|

市场调查报告书

商品编码

1750620

救护车市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Ambulance Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

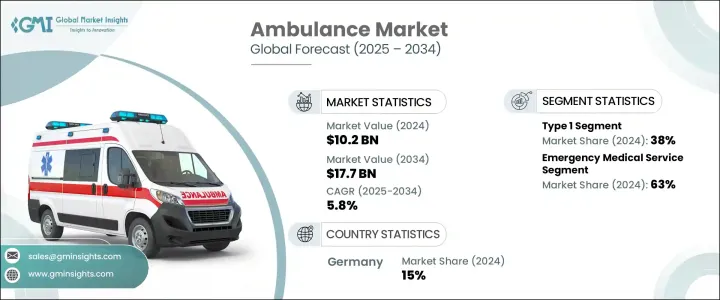

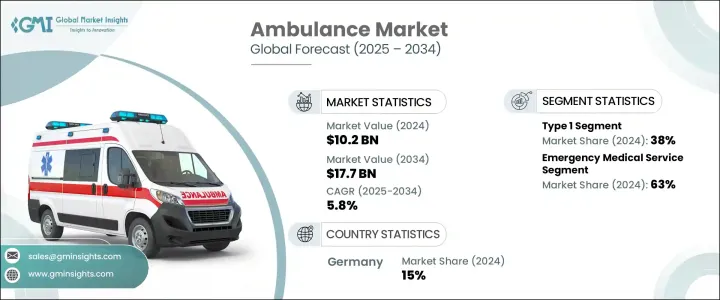

2024年,全球救护车市场规模达102亿美元,预计到2034年将以5.8%的复合年增长率增长,达到177亿美元,这得益于医疗保健支出的增长和紧急医疗服务(EMS)日益增长的重要性。政府和私营部门正在大力投资扩充救护车队、缩短反应时间并升级医疗技术。这些投资有助于确保救护车能够更好地应对紧急情况,并改善转运过程中的病患照护。因此,越来越多的救护车配备了先进的医疗设备,例如呼吸机、自动心肺復苏装置和先进的除颤器,以便在转运过程中处理危重病情。

对气道管理和呼吸器日益增长的重视进一步支撑了救护车市场的成长。呼吸器对于稳定呼吸窘迫患者病情至关重要,确保在心臟骤停或严重创伤等紧急情况下有效输送氧气。这些设备具有可调节压力和容量控制等先进功能,可帮助医护人员在前往医疗机构的途中提供重症监护。随着越来越多的医疗系统认识到高品质急救服务的价值,对装备更精良、更专业的救护车的需求持续增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 102亿美元 |

| 预测值 | 177亿美元 |

| 复合年增长率 | 5.8% |

2024年,1型救护车占据市场主导地位,占38%。这类车辆通常采用卡车底盘,为医疗设备和人员提供耐用的平台和额外的空间。 1型救护车日益受到青睐,是因为它们能够应对紧急情况,包括大型事故或自然灾害,并且能够运送多名患者或大型设备。

2024年,紧急医疗服务(EMS)领域占据63%的市场份额,这得益于医疗服务提供者优先考虑快速、可靠地转运重症患者。远距医疗和行动医疗解决方案的进步进一步提升了紧急医疗服务(EMS)的能力,使护理人员能够远端咨询医生,并在患者抵达医院之前优化护理方案。这些创新预计将增加对更先进的救护车的需求,这些救护车能够在转运过程中提供更远距离、更高品质的护理。

2024年,德国救护车市场占了15%的市场份额,这得益于强有力的监管支持,包括对环境永续性的支持以及电动救护车的日益普及。德国正积极采取措施减少碳足迹,电动救护车也因此越来越受欢迎。随着欧洲各地环境法规的收紧,德国已开始采用包括救护车在内的电动车,以满足严格的排放标准并改善空气品质。此举符合德国对永续发展的更广泛承诺,并使其成为向环保紧急医疗服务 (EMS) 转型的领导者。

全球救护车市场的主要参与者包括 Braun Industries、NAFFCO、Toyota、Demers Ambulances 和 Crestline Ambulance。为了扩大市场影响力,各公司正在投资电动救护车,以实现永续发展目标并降低营运成本。他们将即时远距医疗和先进监控系统等尖端技术融入车辆中。与医疗服务提供者和政府机构合作,改善服务交付和车队管理,有助于各公司提升竞争优势。此外,进军医疗基础设施快速发展的新兴市场,也使各公司得以挖掘新的收入来源。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 技术提供者

- 製造商

- 经销商

- 最终用途

- 利润率分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 其他国家的报復措施

- 对产业的影响

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 展望与未来考虑

- 对贸易的影响

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 慢性病和创伤病例增加

- 医疗支出不断上涨

- 救护车技术的进步

- 全球医疗保健领域的投资不断增长

- 产业陷阱与挑战

- 营运和维护成本高

- 交通拥堵和反应时间延迟

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 类型 1

- 类型 2

- 类型 3

- 中型

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 紧急医疗服务

- 消防救护车

- 其他的

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第八章:市场估计与预测:按燃料,2021 - 2034 年

