|

市场调查报告书

商品编码

1750580

青光眼治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Glaucoma Treatment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

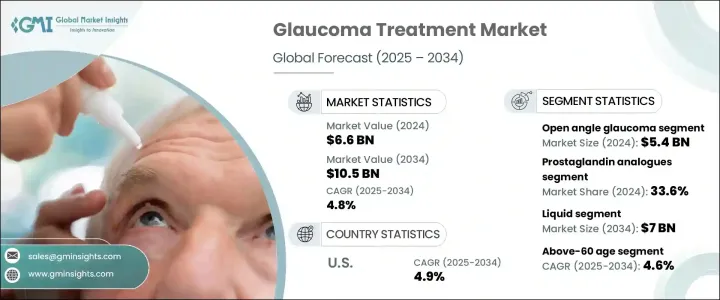

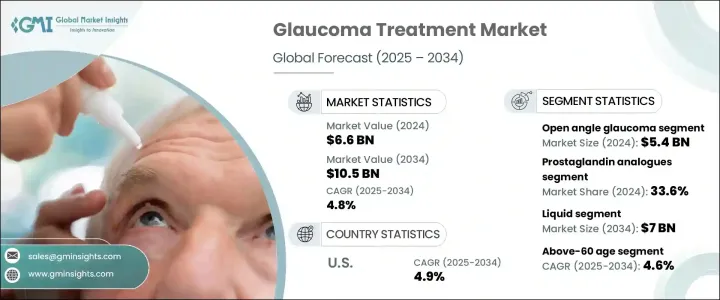

2024年,全球青光眼治疗市场规模达66亿美元,预计2034年将以4.8%的复合年增长率成长,达到105亿美元。这归因于全球范围内青光眼发生率的上升,尤其是在老年人群中。随着全球人口老化,与年龄相关的眼部疾病病例日益增多,病情也愈发严重,促使人们更加需要早期诊断和长期照护。糖尿病和高血压等慢性疾病——都是青光眼的重要风险因素——的发生率也在上升,这进一步加剧了不同人群对有效且持久治疗方案的需求。

各国政府和卫生机构已开始专注于宣传活动,推广早期筛检和常规眼科检查,这有助于在早期发现青光眼。这导致青光眼治疗的启动人数显着增加。市场也受益于新型药物的采用,包括Rho激酶抑制剂和固定剂量联合疗法,这些药物正在扩大治疗方案并改善患者预后。此外,医疗基础设施的改善和可支配收入的成长(尤其是在新兴市场),使得眼科护理更加便捷,使更广泛的人群能够寻求及时、先进的青光眼治疗。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 66亿美元 |

| 预测值 | 105亿美元 |

| 复合年增长率 | 4.8% |

开角型青光眼仍是最常见的青光眼类型,占全球病例的70%以上,2024年价值达54亿美元。青光眼的治疗重点在于控制眼压 (IOP),以防止不可逆转的视神经损伤。大多数疗法着重于帮助降低眼压的药物,包括β受体阻断剂、α受体激动剂、碳酸酐酶抑制剂和前列腺素类似物。开角型青光眼病情发展缓慢,通常没有明显症状,直到出现严重的视力丧失。其慢性特性意味着患者需要持续的长期护理,从而对药物解决方案和定期监测服务产生了持续的需求。

前列腺素类似物透过促进液体引流来降低眼压,在2024年占据治疗市场的最高份额,达到33.6%,预计到2034年将达到37亿美元。前列腺素类似物疗效显着且副作用相对较轻,广泛用于治疗开角型青光眼。随着老龄化人口的增加,预计这类药物的需求将进一步攀升,尤其是在越来越多的患者选择不含防腐剂且使用方便的眼药水配方的情况下。

