|

市场调查报告书

商品编码

1750574

OTC干眼液市场机会、成长动力、产业趋势分析及2025-2034年预测OTC Dry Eye Drops Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

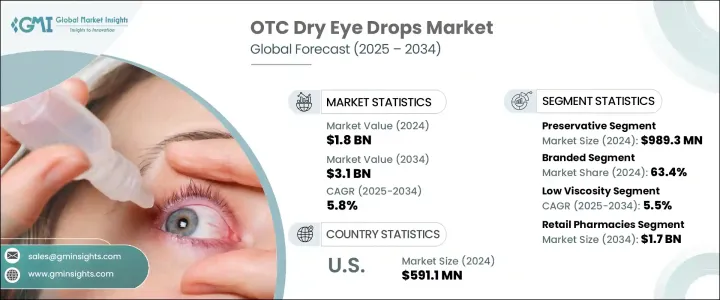

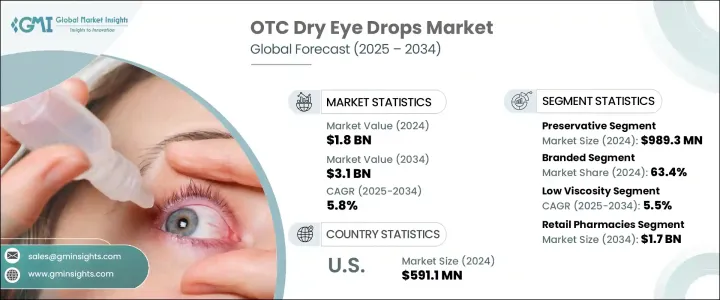

2024年,全球非处方干眼药水市场规模达18亿美元,预计2034年将以5.8%的复合年增长率成长,达到31亿美元。这主要得益于干眼症盛行率的上升。由于人们使用智慧型手机、电脑和平板电脑的时间增加等因素,干眼症正变得越来越普遍。此外,空气污染、灰尘以及长时间暴露在空调环境中等环境因素也会导致干眼症状恶化。随着人们,尤其是年轻人和中年人,眼睛不适的发生频率越来越高,对非处方干眼产品的需求也日益增长。

推动市场成长的另一个关键因素是消费者转向自我照护,越来越多的消费者选择非处方药 (OTC) 来管理眼部健康。随着人们越来越注重健康,并意识到自身健康问题,许多人更倾向于使用非处方药 (OTC) 来缓解干眼症状,从而减少就医需求。非处方眼药水透过零售连锁药局和线上平台的普及,进一步增强了这一趋势。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 31亿美元 |

| 复合年增长率 | 5.8% |

2024年,含防腐剂产品市场价值达9.893亿美元,这得益于其价格实惠、供应充足且效果显着。这些产品使用苯扎氯铵(BAK)等防腐剂来防止多剂量容器中的微生物生长,使其成为许多人的首选。其较长的保质期、便捷的使用方式和较低的价格使其对消费者特别有吸引力,并推动了其广泛应用。由于消费者信任度和品牌忠诚度,知名品牌继续主导这一市场,许多消费者选择含防腐剂的解决方案,是因为他们熟悉这些产品,并且便携式多剂量包装也十分方便。

依产品类型划分,品牌药占最大市场份额,2024 年占 63.4%。领先的製药公司在非处方干眼药水市场保持着强劲的势头,得益于数十年来的信任和认可。品牌产品更可靠、更有效的认知极大地提升了其受欢迎程度,尤其受到患有慢性干眼症的消费者的青睐。这些产品通常能够满足特定需求,例如不含防腐剂的方案,从而吸引广泛的受众。

2024年,美国非处方干眼药水市场占据37.4%的市场份额,这得益于数位设备的广泛使用,越来越多的人长时间面对萤幕,导致眼疲劳和干眼症状加剧。因此,人们对干眼症的认识不断提高,促使更多人寻求非处方药 (OTC) 来缓解不适。美国市场受益于几家主要製药公司的存在,这些公司在非处方干眼产品领域占据主导地位。这些公司利用完善的分销网络和零售合作伙伴关係,使产品能够透过实体店和线上平台广泛销售。

