|

市场调查报告书

商品编码

1750621

颅颜面器械市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Craniomaxillofacial Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

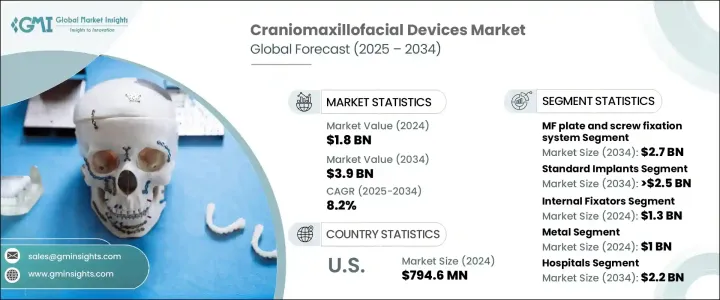

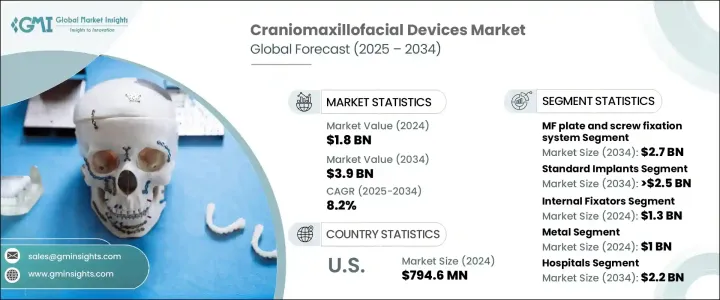

2024年,全球颅颜面器械市场规模达18亿美元,预计2034年将以8.2%的复合年增长率成长,达到39亿美元。这归因于道路交通事故、体育相关事件和暴力事件导致脸部损伤的发生率不断上升,从而刺激了对重建手术的需求。此外,儿童先天性脸部畸形也导致儿科手术对颅颜面器械的需求增加。微创手术的流行趋势也促进了市场的成长,因为这种手术可以加快患者康復速度,并缩短住院时间。

生物相容性金属等手术材料的进步以及影像技术的持续改进,在提升手术效果方面发挥重要作用。这些创新使外科医生能够执行更精准、更微创的手术,从而缩短恢復时间并降低併发症风险。先进成像系统的不断发展,使得手术过程中的即时视觉化成为可能,从而提高了精准度并保障了患者的整体安全。随着这些技术的不断发展,预计将显着促进颅颜面器械市场的成长。此外,发展中国家医疗支出的不断增长也促进了颅颜面器械的普及。这些地区报销政策的完善也有助于提高这些器械的可及性,尤其是在复杂的脸部重建手术中。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 18亿美元 |

| 预测值 | 39亿美元 |

| 复合年增长率 | 8.2% |

MF钢板螺丝固定係统市场预计到2034年将达到27亿美元的市场规模,这得益于其在治疗下颚骨、中面部和颅骨骨折方面的可靠性,目前仍是颅颌面外科手术中最广泛使用的系统之一。它们能够精确定位骨碎片,有助于加快康復速度并增强癒合效果。 MF钢板螺丝固定係统因其操作简单、稳定高效而受到外科医生的青睐。

在产品细分方面,内固定器在2024年的市场规模达到13亿美元,其受欢迎程度日益提升,因为其能够提供内部稳定,从而降低外部感染的风险。内固定器在復原过程中促进骨癒合的能力使其成为微创手术的首选。这种对微创手术的偏好与患者和外科医生对创伤更小、恢復更快的手术的需求相契合。

由于交通事故和运动伤害发生率高,且这些伤害通常需要重建手术,美国颅颜面器械市场在2024年的价值达到7.946亿美元。随着政府计画改善医疗服务可近性以及医疗器材技术创新,美国医院和诊所越来越多地采用先进的颅颜面器械。脸部重建手术的高需求以及尖端医疗技术的普及,预计将在未来几年继续推动美国市场的成长。

全球颅颜面器械市场的主要参与者,例如美敦力、史赛克和强生,都致力于透过策略性收购、产品创新和技术进步来扩大其市场份额。 B Braun 和 Integra 等公司正在透过整合先进的影像系统和生物相容性材料来增强其产品组合,以改善手术效果。此外,Zimmer Biomet 和 KLS Martin 等公司正在加大研发投入,以保持竞争力,确保提供高品质、高效且微创的解决方案。这些策略正在帮助这些参与者在快速发展的颅颜面器械市场中站稳脚跟。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 脸部损伤和创伤发生率上升