美国青光眼治疗市场在2024年达到22.4亿美元,预计2034年将以4.9%的复合年增长率成长。美国人口老化、认知度高,加上强大的医药创新力量,持续推动先进治疗方案的需求。完善的医疗基础设施支持早期诊断和处方药的广泛获取,同时,临床试验和FDA审批的持续投入正在迅速扩大现有药物储备。保险覆盖率的提高和优惠的报销政策也进一步支持了老年人和高风险族群对青光眼治疗方案的采用。

诺华、辉瑞、参天製药、太阳製药、Thea、爱尔康、西普拉、艾伯维、博士伦、Inotek Pharmaceuticals、Eyepoint Pharmaceuticals、梯瓦製药、默克和 Grevis Pharmaceuticals 等公司正积极参与这一领域的竞争。为了确保在青光眼治疗市场的竞争优势,领先的公司正在大力投资研发具有更高疗效和安全性的下一代疗法。他们专注于固定剂量组合,以简化治疗方案并提高患者的依从性。透过合作伙伴关係和分销网络扩展到高成长的新兴市场是另一个关键策略。此外,各公司正在增强数位参与工具和远端患者监控技术,以支持早期介入和持续护理。策略合作、产品线多元化和产品生命週期管理仍然是加强全球区域市场定位的关键。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 全球青光眼盛行率不断上升

- 治疗介入的技术进步

- 增加正在进行的青光眼治疗临床试验和产品发布

- 欠发达国家和发展中国家日益增强的眼科保健意识

- 产业陷阱与挑战

- 与药物相关的副作用

- 严格的监管要求

- 成长动力

- 成长潜力分析

- 管道分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按疾病类型,2021 - 2034 年

- 主要趋势

- 开角型青光眼

- 闭角型青光眼

- 其他疾病类型

第六章:市场估计与预测:按药物类别,2021 - 2034 年

- 主要趋势

- 前列腺素类似物

- β受体阻断剂

- α肾上腺素激动剂

- 碳酸酐酶抑制剂

- 其他药物类别

第七章:市场估计与预测:按配方,2021 - 2034 年

- 主要趋势

- 坚硬的

- 液体

第八章:市场估计与预测:按年龄组,2021 - 2034 年

- 主要趋势

- 18岁以下

- 19 - 40

- 41 - 60

- 60岁以上

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- AbbVie

- Alcon

- Bausch & Lomb

- Cipla

- Eyepoint Pharmaceuticals

- Grevis Pharmaceuticals

- Inotek Pharmaceuticals

- Merck

- Novartis

- Pfizer

- Santen Pharmaceutical

- Sun Pharmaceutical

- Teva Pharmaceutical

- Thea

The Global Glaucoma Treatment Market was valued at USD 6.6 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 10.5 billion by 2034, attributed to the rising incidence of glaucoma worldwide, especially among older adults. As the global population continues to age, cases of age-related ocular disorders are becoming more frequent and severe, prompting a greater need for early diagnosis and long-term care. Chronic illnesses such as diabetes and hypertension-both significant risk factors for developing glaucoma-are also on the rise, which further contributes to increasing demand for effective and long-lasting treatment options across various demographics.

Governments and health agencies have started focusing on awareness campaigns to promote early screening and routine eye examinations, which is helping detect glaucoma at earlier stages. This has led to a notable rise in treatment initiations. The market is also benefiting from the adoption of novel drug classes, including Rho kinase inhibitors and fixed-dose combination therapies, which are expanding treatment alternatives and improving patient outcomes. Additionally, improving healthcare infrastructure and growing disposable incomes-especially in emerging markets-are making ophthalmic care more accessible, enabling a broader segment of the population to pursue timely and advanced glaucoma management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.6 Billion |

| Forecast Value | $10.5 Billion |

| CAGR | 4.8% |

Open-angle glaucoma remains the most diagnosed form of the disease, accounting for more than 70% of global cases and valued at USD 5.4 billion in 2024. Treating glaucoma revolves around managing intraocular pressure (IOP) to prevent irreversible optic nerve damage. Most therapies focus on medications that help reduce IOP, including beta-blockers, alpha agonists, carbonic anhydrase inhibitors, and prostaglandin analogs. Open angle glaucoma condition develops slowly and often without obvious symptoms until significant vision loss occurs. Its chronic nature means patients require continuous and long-term care, creating sustained demand for pharmaceutical solutions and regular monitoring services.

