|

市场调查报告书

商品编码

1750600

高功率电动车母线市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测High Power Electric Vehicle Busbar Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球高功率电动车母线市场规模为4.675亿美元,预计2034年将以20.8%的复合年增长率成长,达到33.2亿美元。这主要得益于全球电动车普及率的不断提高,以及对高效耐用配电组件(尤其是高性能电动车母线)的需求。各地区政府都在执行严格的排放法规,同时提供诱因以加速电动车的生产和普及。这种监管势头正推动汽车製造商和供应商投资于先进的电动车架构,而母线在车辆动力总成和电池系统的高效能传输中发挥关键作用。都市化趋势以及电动两轮车、送货车队和公共交通巴士的兴起,扩大了市场的覆盖范围。

高功率电动车母线对于管理和引导电池单元、驱动单元和电子控制系统之间的电流至关重要。其性能直接影响电动车的效率、安全性和耐用性。材料创新——尤其是铝和铜的整合——显着提高了母线的可靠性和导电性。铜因其卓越的热稳定性和高导电性而日益受到青睐,成为先进电动车平台的理想选择。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.675亿美元 |

| 预测值 | 33.2亿美元 |

| 复合年增长率 | 20.8% |

铝材持续引领高功率电动车母线市场,凭藉其优异的重量、导电性和价格优势,到2024年将占70%的市场份额。随着汽车製造商优先考虑轻量化设计以提高能源效率和续航里程,铝材成为电动车配电系统大规模应用最实用的材料。除了轻量化之外,铝材还具备良好的导热性和导电性,能够满足现代电动车(尤其是在商用和高容量乘用车领域)的性能需求。

2024年,美国大功率电动车母线市场规模达4,660万美元,这得益于电动车销量的激增,这得益于全国范围内充电基础设施的大规模投资以及政府旨在减少碳排放的激励措施。快速充电系统的日益整合以及对增程式电动车日益增长的需求,推动了对坚固耐用、高容量母线解决方案的需求。随着北美转向更清洁的交通生态系统,先进的电气元件正成为消费和商用车平台的优先考虑因素。

影响高功率电动车母线市场的关键参与者包括魏德米勒介面有限公司 (Weidmuller Interface GmbH & Co. KG)、英飞凌科技股份公司 (Infineon Technologies AG)、罗杰斯公司 (Rogers Corporation)、EAE 集团 (EAE Group)、美尔森公司 (Mersen SA)、EMS ESD 集团 (EMS Group)、西门子 (Siemens)、Braruens、At. Connectivity)、安费诺公司 (Amphenol Corporation)、三菱电机株式会社 (Mitsubishi Electric Corporation)、罗格朗 (Legrand)、施耐德电气 (Schneider Electric)、Littelfuse Inc. 和 EG Electronics。这些公司正在采取多种策略方法来巩固其市场地位。这些措施包括扩大生产能力、投资研发以提高导电性和热性能,以及与电动车製造商合作提供整合设计解决方案。许多公司专注于轻量化、高效材料,并探索模组化母线系统,以支援跨不同车型领域的可扩展电动车平台。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:2024 年竞争格局

- 介绍

- 战略仪表板

- 策略倡议

- 公司市占率

- 竞争基准测试

- 创新与技术格局

第五章:市场规模及预测:依资料,2021 - 2034 年

- 主要趋势

- 铜

- 铝

第六章:市场规模及预测:依地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 挪威

- 德国

- 法国

- 荷兰

- 英国

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 新加坡

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 以色列

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第七章:公司简介

- Amphenol Corporation

- Brar Elettromeccanica SpA

- EAE Group

- EG Electronics

- EMS Group

- Infineon Technologies AG

- Legrand

- Littelfuse, Inc.

