|

市场调查报告书

商品编码

1750606

金属玻璃市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Metallic Glasses Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

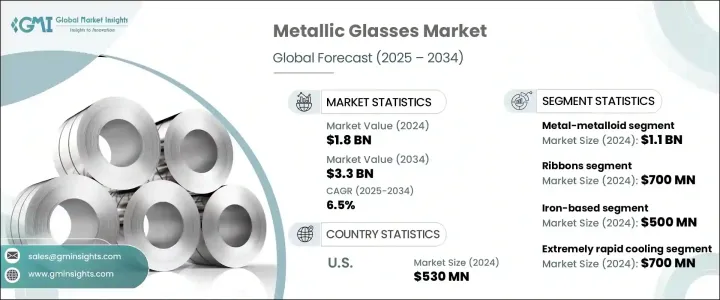

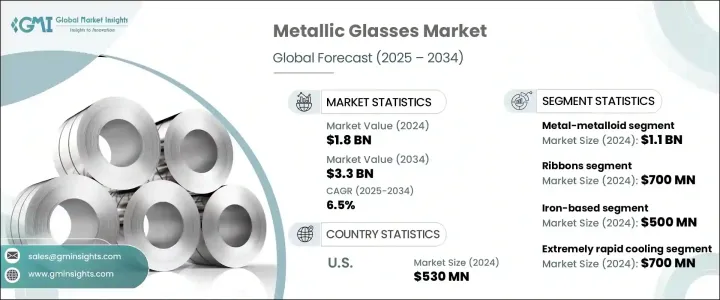

2024年,全球金属玻璃市场规模达18亿美元,预计年复合成长率将达6.5%,2034年将达33亿美元。这得益于金属玻璃的独特性能,即兼具高抗拉强度、优异的耐腐蚀性和延展性。金属玻璃的非晶态原子结构使其在严苛条件下也能表现出色,是结构强度和精度的理想选择。它们在对耐用性和耐磨性有严格要求的行业中大有可为,例如电气和磁性元件。随着各行各业对更先进、更有效率材料的需求不断增长,金属玻璃的广泛应用也日益受到青睐。

市场受益于电磁和电子领域需求的成长。金属玻璃的低功耗和高效率使其适用于磁芯、感测器和变压器。此外,快速凝固和物理气相沉积等製造技术的进步正在降低生产成本并实现规模化营运。生物医学领域是金属玻璃的另一个关键成长领域,因为其生物相容性和机械强度使其成为医疗植入物和手术工具的理想选择。金属玻璃的抗菌和耐磨性也增加了其在医疗保健应用领域的吸引力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 33亿美元 |

| 复合年增长率 | 6.5% |

2024年,金属玻璃市场中的金属-准金属部分价值11亿美元,预计到2034年将以5.7%的复合年增长率增长,这得益于对轻量化和高性价比材料日益增长的需求,尤其是在消费电子、扩增实境/虚拟实境 (AR/VR) 和医疗设备等行业。这些材料在强度和柔韧性之间实现了完美平衡,使其成为这些快速发展行业中微型组件的理想选择。随着技术进步推动产品尺寸更小、效率更高,金属-准金属玻璃预计将在各种应用中加速普及。

金属带市场规模在2024年将达到7亿美元,预计到2034年也将实现5.1%的成长率,这得益于其卓越的磁性能,使其特别适用于变压器和磁性感测器。随着对先进电子系统、节能设备和更精密感测器技术的需求不断增长,金属玻璃製成的金属带将继续在这些应用中发挥关键作用。它们能够在严苛条件下保持高性能,这对于专注于发电、能源分配和高科技感测技术的行业而言,无疑是一项宝贵的资产。

2024年,美国金属玻璃市场价值达5.3亿美元,预估2025年至2034年的复合年增长率为6%,主要得益于航太、国防系统和电子产品领域对金属玻璃日益增长的需求。製造商和国防承包商之间的密切合作正在加速新型金属玻璃解决方案的开发和推广。此外,美国的研究机构在推动新型合金和优化生产流程方面发挥着至关重要的作用,这进一步支持了市场的扩张。

