断程序,在这些程序中,速度、精确度和影像清晰度至关重要。它们与各种成像系统的兼容性以及快速在血液中循环的能力,使其成为需要即时准确诊断资料的临床医生的首选。无论是在急诊或门诊,液体造影剂的可靠性和高效性都巩固了其作为现代诊断工作流程中首选介质的地位。

2024年,美国显影剂市场规模达23亿美元,预计2034年将达39亿美元。这一增长趋势主要源于慢性病发病率的上升,尤其是在老年人口中,癌症、心血管疾病和神经退化性疾病等疾病需要定期进行高精度成像。 MRI和CT技术在筛检和监测中的应用日益广泛,推动了对造影剂的稳定需求。此外,包括人工智慧驱动的成像平台在内的成像技术创新,提高了造影剂的有效性,确保了最佳剂量和更佳的影像撷取效果。

市场上的知名公司包括 TAEJOON Pharmaceutical、GE HealthCare Technologies、Livealth Biopharma、Bracco、Unijules Life Sciences、Guerbet、Trivitron Healthcare、nanoPET Pharma、Senochemia Pharmazeutika、Bayer、Jodas Expoim、JB Chemicals & Pharmaceticals、Fresenius、Bayer、Jodas Expoim、JB Chemicals & Pharmaceticals、Fresenius、Bayer、Jodasaim、JB为了巩固市场地位,主要参与者正在投资研发安全性更高的下一代造影剂。他们也与影像设备製造商结成策略联盟,并扩大全球分销网络。一些公司正在探索人工智慧整合平台,以支援精准成像并减少造影剂剂量。此外,有针对性的行销、监管部门的批准以及在新兴市场的扩张有助于他们获得竞争优势,并促进跨地区的收入成长。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 造影剂监理审批不断增加

- 放射线检查的成长

- 慢性病发生率激增

- 微创手术增多

- 产业陷阱与挑战

- 存在严格的法规和频繁的产品召回

- 与造影剂相关的过敏反应和副作用

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 各国应对措施

- 对产业的影响

- 供应方影响(製造成本)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(消费者成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(製造成本)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 碘造影剂

- 钆基造影剂

- 微泡造影剂

- 钡基造影剂

第六章:市场估计与预测:依形式,2021 年至 2034 年

- 主要趋势

- 液体

- 粉末

- 其他形式

第七章:市场估计与预测:按模式,2021 年至 2034 年

- 主要趋势

- X射线

- 电脑断层扫描(CT)

- 磁振造影(MRI)

- 超音波

第八章:市场估计与预测:依管理路线,2021 年至 2034 年

- 主要趋势

- 血管内途径

- 口服途径

- 直肠途径

- 其他给药途径

第九章:市场估计与预测:按适应症,2021 年至 2034 年

- 主要趋势

- 神经系统疾病

- 癌症

- 心血管疾病

- 胃肠道疾病

- 肌肉骨骼疾病

- 肾臟疾病

第 10 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 放射学

- 介入放射学

- 介入性心臟病学

第 11 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院、诊所和 ASC

- 诊断影像中心

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十三章:公司简介

- Bayer

- Bracco

- GE HealthCare Technologies

- Guerbet

- Fresenius

- iMAX Diagnostic Imaging

- JB Chemicals & Pharmaceuticals

- Jodas Expoim

- Lantheus

- Livealth Biopharma

- nanoPET Pharma

- Senochemia Pharmazeutika

- TAEJOON Pharmaceutical

- Trivitron Healthcare

- Unijules Life Sciences

The Global Contrast Media Market was valued at USD 7.2 billion in 2024 and is estimated to grow at a CAGR of 6.1% to reach USD 12.9 billion by 2034, driven by the increased reliance on medical imaging to diagnose and manage a wide range of chronic health conditions. As the need for accurate and early diagnosis continues to rise, so do imaging techniques such as MRI, CT, X-ray, and ultrasound-all of which depend heavily on contrast agents to improve clarity and detail. Hospitals and diagnostic centers are performing more radiological procedures than ever, with inpatient and outpatient volumes increasing due to a growing population and the higher incidence of chronic illness.

Contrast-enhanced imaging is useful in identifying subtle abnormalities in tissues, blood vessels, and organs. This is especially critical in early detection leads to more effective treatment plans. The development of advanced imaging platforms and the integration of artificial intelligence are also shaping the landscape. Modern AI-driven radiology platforms enable precise dosage management and optimized workflow, supporting better diagnostic outcomes while maintaining patient safety.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7.2 Billion |

| Forecast Value | $12.9 Billion |

| CAGR | 6.1% |

In 2024, iodinated contrast agents led the market with a 65.3% share. Their strong uptake is supported by widespread application in CT and X-ray procedures. Their versatility allows use across several diagnostic methods, including angiography and urography. The density of iodine enhances contrast and definition, crucial for clear and precise imaging results. This improved visibility allows for more confident diagnosis and treatment planning. The properties of iodine-based agents align well with the energy levels used in standard diagnostic imaging, making them the preferred choice across clinical settings.

