|

市场调查报告书

商品编码

1750594

工业电子燃料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Industrial E-Fuel Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

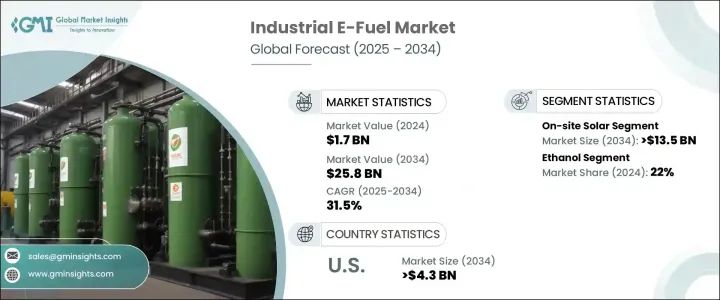

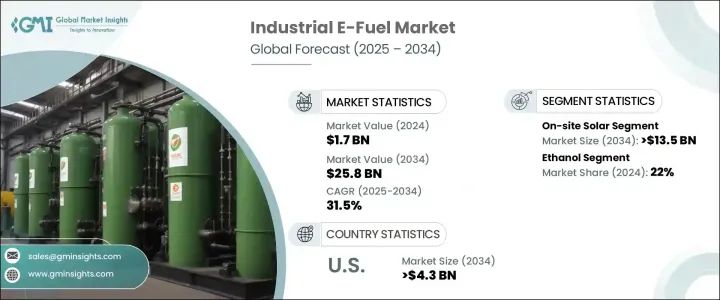

2024年,全球工业电子燃料市场规模达17亿美元,预计2034年将以31.5%的复合年增长率成长,达到258亿美元。这得归功于全球脱碳的推动以及工业领域对永续能源替代品日益增长的需求。随着各行各业纷纷寻求传统化石燃料的可行替代品,电子燃料已成为製造业、重型运输和航空等产业的有力解决方案。先进生产技术的融合,加上效率和成本控制的改进,持续提升了这些合成燃料的可行性。政府的支持性倡议、清洁能源激励措施以及全球减排目标加速了其应用。

此外,对再生能源与工业营运整合的高度重视,鼓励企业采用长期、碳中和的能源架构。企业将其策略与全球永续发展目标结合,优先考虑低排放燃料,以减少对传统化石能源的依赖。迈向稳定且富有韧性的能源供应链的倡议不仅受到环境法规的推动,也受到本地化清洁能源生产的经济优势的驱动。这一趋势为电子燃料释放了新的潜力,尤其是在难以脱碳的产业,因为单靠再生能源电力可能无法满足需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 17亿美元 |

| 预测值 | 258亿美元 |

| 复合年增长率 | 31.5% |

预计到2034年,现场太阳能发电领域将创造135亿美元的产值,这反映了其在提供Power-to-X流程所需的再生电力方面的关键贡献。这些再生能源支持碳中和燃料生产,并帮助各行各业实现永续发展目标。先进的控制系统和支援性政策框架推动了向离网再生能源发电的转变,这与分散式电燃料营运无缝衔接。

乙醇市场在2024年占据22%的市场份额,预计到2034年将以32%的复合年增长率成长。乙醇与现有燃料基础设施的兼容性以及易于融入各种工业流程的特性,使其成为可靠且可扩展的替代品。随着生产技术的不断进步,生物基乙醇的发展势头强劲,各行各业都在寻求灵活的解决方案来满足脱碳要求。生物基乙醇能够与其他合成燃料无缝混合,这增强了其在工业领域的吸引力,有助于推动向永续能源的转型。

2024年,美国工业电子燃料市场产值达2.354亿美元,预计2034年将达到43亿美元,这得益于联邦扶持政策、清洁能源资助计画以及再生能源技术日益普及的应用。美国将继续利用多样化的太阳能和风能资源,透过Power-to-X和其他新兴途径支持电子燃料生产。再加上燃料合成和碳捕获技术的进步,这些努力正在巩固美国在工业电子燃料转型领域的全球领先地位。

eFuel Pacific、Climeworks、Electrochaea、Archer Daniels Midland、Ballard Power Systems、MAN Energy Solutions、INFRA Synthetic Fuels、保时捷、HIF Global、Clean Fuels Alliance America、Sunfire、Arc eFuels、Liquid Wind、LanzaJet、FuelCell Energy、NSunfire、Arc eFuels、Liquid Wind、LanzaJet、FuelCell Energy、N这些公司专注于扩大产能、投资再生能源设施,并建立策略联盟以加速商业化进程。许多公司也利用碳捕获技术,并建立整合供应链,以支援可扩展的清洁燃料分销。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 策略倡议