- 越来越多的人接受整容手术

- 先天性脸部畸形的盛行率不断上升

- 不断扩大的医疗支出

- 产业陷阱与挑战

- 颅颜面手术费用高昂

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 2024年定价分析

- 竞争对手提供的患者专用颅颜面植入物

- 报销场景

- 技术格局

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- MF板螺丝固定係统

- 颅骨瓣固定係统

- CMF牵引系统

- 颞颚关节置换系统

- 胸椎固定係统

- 骨移植替代系统

第六章:市场估计与预测:按植入物类型,2021 年至 2034 年

- 主要趋势

- 标准植入物

- 客製化/患者专用植入物

第七章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 内固定器

- 外固定器

第八章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 金属

- 生物可吸收材料

- 陶瓷

- 聚合物

第九章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 创伤重建手术

- 颅脑手术

- 中面部手术

- 眼眶底重建手术

- 下颚手术

- 正颚手术

- 整型手术

第 10 章:市场估计与预测:按可吸收性,2021 年至 2034 年

- 主要趋势

- 可吸收固定器

- 不可吸收固定器

第 11 章:市场估计与预测:按设备类型,2021 年至 2034 年

- 主要趋势

- 重建手术器械

- 创伤手术器械

第 12 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第 13 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 14 章:公司简介

- acumed

- B Braun

- CAVENDISH IMPLANTS

- CONMED

- INTEGRA

- Johnson & Johnson

- KLS martin Group

- Matrix Surgical USA

- medartis

- Medtronic

- stryker

- XILLOC

- ZIMMER BIOMET

The Global Craniomaxillofacial Devices Market was valued at USD 1.8 billion in 2024 and is estimated to grow at a CAGR of 8.2% to reach USD 3.9 billion by 2034, attributed to the rising occurrence of facial injuries resulting from road accidents, sports-related incidents, and violence, which are fueling the demand for reconstructive surgeries. Additionally, congenital facial deformities in children contribute to the increased need for CMF devices in pediatric surgeries. The trend toward minimally invasive surgical procedures, which offer faster recovery and shorter hospital stays, is also contributing to the growth.

Advancements in surgical materials, such as biocompatible metals, and the continuous improvement in imaging technologies are playing a significant role in enhancing surgical outcomes. These innovations enable surgeons to perform more accurate and minimally invasive procedures, leading to quicker recovery times and reduced risk of complications. The ongoing development of advanced imaging systems allows for real-time visualization during surgeries, improving precision and overall safety for patients. As these technologies continue to evolve, they are expected to significantly contribute to the growth of the craniomaxillofacial devices market. Additionally, the rising healthcare spending in developing countries is facilitating greater access to CMF devices. Improved reimbursement policies in these regions are helping to make these devices more accessible, especially for complex facial reconstruction cases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.8 Billion |

| Forecast Value | $3.9 Billion |

| CAGR | 8.2% |

The MF plate and screw fixation system segment is expected to generate USD 2.7 billion by 2034 driven by the reliability in treating fractures of the mandible, midface, and skull, these systems remain among the most widely used in craniomaxillofacial surgeries. They offer precise alignment of bone fragments, contributing to faster recovery and enhanced healing. MF plate and screw fixation systems are favored by surgeons due to their straightforward application and efficient stabilization capabilities.

In terms of product segmentation, internal fixators generated USD 1.3 billion in 2024, gaining popularity because internal fixators offer the benefit of providing internal stabilization, which reduces the risk of external infections. Their ability to promote bone healing during recovery makes them highly favored for minimally invasive surgeries. This preference for less invasive procedures aligns with patient and surgeon demand for less traumatic surgeries that also offer quicker recovery times.

U.S. Craniomaxillofacial Devices Market was valued at USD 794.6 million in 2024 due to the high incidence of traffic-related accidents and sports injuries, which often require reconstructive surgeries. With government programs improving healthcare access and technological innovations in medical devices, hospitals and clinics in the U.S. are increasingly adopting advanced CMF devices. This combination of high demand for facial reconstruction procedures and enhanced access to cutting-edge medical technologies is expected to continue driving the U.S. market growth in the coming years.

