|

市场调查报告书

商品编码

1750589

葡萄籽萃取物市场机会、成长动力、产业趋势分析及2025-2034年预测Grape Seed Extracts Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

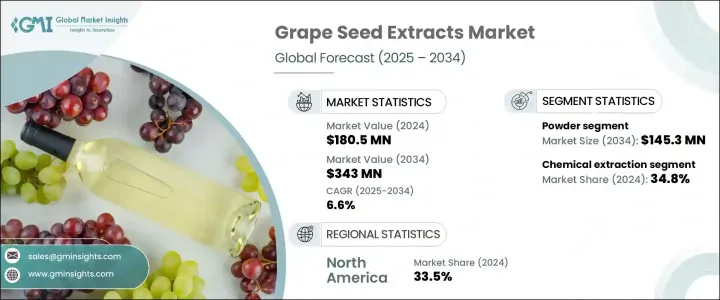

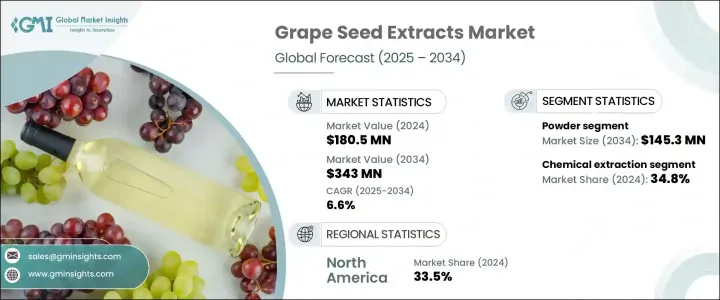

2024年,全球葡萄籽萃取物市场规模达1.805亿美元,预计到2034年将以6.6%的复合年增长率成长,达到3.43亿美元。这一增长主要源于注重健康的消费群体对天然植物成分日益增长的需求。葡萄籽萃取物源自完整的葡萄籽,以其高浓度的原花青素而闻名。原花青素是一种强大的抗氧化化合物,具有多种健康益处。这些化合物因其抗氧化压力和抗真菌作用而广受讚誉,使其成为个人护理、食品饮料和营养保健品等各种应用领域中极具吸引力的成分。

消费者越来越了解抗氧化剂在促进整体健康方面的作用,这对葡萄籽萃取物在多个行业的应用产生了积极影响。其公认的益处,例如支持心血管健康和免疫功能,使其成为功能性食品配方和膳食补充剂中备受欢迎的成分。人们对天然和有机产品日益增长的兴趣,加上人们转向预防性医疗保健,持续推动市场的发展。此外,提取技术和配方技术的创新使製造商能够满足最终用户的多样化需求,使产品更易于获取且用途更广泛。清洁标籤成分的趋势也提升了葡萄籽萃取物的吸引力,尤其是在註重透明度和简单性的配方中。随着消费者越来越倾向于更健康的生活方式和整体健康趋势,葡萄籽萃取物等植物源成分的重要性可能会进一步加深,从而在预测期内推动市场稳步扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.805亿美元 |

| 预测值 | 3.43亿美元 |

| 复合年增长率 | 6.6% |

就剂型而言,葡萄籽萃取物市场细分为粉末、液体、胶囊和片剂、软胶囊以及其他剂型。其中,粉末剂型占主导地位,预计到2034年将达到1.453亿美元,复合年增长率超过6.4%。粉末剂型尤其受欢迎,因为它易于添加到膳食补充剂、功能性食品混合物和健康饮料中。其更长的保质期和灵活的使用方式,使其成为追求稳定性和便利性的製造商的理想之选。随着功能性营养需求的成长,尤其是在註重健康的消费者群体中,粉末剂型的市场发展势头强劲。它支援多种应用形式,并吸引了广泛的人群,从而巩固了其显着的市场份额。

就萃取製程而言,业界将方法分为机械萃取、化学萃取、超临界流体萃取、热水萃取等。 2024年,化学萃取占据市场主导地位,市占率达34.8%,预计2025年至2034年期间的复合年增长率为6.8%。该方法之所以被广泛采用,是因为它能够实现更高的纯度和一致的结果,这对于大规模生产和医药级应用至关重要。儘管人们正在探索可持续性和效率的替代方法,但化学提取仍然保持领先地位,尤其是在註重高效性的领域。

另一方面,机械萃取采用物理方法,不使用化学品,提供了更自然的途径。这使得它对符合清洁标籤和有机标准的生产商尤其有吸引力。儘管机械萃取是一种环保方法,但它也存在萃取率较低和精炼能力有限的问题。然而,随着加工设备的不断进步,机械萃取仍有望获得更强劲的立足点,预计未来几年将实现温和成长。

