|

市场调查报告书

商品编码

1750603

电子汽油市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测E-Gasoline Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

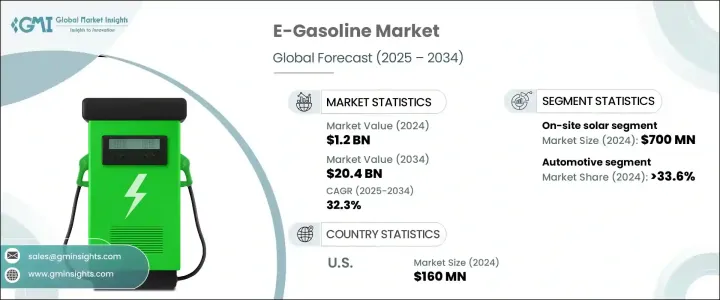

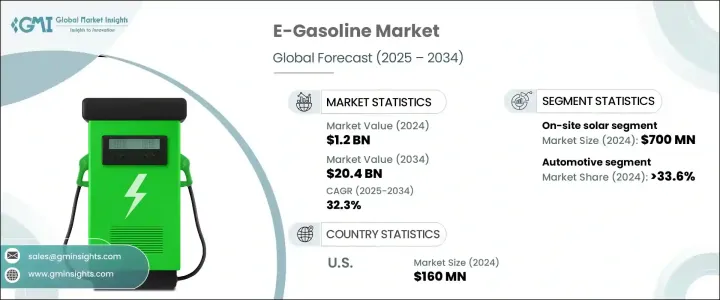

2024年,全球电子汽油市场规模达12亿美元,预计到2034年将以32.3%的复合年增长率增长,达到204亿美元,这得益于日益严格的排放法规和对可持续燃料替代品日益增长的需求。随着各国政府实施更严格的环境标准,各行各业纷纷采用更清洁的技术,推动了对电子汽油等环保解决方案的需求。消费者日益增强的气候变迁意识以及为低碳燃料支付溢价的意愿也推动了这一转变。电子汽油作为合成燃料,作为传统化石燃料的更清洁替代品,正日益受到青睐,有助于减少各行各业,尤其是交通运输领域的温室气体排放。

新技术进步降低了生产成本并提高了效率,使电子汽油成为旨在降低碳足迹的企业和消费者更实用的选择。合成燃料生产方法的开发使电子汽油能够更有效地扩大规模,吸引了能源公司的大量投资。汽车产业与能源产业之间的合作在建立电子汽油生产和分销基础设施方面发挥关键作用,加速了其在全球燃料网路中的采用和整合。此外,这些合作有助于简化电子汽油技术的创新,确保燃料的随时可用,并满足日益增长的可持续能源需求。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 204亿美元 |

| 复合年增长率 | 32.3% |

随着各国政府和企业加大安装大型风力涡轮机的力度,对清洁再生能源的需求不断增长,风能产业有望迎来令人瞩目的成长。预计到2034年,该产业的复合年增长率将达到33%。再生能源的应用如今被视为应对气候变迁的关键支柱,而风能是利用自然资源发电最有效的方式之一。涡轮机设计和效率的技术改进使风力发电更加可行且更具成本效益,即使在先前不适合的地区也是如此。

预计到2034年,海运产业的复合年增长率将达到32%。该行业正在积极努力遵守更严格的环境法规,并减少其整体温室气体排放。这些法规,例如欧盟的《欧盟燃料条例》(FuelEU Maritime Regulation),鼓励海运业摆脱传统的高排放燃料,转向电子汽油、氢气和氨气等替代燃料。由于国际航运是全球碳排放的主要贡献者,低碳燃料的推广动能正在增强,尤其是在永续发展政策严格的欧洲。

预计到2034年,欧洲电子汽油市场将以30%的复合年增长率成长,碳中和指令将推动其快速普及。 《欧洲绿色协议》等关键政策和产业合作正在加速各种交通方式(包括汽车和航空)向永续燃料的转型。欧盟2030年具有约束力的再生能源目标,其中包括大量使用先进生物燃料和非生物来源再生燃料(RFNBO),进一步巩固了这一成长势头。

全球电子汽油市场的领导企业包括Arcadia eFuels、埃克森美孚、巴拉德动力系统和LanzaJet。这些公司专注于策略合作伙伴关係、技术进步和规模化生产,以巩固其市场地位。许多企业也正在研发方面投入巨资,以提高电子汽油生产流程的效率和可扩展性。此外,他们还与政府和其他行业领导者密切合作,以确保必要的基础设施到位,从而支持电子汽油的广泛应用。凭藉可持续性和合规性,这些公司正在将自己定位为低碳能源未来的关键参与者。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 对贸易的影响

- 展望与未来考虑

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 战略仪表板

- 策略倡议

- 公司市占率

- 竞争基准测试

- 创新与永续发展格局

第五章:市场规模及预测:按再生能源,2021 - 2034 年

- 主要趋势

- 现场太阳能

- 风

第六章:市场规模及预测:依技术分类,2021 - 2034 年

- 主要趋势

- 费托合成

- 增强型多普勒雷达系统

- 其他的

第七章:市场规模及预测:依应用,2021 - 2034

- 主要趋势

- 汽车

- 海洋

- 航空

- 工业的

- 其他的

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 南非

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- Arcadia eFuels

- Archer Daniels Midland Co.