全球非处方干眼液市场的主要参与者包括博士伦健康公司、乐敦製药、爱尔康、参天製药、Thea Pharmaceuticals、Prestige Consumer Healthcare、Similasan Corporation、URSAPHARM Arzneimittel、OASIS、NovaBay Pharmaceuticals、Jadran-Galenski Laboratorij、carebbcom、Hanx 或 Healthcare、Scope、ScUm.为了加强市场占有率,非处方干眼液市场的公司正专注于扩大产品组合,以满足多样化的消费者需求。他们投资研发,以创造更有效的配方,例如不含防腐剂和速效产品。此外,与零售药局和电子商务平台的策略合作伙伴关係正在帮助公司提高可及性。有效的行销和品牌建立对于维持客户忠诚度也至关重要,尤其是在消费者对用于自我照顾的产品越来越挑剔的情况下。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 干眼症盛行率上升

- 提高意识和自我保健习惯

- 增加萤幕时间和数位装置的使用时间

- 产品配方的技术进步

- 产业陷阱与挑战

- 副作用和过敏反应

- 替代疗法的可用性

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 技术格局

- 核心技术

- 邻近技术

- 定价分析

- 未来市场趋势

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 年至 2034 年

- 主要趋势

- 防腐剂

- 不含防腐剂

第六章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 品牌

- 泛型

第七章:市场估计与预测:按黏度,2021 年至 2034 年

- 主要趋势

- 低黏度

- 高黏度

第八章:市场估计与预测:按配销通路,2021 年至 2034 年

- 主要趋势

- 零售药局

- 网路药局

- 其他分销管道

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AbbVie

- Alcon

- Bausch Health Companies

- Jadran-Galenski Laboratorij

- Medicom Healthcare

- NovaBay Pharmaceuticals

- OASIS

- Prestige Consumer Healthcare

- Rohto Pharmaceutical

- Santen Pharmaceutical

- Similasan Corporation

- Scope Eyecare

- Thea Pharmaceuticals

- URSAPHARM Arzneim

The Global OTC Dry Eye Drops Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 3.1 billion by 2034, driven by the rising prevalence of dry eye syndrome, which is becoming more common due to factors such as increased screen time from smartphones, computers, and tablets. Additionally, environmental elements like air pollution, dust, and extended exposure to air-conditioned spaces are contributing to the worsening of dry eye symptoms. As people, especially younger and middle-aged groups, experience more frequent eye discomfort, the demand for OTC dry eye products is growing.

Another key factor supporting the market's growth is the shift toward self-care, with more consumers opting for OTC remedies to manage their eye health. As individuals become more health-conscious and aware of their conditions, many prefer to address their dry eye symptoms with OTC solutions, reducing the need for medical consultations. This trend is further amplified by the accessibility of OTC eye drops through retail pharmacy chains and online platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 5.8% |

The preservative-containing segment was valued at USD 989.3 million in 2024, due to its affordability, availability, and effectiveness. These products use preservatives like benzalkonium chloride (BAK) to prevent microbial growth in multi-dose containers, making them a preferred choice for many. Their extended shelf life, ease of use, and lower price point make them particularly attractive to consumers, driving widespread adoption. Well-established brands continue to dominate this segment due to consumer trust and brand loyalty, with many customers choosing preservative-based solutions because of familiarity and the convenience of portable, multi-dose packaging.

Based on product types, the branded segment holds the largest market share, capturing 63.4% in 2024. Leading pharmaceutical companies maintain a strong presence in the OTC dry eye drops market, benefitting from decades of trust and recognition. The perception of branded products being more reliable and effective contributes significantly to their popularity, especially for consumers suffering from chronic dry eye conditions. These products often cater to specific needs, such as preservative-free solutions, making them appealing to a wide audience.