从区域来看,北美目前引领全球葡萄籽萃取物市场,2024年将占据33.5%的市场。该地区受益于营养保健食品和功能性食品领域的强劲需求,消费者越来越注重积极的健康管理。对永续实践的高度重视和对天然健康产品的日益提升,对该地区市场领导地位起到了重要作用。监管架构和膳食补充剂的支持性环境进一步提升了北美市场的潜力。该地区也受益于完善的分销网络和广泛的健康零售平台。

全球竞争格局呈现高度竞争态势,排名前五的公司占据了相当大的市场份额。这些参与者不断投资于产品开发、供应链优化和策略合作伙伴关係,以巩固其市场地位。天然成分采购的创新以及努力满足不断变化的消费者期望是主要利害关係人所采取策略的核心。在市场对高品质葡萄籽萃取产品日益增长的需求背景下,各公司正专注于研发、品牌定位和产品多元化,努力保持市场竞争力并抢占更大的市场份额。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 主要製造商

- 经销商

- 整个产业的利润率

- 供应链和分销分析

- 原物料采购

- 生产製造

- 冷链基础设施

- 分销管道

- 供应链挑战与优化

- 永续实践

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 2021-2024年主要出口国

- 2021-2024年主要出口国

- 衝击力

- 成长动力

- 消费者对健康益处的认知不断提高

- 对天然补充品的需求不断增加

- 生活方式疾病盛行率上升

- 扩大化妆品和个人护理领域的应用

- 产业陷阱与挑战

- 生产成本高

- 替代抗氧化剂来源的可用性

- 市场机会

- 萃取工艺的技术进步

- 新兴市场需求不断成长

- 开发新配方

- 功能性食品和饮料应用的扩展

- 3.6.4 市场挑战

- 萃取物品质标准化

- 一些健康声明的临床证据有限

- 供应链中断

- 来自合成替代品的竞争

- 市场机会

- 成长动力

- 原料景观

- 製造业趋势

- 技术演进

- 定价分析和成本结构

- 价格趋势(美元/吨)

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东非洲

- 定价因素(原料、能源、劳力)

- 区域价格差异

- 成本结构明细

- 获利能力分析

- 价格趋势(美元/吨)

- 监管框架和标准

- FDA 法规和 GRAS 状态

- 欧洲食品安全局(EFSA)指南

- 亚太地区监管格局

- 监管变化对市场成长的影响

- 波特的分析

- Pestel 分析

- 永续发展趋势对生产和消费的影响

- 新参与者的市场进入策略

- 原料分析与采购策略

- 葡萄品种及其对萃取物品质的影响

- 酿酒副产品的利用

- 永续采购实践

- 植物化学成分分析

- 原花青素

- 黄酮类化合物

- 酚酸

- 其他生物活性化合物

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司热图分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

- Expansion

- Mergers & acquisition

- Collaborations

- New product launches

- Research & development

- 主要参与者的最新发展和影响分析

- 公司分类

- 参与者概述

- 财务表现

- 产品基准测试

第五章:市场估计与预测:依形式,2021-2034

- 主要趋势

- 粉末

- 液体

- 软胶囊

- 胶囊和片剂

- 其他的

第六章:市场估计与预测:按提取方法,2021-2034 年

- 主要趋势

- 机械萃取

- 化学萃取

- 超临界流体萃取

- 热水萃取

- 其他的

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 膳食补充剂

- 食品和饮料

- 功能性食品

- 功能性饮料

- 其他的

- 製药

- 动物

- 化妆品和个人护理

- 皮肤护理

- 头髮护理

- 其他

- 其他的

第 8 章:市场估计与预测:按治疗适应症,2021-2034 年

- 主要趋势

- 心血管健康

- 抗衰老和皮肤健康

- 糖尿病管理

- 癌症预防

- 认知健康

- 其他的

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- B2B

- B2C

- 超市和大卖场

- 专卖店

- 网路零售

- 药局和药局

- 其他的

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Indena SpA

- Botanic Healthcare

- Polyphenolics (Division of Constellation Brands)

- Naturex (Part of Givaudan)

- Nexira

- Dohler Group

- Keller Juices SRL

- NOW Foods

- Solgar Inc. (Part of The Nature's Bounty Co.)

- JF Natural (Zhejiang Jianfeng Group)

- Undersun Biomedtech Corp.

- Grap'Sud

- Nutra Green Biotechnology Co., Ltd.

- Ethical Naturals, Inc.

- Hunan Sunfull Bio-tech Co., Ltd.