Key players in the Global Craniomaxillofacial Devices Market, such as Medtronic, Stryker, and Johnson & Johnson, focus on expanding their market presence through strategic acquisitions, product innovations, and technological advancements. Companies like B Braun and Integra are enhancing their portfolios by incorporating advanced imaging systems and biocompatible materials to improve surgical outcomes. Additionally, firms like Zimmer Biomet and KLS Martin are increasing their investments in research and development to stay competitive, ensuring they provide high-quality, efficient, and minimally invasive solutions. These strategies are helping these players strengthen their foothold in the rapidly evolving craniomaxillofacial devices market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates & calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising incidence of facial injuries and trauma

- 3.2.1.2 Increasing adoption of cosmetic surgeries

- 3.2.1.3 Growing prevalence of congenital facial deformities

- 3.2.1.4 Expanding healthcare expenditure

- 3.2.2 Industry pitfalls & challenges

- 3.2.2.1 High cost of craniomaxillofacial procedures

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Retaliatory measures

- 3.5.2 Impact on the Industry

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (selling price)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (raw materials)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Pricing analysis, 2024

- 3.7 Patient specific craniomaxillofacial implants, by competitor

- 3.8 Reimbursement scenario

- 3.9 Technology landscape

- 3.10 Gap analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 MF plate and screw fixation system

- 5.3 Cranial flap fixation system

- 5.4 CMF distraction system

- 5.5 Temporomandibular joint replacement system

- 5.6 Thoracic fixation system

- 5.7 Bone graft substitute system

Chapter 6 Market Estimates and Forecast, By Implant Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Standard implants

- 6.3 Customized/patient-specific implants

Chapter 7 Market Estimates and Forecast, By Location, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Internal fixators

- 7.3 External fixators

Chapter 8 Market Estimates and Forecast, By Material, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Metals

- 8.3 Bioabsorbable materials

- 8.4 Ceramics

- 8.5 Polymers

Chapter 9 Market Estimates and Forecast, By Applications, 2021 – 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Trauma reconstruction surgery

- 9.2.1 Cranial surgery

- 9.2.2 Mid-face surgery

- 9.2.3 Orbital floor reconstruction surgery

- 9.2.4 Mandibular surgery

- 9.3 Orthognathic surgery

- 9.4 Plastic surgery

Chapter 10 Market Estimates and Forecast, By Resorbability, 2021 – 2034 ($ Mn)

- 10.1 Key trends

- 10.2 Resorbable fixators

- 10.3 Non-resorbable fixators

Chapter 11 Market Estimates and Forecast, By Device Type, 2021 – 2034 ($ Mn)

- 11.1 Key trends

- 11.2 Reconstruction surgery devices

- 11.3 Trauma surgery devices

Chapter 12 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 12.1 Key trends

- 12.2 Hospitals

- 12.3 Ambulatory surgery centers

- 12.4 Other end use

Chapter 13 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 13.1 Key trends

- 13.2 North America

- 13.2.1 U.S.

- 13.2.2 Canada

- 13.3 Europe

- 13.3.1 Germany

- 13.3.2 UK

- 13.3.3 France

- 13.3.4 Spain

- 13.3.5 Italy

- 13.3.6 Netherlands

- 13.4 Asia Pacific

- 13.4.1 China

- 13.4.2 Japan

- 13.4.3 India

- 13.4.4 Australia

- 13.4.5 South Korea

- 13.5 Latin America

- 13.5.1 Brazil

- 13.5.2 Mexico

- 13.5.3 Argentina

- 13.6 Middle East and Africa

- 13.6.1 South Africa

- 13.6.2 Saudi Arabia

- 13.6.3 UAE

Chapter 14 Company Profiles

- 14.1 acumed

- 14.2 B Braun

- 14.3 CAVENDISH IMPLANTS

- 14.4 CONMED

- 14.5 INTEGRA

- 14.6 Johnson & Johnson

- 14.7 KLS martin Group

- 14.8 Matrix Surgical USA

- 14.9 medartis

- 14.10 Medtronic

- 14.11 stryker

- 14.12 XILLOC

- 14.13 ZIMMER BIOMET