|

市场调查报告书

商品编码

1750575

住宅太阳能发电机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Residential Solar Generator Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

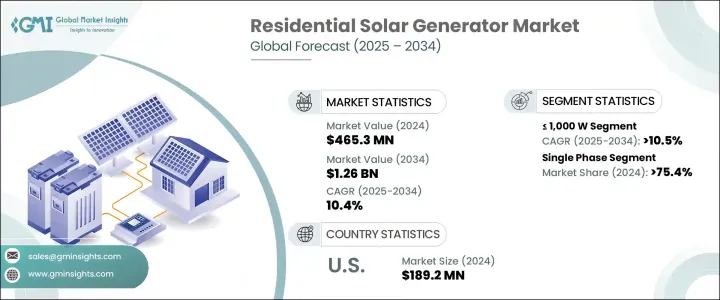

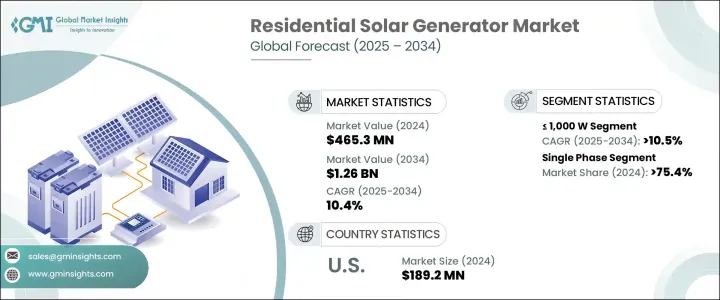

2024年,全球住宅太阳能发电机市场规模达4.653亿美元,预计到2034年将以10.4%的复合年增长率成长,达到12.6亿美元。这得益于清洁再生能源解决方案需求的不断增长以及居民环保意识的不断增强。随着全球能源结构向永续能源转型,太阳能发电机正成为住宅应用的首选。能源独立的推动,加上电网系统频繁波动和断电事件的增多,正在加速这一转变。锂离子电池和固态电池技术的持续改进,以及能源管理系统在家庭中的集成,正在增强住宅太阳能解决方案的吸引力。这些进步使太阳能发电机更加高效、耐用且用户友好。

政府的减排政策和鼓励再生能源应用的税收优惠政策发挥着至关重要的作用。智慧家庭系统的持续普及优先考虑节能,并有助于市场扩张。即使面临生产成本上升和进口零件关税等挑战,由于国内製造业和产业创新日益受到重视,长期前景依然强劲。家用太阳能发电机也因其能够降低电费和碳足迹而受到重视,对于希望采用更清洁能源的房主来说,这是一项相当吸引人的投资。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.653亿美元 |

| 预测值 | 12.6亿美元 |

| 复合年增长率 | 10.4% |

额定功率在 1,000 瓦以上至 2,000 瓦之间的发电机在 2024 年创造了 1.5 亿美元的收入,反映出它们在住宅环境中日益增长的重要性。这些中檔系统在经常断电的地区尤其受欢迎,它们为房主提供了可靠且高效的备用电源,而无需进行大规模的基础设施升级。它们体积小巧,输出功率足以满足基本电器的需求,使其成为中小型住宅的理想选择。随着消费者寻求兼顾电力容量和便携性的经济高效的能源解决方案,这一细分市场将继续受到青睐。

三相太阳能发电机市场预计将经历强劲成长,预计2034年复合年增长率将达到10%。这一趋势源于对能够处理更大电力负载并与再生能源框架无缝整合的系统日益增长的需求。随着越来越多的家庭安装太阳能板、电动车充电站和能源管理系统,对三相配置的需求也将随之成长。这些发电机旨在支援高效的能源使用,使其成为智慧家庭和大型住宅环境中不可或缺的能源,因为稳定性和可扩展性至关重要。

2024年,美国住宅太阳能发电机市场规模达1.892亿美元,这标誌着全球最发达的能源市场之一——美国——正展现出强劲的发展势头。随着极端天气事件和电网基础设施老化导致的停电事件日益增多,房主比以往任何时候都更加重视能源安全。这种转变鼓励人们采用太阳能备用系统,不仅能提供可靠的离网供电,还能实现长期节能。美国政府推出的税收抵免、退税和清洁能源计画资助等措施正在加速市场渗透,尤其是在电费高昂、停电频繁的州。

EcoFlow、Powerenz、Jackery、GROWATT、Bluetti、Nature's Generator、Inergy、HomeGrid、Aton Solar、PowerOak、Anern、Renogy、Humless、ACOPOWER、Milesolar、Goal Zero、Generac Power Systems、Lion Energy、Anker 和 OUPES 等公司正在巩固部署策略倡议,以巩固其市场地位。这些措施包括开发高容量可携式设备、拓展电商管道、利用智慧电池创新以及增强客户服务网路。许多品牌专注于扩大分销合作伙伴关係,并提供针对不同住宅需求的客製化能源解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 策略倡议