- 公司市占率分析

- 竞争基准测试

- 创新与技术格局

第五章:市场规模及预测:按再生能源,2021 - 2034 年

- 主要趋势

- 现场太阳能

- 风

第六章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 费托合成

- 增强型多普勒雷达系统

- 其他的

第七章:市场规模及预测:依产品,2021 - 2034

- 主要趋势

- 电子汽油

- 电动柴油

- 电子煤油

- 乙醇

- 电子甲醇

- 其他的

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 荷兰

- 西班牙

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- Archer Daniels Midland

- Arcadia eFuels

- Ballard Power Systems

- Ceres Power

- Clean Fuels Alliance America

- Climeworks

- Electrochaea

- eFuel Pacific

- ExxonMobil

- FuelCell Energy

- HIF Global

- INFRA Synthetic Fuels

- LanzaJet

- Liquid Wind

- MAN Energy Solutions

- Norsk e-Fuel

- Porsche

- Sunfire

The Global Industrial E-Fuel Market was valued at USD 1.7 billion in 2024 and is estimated to grow at a CAGR of 31.5% to reach USD 25.8 billion by 2034, driven by the global push toward decarbonization and the rising need for sustainable energy alternatives across industrial applications. As industries search for viable replacements for conventional fossil fuels, e-fuels have emerged as a compelling solution for sectors such as manufacturing, heavy transport, and aviation. The integration of advanced production technologies, coupled with improvements in efficiency and cost control, continues to enhance the viability of these synthetic fuels. Supportive government initiatives, clean energy incentives, and global emission reduction targets accelerate adoption.

Moreover, the heightened emphasis on integrating renewables with industrial operations encourages businesses to adopt long-term, carbon-neutral energy frameworks. Companies align their strategies with global sustainability targets, prioritizing low-emission fuels that reduce dependence on traditional fossil energy sources. The move toward stable and resilient energy supply chains is not only driven by environmental regulations but also by the economic advantages of localized, clean energy production. This trend unlocks new potential for e-fuels, especially in hard-to-decarbonize sectors where renewable electricity alone may not suffice.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.7 billion |

| Forecast Value | $25.8 billion |

| CAGR | 31.5% |

The on-site solar segment is projected to generate USD 13.5 billion by 2034, reflecting its critical contribution in providing the renewable electricity required for Power-to-X processes. These renewable energy sources support carbon-neutral fuel production and help industries meet sustainability goals. Advanced control systems and supportive policy frameworks fuel the shift toward off-grid renewable generation, which aligns seamlessly with decentralized e-fuel operations.

The ethanol segment held a 22% share in 2024 and is projected to grow at a CAGR of 32% through 2034. Its compatibility with current fuel infrastructure and ease of integration into various industrial processes have made ethanol a reliable and scalable alternative. With ongoing advances in production technologies, bio-based ethanol is gaining momentum as industries seek flexible solutions to meet decarbonization mandates. Its ability to blend seamlessly with other synthetic fuels enhances its appeal in industrial settings, transitioning toward sustainable energy.

United States Industrial E-Fuel Market generated USD 235.4 million in 2024 and is estimated to reach USD 4.3 billion by 2034, underpinned by supportive federal policies, clean energy funding programs, and increasing deployment of renewable technologies. The U.S. continues to leverage a diverse mix of solar and wind resources to support e-fuel production through Power-to-X and other emerging pathways. Coupled with advancements in fuel synthesis and carbon capture technologies, these efforts are helping to cement the U.S. as a global frontrunner in the industrial e-fuel transition.

Key players such as eFuel Pacific, Climeworks, Electrochaea, Archer Daniels Midland, Ballard Power Systems, MAN Energy Solutions, INFRA Synthetic Fuels, Porsche, HIF Global, Clean Fuels Alliance America, Sunfire, Arcadia eFuels, Liquid Wind, LanzaJet, FuelCell Energy, Norsk e-Fuel, ExxonMobil, and Ceres Power are strengthening their position through innovation, joint ventures, and sustainable technology development. These companies are focused on expanding production capacity, investing in renewable-powered facilities, and forming strategic alliances to accelerate commercialization. Many are also leveraging carbon capture technologies and creating integrated supply chains to support scalable, clean fuel distribution.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's Analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL Analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiatives

- 4.4 Company market share analysis

- 4.5 Competitive benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Renewable Source, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 On-site solar

- 5.3 Wind

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Fischer-tropsch

- 6.3 eRWGS

- 6.4 Others

Chapter 7 Market Size and Forecast, By Product, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 E-gasoline

- 7.3 E-diesel

- 7.4 E-kerosene

- 7.5 Ethanol

- 7.6 E-methanol

- 7.7 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Netherlands

- 8.3.5 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Archer Daniels Midland

- 9.2 Arcadia eFuels

- 9.3 Ballard Power Systems

- 9.4 Ceres Power

- 9.5 Clean Fuels Alliance America

- 9.6 Climeworks

- 9.7 Electrochaea

- 9.8 eFuel Pacific

- 9.9 ExxonMobil

- 9.10 FuelCell Energy

- 9.11 HIF Global

- 9.12 INFRA Synthetic Fuels

- 9.13 LanzaJet

- 9.14 Liquid Wind

- 9.15 MAN Energy Solutions

- 9.16 Norsk e-Fuel

- 9.17 Porsche

- 9.18 Sunfire