全球金属玻璃市场的主要公司包括贺利氏控股有限公司 (Heraeus Holding GmbH)、Liquidmetal Technologies Inc.、Materion Corporation、Usha Amorphous Metals Limited 和日立金属有限公司 (Hitachi Metals Ltd.)。为了巩固市场地位,金属玻璃市场中的公司专注于扩大产能并改善製造流程以降低成本。与研究机构和其他行业参与者的策略合作伙伴关係和合作正在加速创新和新材料的引入。製造商投资于积层製造和先进合金开发等技术进步,以满足各行各业对高性能材料日益增长的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 市场定义与演变

- 金属玻璃的定义与分类

- 金属玻璃的历史发展

- 材料成分和性能

- 原子结构和特性

- 机械性质

- 磁性

- 耐腐蚀

- 热性能

- 製造流程

- 快速凝固技术

- 熔融纺丝

- 气体雾化

- 吸铸

- 增材製造

- 比较分析:金属玻璃与传统材料

- 金属玻璃与晶体金属

- 金属玻璃与陶瓷

- 金属玻璃与聚合物

- 金属玻璃的技术进步

- 川普政府关税的影响—结构化概述

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国

- 主要进口国

- 利润率分析

- 监管环境和标准

- 全球监理框架

- 区域监理框架

- 北美洲

- FDA 法规(针对医疗应用)

- Astm 标准

- 其他相关规定

- 欧洲

- 欧盟医疗器材法规(mdr)

- CE标誌要求

- 达到法规

- 亚太

- 中国法规

- 日本的规定

- 其他地区法规

- 世界其他地区

- 北美洲

- 产品认证和标准

- 品质标准

- 安全标准

- 绩效标准

- 合规挑战与策略

- 未来监管趋势及其影响

- 市场动态

- 市场驱动因素

- 优异的材料性能

- 电子和能源领域的需求不断增长

- 製造技术的进步

- 生物医学领域的应用日益增多

- 市场限制

- 生产成本高

- 尺寸和形状能力有限

- 脆性和有限的延展性

- 来自传统材料的竞争

- 市场机会

- 航太和国防领域的新兴应用

- 积层製造的进步

- 对永续材料的需求不断增长

- 发展中经济体的扩张

- 市场挑战

- 扩大生产

- 实现始终如一的质量

- 监理合规性

- 市场认知度与接受度

- 市场驱动因素

- 波特五力分析

- 杵分析

- 价值链分析

- 原物料供应商

- 製造商

- 经销商

- 最终用户

- 环境、社会与治理 (esg) 分析

- 环境影响评估

- 碳足迹分析

- 生命週期评估(LCA)