- 主要趋势

- 柴油引擎

- 汽油

- 电动车

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Auto Ribeiro

- BAUS AT

- Bollanti

- Braun Industries

- Crestline Ambulance

- Demers Ambulances

- Excellence

- Frazer Ltd

- JCBL Group

- Life Line Emergency Vehicles

- Medicop

- Medix Specialty Vehicles

- Miller Coach Company

- NAFFCO

- O&H Vehicle Technology

- Osage Ambulances

- Profile Vehicles Oy

- REV Group

- Toyota

- WAS

The Global Ambulance Market was valued at USD 10.2 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 17.7 billion by 2034, driven by the increased healthcare spending and the rising importance of emergency medical services (EMS). Government and private sectors are investing significantly in expanding ambulance fleets, improving response times, and upgrading medical technology. These investments help ensure that ambulances are better equipped to handle emergencies, improving patient care during transport. As a result, ambulances are increasingly equipped with advanced medical equipment, such as ventilators, automated CPR devices, and advanced defibrillators, to manage critical conditions during transit.

The growing emphasis on airway management and ventilators further supports the ambulance market's growth. Ventilators are crucial in stabilizing patients with respiratory distress, ensuring oxygen is delivered effectively during emergencies such as cardiac arrest or severe trauma. With advanced features like adjustable pressure and volume control, these devices help paramedics provide critical care while en route to medical facilities. As more healthcare systems recognize the value of high-quality EMS, demand for better-equipped and specialized ambulances continues to rise.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.2 Billion |

| Forecast Value | $17.7 Billion |

| CAGR | 5.8% |

In 2024, Type 1 ambulances led the market, accounting for 38% share. These vehicles, typically built on a truck chassis, provide a durable platform and additional space for medical equipment and personnel. The growing preference for Type 1 ambulances is driven by their ability to handle emergencies, including large-scale accidents or natural disasters, and their capacity to transport multiple patients or larger equipment.

The EMS segment held a 63% share in 2024, driven by healthcare providers prioritizing rapid, reliable transport of critically ill patients. Advances in telemedicine and mobile health solutions have further improved EMS capabilities, enabling paramedics to consult with doctors remotely and optimize care before patients arrive at the hospital. These innovations are expected to increase the demand for more advanced ambulances capable of longer-distance, high-level care during transport.

Germany Ambulance Market held a 15% share in 2024, fueled by strong regulatory support for environmental sustainability and the growing adoption of electric ambulances. The country is taking proactive steps to reduce its carbon footprint, making electric ambulances an increasingly popular choice. As environmental regulations tighten across Europe, Germany has embraced electric vehicles, including ambulances, to meet stringent emission standards and contribute to cleaner air. This move aligns with the nation's broader commitment to sustainability and has positioned it as a leader in the transition toward eco-friendly emergency medical services (EMS).

Key players in the Global Ambulance Market include Braun Industries, NAFFCO, Toyota, Demers Ambulances, and Crestline Ambulance. To expand their market footprint, companies are investing in electric ambulances to meet sustainability goals and reduce operational costs. They integrate cutting-edge technologies like real-time telemedicine and advanced monitoring systems into their vehicles. Collaborations with healthcare providers and government agencies to improve service delivery and fleet management are helping companies enhance their competitive advantage. Additionally, expanding into emerging markets where healthcare infrastructure is rapidly developing has allowed companies to tap into new revenue streams.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Technology providers

- 3.2.3 Manufacturers

- 3.2.4 Distributors

- 3.2.5 End use

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Production cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and product strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news & initiatives

- 3.8 Regulatory landscape

- 3.9 Impact forces

- 3.9.1 Growth drivers

- 3.9.1.1 Rise in chronic diseases and trauma cases

- 3.9.1.2 Rising healthcare expenditure

- 3.9.1.3 Advancements in ambulance technology

- 3.9.1.4 Growing investments in the healthcare sector across the globe

- 3.9.2 Industry pitfalls & challenges

- 3.9.2.1 High operational and maintenance cost

- 3.9.2.2 Traffic congestion and delayed response times

- 3.9.1 Growth drivers

- 3.10 Growth potential analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Type 1

- 5.3 Type 2

- 5.4 Type 3

- 5.5 Medium-duty

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Emergency medical service

- 6.3 Fire ambulances

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 OEM

- 7.3 Aftermarket

Chapter 8 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Diesel

- 8.3 Gasoline

- 8.4 Electric vehicles

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Auto Ribeiro

- 10.2 BAUS AT

- 10.3 Bollanti

- 10.4 Braun Industries

- 10.5 Crestline Ambulance

- 10.6 Demers Ambulances

- 10.7 Excellence

- 10.8 Frazer Ltd

- 10.9 JCBL Group

- 10.10 Life Line Emergency Vehicles

- 10.11 Medicop

- 10.12 Medix Specialty Vehicles

- 10.13 Miller Coach Company

- 10.14 NAFFCO

- 10.15 O&H Vehicle Technology

- 10.16 Osage Ambulances

- 10.17 Profile Vehicles Oy

- 10.18 REV Group

- 10.19 Toyota

- 10.20 WAS