- Ballard Power Systems, Inc.

- Ceres Power Holding Plc

- Climeworks AG

- Clean Fuels Alliance America

- Electrochaea GmbH

- eFuel Pacific Limited

- ExxonMobil

- FuelCell Energy, Inc.

- HIF Global

- INFRA Synthetic Fuels, Inc.

- Liquid Wind

- LanzaJet

- MAN Energy Solutions

- Norsk E-Gasoline AS

- Porsche

- Sunfire GmbH

The Global E-Gasoline Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 32.3% to reach USD 20.4 billion by 2034, driven by increasingly stringent emission regulations and a rising demand for sustainable fuel alternatives. As governments enforce stricter environmental standards, industries adopt cleaner technologies, pushing the demand for eco-friendly solutions like e-gasoline. Consumers' growing awareness of climate change and willingness to pay a premium for low-carbon fuels also support this shift. E-gasoline, as a synthetic fuel, is gaining traction as a cleaner alternative to traditional fossil fuels, aiding in reducing greenhouse gas emissions across various sectors, particularly transportation.

New technological advancements have led to lower production costs and improved efficiency, making e-gasoline a more practical choice for businesses and consumers aiming to lower their carbon footprint. The development of synthetic fuel production methods is enabling e-gasoline to scale more effectively, drawing substantial investments from energy companies. Partnerships between the automotive and energy industries play a key role in building infrastructure for e-gasoline production and distribution, accelerating its adoption and integration into global fuel networks. Additionally, these collaborations help streamline innovation in e-gasoline technology, ensuring that the fuel is readily available and meets the growing demand for sustainable energy sources.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $20.4 Billion |

| CAGR | 32.3% |

The wind energy sector is poised for impressive growth, with expectations for a CAGR of 33% by 2034 driven by the accelerating demand for clean, renewable energy, as governments and corporations ramp up efforts to install large-scale wind turbines. Renewable energy adoption is now seen as a key pillar in tackling climate change, and wind energy is one of the most efficient ways to harness natural resources to produce electricity. Technological improvements in turbine design and efficiency make wind power more viable and cost-effective, even in previously unsuitable locations.

The maritime segment, with a projected CAGR of 32% through 2034, is actively working to comply with stricter environmental regulations and reduce its overall greenhouse gas emissions. These regulations, such as the EU's FuelEU Maritime Regulation, encourage the maritime industry to move away from traditional high-emission fuels and shift to alternative options like e-gasoline, hydrogen, and ammonia. As international shipping is a major contributor to global carbon emissions, the push for low-carbon fuels is gaining momentum, particularly in Europe, where sustainability policies are stringent.

Europe E-Gasoline Market is expected to grow at a CAGR of 30% through 2034, with carbon-neutral mandates driving rapid adoption. Key policies like the European Green Deal and industry collaborations are accelerating the transition to sustainable fuels for various transportation modes, including cars and aviation. The EU's binding renewable energy targets for 2030, which include a significant share for advanced biofuels and renewable fuels of non-biological origin (RFNBOs), further reinforce this growth.

Leading players in the Global E-Gasoline Market include Arcadia eFuels, ExxonMobil, Ballard Power Systems, and LanzaJet. These companies are focusing on strategic partnerships, technological advancements, and scaling production to strengthen their position in the market. Many of these players are also investing heavily in R&D to improve the efficiency and scalability of e-gasoline production processes. In addition, they are working closely with governments and other industry leaders to ensure that the necessary infrastructure is in place to support widespread adoption. With sustainability and regulatory compliance, these companies are positioning themselves as key players in a low-carbon energy future.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data source

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.1 Impact on trade

- 3.3 Outlook and future considerations

- 3.4 Industry impact forces

- 3.4.1 Growth drivers

- 3.4.2 Industry pitfalls & challenges

- 3.5 Growth potential analysis

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Strategic dashboard

- 4.3 Strategic initiative

- 4.4 Company market share

- 4.5 Competitive benchmarking

- 4.6 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Renewable Source, 2021 - 2034 (USD Billion)

- 5.1 Key trends

- 5.2 On-site solar

- 5.3 Wind

Chapter 6 Market Size and Forecast, By Technology, 2021 - 2034 (USD Billion)

- 6.1 Key trends

- 6.2 Fischer-tropsch

- 6.3 eRWGS

- 6.4 Others

Chapter 7 Market Size and Forecast, By Application, 2021 - 2034 (USD Billion)

- 7.1 Key trends

- 7.2 Automotive

- 7.3 Marine

- 7.4 Aviation

- 7.5 Industrial

- 7.6 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Billion)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 South Africa

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 Arcadia eFuels

- 9.2 Archer Daniels Midland Co.

- 9.3 Ballard Power Systems, Inc.

- 9.4 Ceres Power Holding Plc

- 9.5 Climeworks AG

- 9.6 Clean Fuels Alliance America

- 9.7 Electrochaea GmbH

- 9.8 eFuel Pacific Limited

- 9.9 ExxonMobil

- 9.10 FuelCell Energy, Inc.

- 9.11 HIF Global

- 9.12 INFRA Synthetic Fuels, Inc.

- 9.13 Liquid Wind

- 9.14 LanzaJet

- 9.15 MAN Energy Solutions

- 9.16 Norsk E-Gasoline AS

- 9.17 Porsche

- 9.18 Sunfire GmbH