- Mersen SA

- Mitsubishi Electric Corporation

- Rogers Corporation

- Schneider Electric

- Siemens

- TE Connectivity

- Weidmuller Interface GmbH & Co. KG

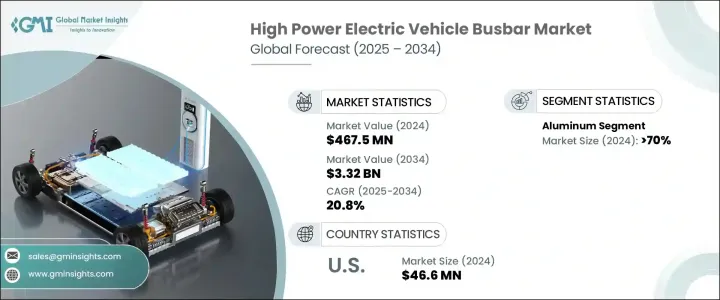

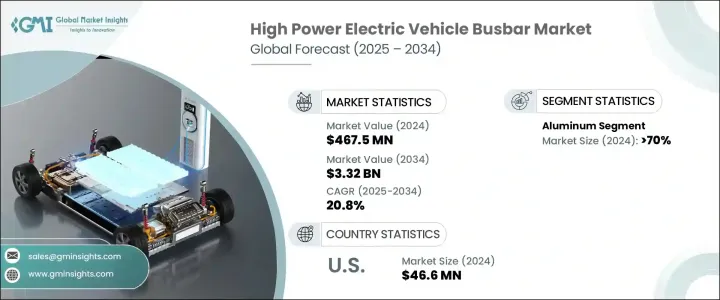

The Global High Power Electric Vehicle Busbar Market was valued at USD 467.5 million in 2024 and is estimated to grow at a CAGR of 20.8% to reach USD 3.32 billion by 2034, driven by the rising adoption of electric vehicles worldwide and the demand for efficient and durable power distribution components, especially high-performance EV busbars. Governments across regions are enforcing strict emission regulations while providing incentives to accelerate EV production and adoption. This regulatory momentum is pushing automakers and suppliers to invest in advanced electric vehicle architecture, with busbars playing a key role in efficient energy transfer within the vehicle's powertrain and battery systems. Urbanization trends and the rise of electric two-wheelers, delivery fleets, and public transit buses expand the market's reach.

High-power EV busbars are essential in managing and directing electric currents between battery cells, drive units, and electronic control systems. Their performance directly impacts the efficiency, safety, and durability of EVs. Innovations in materials-specifically the integration of aluminum and copper-are significantly boosting their reliability and conductivity. Copper is gaining traction due to its superior thermal stability and high electrical conductivity, making it ideal for advanced EV platforms.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $467.5 Million |

| Forecast Value | $3.32 Billion |

| CAGR | 20.8% |

The aluminum segment continues to lead the high-power EV busbar market in volume, accounting for a 70% share in 2024 attributed to its favorable weight, conductivity, and affordability. As automakers prioritize lightweight vehicle designs to improve energy efficiency and range, aluminum emerges as the most practical material for large-scale application in EV power distribution systems. Beyond just its lightness, aluminum offers sufficient thermal and electrical conductivity to meet the performance demands of modern electric vehicles, particularly in commercial and high-volume passenger segments.

United States High Power Electric Vehicle Busbar Market was valued at USD 46.6 million in 2024, driven by the surge in EV sales supported by expansive investments in nationwide charging infrastructure and government-backed incentives aimed at reducing carbon emissions. The increasing integration of fast-charging systems and the growing demand for extended-range EVs drive the need for robust and high-capacity busbar solutions. As North America shifts toward a cleaner transportation ecosystem, advanced electrical components are becoming a priority in consumer and commercial vehicle platforms.

Key players shaping the High Power Electric Vehicle Busbar Market include Weidmuller Interface GmbH & Co. KG, Infineon Technologies AG, Rogers Corporation, EAE Group, Mersen SA, EMS Group, Siemens, Brar Elettromeccanica SpA, TE Connectivity, Amphenol Corporation, Mitsubishi Electric Corporation, Legrand, Schneider Electric, Littelfuse Inc., and EG Electronics. These companies are adopting several strategic approaches to solidify their market position. Efforts include expanding production capabilities, investing in R&D to enhance conductivity and thermal performance, and collaborating with EV manufacturers for integrated design solutions. Many are focusing on lightweight, high-efficiency materials and exploring modular busbar systems to support scalable EV platforms across various vehicle segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Market estimates & forecast parameters

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Regulatory landscape

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1.1 Introduction

- 4.1.2 Strategic dashboard

- 4.1.3 Strategic initiative

- 4.1.4 Company market share

- 4.1.5 Competitive benchmarking

- 4.1.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Material, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Copper

- 5.3 Aluminum

Chapter 6 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 North America

- 6.2.1 U.S.

- 6.2.2 Canada

- 6.3 Europe

- 6.3.1 Norway

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Netherlands

- 6.3.5 UK

- 6.3.6 Sweden

- 6.4 Asia Pacific

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Singapore

- 6.5 Middle East & Africa

- 6.5.1 Saudi Arabia

- 6.5.2 UAE

- 6.5.3 Israel

- 6.5.4 South Africa

- 6.6 Latin America

- 6.6.1 Brazil

- 6.6.2 Argentina

Chapter 7 Company Profiles

- 7.1 Amphenol Corporation

- 7.2 Brar Elettromeccanica SpA

- 7.3 EAE Group

- 7.4 EG Electronics

- 7.5 EMS Group

- 7.6 Infineon Technologies AG

- 7.7 Legrand

- 7.8 Littelfuse, Inc.

- 7.9 Mersen SA

- 7.10 Mitsubishi Electric Corporation

- 7.11 Rogers Corporation

- 7.12 Schneider Electric

- 7.13 Siemens

- 7.14 TE Connectivity

- 7.15 Weidmuller Interface GmbH & Co. KG