The Global Grape Seed Extracts Market was valued at USD 180.5 million in 2024 and is estimated to grow at a CAGR of 6.6% to reach USD 343 million by 2034. This growth is largely driven by the increasing demand for natural, plant-based ingredients across health-conscious consumer segments. Grape seed extract, sourced from whole grape seeds, is known for its high concentration of procyanidins-powerful antioxidant compounds that support various health benefits. These compounds are widely appreciated for their ability to combat oxidative stress and provide antifungal effects, making grape seed extract an attractive ingredient in various applications, including personal care, food and beverage, and nutraceuticals.

Consumers are becoming more informed about the role of antioxidants in promoting overall wellness, which has positively impacted the adoption of grape seed extract across multiple industries. Its perceived benefits, such as supporting cardiovascular health and immune function, have made it a popular inclusion in functional food formulations and dietary supplements. The expanding interest in natural and organic products, combined with the shift toward preventive healthcare, continues to push the market forward. Furthermore, innovation in extraction techniques and formulation technologies is allowing manufacturers to cater to the diverse demands of end-users, making the product more accessible and versatile. The move toward clean-label ingredients also boosts the appeal of grape seed extract, especially in formulations that prioritize transparency and simplicity. As consumers gravitate toward healthier lifestyles and holistic wellness trends, the importance of plant-derived ingredients like grape seed extract is likely to deepen, contributing to steady market expansion through the forecast period.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $180.5 Million |

| Forecast Value | $343 Million |

| CAGR | 6.6% |

In terms of form, the grape seed extracts market is segmented into powder, liquid, capsules and tablets, soft gels, and other variants. Among these, the powder segment stands out as a dominant contributor and is projected to reach USD 145.3 million by 2034, expanding at a CAGR of over 6.4%. The powdered form is especially popular due to its easy incorporation into dietary supplements, functional food blends, and wellness beverages. Its longer shelf life and flexibility in usage make it highly favorable for manufacturers seeking stability and convenience. As demand rises for functional nutrition, particularly among health-focused consumers, the powder form continues to gain momentum. It supports various application formats and appeals to a broad demographic base, reinforcing its significant market share.

When it comes to extraction processes, the industry categorizes methods into mechanical extraction, chemical extraction, supercritical fluid extraction, hot water extraction, and others. In 2024, chemical extraction led the market with a 34.8% share and is forecast to grow at a CAGR of 6.8% between 2025 and 2034. The widespread adoption of this method is due to its ability to achieve higher purity levels and consistent results, which is crucial for large-scale production and pharmaceutical-grade applications. While alternative methods are being explored for their sustainability and efficiency, chemical extraction continues to maintain its lead, especially where high efficacy is a priority.

Mechanical extraction, on the other hand, offers a more natural route by utilizing physical means without the use of chemicals. This makes it particularly attractive to producers who align with clean-label and organic standards. Despite its eco-friendly approach, this method struggles with lower extraction yields and limited refinement capabilities. However, with ongoing advancements in processing equipment, the potential for mechanical extraction to gain a stronger foothold remains promising, and moderate growth is expected for this segment in the coming years.

Regionally, North America currently leads the global grape seed extracts market, accounting for 33.5% of the total market share in 2024. The region benefits from robust demand in the nutraceutical and functional foods sector, where consumers are increasingly focused on proactive health management. A strong emphasis on sustainable practices and heightened awareness of natural health products have played a major role in the region's market leadership. Regulatory frameworks and a supportive environment for dietary supplements further enhance the market's potential in North America. The region also benefits from a well-established distribution network and widespread availability of health-focused retail platforms.

The global competitive landscape is characterized by high rivalry, with the top five companies holding a considerable share of the market. These players are continuously investing in product development, supply chain optimization, and strategic partnerships to strengthen their foothold. Innovation in natural ingredient sourcing and efforts to align with evolving consumer expectations are central to the strategies adopted by key stakeholders. With a focus on research, brand positioning, and product diversification, companies are working to maintain relevance and capture greater market share amid rising demand for high-quality grape seed extract offerings.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Key manufacturers

- 3.1.2 Distributors

- 3.1.3 Profit margins across the industry

- 3.1.4 Supply chain and distribution analysis

- 3.1.4.1 Raw material sourcing

- 3.1.4.2 Production and manufacturing

- 3.1.4.3 Cold chain infrastructure

- 3.1.4.4 Distribution channels

- 3.1.4.5 Supply chain challenges and optimization

- 3.1.4.6 Sustainable practices

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS code)

- 3.3.1 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.3.2 Major exporting countries, 2021-2024 (Kilo Tons)

