|

市场调查报告书

商品编码

1750626

电池测试设备市场机会、成长动力、产业趋势分析及2025-2034年预测Battery Test Equipment Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球电池测试设备市场规模达12亿美元,预计到2034年将以6.5%的复合年增长率成长,达到22亿美元,这主要得益于电动车需求的不断增长、再生能源基础设施的进步以及智慧电子设备的成长。随着电池系统日益复杂且性能要求越来越高,製造商越来越重视能够确保电池耐用性、准确性和符合国际安全标准的测试工具。对电池健康、生命週期优化和预测性诊断的日益关注,使得测试设备成为各行各业的必备之物。自动化、资料分析和云端平台的整合也正在改变传统的测试工作流程。

这些智慧系统可实现即时监控、进阶资料记录和错误检测,为製造商提供更快、更精准的洞察。随着新型电池化学成分和架构的出现,对灵活、可扩展且智慧的测试解决方案的需求日益增长,这对于维护运输、储存和电子等领域的产品可靠性至关重要。这些现代化系统不仅提高了诊断的准确性,还缩短了测试週期,从而加快了创新电池技术的上市时间。它们能够适应各种电池规格和配置,确保其在快速发展的能源格局中始终保持竞争力。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 12亿美元 |

| 预测值 | 22亿美元 |

| 复合年增长率 | 6.5% |

在功能性细分领域中,2024年,电池级测试占据主导地位,市场规模达7亿美元,因为在组装成电池模组或电池组之前,需要对单个电池进行详细分析,以检测与能量容量、内阻和电压一致性相关的问题。这种基础评估在预防系统故障和提高营运效率方面发挥关键作用。随着电池技术的快速发展,电池测试在确保产品寿命和安全性能方面比以往任何时候都更加重要。

从产品类型来看,固定式测试系统占据了最大的市场份额,到2024年将达到70%。其卓越的精度、更长的测试时间以及管理复杂性能评估的能力使其成为涉及大规模储能和重型电池组应用的理想选择。在受控条件下进行全面分析的需求,使得固定式设备继续成为致力于提供高性能能源解决方案的开发商、研究人员和电池製造商的首选。

美国电池测试设备市场在2024年创收1.961亿美元,预计到2034年将以6.8%的复合年增长率增长,这得益于持续创新、清洁能源领域的扩张以及电池生产和测试基础设施投资的不断增加。政府的支持性政策和电动车的快速普及也加速了该地区对先进电池测试技术的需求。

为了巩固市场地位,Chroma ATE、Arbin、NH Research、Midtronics 和 Neware Technology Limited 等公司正在实施以产品创新、全球扩张和协作为重点的策略性倡议。许多公司正在投资研发,以提高测试精度并支援不断发展的电池化学技术。 Maccor 和 Bitrode 等公司正在推出可扩展的模组化测试平台,以满足多样化的客户需求。此外,一些公司正在整合人工智慧驱动的分析和云端连接,以提供智慧诊断工具。与研究机构和原始设备製造商 (OEM) 的合作以及客製化服务,也帮助这些公司在充满活力、创新驱动的市场中获得竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 组件提供者