Prostaglandin analogs, which help lower eye pressure by enhancing fluid drainage, commanded the highest share of the treatment market in 2024, making up 33.6% share and is projected to reach USD 3.7 billion by 2034. Their effectiveness and relatively mild side effect profile make them widely prescribed for managing open-angle glaucoma. With aging populations increasing, the demand for these medications is expected to climb further, particularly as more patients opt for preservative-free and user-friendly eye drop formulations.

U.S. Glaucoma Treatment Market generated USD 2.24 billion in 2024 and is set to grow at a 4.9% CAGR through 2034. The country's aging population and high awareness levels, coupled with the strong presence of pharmaceutical innovators, continue to fuel demand for advanced treatment options. A well-established healthcare infrastructure supports early diagnosis and widespread access to prescription therapies, while ongoing investments in clinical trials and FDA approvals are rapidly expanding the available drug pipeline. Increased insurance coverage and favorable reimbursement policies are further supporting treatment adoption among the elderly and high-risk groups.

Companies like Novartis, Pfizer, Santen Pharmaceutical, Sun Pharmaceutical, Thea, Alcon, Cipla, AbbVie, Bausch & Lomb, Inotek Pharmaceuticals, Eyepoint Pharmaceuticals, Teva Pharmaceutical, Merck, and Grevis Pharmaceuticals are actively competing in this space. To secure a competitive edge in the glaucoma treatment market, leading companies are investing heavily in R&D to develop next-generation therapies with improved efficacy and safety. They are focusing on fixed-dose combinations to simplify treatment regimens and improve patient adherence. Expanding into high-growth emerging markets through partnerships and distribution networks is another key strategy. Additionally, firms are enhancing digital engagement tools and remote patient monitoring technologies to support early intervention and ongoing care. Strategic collaborations, pipeline diversification, and product lifecycle management remain central to strengthening market positioning across global regions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing prevalence of glaucoma disease worldwide

- 3.2.1.2 Technological advancements in therapeutic interventions

- 3.2.1.3 Increasing ongoing clinical trials and product launches for glaucoma treatment

- 3.2.1.4 Growing awareness initiatives regarding eye care in underdeveloped and developing nations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Side effects associated with the drugs

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Pipeline analysis

- 3.5 Regulatory landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Disease Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Open angle glaucoma

- 5.3 Angle closure glaucoma

- 5.4 Other disease types

Chapter 6 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Prostaglandin analogs

- 6.3 Beta-blockers

- 6.4 Alpha adrenergic agonist

- 6.5 Carbonic anhydrase inhibitors

- 6.6 Other drug classes

Chapter 7 Market Estimates and Forecast, By Formulation, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Solid

- 7.3 Liquid

Chapter 8 Market Estimates and Forecast, By Age Group, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Below 18

- 8.3 19 - 40

- 8.4 41 - 60

- 8.5 Above 60

Chapter 9 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospital pharmacies

- 9.3 Retail pharmacies

- 9.4 Online pharmacies

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 AbbVie

- 11.2 Alcon

- 11.3 Bausch & Lomb

- 11.4 Cipla

- 11.5 Eyepoint Pharmaceuticals

- 11.6 Grevis Pharmaceuticals

- 11.7 Inotek Pharmaceuticals

- 11.8 Merck

- 11.9 Novartis

- 11.10 Pfizer

- 11.11 Santen Pharmaceutical

- 11.12 Sun Pharmaceutical

- 11.13 Teva Pharmaceutical

- 11.14 Thea