|

市场调查报告书

商品编码

1750576

住宅暖气设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Residential Heating Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

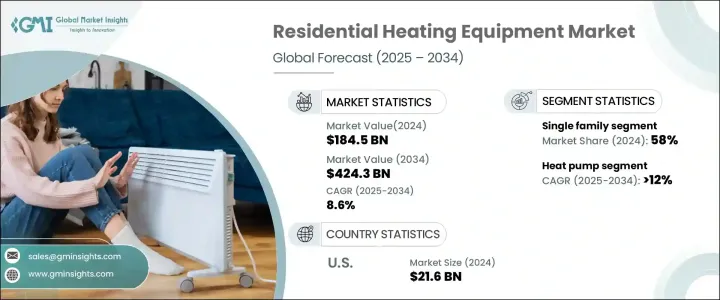

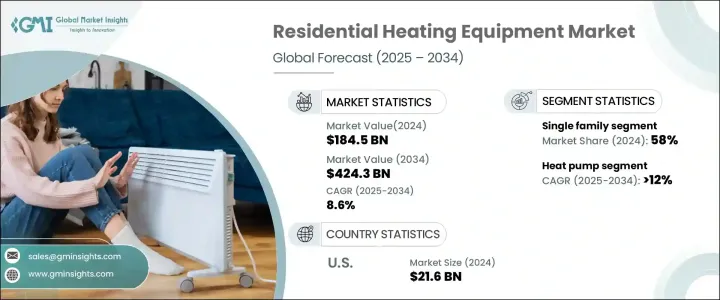

2024年,全球住宅暖气设备市场规模达1,845亿美元,预计到2034年将以8.6%的复合年增长率成长,达到4,243亿美元。这得益于消费者对能源效率和环境永续性的认识不断提高,促使他们采用先进环保的暖气系统。世界各国政府正在设定碳中和目标,并实施政策鼓励房主投资节能解决方案,从而促进智慧永续家庭供暖的转型。城市住房开发和对降低能源消耗的持续关注推动了高效供暖技术的采用。此外,将先进的电热泵整合到混合加热系统中,有助于住宅领域的可持续减排。

美国各地极端寒流的频率和强度不断增加,使得可靠的住宅暖气系统不再只是一种偏好,而成为一种必需品。为此,越来越多的房主开始采用先进的暖气技术,以确保无论外部条件如何,室内温度都能保持恆定。同时,物联网系统和智慧恆温器等智慧控制系统的集成,使用户能够更精确地管理能源使用。这些创新技术帮助家庭减少不必要的供暖,不仅减少了每月的水电费,也符合更广泛的永续发展目标。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1845亿美元 |

| 预测值 | 4243亿美元 |

| 复合年增长率 | 8.6% |

预计到2034年,热泵住宅暖气设备市场的复合年增长率将达到12%。对节能解决方案日益增长的需求,加上政府的利多政策,将推动住宅热泵的普及。持续的技术发展将提高其运作效率,并促进环保实践。市场细分为单户住宅和多户住宅应用。

预计到2034年,单户住宅暖气设备市场将以8%的复合年增长率推动业务成长,到2024年将占据58%的市场份额。随着客製化解决方案日益增长的需求,以满足多样化的供暖需求,产品的采用率也将不断提升。此外,远端监控系统的整合、预测性维护和流程优化也将推动产业前景。

2024年,美国住宅暖气设备市场规模达216亿美元,这得益于环保法规、消费者意识的提升以及政府支持的节能升级项目。此外,该市场也受益于广泛的改造活动,老旧的暖气系统正被符合新碳排放标准的高性能替代方案所取代。此外,住宅空间向电气化的转变也为热泵和混合供暖系统创造了新的机会。

市场主要参与者包括惠而浦、威能集团、Bradford White Corporation、法罗利、克瑞、三星、松下、AO Smith、开利、大金工业、伦诺克斯国际、罗伯特·博世、Hoval、特灵科技、林内美国、Rheem Manufacturing Company、通用电器、LG电子、阿里斯顿控股、Havells India、Brm Fvs Manufacturing Company、通用电器、LG电子、阿里斯顿控股、Havells India、BrmWrovers、国际自控。为了巩固市场地位,住宅暖气设备产业的公司正在采取各种策略。这些策略包括推出创新产品、扩大分销网络、建立策略合作伙伴关係和进行收购。例如,一些公司正在开发整合再生能源和智慧技术的先进暖气系统,以满足日益增长的节能解决方案需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 战略仪表板