- 公司市占率分析

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:依产能,2021 - 2034 年

- 主要趋势

- ≤ 1,000 瓦

- > 1,000 瓦 - 2,000 瓦

- > 2,000 瓦 - 3,000 瓦

- > 3,000 瓦

第六章:市场规模及预测:依阶段,2021 - 2034

- 主要趋势

- 单相

- 三相

第七章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 义大利

- 波兰

- 荷兰

- 奥地利

- 法国

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 菲律宾

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 埃及

- 奈及利亚

- 以色列

- 拉丁美洲

- 巴西

- 智利

- 墨西哥

第八章:公司简介

- ACOPOWER

- Anern

- Anker

- Aton Solar

- Bluetti

- EcoFlow

- Generac Power Systems

- Goal Zero

- GROWATT

- HomeGrid

- Humless

- Inergy

- Jackery

- Lion Energy

- Milesolar

- Nature's Generator

- OUPES

- Powerenz

- PowerOak

- Renogy

The Global Residential Solar Generator Market was valued at USD 465.3 million in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 1.26 billion by 2034, driven by the rising demand for clean, renewable energy solutions and increasing environmental awareness among homeowners. As the world shifts toward more sustainable energy options, solar generators are becoming a top choice for residential applications. The push for energy independence, along with the frequent instability in grid systems and increasing power disruptions, is accelerating this shift. Ongoing improvements in lithium-ion and solid-state battery technologies, as well as the integration of energy management systems in households, are enhancing the appeal of residential solar solutions. These advancements make solar generators more efficient, durable, and user-friendly.

Government policies focused on emission reductions and tax incentives for renewable adoption play a critical role. The ongoing adoption of smart home systems prioritizes energy savings and contributes to market expansion. Even with challenges like rising production costs and tariffs on imported components, the long-term outlook remains strong due to a growing focus on domestic manufacturing and innovation in the sector. Residential solar generators are also valued for their ability to reduce electricity bills and lower carbon footprints, making them an attractive investment for homeowners aiming to adopt cleaner energy sources.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $465.3 Million |

| Forecast Value | $1.26 Billion |

| CAGR | 10.4% |

Generators with power ratings between >1,000 W and 2,000 W generated USD 150 million in 2024, reflecting their growing importance in residential settings. These mid-range systems are particularly favored in areas facing recurrent power interruptions, offering homeowners a dependable and efficient backup power source without requiring significant infrastructure upgrades. Their compact size, combined with sufficient output for essential appliances, makes them ideal for small to medium-sized homes. This segment continues to gain traction as consumers seek cost-effective energy solutions that balance power capacity and portability.

The three-phase solar generator segment is set to experience robust growth, with projections indicating a CAGR of 10% through 2034. This trend is driven by a rising need for systems capable of handling larger electrical loads and integrating seamlessly with renewable energy frameworks. As more homes incorporate solar panels, electric vehicle charging stations, and energy management systems, the demand for three-phase configurations will grow. These generators are designed to support high-efficiency energy usage, making them essential in smart homes and larger residential setups where stability and scalability are crucial.

United States Residential Solar Generator Market was valued at USD 189.2 million in 2024, signaling strong momentum in one of the world's most advanced energy markets. With increasing power outages caused by extreme weather events and aging grid infrastructure, homeowners prioritize energy security more than ever. This shift encourages the adoption of solar-powered backup systems that provide off-grid reliability and long-term savings. U.S. government initiatives such as tax credits, rebates, and funding for clean energy projects are accelerating market penetration, particularly in states with high electricity costs and frequent outages.

Companies such as EcoFlow, Powerenz, Jackery, GROWATT, Bluetti, Nature's Generator, Inergy, HomeGrid, Aton Solar, PowerOak, Anern, Renogy, Humless, ACOPOWER, Milesolar, Goal Zero, Generac Power Systems, Lion Energy, Anker, and OUPES are deploying strategic initiatives to secure their market position. These include developing high-capacity, portable units, expanding e-commerce channels, leveraging smart battery innovations, and enhancing customer service networks. Many brands focus on expanding distribution partnerships and offering customizable energy solutions tailored to diverse residential needs.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiatives

- 4.4 Company market share analysis, 2024

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 ≤ 1,000 W

- 5.3 > 1,000 W - 2,000 W

- 5.4 > 2,000 W - 3,000 W

- 5.5 > 3,000 W

Chapter 6 Market Size and Forecast, By Phase, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Single phase

- 6.3 Three phase

Chapter 7 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 Italy

- 7.3.3 Poland

- 7.3.4 Netherlands

- 7.3.5 Austria

- 7.3.6 France

- 7.3.7 Spain

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Australia

- 7.4.3 India

- 7.4.4 Japan

- 7.4.5 South Korea

- 7.4.6 Philippines

- 7.5 Middle East & Africa

- 7.5.1 Saudi Arabia

- 7.5.2 UAE

- 7.5.3 South Africa

- 7.5.4 Egypt

- 7.5.5 Nigeria

- 7.5.6 Israel

- 7.6 Latin America

- 7.6.1 Brazil

- 7.6.2 Chile

- 7.6.3 Mexico

Chapter 8 Company Profiles

- 8.1 ACOPOWER

- 8.2 Anern

- 8.3 Anker

- 8.4 Aton Solar

- 8.5 Bluetti

- 8.6 EcoFlow

- 8.7 Generac Power Systems

- 8.8 Goal Zero

- 8.9 GROWATT

- 8.10 HomeGrid

- 8.11 Humless

- 8.12 Inergy

- 8.13 Jackery

- 8.14 Lion Energy

- 8.15 Milesolar

- 8.16 Nature's Generator

- 8.17 OUPES

- 8.18 Powerenz

- 8.19 PowerOak

- 8.20 Renogy