|

市场调查报告书

商品编码

1750590

帕金森氏症治疗市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Parkinson's Disease Therapeutics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

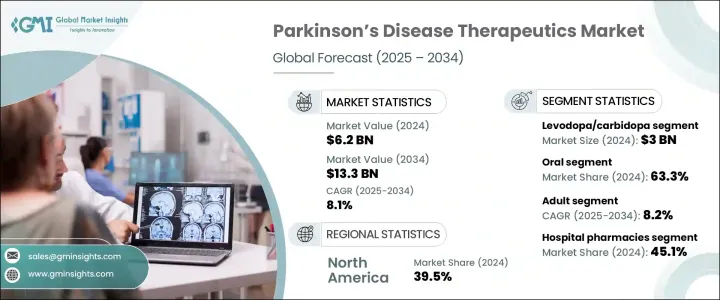

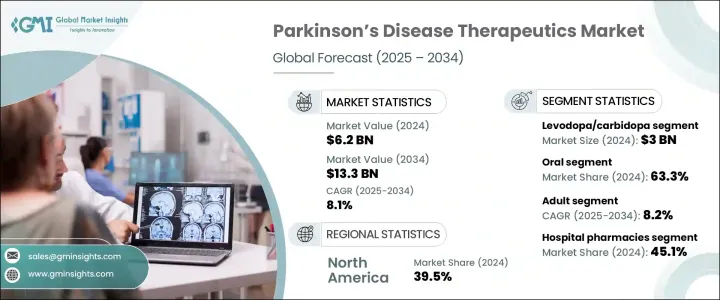

2024年,全球帕金森氏症治疗市场规模达62亿美元,预计年复合成长率将达8.1%,到2034年将达到133亿美元,这主要得益于帕金森氏症发病率的不断上升,尤其是在全球老龄化人口中。随着预期寿命的延长,帕金森氏症等与年龄相关的神经退化性疾病的发生率正在迅速上升。北美、欧洲以及亚太部分地区的国家正经历老龄人口的显着增长,这推动了对更有效治疗方案的需求。医疗保健系统正积极应对这项挑战,优先发展治疗创新,并扩大针对帕金森氏症患者的专科护理覆盖范围。

随着医药技术的不断进步,市场正经历重大变革。虽然传统疗法仍然被广泛使用,但人们越来越关注能够更有针对性地控制症状的替代疗法。针对不同神经通路的药物类别正在被探索,以更有效地控制疾病进展。创新的给药平台也正在产生影响。这些平台包括使用者友善的系统,可以提高患者的依从性,尤其是对于需要长期照护的患者。透皮给药系统、吸入途径和输注疗法因其能够稳定、可控地输送药物且併发症更少而广受欢迎。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 62亿美元 |

| 预测值 | 133亿美元 |

| 复合年增长率 | 8.1% |

左旋多巴/卡比多巴在2024年的销售额达到30亿美元。其持续的主导地位归功于其能够治疗各种运动症状。增强型配方可提供缓释和持续给药,有助于减少併发症并提供持续的症状管理。该药物的广泛使用、价格实惠以及成熟的临床疗效使其成为高收入和新兴经济体帕金森氏症治疗的基石。

2024年,口服药物占63.3%。其易用性、成本效益和易获得性使其成为接受终身治疗的患者的首选途径。许多最常使用的帕金森氏症治疗药物,尤其是用于缓解运动症状的药物,都是口服製剂。这不仅提高了依从性,也减少了住院给药的需求,使口服药物成为治疗领域的主导力量。

2024年,美国帕金森氏症治疗市场规模达23亿美元。其强大的医疗体系、先进的监管途径以及早期获得尖端疗法的机会,使其成为帕金森氏症治疗领域的领导者。此外,美国也受惠于强大的病患支援网络和合作研发,这些都促进了药物研发,并加速了新型疗法的商业化。

该行业的知名企业包括梯瓦製药 (Teva Pharmaceutical)、纽伦製药 (Newron Pharmaceuticals)、优时比 (UCB)、住友製药 (Sumitomo Dainippon Pharma)、罗氏製药 (F. Hoffmann-La Roche)、协和麒麟 (Kyowa Kirin)、奥利安林 (Oreo)、Yororkan Pharmaus、Yorimel (Boelinger) Pharmaceuticals、艾伯维 (AbbVie)、Amneal Pharmaceuticals、诺华 (Novartis)、Desitin Arzneimittel、Acorda Therapeutics (Merz Therapeutics) 和阿卡迪亚製药 (Acadia Pharmaceuticals)。为了巩固其在帕金森氏症治疗市场的地位,各公司强调策略性研发投资,以开发安全性和有效性更高的下一代疗法。他们积极争取监管批准,以加快审批速度并获得早期市场准入。与学术机构和生物技术公司的合作,使创新管道更加多元化。不断扩大的全球分销网络,尤其是在新兴经济体,确保了更广泛的药物供应。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 人口老化导致全球帕金森氏症患者病率上升

- 药物传输技术与新配方的进步

- 生物製药公司不断增加的研发投资

- 非营利组织和倡导组织的大力支持

- 产业陷阱与挑战

- 低收入地区先进疗法成本高且报销有限

- 缺乏治癒性治疗且现有药物的副作用持续存在

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 流行病学概况

- 未来市场趋势

- 管道分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按药物类别,2021 - 2034 年

- 主要趋势

- 左旋多巴/卡比多巴

- 多巴胺激动剂

- 腺苷A2A拮抗剂

- COMT抑制剂

- MAO-B抑制剂

- 麸胺酸拮抗剂

- 胆碱酯酶抑制剂

- 其他药物类别

第六章:市场估计与预测:按管理路线,2021 - 2034 年

- 主要趋势

- 口服

- 透皮

- 皮下

- 其他给药途径

第七章:市场估计与预测:按患者,2021 - 2034 年

- 主要趋势

- 成人

- 儿科

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 医院药房

- 零售药局

- 网路药局

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- AbbVie

- Acadia Pharmaceuticals

- Acorda Therapeutics (Merz Therapeutics)