U.S. OTC Dry Eye Drops Market held 37.4% share in 2024, driven by the widespread use of digital devices, with more people spending prolonged hours on screens, leading to a rise in eye strain and dry eye symptoms. As a result, there is a growing awareness of the condition, prompting more individuals to seek over-the-counter (OTC) solutions to manage the discomfort. U.S. market benefits from the presence of several key pharmaceutical companies, which dominate the OTC dry eye product landscape. These companies leverage well-established distribution networks and retail partnerships, making products widely accessible through brick-and-mortar stores and online platforms.

Key players in the Global OTC Dry Eye Drops Market include Bausch Health Companies, Rohto Pharmaceutical, Alcon, Santen Pharmaceutical, Thea Pharmaceuticals, Prestige Consumer Healthcare, Similasan Corporation, URSAPHARM Arzneimittel, OASIS, NovaBay Pharmaceuticals, Jadran-Galenski Laboratorij, Medicom Healthcare, Scope Eyecare, and AbbVie. To strengthen their market presence, companies in the OTC Dry Eye Drops Market are focusing on expanding product portfolios to address diverse consumer needs. They invest in research and development to create more effective formulations, such as preservative-free and fast-acting products. Furthermore, strategic partnerships with retail pharmacies and e-commerce platforms are helping companies enhance accessibility. Effective marketing and branding efforts are also crucial in maintaining customer loyalty, especially as consumers become more discerning about the products they use for self-care.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of dry eye disease

- 3.2.1.2 Growing awareness and self-care practices

- 3.2.1.3 Increased screen time and digital device usage

- 3.2.1.4 Technological advancements in product formulations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects and allergic reactions

- 3.2.2.2 Availability of alternative treatments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.3.1 Japan

- 3.4.3.2 China

- 3.4.3.3 India

- 3.4.3.4 Australia

- 3.5 Technology landscape

- 3.5.1 Core technologies

- 3.5.2 Adjacent technologies

- 3.6 Pricing analysis

- 3.7 Future market trends

- 3.8 Trump administration tariffs

- 3.8.1 Impact on trade

- 3.8.1.1 Trade volume disruptions

- 3.8.1.2 Retaliatory measures

- 3.8.2 Impact on the industry

- 3.8.2.1 Supply-side impact

- 3.8.2.1.1 Price volatility in key materials

- 3.8.2.1.2 Supply chain restructuring

- 3.8.2.1.3 Production cost implications

- 3.8.2.2 Demand-side impact (selling price)

- 3.8.2.2.1 Price transmission to end markets

- 3.8.2.2.2 Market share dynamics

- 3.8.2.2.3 Consumer response patterns

- 3.8.2.1 Supply-side impact

- 3.8.3 Key companies impacted

- 3.8.4 Strategic industry responses

- 3.8.4.1 Supply chain reconfiguration

- 3.8.4.2 Pricing and product strategies

- 3.8.4.3 Policy engagement

- 3.8.5 Outlook and future considerations

- 3.8.1 Impact on trade

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Preservative

- 5.3 Preservative-free

Chapter 6 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Branded

- 6.3 Generics

Chapter 7 Market Estimates and Forecast, By Viscosity, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Low viscosity

- 7.3 High viscosity

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Retail pharmacies

- 8.3 Online pharmacies

- 8.4 Other distribution channels

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Alcon

- 10.3 Bausch Health Companies

- 10.4 Jadran-Galenski Laboratorij

- 10.5 Medicom Healthcare

- 10.6 NovaBay Pharmaceuticals

- 10.7 OASIS

- 10.8 Prestige Consumer Healthcare

- 10.9 Rohto Pharmaceutical

- 10.10 Santen Pharmaceutical

- 10.11 Similasan Corporation

- 10.12 Scope Eyecare

- 10.13 Thea Pharmaceuticals

- 10.14 URSAPHARM Arzneim