|

市场调查报告书

商品编码

1750613

经桡动脉接取设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Transradial Access Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

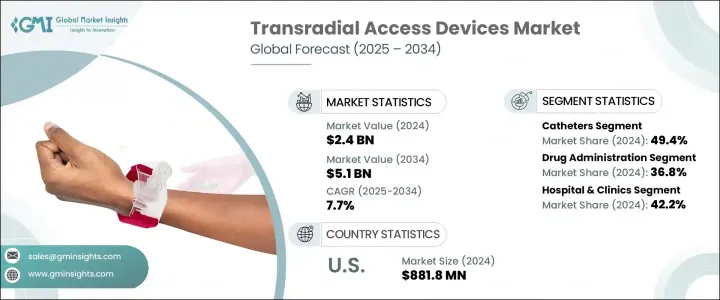

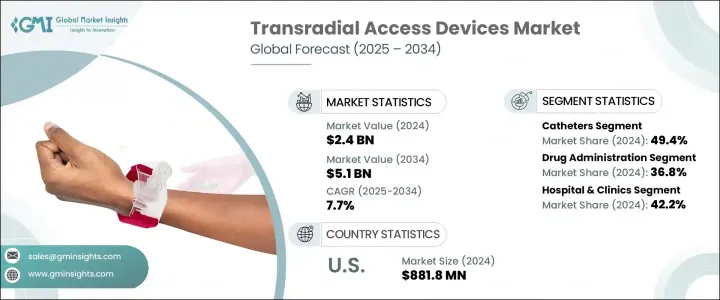

2024年,全球经桡动脉介入器械市场价值为24亿美元,预计到2034年将以7.7%的复合年增长率增长,达到51亿美元,这主要得益于心血管疾病(CVD)患病率的不断上升以及人们对微创介入手术日益增长的偏好。与传统方法相比,经桡动脉介入能够加快患者康復速度、降低出血风险并缩短住院时间,因此正日益受到青睐。随着医疗保健提供者更加重视安全性、舒适性和效率,向桡动脉介入的转变重塑了临床实践。经桡动脉介入已得到证实的临床可靠性和操作优势,进一步推动了导管室采用桡动脉优先介入的趋势。

对桡动脉技术的日益依赖推动了全球对经桡动脉介入器械(包括鞘管、导引线、止血带和导管等组件)的强劲需求。桡动脉入路的临床优势——例如更低的出血风险、更快的患者活动和更短的住院时间——持续影响介入性心臟病学的手术方案。随着医疗服务提供者致力于优化效率和患者满意度,采用桡动脉优先策略不仅在已开发市场日益普及,而且在心血管基础设施不断改善的新兴经济体中也日益流行。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 24亿美元 |

| 预测值 | 51亿美元 |

| 复合年增长率 | 7.7% |

导管目前在该产品领域占据领先地位,2024 年的市占率高达 49.4%。导管在复杂的血管网路中导航的有效性以及精准的器械输送能力使其成为心臟诊断和治疗手术的关键。导管设计的创新,例如扭矩响应的提升、柔韧性的增强以及亲水涂层,显着提高了手术成功率和患者的整体预后。此外,专为经桡动脉介入设计的新一代导管有助于减少穿刺部位併发症,并提高手术效率。

此外,药物管理领域在2024年占据36.8%的市场份额,预计到2034年将达到18亿美元。这些设备能够将标靶药物直接输送至患处,不仅可以提高治疗效果,还能缩短復原时间。这种能力在急性心血管事件中至关重要,因为快速给药可以挽救生命。由于其精准性和微创性,经桡动脉入路正被越来越多地探索更广泛的应用。它在心臟和非心臟疾病药物传递方面的作用日益增强,反映了经桡动脉解决方案的适应性及其不断扩展的应用范围。

2024年,美国经桡动脉介入器械市场规模达8.818亿美元,这得益于心血管介入手术数量的增长、支持性报销政策以及术者对桡动脉介入的偏好,这些因素正在加速其应用。随着人们对经桡动脉介入手术益处的认识不断提高,医疗体系的整合程度也不断提升。医院正迅速转向门诊PCI模式,充分利用桡动脉介入手术缩短病患恢復时间和简化手术的优势。监管支援、临床培训项目以及对先进导管室基础设施的投资,进一步巩固了这些器械的广泛应用。这种不断发展的环境确保了经桡动脉介入手术始终处于该地区介入性心臟病学创新的前沿。

该领域的主要参与者包括波士顿科学公司 (Boston Scientific)、Alvimedica、碧迪医疗 (Becton Dickinson and Company)、泰尔茂 (Terumo)、美敦力 (Medtronic)、泰利福 (Teleflex)、Palex Medical、ICU Medical、InnoMedica、康德Industries、AngioDynamics 和 Oscor。为了确保竞争优势,领先的公司专注于产品创新和技术升级。他们投资先进材料、人体工学设计和改进功能,以提高临床医生的可用性和患者的舒适度。许多公司透过策略合作伙伴关係、併购来扩大其地域覆盖范围。与医院和医疗保健网路的合作有助于早期采用和市场渗透。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 已开发经济体和发展中经济体心血管疾病盛行率不断上升

