|

市场调查报告书

商品编码

1750592

机器人义肢市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Robotic Prosthetics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

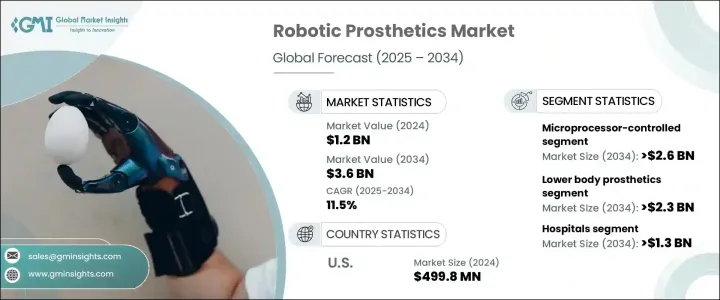

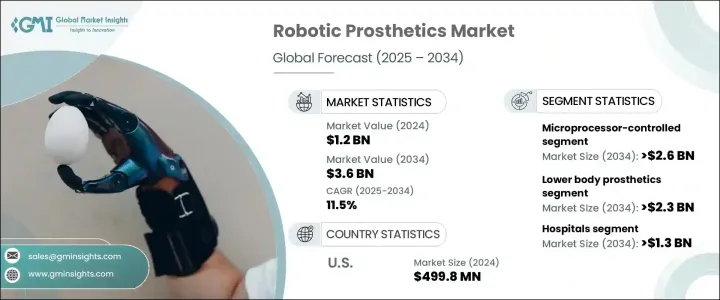

2024年,全球机器人义肢市场规模达12亿美元,预计2034年将以11.5%的复合年增长率成长,达到36亿美元。这得归功于义肢技术(尤其是机器人应用)的进步,以及对行动辅助设备日益增长的需求。人口老化、因创伤、糖尿病和血管疾病导致的失能病例增加等因素也推动市场扩张。

机器人义肢,尤其是微处理器控制 (MPC) 和人工智慧驱动的模型,提供了更强大的功能性和适应性,使用户能够轻鬆活动,并提升整体生活品质。碳纤维和钛等轻质材料的进步显着提高了义肢的强度和耐用性。这些材质不仅提升了义肢的整体性能,也使其更加舒适、可靠、易于使用。这些材料的使用确保了义肢在保持强度的前提下保持轻便,使用户能够自由轻鬆地活动。随着越来越多的人寻求兼顾功能性和舒适性的义肢解决方案,市场也随之扩大。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 36亿美元 |

| 复合年增长率 | 11.5% |

市场细分为多个类别,包括技术和身体部位分类,每个类别都在推动成长方面发挥着至关重要的作用。例如,微处理器控制 (MPC) 义肢市场预计将显着成长,预计复合年增长率为 11.2%。到 2034 年,该市场的规模预计将达到 26 亿美元。 MPC 义肢具有许多优势,例如平衡能力提升、能量管理更佳、适应性增强。这些特性使用户能够更自然地活动并保持更大的独立性,这使得 MPC 技术在寻求先进行动解决方案的截肢者中越来越受欢迎。

另一个重要领域—下肢义肢—也将迎来强劲成长,预计复合年增长率为11.4%,到2034年市场规模将达到23亿美元。这个领域包括机器人膝关节和踝关节,它们在肢体丧失后恢復运动和平衡方面发挥着至关重要的作用。这些义肢装置对于提升使用者的行走、跑步和长时间站立能力至关重要,从而显着提升他们的整体生活品质。透过恢復自主性和活动能力,下肢义肢可以帮助人们过着更积极、更充实的生活。

由于美国完善的医疗基础设施和雄厚的医疗支出,美国机器人义肢市场在2024年的估值达到4.998亿美元。美国截肢人口众多,推动了对先进义肢技术的需求不断增长。美国对研究资金的投入以及义肢领域的持续技术进步,使其成为全球市场领导者。这进一步刺激了对高品质、创新机器人义肢解决方案的需求。

全球机器人义肢产业的知名企业,例如 Axile Bionics、Brain Robotics 和 Blatchford Group,正在采取各种策略来巩固其市场地位。这些公司专注于持续的技术创新,重点是提高机器人义肢的功能性、舒适性和价格承受能力。例如,Ottobock 和 Fillauer LLC 投资研发更轻、更耐用的义肢材料。与医疗保健专业人士的合作以及政府资助使 Motorica 和 Myomo 等公司能够改进产品并扩大市场份额。此外,与保险公司和医疗保健机构的策略合作伙伴关係正在帮助公司确保更多有需要的人能够获得机器人义肢。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 截肢手术数增加

- 技术进步

- 週边血管疾病和其他慢性疾病的盛行率不断上升

- 事故伤害和创伤病例数不断增加

- 产业陷阱与挑战

- 机器人义肢设备成本高

- 可重复使用器械的感染风险担忧

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 各国应对措施

- 对产业的影响

- 供应方影响(製造成本)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(消费者成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(製造成本)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 定价分析

- 技术格局

- 差距分析

- 波特的分析

- PESTEL分析

- 未来市场趋势

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 微处理器控制(MPC)