- 废弃物管理和回收利用

- 生产中的能源消耗

- 社会影响

- 劳动实务和工作条件

- 社区影响力和参与

- 健康和安全考虑

- 治理和道德考虑

- 公司治理实践

- 道德供应链管理

- 透明度和报告

- 关键参与者的 ESG 绩效基准

- ESG风险评估及缓解策略

- 金属玻璃产业的未来 ESG 趋势

- 环境影响评估

- 製造和生产分析

- 製造流程概述

- 原料采购与准备

- 合金熔化和均质化

- 快速凝固技术

- 后处理和精加工

- 品质控制和测试

- 生产成本分析

- 原料成本

- 能源成本

- 劳动成本

- 製造费用

- 成本优化策略

- 製造设施分析

- 主要製造地点

- 生产能力评估

- 设施扩建计划

- 供应链挑战与解决方案

- 製造流程的可持续性

- 能源效率措施

- 减少废弃物的策略

- 环保材料和工艺

- 製造流程概述

- 消费者行为与市场趋势分析

- 消费者偏好与购买模式

- 影响购买决策的因素

- 性能和品质

- 成本考虑

- 可持续性因素

- 品牌声誉

- 产业特定的采用趋势

- 电子业采用

- 汽车业采用

- 医疗业采用

- 航太航太业采用

- 消费者行为的区域差异

- 数位转型对消费者参与度的影响

- 未来消费趋势及其影响

- 技术格局与创新分析

- 金属玻璃的当前技术趋势

- 新兴技术及其潜在影响

- 先进的製造技术

- 新型合金成分

- 表面改质技术

- 复合金属玻璃

- 研发活动与创新中心

- 跨应用程式的技术采用趋势

- 技术准备评估

- 未来技术路线图 2025-2034

- 定价分析与经济因素

- 价格趋势分析

- 历史价格趋势

- 目前定价情景

- 价格预测

- 影响定价的因素

- 原料成本

- 生产复杂性

- 生产规模

- 市场竞争

- 特定于应用程式的要求

- 区域价格差异

- 价格价值关係分析

- 影响市场的经济指标

- GDP成长和工业生产

- 研发支出

- 金属商品价格

- 能源成本

- 主要市场参与者的定价策略

- 价格趋势分析

- 原料和供应链分析

- 主要原料概览

- 金属和准金属

- 稀土元素

- 其他关键材料

- 原物料采购

- 全球供应来源

- 供应集中和风险

- 可持续采购倡议

- 供应链结构与动态

- 上游供应链

- 中游加工

- 下游分销

- 供应链挑战

- 原料可用性和关键性

- 价格波动

- 地缘政治因素

- 物流和运输

- 供应链风险缓解策略

- 原料和供应链的未来趋势

- 主要原料概览

第四章:竞争格局

- 主要参与者的市占率分析

- 竞争定位矩阵

- 主要参与者所采用的竞争策略

- 产品创新与开发

- 併购

- 伙伴关係和合作

- 扩张策略

- 投资分析和市场吸引力

- 目前投资情境

- 按领域分類的投资机会

- 各地区的投资机会

- 投资报酬率分析

- 创投与私募股权格局

- 併购活动分析

- 未来投资展望

- 风险评估和缓解策略

- 市场风险

- 技术风险

- 监理风险

- 竞争风险

- 供应链风险

- 环境和永续性风险

- 风险缓解策略

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 金属-金属金属玻璃

- 金属-类金属玻璃

第六章:市场估计与预测:依形式,2021 年至 2034 年

- 主要趋势

- 丝带

- 电线

- 粉末

- 工作表

- 其他的

第七章:市场估计与预测:依材料成分,2021 年至 2034 年

- 主要趋势

- 铁基

- 锆基

- 钛基

- 铜基

- 钯基

- 镁基

- 铝基

- 其他作品

第八章:市场估计与预测:按製造工艺,2021 年至 2034 年

- 主要趋势

- 极快的冷却速度

- 物理气相沉积

- 固相反应

- 离子辐照

- 其他的

第九章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 电子和电气

- 汽车和运输

- 航太和国防

- 医疗保健

- 体育和休閒

- 活力

- 工业设备

- 其他的

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Amorphology Inc.

- Antai Technology Co., Ltd.

- EPSON ATMIX Corporation

- Exmet AB

- Glassimetal Technology

- Heraeus Holding

- Hitachi Metals Ltd.

- Liquidmetal Technologies Inc.

- Materion Corporation

- PrometalTech

- PX Group SA

- Qingdao Yunlu Advanced Materials Technology Co., Ltd.

- RS Alloys

- Usha Amorphous Metals Limited

The Global Metallic Glasses Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 3.3 billion by 2034, driven by the unique properties of metallic glasses, which combine high tensile strength with excellent corrosion resistance and malleability. These materials' amorphous atomic structure allows them to perform exceptionally well under challenging conditions, making them ideal for structural strength and precision. They are useful in industries requiring durability and resistance to wear, such as electrical and magnetic components. As industries continue to demand more advanced and efficient materials, the versatile applications of metallic glasses are gaining traction.

The market benefits from increased demand in the electromagnetic and electronics sectors. Metallic glasses' low power dissipation and high efficiency make them suitable for magnetic cores, sensors, and transformers. Moreover, advancements in manufacturing technologies, such as rapid solidification and physical vapor deposition, are reducing production costs and enabling scalable operations. The biomedical sector is another key growth area for metallic glasses, as their biocompatibility and mechanical strength make them ideal for medical implants and surgical tools. Their resistance to bacteria and wear adds to their appeal for healthcare applications.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.3 Billion |

| CAGR | 6.5% |

In 2024, the metal-metalloid segment of the metallic glasses market was valued at USD 1.1 billion and is projected to grow at a CAGR of 5.7% through 2034 fueled by the rising demand for lightweight and cost-effective materials, particularly in industries such as consumer electronics, augmented reality/virtual reality (AR/VR), and medical devices. These materials offer the perfect balance of strength and flexibility, making them ideal for the miniaturized components in these fast-evolving sectors. As technological advancements push for smaller, more efficient products, the adoption of metal-metalloid glasses is expected to accelerate across various applications.