- 策略倡议

- 竞争基准测试

- 创新与技术格局

第五章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 热泵

- 锅炉

- 炉

- 热水器

- 其他的

第六章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 单户住宅

- 多户住宅

第七章:市场规模及预测:依销售管道,2021 - 2034 年

- 主要趋势

- 在线的

- 经销商

- 零售

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 葡萄牙

- 罗马尼亚

- 荷兰

- 瑞士

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 埃及

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- AO Smith

- Ariston Holding

- Arovast Corporation

- BDR Thermea Group

- Bradford White Corporation

- Carrier Corporation

- Crane

- DAIKIN INDUSTRIES

- Ferroli

- GE Appliances

- Havells India

- Hoval

- Johnson Control International

- Lennox International

- LG Electronics

- Panasonic Corporation

- Rheem Manufacturing Company

- Rinnai America

- Robert Bosch

- SAMSUNG

- Trane Technologies

- Vaillant Group

- VIESSMANN

- Whirlpool

The Global Residential Heating Equipment Market was valued at USD 184.5 billion in 2024 and is estimated to grow at a CAGR of 8.6% to reach USD 424.3 billion by 2034, driven by increasing awareness of energy efficiency and environmental sustainability, prompting consumers to adopt advanced and eco-friendly heating systems. Governments worldwide are setting carbon neutrality targets and implementing policies encouraging homeowners to invest in energy-efficient solutions, facilitating the transition toward smart and sustainable home heating. Urban housing development and the ongoing focus on reducing energy consumption fuel the adoption of efficient heating technologies. Additionally, the integration of advanced electric heat pumps into hybrid systems supports sustainable emission reduction within the residential sector.

The growing frequency and intensity of extreme cold spells across the U.S. have made dependable residential heating systems not just a preference but a necessity. In response, more homeowners are turning to advanced heating technologies that ensure consistent indoor temperatures regardless of external conditions. At the same time, the integration of intelligent controls, such as IoT-enabled systems and smart thermostats, is enabling users to manage energy usage with greater precision. These innovations help households cut down on unnecessary heating, which not only reduces monthly utility bills but also aligns with broader sustainability goals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $184.5 Billion |

| Forecast Value | $424.3 Billion |

| CAGR | 8.6% |

The heat pump residential heating equipment market is expected to grow at a CAGR of 12% through 2034. The increasing need for energy-efficient solutions, coupled with favorable government policies, will boost the adoption of residential heat pumps. Ongoing technological developments will enhance their operational efficiency and promote environmentally friendly practices. The market is segmented into single-family and multi-family applications.

The single-family residential heating equipment segment is anticipated to drive business growth at a CAGR of 8% through 2034, holding a share of 58% in 2024. The growing demand for customized solutions to meet diverse heating needs will increase product adoption. Additionally, integrating remote monitoring systems, predictive maintenance, and process optimization will propel the industry outlook.

U.S. Residential Heating Equipment Market was valued at USD 21.6 billion in 2024, fueled by environmental mandates, rising consumer awareness, and government-backed programs that incentivize energy-efficient upgrades. The market is also benefiting from widespread retrofitting activities, where older heating systems are being replaced with high-performance alternatives that comply with newer carbon emission standards. Additionally, the shift toward electrification in residential spaces creates new opportunities for heat pumps and hybrid systems.

Key players in the market include Whirlpool, Vaillant Group, Bradford White Corporation, Ferroli, Crane, SAMSUNG, Panasonic Corporation, A.O. Smith, Carrier Corporation, DAIKIN INDUSTRIES, Lennox International, Robert Bosch, Hoval, Trane Technologies, Rinnai America, Rheem Manufacturing Company, GE Appliances, LG Electronics, Ariston Holding, Havells India, BDR Thermea Group, Arovast Corporation, Johnson Control International, VIESSMANN. To strengthen their market presence, companies in the residential heating equipment industry are adopting various strategies. These include launching innovative products, expanding distribution networks, and forming strategic partnerships and acquisitions. For instance, companies are developing advanced heating systems that integrate renewable energy sources and smart technologies to meet the growing demand for energy-efficient solutions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million & ‘000 Units)

- 5.1 Key trends

- 5.2 Heat pump

- 5.3 Boiler

- 5.4 Furnace

- 5.5 Water heater

- 5.6 Others

Chapter 6 Market Size and Forecast, By Application, 2021 - 2034 (USD Million & ‘000 Units)

- 6.1 Key trends

- 6.2 Single-family

- 6.3 Multi-family

Chapter 7 Market Size and Forecast, By Sales Channel, 2021 - 2034 (USD Million & ‘000 Units)

- 7.1 Key trends

- 7.2 Online

- 7.3 Dealer

- 7.4 Retail

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & ‘000 Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 France

- 8.3.3 UK

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Portugal

- 8.3.7 Romania

- 8.3.8 Netherlands

- 8.3.9 Switzerland

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Egypt

- 8.5.4 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 A.O. Smith

- 9.2 Ariston Holding

- 9.3 Arovast Corporation

- 9.4 BDR Thermea Group

- 9.5 Bradford White Corporation

- 9.6 Carrier Corporation

- 9.7 Crane

- 9.8 DAIKIN INDUSTRIES

- 9.9 Ferroli

- 9.10 GE Appliances

- 9.11 Havells India

- 9.12 Hoval

- 9.13 Johnson Control International

- 9.14 Lennox International

- 9.15 LG Electronics

- 9.16 Panasonic Corporation

- 9.17 Rheem Manufacturing Company

- 9.18 Rinnai America

- 9.19 Robert Bosch

- 9.20 SAMSUNG

- 9.21 Trane Technologies

- 9.22 Vaillant Group

- 9.23 VIESSMANN

- 9.24 Whirlpool