The liquid contrast media segment held 78.4% share in 2024. Their widespread use is largely attributed to the practical advantages they offer-simple administration methods, rapid absorption, and effective visualization of internal structures. These agents are routinely used in high-demand diagnostic procedures like CT scans, where speed, precision, and image clarity are paramount. Their compatibility with various imaging systems and ability to quickly circulate through the bloodstream make them a go-to option for clinicians needing immediate and accurate diagnostic data. In both emergency and outpatient settings, the reliability and efficiency of liquid contrast media have solidified their position as the preferred medium in modern diagnostic workflows.

United States Contrast Media Market reached USD 2.3 billion in 2024 and is forecasted to reach USD 3.9 billion by 2034. This upward trajectory is propelled by a rise in chronic disease incidence, particularly within the aging population, where conditions like cancer, cardiovascular disease, and neurodegenerative disorders demand regular, high-precision imaging. Increasing use of MRI and CT technologies for both screening and monitoring drives steady demand for contrast-enhanced imaging agents. Additionally, innovation in imaging technologies, including AI-driven imaging platforms, makes contrast agents more effective, ensuring optimal dosing and better image acquisition.

Prominent companies in the market include TAEJOON Pharmaceutical, GE HealthCare Technologies, Livealth Biopharma, Bracco, Unijules Life Sciences, Guerbet, Trivitron Healthcare, nanoPET Pharma, Senochemia Pharmazeutika, Bayer, Jodas Expoim, J.B. Chemicals & Pharmaceuticals, Fresenius, Lantheus, and iMAX Diagnostic Imaging. To strengthen their market presence, key players are investing in R&D for next-gen contrast agents with improved safety profiles. They are also forming strategic alliances with imaging equipment manufacturers and expanding their global distribution networks. Several companies are exploring AI-integrated platforms to support precision imaging and reduce contrast dosage. Moreover, targeted marketing, regulatory approvals, and expansion in emerging markets help them secure a competitive advantage and boost revenue growth across geographies.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing regulatory approvals of contrast media

- 3.2.1.2 Growth in radiological examinations

- 3.2.1.3 Surging incidence of chronic diseases

- 3.2.1.4 Increase in minimally invasive procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Presence of stringent regulations and frequent product recalls

- 3.2.2.2 Allergic reactions and side-effects associated with contrast media

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.2.1.1.1 Price volatility in key materials

- 3.5.2.1.1.2 Supply chain restructuring

- 3.5.2.1.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (cost to consumers)

- 3.5.2.2.1.1 Price transmission to end markets

- 3.5.2.2.1.2 Market share dynamics

- 3.5.2.2.1.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Iodinated contrast media

- 5.3 Gadolinium-based contrast media

- 5.4 Microbubble contrast media

- 5.5 Barium-based contrast media

Chapter 6 Market Estimates and Forecast, By Form, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Liquid

- 6.3 Powder

- 6.4 Other forms

Chapter 7 Market Estimates and Forecast, By Modality, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 X-ray

- 7.3 Computed tomography (CT)

- 7.4 Magnetic resonance imaging (MRI)

- 7.5 Ultrasound

Chapter 8 Market Estimates and Forecast, By Route of Administration, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Intravascular route

- 8.3 Oral route

- 8.4 Rectal route

- 8.5 Other routes of administration

Chapter 9 Market Estimates and Forecast, By Indication, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Neurological disorders

- 9.3 Cancer

- 9.4 Cardiovascular disease

- 9.5 Gastrointestinal disorders

- 9.6 Musculoskeletal disorders

- 9.7 Nephrological disorders

Chapter 10 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Radiology

- 10.3 Interventional radiology

- 10.4 Interventional cardiology

Chapter 11 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 Hospitals, clinics, and ASCs

- 11.3 Diagnostic imaging centers

Chapter 12 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 U.S.

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Spain

- 12.3.5 Italy

- 12.3.6 Netherlands

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 Middle East and Africa

- 12.6.1 Saudi Arabia

- 12.6.2 South Africa

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Bayer

- 13.2 Bracco

- 13.3 GE HealthCare Technologies

- 13.4 Guerbet

- 13.5 Fresenius

- 13.6 iMAX Diagnostic Imaging

- 13.7 J.B. Chemicals & Pharmaceuticals

- 13.8 Jodas Expoim

- 13.9 Lantheus

- 13.10 Livealth Biopharma

- 13.11 nanoPET Pharma

- 13.12 Senochemia Pharmazeutika

- 13.13 TAEJOON Pharmaceutical

- 13.14 Trivitron Healthcare

- 13.15 Unijules Life Sciences