The ribbons segment, valued at USD 700 million in 2024, is also projected to experience a growth rate of 5.1% through 2034, attributed to their exceptional magnetic properties, which make them particularly suitable for use in transformers and magnetic sensors. As the demand for advanced electronic systems, energy-efficient equipment, and more precise sensor technologies increases, ribbons made from metallic glasses will continue to play a crucial role in these applications. Their ability to perform under demanding conditions while maintaining high performance makes them an asset for industries focusing on power generation, energy distribution, and high-tech sensing technologies.

U.S. Metallic Glasses Market was valued at USD 530 million in 2024, with a projected growth rate of 6% CAGR from 2025 to 2034, driven by the growing demand for metallic glasses in aerospace, defense systems, and electronics. Close collaboration between manufacturers and defense contractors is expediting the development and distribution of new metallic glass solutions. Additionally, research institutions in the U.S. are playing a vital role in advancing new alloys and optimizing production processes, which further supports the market's expansion.

Key companies in the Global Metallic Glasses Market include Heraeus Holding GmbH, Liquidmetal Technologies Inc., Materion Corporation, Usha Amorphous Metals Limited, and Hitachi Metals Ltd. To strengthen their presence, companies in the metallic glasses market focus on expanding production capabilities and refining manufacturing processes to reduce costs. Strategic partnerships and collaborations with research institutions and other industry players are helping accelerate innovation and the introduction of new materials. Manufacturers invest in technological advancements, such as additive manufacturing and advanced alloy development, to meet the growing demand for high-performance materials across various industries.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Market definition and evolution

- 3.1.1 Definition and classification of metallic glasses

- 3.1.2 Historical development of metallic glasses

- 3.1.3 Material composition and properties

- 3.1.3.1 Atomic structure and characteristics

- 3.1.3.2 Mechanical properties

- 3.1.3.3 Magnetic properties

- 3.1.3.4 Corrosion resistance

- 3.1.3.5 Thermal properties

- 3.1.4 Manufacturing processes

- 3.1.4.1 Rapid solidification techniques

- 3.1.4.2 Melt spinning

- 3.1.4.3 Gas atomization

- 3.1.4.4 Suction casting

- 3.1.4.5 Additive manufacturing

- 3.1.5 Comparative analysis: metallic glasses vs. Conventional materials

- 3.1.5.1 Metallic glasses vs. Crystalline metals

- 3.1.5.2 Metallic glasses vs. Ceramics

- 3.1.5.3 Metallic glasses vs. Polymers

- 3.1.6 Technological advancements in metallic glasses

- 3.2 Impact of trump administration tariffs – structured overview

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.2 Price volatility in key materials

- 3.2.2.3 Supply chain restructuring

- 3.2.2.4 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (hs code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Profit margin analysis

- 3.5 Regulatory landscape and standards

- 3.5.1 Global regulatory framework

- 3.5.2 Regional regulatory frameworks

- 3.5.2.1 North America

- 3.5.2.1.1 Fda regulations (for medical applications)

- 3.5.2.1.2 Astm standards

- 3.5.2.1.3 Other relevant regulations

- 3.5.2.2 Europe

- 3.5.2.2.1 Eu medical device regulation (mdr)