- Amneal Pharmaceuticals

- Boehringer Ingelheim

- Desitin Arzneimittel

- F. Hoffmann-La Roche

- Kyowa Kirin

- Newron Pharmaceuticals

- Novartis

- Orion Pharma

- Sumitomo Dainippon Pharma

- Supernus Pharmaceuticals

- Teva Pharmaceutical

- UCB

The Global Parkinson's Disease Therapeutics Market was valued at USD 6.2 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 13.3 billion by 2034, driven by the increasing incidence of Parkinson's disease, particularly among aging populations worldwide. As life expectancy improves, the prevalence of age-related neurodegenerative conditions like Parkinson's is expanding rapidly. Countries across North America, Europe, and parts of the Asia-Pacific region are witnessing a notable rise in the elderly demographic, which is fueling demand for more effective treatments. Healthcare systems are responding by prioritizing therapeutic innovations and expanding access to specialized care tailored to patients with Parkinson's disease.

The market is experiencing significant transformation as pharmaceutical advancements continue to emerge. While traditional therapies remain widely used, there's increasing attention on alternative treatments that provide more targeted symptom control. Drug classes targeting different neural pathways are being explored to manage disease progression more effectively. Innovative delivery platforms are also making an impact. These include user-friendly systems that improve patient adherence, especially for individuals requiring long-term care. Transdermal systems, inhalation routes, and infusion therapies are popular due to their ability to deliver steady, controlled medication with fewer complications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.2 Billion |

| Forecast Value | $13.3 Billion |

| CAGR | 8.1% |

The Levodopa/carbidopa generated USD 3 billion in 2024. Its continued dominance is attributed to its ability to address varied motor symptoms. Enhanced formulations offering extended release and continuous delivery have helped reduce complications and provide consistent symptom management. This drug's widespread use, affordability, and established clinical efficacy make it a cornerstone in Parkinson's treatment across high-income and emerging economies.

Oral medications accounted for a 63.3% share in 2024. Their ease of use, cost-effectiveness, and availability make them the preferred route for patients undergoing lifelong treatment. Many of the most prescribed Parkinson's therapies, particularly those for motor symptom relief, are developed in oral formulations. This not only improves adherence but also limits the need for hospital-based administration, making oral drugs a dominant force in the therapeutic landscape.

U.S. Parkinson's Disease Therapeutics Market generated USD 2.3 billion in 2024. Its robust healthcare system, advanced regulatory pathways, and early access to cutting-edge treatments contribute to its leadership in Parkinson's care. The country also benefits from strong patient support networks and collaborative R&D efforts, which promote drug discovery and accelerate the commercialization of novel therapies.

Prominent players in this industry include Teva Pharmaceutical, Newron Pharmaceuticals, UCB, Sumitomo Dainippon Pharma, F. Hoffmann-La Roche, Kyowa Kirin, Orion Pharma, Boehringer Ingelheim, Supernus Pharmaceuticals, AbbVie, Amneal Pharmaceuticals, Novartis, Desitin Arzneimittel, Acorda Therapeutics (Merz Therapeutics), and Acadia Pharmaceuticals. To strengthen their position in the Parkinson's disease therapeutics market, companies emphasize strategic R&D investments to develop next-generation therapies with better safety and efficacy. They pursue regulatory designations to accelerate approvals and gain early market access. Collaborations with academic institutions and biotech firms allow for diversified innovation pipelines. Expanding global distribution networks, especially in emerging economies, ensures wider medications.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising global prevalence of Parkinson’s disease due to an aging population

- 3.2.1.2 Advancements in drug delivery technologies and novel formulations

- 3.2.1.3 Growing research and development investments by biopharmaceutical companies

- 3.2.1.4 Strong support from non-profits and advocacy organizations

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced therapies and limited reimbursement in low income regions

- 3.2.2.2 Lack of curative treatments and persistent side effects of current medications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Epidemiology landscape

- 3.7 Future market trends

- 3.8 Pipeline analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Drug Class, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Levodopa/carbidopa

- 5.3 Dopamine agonists

- 5.4 Adenosine A2A antagonists

- 5.5 COMT inhibitors

- 5.6 MAO-B inhibitors

- 5.7 Glutamate antagonists

- 5.8 Cholinesterase inhibitors

- 5.9 Other drug classes

Chapter 6 Market Estimates and Forecast, By Route of Administration, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Oral

- 6.3 Transdermal

- 6.4 Subcutaneous

- 6.5 Other routes of administration

Chapter 7 Market Estimates and Forecast, By Patient, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Adult

- 7.3 Pediatric

Chapter 8 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospital pharmacies

- 8.3 Retail pharmacies

- 8.4 Online pharmacies

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 AbbVie

- 10.2 Acadia Pharmaceuticals

- 10.3 Acorda Therapeutics (Merz Therapeutics)

- 10.4 Amneal Pharmaceuticals

- 10.5 Boehringer Ingelheim

- 10.6 Desitin Arzneimittel

- 10.7 F. Hoffmann-La Roche

- 10.8 Kyowa Kirin

- 10.9 Newron Pharmaceuticals

- 10.10 Novartis

- 10.11 Orion Pharma

- 10.12 Sumitomo Dainippon Pharma

- 10.13 Supernus Pharmaceuticals

- 10.14 Teva Pharmaceutical

- 10.15 UCB