- 老年人口的成长

- 采用桡动脉入路进行介入手术的偏好日益增加

- 桡动脉通路装置在儿科患者的应用日益增多

- 产业陷阱与挑战

- 严格的监管框架

- 血管通路装置成本高且维护成本高

- 发展中国家缺乏心胸外科医师

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑川普政府关税

- 对贸易的影响

- 未来市场趋势

- 差距分析

- 专利分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 导管

- 导丝

- 鞘管和鞘管导入器

- 配件

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 药物管理

- 液体和营养管理

- 输血

- 诊断和测试

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 门诊手术中心

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Alvimedica

- Ameco Medical Industries

- AngioDynamics

- Becton Dickinson and Company

- Boston Scientific

- Cardinal Health

- Edward Lifesciences

- ICU Medical

- InnoMedica

- Medtronic

- Merit Medical System

- NIPRO Medical

- Oscor

- Palex Medical

- Teleflex

- Terumo

The Global Transradial Access Devices Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 7.7% to reach USD 5.1 billion by 2034, driven by the increasing prevalence of cardiovascular diseases (CVDs) and the rising preference for minimally invasive interventional procedures. Transradial access is gaining traction due to its ability to offer faster patient recovery, reduced risk of bleeding, and shorter hospital stays compared to traditional methods. The shift toward radial artery access has reshaped clinical practice, as healthcare providers prioritize safety, comfort, and efficiency. The trend toward using radial-first approaches in catheterization laboratories has been further fueled by its demonstrated clinical reliability and operational benefits.

This increasing reliance on radial techniques drives strong demand for transradial access devices worldwide, including components such as sheaths, guidewires, hemostasis bands, and catheters. The clinical advantages of the radial approach-such as lower bleeding risk, faster patient mobilization, and shorter hospital stays-continue to shape procedural protocols in interventional cardiology. As healthcare providers aim to optimize efficiency and patient satisfaction, adopting radial-first strategies is expanding not only in developed markets but also gaining momentum in emerging economies with improving cardiovascular infrastructure.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $5.1 Billion |

| CAGR | 7.7% |

Catheters currently lead the product segment with a commanding market share of 49.4% in 2024. Their effectiveness in navigating complex vascular networks and facilitating accurate device delivery makes them vital in diagnostic and therapeutic cardiac procedures. Innovation in catheter designs, such as improved torque response, enhanced flexibility, and hydrophilic coatings, has significantly boosted procedural success rates and overall patient outcomes. Furthermore, next-generation catheters designed specifically for transradial interventions contribute to reduced access site complications and increased procedural efficiency.

Additionally, the drug administration segment holds a 36.8% market share in 2024 and is forecasted to reach USD 1.8 billion by 2034. The ability of these devices to deliver targeted medications directly to affected areas not only enhances therapeutic results but also shortens recovery times. This capability is important in acute cardiovascular events, where rapid drug delivery can be life-saving. Transradial access is now being increasingly explored for broader applications, thanks to its precision and minimally invasive nature. Its growing role in delivering pharmacological agents for cardiac and non-cardiac conditions reflects the adaptability and expanding scope of transradial solutions.

U.S. Transradial Access Devices Market generated USD 881.8 million in 2024, driven by the number of cardiovascular interventions, supportive reimbursement policies, and operator preference for radial access, which is accelerating adoption. Increased awareness of the benefits of transradial procedures is leading to greater integration across healthcare systems. Hospitals are rapidly transitioning to outpatient-based PCI models, taking advantage of the reduced recovery time and procedural simplicity of radial access. Regulatory support, clinical training programs, and investment in advanced cath lab infrastructure further reinforce the widespread use of these devices. This progressive environment ensures that transradial access remains at the forefront of interventional cardiology innovation in the region.

Key players operating in this space include Boston Scientific, Alvimedica, Becton Dickinson and Company, Terumo, Medtronic, Teleflex, Palex Medical, ICU Medical, InnoMedica, Cardinal Health, Merit Medical System, Edward Lifesciences, NIPRO Medical, Ameco Medical Industries, AngioDynamics, and Oscor. To secure a competitive edge, leading companies are focusing on product innovation and technological upgrades. They invest in advanced materials, ergonomic designs, and improved functionality to boost clinician usability and patient comfort. Many firms expand their geographic footprint through strategic partnerships, mergers, and acquisitions. Collaborations with hospitals and healthcare networks help in early adoption and market penetration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing prevalence of cardiovascular disease in developed and developing economies

- 3.2.1.2 Growth in elderly age group

- 3.2.1.3 Rising preference for interventional procedures using radial artery access

- 3.2.1.4 Growing use of radial access devices in pediatric patients

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Stringent regulatory framework

- 3.2.2.2 High cost and maintenance of vascular access devices

- 3.2.2.3 Dearth of cardiothoracic surgeons in developing nations

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerationsTrump administration tariffs

- 3.6.1 Impact on trade

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Patent analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive analysis of major market players

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Catheters

- 5.3 Guidewires

- 5.4 Sheath and sheath introducers

- 5.5 Accessories

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Drug administration

- 6.3 Fluid and nutrition administration

- 6.4 Blood transfusion

- 6.5 Diagnostics and testing

- 6.6 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alvimedica

- 9.2 Ameco Medical Industries

- 9.3 AngioDynamics

- 9.4 Becton Dickinson and Company

- 9.5 Boston Scientific

- 9.6 Cardinal Health

- 9.7 Edward Lifesciences

- 9.8 ICU Medical

- 9.9 InnoMedica

- 9.10 Medtronic

- 9.11 Merit Medical System

- 9.12 NIPRO Medical

- 9.13 Oscor

- 9.14 Palex Medical

- 9.15 Teleflex

- 9.16 Terumo