- 3.5.2.2.2 Ce marking requirements

- 3.5.2.2.3 Reach regulations

- 3.5.2.3 Asia-pacific

- 3.5.2.3.1 China's regulations

- 3.5.2.3.2 Japan's regulations

- 3.5.2.3.3 Other regional regulations

- 3.5.2.4 Rest of the world

- 3.5.2.1 North America

- 3.5.3 Product certification and standards

- 3.5.3.1 Quality standards

- 3.5.3.2 Safety standards

- 3.5.3.3 Performance standards

- 3.5.4 Compliance challenges and strategies

- 3.5.5 Future regulatory trends and their implications

- 3.6 Market dynamics

- 3.6.1 Market drivers

- 3.6.1.1 Superior material properties

- 3.6.1.2 Increasing demand in electronics and energy sectors

- 3.6.1.3 Advancements in manufacturing technologies

- 3.6.1.4 Growing applications in biomedical field

- 3.6.2 Market restraints

- 3.6.2.1 High production costs

- 3.6.2.2 Limited size and shape capabilities

- 3.6.2.3 Brittleness and limited ductility

- 3.6.2.4 Competition from conventional materials

- 3.6.3 Market opportunities

- 3.6.3.1 Emerging applications in aerospace and defense

- 3.6.3.2 Advancements in additive manufacturing

- 3.6.3.3 Growing demand for sustainable materials

- 3.6.3.4 Expansion in developing economies

- 3.6.4 Market challenges

- 3.6.4.1 Scaling up production

- 3.6.4.2 Achieving consistent quality

- 3.6.4.3 Regulatory compliance

- 3.6.4.4 Market awareness and acceptance

- 3.6.1 Market drivers

- 3.7 Porter's five forces analysis

- 3.8 Pestle analysis

- 3.9 Value chain analysis

- 3.9.1 Raw material suppliers

- 3.9.2 Manufacturers

- 3.9.3 Distributors

- 3.9.4 End users

- 3.10 Environmental, social, and governance (esg) analysis

- 3.10.1 Environmental impact assessment

- 3.10.1.1 Carbon footprint analysis

- 3.10.1.2 Life cycle assessment (lca)