- 3.4 Impact forces

- 3.4.1 Growth drivers

- 3.4.1.1 Growing consumer awareness about health benefits

- 3.4.1.2 Increasing demand for natural supplements

- 3.4.1.3 Rising prevalence of lifestyle diseases

- 3.4.1.4 Expanding applications in cosmetics and personal care

- 3.4.2 Industry pitfalls & challenges

- 3.4.2.1 High production costs

- 3.4.2.2 Availability of alternative antioxidant sources

- 3.4.3 Market opportunities

- 3.4.3.1 Technological advancements in extraction processes

- 3.4.3.2 Growing demand in emerging markets

- 3.4.3.3 Development of novel formulations

- 3.4.3.4 Expansion in functional food and beverage applications

- 3.4.4 market challenges

- 3.4.4.1 Standardization of extract quality

- 3.4.4.2 Limited clinical evidence for some health claims

- 3.4.4.3 Supply chain disruptions

- 3.4.4.4 Competition from synthetic alternatives

- 3.4.5 Market opportunity

- 3.4.1 Growth drivers

- 3.5 Raw material landscape

- 3.5.1 Manufacturing trends

- 3.5.2 Technology evolution

- 3.6 Pricing analysis and cost structure

- 3.6.1 Pricing trends

- 3.6.1.1 North America

- 3.6.1.2 Europe

- 3.6.1.3 Asia Pacific

- 3.6.1.4 Latin America

- 3.6.1.5 Middle East Africa

- 3.6.2 Pricing factors (raw materials, energy, labor)

- 3.6.3 Regional price variations

- 3.6.4 Cost structure breakdown

- 3.6.5 Profitability analysis

- 3.6.1 Pricing trends

- 3.7 Regulatory framework and standards

- 3.7.1 FDA regulations and GRAS Status

- 3.7.2 European food safety authority (EFSA) guidelines

- 3.7.3 Asia-pacific regulatory landscape

- 3.7.4 Impact of regulatory changes on market growth

- 3.8 Porter's analysis

- 3.9 Pestel analysis

- 3.10 Impact of sustainability trends on production and consumption

- 3.11 Market entry strategies for new players

- 3.12 Raw material analysis and sourcing strategies

- 3.12.1 Grape varieties and their impact on extract quality

- 3.12.2 Winemaking by-products utilization

- 3.12.3 Sustainable sourcing practices

- 3.13 Phytochemical composition analysis

- 3.13.1 Proanthocyanidins

- 3.13.2 Flavonoids

- 3.13.3 Phenolic acids

- 3.13.4 Other bioactive compounds

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis, 2024

- 4.3 Company heat map analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

- 4.7 Recent developments & impact analysis by key players

- 4.7.1 Company categorization

- 4.7.2 Participant’s overview

- 4.7.3 Financial performance

- 4.8 Product benchmarking

Chapter 5 Market Estimates & Forecast, By Form, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Powder

- 5.3 Liquid

- 5.4 Soft gels

- 5.5 Capsules and tablets

- 5.6 Others

Chapter 6 Market Estimates & Forecast, By Extraction Method, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Mechanical extraction

- 6.3 Chemical extraction

- 6.4 Supercritical fluid extraction

- 6.5 Hot water extraction

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Dietary supplements

- 7.3 Food and beverages

- 7.3.1 Functional foods

- 7.3.2 Functional beverages

- 7.3.3 Others

- 7.4 Pharmaceuticals

- 7.5 Animal

- 7.6 Cosmetics and personal care

- 7.6.1 Skin care

- 7.6.2 Hair care

- 7.6.3 Other

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By Therapeutic Indication, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Cardiovascular health

- 8.3 Anti-aging and skin health

- 8.4 Diabetes management

- 8.5 Cancer prevention

- 8.6 Cognitive health

- 8.7 Others

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 B2B

- 9.3 B2C

- 9.3.1 Supermarkets and hypermarkets

- 9.3.2 Specialty stores

- 9.3.3 Online retail

- 9.3.4 Pharmacy and drug stores

- 9.3.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Indena S.p.A.

- 11.2 Botanic Healthcare

- 11.3 Polyphenolics (Division of Constellation Brands)

- 11.4 Naturex (Part of Givaudan)

- 11.5 Nexira

- 11.6 Dohler Group

- 11.7 Keller Juices S.R.L

- 11.8 NOW Foods

- 11.9 Solgar Inc. (Part of The Nature's Bounty Co.)

- 11.10 JF Natural (Zhejiang Jianfeng Group)

- 11.11 Undersun Biomedtech Corp.

- 11.12 Grap'Sud

- 11.13 Nutra Green Biotechnology Co., Ltd.

- 11.14 Ethical Naturals, Inc.

- 11.15 Hunan Sunfull Bio-tech Co., Ltd.