- 肌电

第六章:市场估计与预测:依极端情况,2021 - 2034 年

- 主要趋势

- 下肢义肢

- 义肢膝关节

- 义肢踝关节

- 其他下肢义肢

- 上肢义肢

- 义肢

- 假手

- 其他上肢义肢

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 专科诊所

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Axile Bionics

- Blatchford Group

- Brain Robotics

- Fillauer LLC

- Mobius Bionics

- Motorica

- Myomo

- Open Bionics

- Ossur

- Ottobock

- Proteor

- ProtUnics

- Psyonic

- RSL Steeper

The Global Robotic Prosthetics Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 11.5% to reach USD 3.6 billion by 2034, driven by advancements in prosthetic technology, especially robotic applications, and the increasing demand for mobility aids. Factors like an aging population, rising instances of loss due to trauma, diabetes, and vascular diseases are also fueling market expansion.

Robotic prosthetics, particularly microprocessor-controlled (MPC) and AI-driven models, offer improved functionality and adaptability, allowing users to move with ease and increasing the overall quality of life. The advancement of lightweight materials such as carbon fiber and titanium has significantly contributed to improving the strength and durability of prosthetics. These materials not only enhance the overall performance of prosthetic devices but also make them more comfortable, reliable, and user-friendly. The use of such materials ensures that the prosthetics are lightweight without compromising on strength, enabling users to move freely and with ease. This has expanded the market, as more individuals seek prosthetic solutions that cater to both functionality and comfort.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $3.6 Billion |

| CAGR | 11.5% |

The market is segmented into various categories, including technology and body part classifications, each playing a crucial role in driving growth. The microprocessor-controlled (MPC) prosthetics segment, for instance, is expected to witness considerable growth, with a projected CAGR of 11.2%. By 2034, this segment is anticipated to reach USD 2.6 billion in market value. MPC prosthetics offer substantial benefits, such as improved balance, better energy management, and enhanced adaptability. These features empower users to move more naturally and maintain greater independence, which makes MPC technology increasingly popular among amputees seeking advanced mobility solutions.

Another important segment, lower body prosthetics, is also set for strong growth, with a forecasted CAGR of 11.4%, reaching USD 2.3 billion by 2034, includes robotic knees and ankles, which play an essential role in restoring movement and balance following limb loss. These prosthetic devices are crucial for improving a user's ability to walk, run, and stand for longer periods, significantly enhancing their overall quality of life. By restoring autonomy and mobility, lower body prosthetics help individuals lead more active and fulfilling lives.

United States Robotic Prosthetics Market was valued at USD 499.8 million in 2024 due to the country's well-established healthcare infrastructure and substantial healthcare spending. The U.S. has a significant population of amputees, contributing to the rising demand for advanced prosthetic technologies. The nation's commitment to research funding and the continuous technological advancements in the field of prosthetics have positioned it as a global leader in the market. This has further fueled the demand for high-quality, innovative robotic prosthetic solutions.

Prominent players in the Global Robotic Prosthetics Industry, such as Axile Bionics, Brain Robotics, and Blatchford Group, are adopting various strategies to strengthen their market positions. These companies focus on continuous technological innovation, with an emphasis on improving the functionality, comfort, and affordability of robotic prosthetics. For instance, Ottobock and Fillauer LLC invest in R&D to develop lighter, more durable prosthetic materials. Collaborations with healthcare professionals and government funding have allowed companies like Motorica and Myomo to refine their products and expand their market share. Additionally, strategic partnerships with insurance providers and healthcare organizations are helping companies ensure wider accessibility of robotic prosthetics to those in need.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rise in the number of limb amputation procedures

- 3.2.1.2 Technological advancements

- 3.2.1.3 Increasing prevalence of peripheral vascular disease and other chronic conditions

- 3.2.1.4 Rising number of accident injuries & trauma cases

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of robotic prosthetics devices

- 3.2.2.2 Concerns over infection risks with reusable instruments

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (Cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (Cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Pricing analysis

- 3.7 Technology landscape

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Future market trends

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Microprocessor-controlled (MPC)

- 5.3 Myoelectric

Chapter 6 Market Estimates and Forecast, By Extremity, 2021 - 2034 ($ Mn & Units)

- 6.1 Key trends

- 6.2 Lower body prosthetics

- 6.2.1 Prosthetic knee

- 6.2.2 Prosthetic ankle

- 6.2.3 Other lower body prosthetics

- 6.3 Upper body prosthetics

- 6.3.1 Prosthetic arm

- 6.3.2 Prosthetic hand

- 6.3.3 Other upper body prosthetics

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Speciality clinics

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Axile Bionics

- 9.2 Blatchford Group

- 9.3 Brain Robotics

- 9.4 Fillauer LLC

- 9.5 Mobius Bionics

- 9.6 Motorica

- 9.7 Myomo

- 9.8 Open Bionics

- 9.9 Ossur

- 9.10 Ottobock

- 9.11 Proteor

- 9.12 ProtUnics

- 9.13 Psyonic

- 9.14 RSL Steeper