- 3.10.1.3 Waste management and recycling

- 3.10.1.4 Energy consumption in production

- 3.10.2 Social implications

- 3.10.2.1 Labor practices and working conditions

- 3.10.2.2 Community impact and engagement

- 3.10.2.3 Health and safety considerations

- 3.10.3 Governance and ethical considerations

- 3.10.3.1 Corporate governance practices

- 3.10.3.2 Ethical supply chain management

- 3.10.3.3 Transparency and reporting

- 3.10.4 Esg performance benchmarking of key players

- 3.10.5 Esg risk assessment and mitigation strategies

- 3.10.6 Future esg trends in the metallic glasses industry

- 3.10.1 Environmental impact assessment

- 3.11 Manufacturing and production analysis

- 3.11.1 Manufacturing process overview

- 3.11.1.1 Raw material procurement and preparation

- 3.11.1.2 Alloy melting and homogenization

- 3.11.1.3 Rapid solidification techniques

- 3.11.1.4 Post-processing and finishing

- 3.11.1.5 Quality control and testing

- 3.11.2 Production cost analysis

- 3.11.2.1 Raw material costs

- 3.11.2.2 Energy costs

- 3.11.2.3 Labor costs

- 3.11.2.4 Manufacturing overheads

- 3.11.2.5 Cost optimization strategies

- 3.11.3 Manufacturing facilities analysis

- 3.11.3.1 Key manufacturing locations

- 3.11.3.2 Production capacity assessment

- 3.11.3.3 Facility expansion plans

- 3.11.4 Supply chain challenges and solutions

- 3.11.5 Sustainability in manufacturing processes

- 3.11.5.1 Energy efficiency measures

- 3.11.5.2 Waste reduction strategies

- 3.11.5.3 Eco-friendly materials and processes

- 3.11.1 Manufacturing process overview

- 3.12 Consumer behavior and market trends analysis

- 3.12.1 Consumer preferences and purchasing patterns

- 3.12.2 Factors influencing purchase decisions

- 3.12.2.1 Performance and quality

- 3.12.2.2 Cost considerations

- 3.12.2.3 Sustainability factors

- 3.12.2.4 Brand reputation

- 3.12.3 Industry-specific adoption trends

- 3.12.3.1 Electronics industry adoption

- 3.12.3.2 Automotive industry adoption

- 3.12.3.3 Medical industry adoption

- 3.12.3.4 Aerospace industry adoption

- 3.12.4 Regional variations in consumer behavior

- 3.12.5 Impact of digital transformation on consumer engagement

- 3.12.6 Future consumer trends and their implications

- 3.13 Technological landscape and innovation analysis

- 3.13.1 Current technological trends in metallic glasses

- 3.13.2 Emerging technologies and their potential impact

- 3.13.2.1 Advanced manufacturing techniques

- 3.13.2.2 Novel alloy compositions

- 3.13.2.3 Surface modification technologies

- 3.13.2.4 Composite metallic glasses

- 3.13.3 R&d activities and innovation hubs

- 3.13.4 Technology adoption trends across applications

- 3.13.5 Technology readiness assessment

- 3.13.6 Future technology roadmap 2025-2034

- 3.14 Pricing analysis and economic factors

- 3.14.1 Pricing trends analysis

- 3.14.1.1 Historical price trends

- 3.14.1.2 Current pricing scenario

- 3.14.1.3 Price forecast

- 3.14.2 Factors affecting pricing

- 3.14.2.1 Raw material costs

- 3.14.2.2 Production complexity

- 3.14.2.3 Scale of production

- 3.14.2.4 Market competition

- 3.14.2.5 Application-specific requirements

- 3.14.3 Regional price variations

- 3.14.4 Price-value relationship analysis

- 3.14.5 Economic indicators impacting the market

- 3.14.5.1 Gdp growth and industrial production

- 3.14.5.2 R&d spending

- 3.14.5.3 Metal commodity prices

- 3.14.5.4 Energy costs

- 3.14.6 Pricing strategies of key market players

- 3.14.1 Pricing trends analysis

- 3.15 Raw materials and supply chain analysis

- 3.15.1 Key raw materials overview

- 3.15.1.1 Metals and metalloids

- 3.15.1.2 Rare earth elements

- 3.15.1.3 Other critical materials

- 3.15.2 Raw material sourcing and procurement

- 3.15.2.1 Global supply sources

- 3.15.2.2 Supply concentration and risks

- 3.15.2.3 Sustainable sourcing initiatives

- 3.15.3 Supply chain structure and dynamics

- 3.15.3.1 Upstream supply chain

- 3.15.3.2 Midstream processing

- 3.15.3.3 Downstream distribution

- 3.15.4 Supply chain challenges

- 3.15.4.1 Raw material availability and criticality

- 3.15.4.2 Price volatility

- 3.15.4.3 Geopolitical factors

- 3.15.4.4 Logistics and transportation

- 3.15.5 Supply chain risk mitigation strategies

- 3.15.6 Future trends in raw materials and supply chain

- 3.15.1 Key raw materials overview

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis of key players

- 4.2 Competitive positioning matrix

- 4.3 Competitive strategies adopted by key players

- 4.3.1 Product innovation and development

- 4.3.2 Mergers and acquisitions

- 4.3.3 Partnerships and collaborations

- 4.3.4 Expansion strategies

- 4.4 Investment analysis and market attractiveness

- 4.4.1 Current investment scenario

- 4.4.2 Investment opportunities by segment

- 4.4.3 Investment opportunities by region

- 4.4.4 Roi analysis

- 4.4.5 Venture capital and private equity landscape

- 4.4.6 M&a activity analysis

- 4.4.7 Future investment outlook

- 4.5 Risk assessment and mitigation strategies

- 4.5.1 Market risks

- 4.5.2 Technological risk

- 4.5.3 Regulatory risks

- 4.5.4 Competitive risks

- 4.5.5 Supply chain risks

- 4.5.6 Environmental and sustainability risks

- 4.5.7 Risk mitigation strategies

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Metal-metal metallic glasses

- 5.3 Metal-metalloid metallic glasses

Chapter 6 Market Estimates and Forecast, By Form, 2021 – 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Ribbons

- 6.3 Wires

- 6.4 Powders

- 6.5 Sheets

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Material Composition, 2021 – 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Iron-based

- 7.3 Zirconium-based

- 7.4 Titanium-based

- 7.5 Copper-based

- 7.6 Palladium-based

- 7.7 Magnesium-based

- 7.8 Aluminum-based

- 7.9 Other compositions

Chapter 8 Market Estimates and Forecast, By Manufacturing Process, 2021 – 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Extremely rapid cooling

- 8.3 Physical vapor deposition

- 8.4 Solid-state reaction

- 8.5 Ion irradiation

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By End Use Industry, 2021 – 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Electronics and electrical

- 9.3 Automotive and transportation

- 9.4 Aerospace and defense

- 9.5 Medical and healthcare

- 9.6 Sports and leisure

- 9.7 Energy

- 9.8 Industrial equipment

- 9.9 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Amorphology Inc.

- 11.2 Antai Technology Co., Ltd.

- 11.3 EPSON ATMIX Corporation

- 11.4 Exmet AB

- 11.5 Glassimetal Technology

- 11.6 Heraeus Holding

- 11.7 Hitachi Metals Ltd.

- 11.8 Liquidmetal Technologies Inc.

- 11.9 Materion Corporation

- 11.10 PrometalTech

- 11.11 PX Group SA

- 11.12 Qingdao Yunlu Advanced Materials Technology Co., Ltd.

- 11.13 RS Alloys

- 11.14 Usha Amorphous Metals Limited