- 製造商

- 技术提供者

- 配销通路分析

- 最终用途

- 利润率分析

- 供应商格局

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 对贸易的影响

- 技术与创新格局

- 专利分析

- 监管格局

- 成本細項分析

- 重要新闻和倡议

- 衝击力

- 成长动力

- 充电电池需求不断成长

- 电动车(EV)普及率的成长

- 扩大储能係统

- 电池测试的技术进步

- 产业陷阱与挑战

- 初始投资成本高

- 电池技术的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 固定式

- 便携的

第六章:市场估计与预测:依功能,2021 - 2034 年

- 主要趋势

- 电池测试

- 模组测试

- 包装测试

第七章:市场估计与预测:按设备,2021 - 2034 年

- 主要趋势

- 容量测试仪

- 安全检测设备

- 温度测试仪

- 电阻测试仪

- 电压监视器

- 故障追踪器

- 其他的

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 汽车

- 消费性电子产品

- 能源和公用事业

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 法国

- 英国

- 西班牙

- 义大利

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 南非

- 沙乌地阿拉伯

第十章:公司简介

- AMETEK

- Amprobe

- Arbin Instruments

- BatteryDAQ

- Bio-Logic Science

- Bitrode

- Cadex Electronics

- Chroma ATE

- Digatron Power Electronics

- FLIR Systems

- HIOKI EE

- ITECH Electronic

- Keysight Technologies

- Maccor

- Megger

- Midtronics

- Neware

- NH Research

- Pine Research

- Tenmars

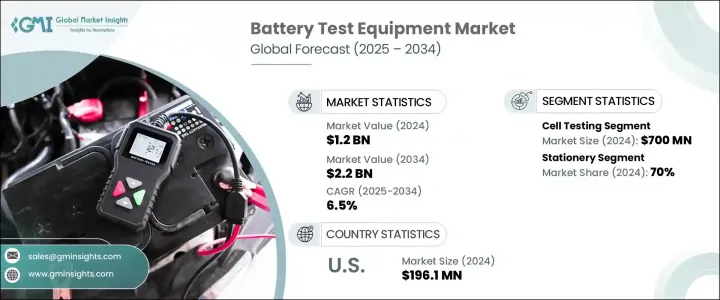

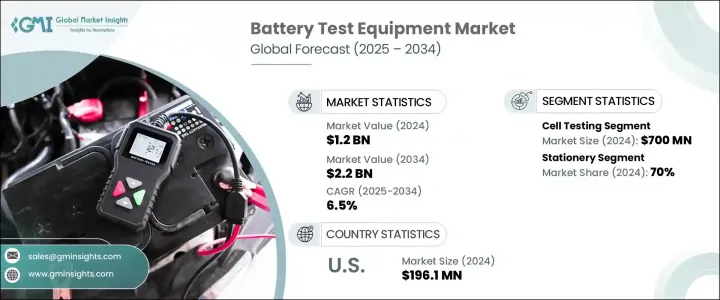

The Global Battery Test Equipment Market was valued at USD 1.2 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 2.2 billion by 2034, driven by the rising demand for electric mobility, advancements in renewable energy infrastructure, and growth in smart electronic devices. As battery systems become more complex and performance-intensive, manufacturers are placing higher emphasis on testing tools that ensure battery durability, accuracy, and compliance with international safety standards. This rising focus on battery health, lifecycle optimization, and predictive diagnostics has made test equipment essential across industries. The integration of automation, data analytics, and cloud platforms is also transforming traditional testing workflows.

These intelligent systems allow for real-time monitoring, advanced data logging, and error detection, providing manufacturers with faster, more precise insights. As new battery chemistries and architectures emerge, the need for flexible, scalable, and smart testing solutions becomes increasingly critical in maintaining product reliability across sectors such as transportation, storage, and electronics. These modern systems not only improve the accuracy of diagnostics but also reduce testing cycle times, enabling quicker time-to-market for innovative battery technologies. Their adaptability to a wide range of cell formats and configurations ensures they remain relevant in a rapidly evolving energy landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.2 Billion |

| Forecast Value | $2.2 Billion |

| CAGR | 6.5% |

Among functional segments, testing at the cell level dominated in 2024, generating USD 700 million due to the need for detailed analysis of individual cells to detect issues related to energy capacity, internal resistance, and voltage consistency before assembly into battery modules or packs. Such foundational evaluation plays a pivotal role in preventing system-wide failures and improving operational efficiency. With the rapid evolution of battery technology, cell testing has become more crucial than ever in guaranteeing product longevity and safe performance.

From a product type perspective, stationary test systems held the largest share of the market, accounting for 70% in 2024. Their superior precision, longer testing capabilities, and ability to manage complex performance evaluations have made them ideal for applications involving large-scale energy storage and heavy-duty battery units. The need for comprehensive analysis under controlled conditions continues to make stationary equipment the preferred choice for developers, researchers, and battery manufacturers focused on delivering high-performance energy solutions.

United States Battery Test Equipment Market generated USD 196.1 million in 2024 and is projected to grow at a CAGR of 6.8% through 2034, driven by continuous innovation, expansion in the clean energy sector, and increasing investments in battery production and testing infrastructure. Supportive government policies and the rapid adoption of electric mobility have also accelerated the demand for advanced battery testing technologies across the region.

To strengthen their market position, companies like Chroma ATE, Arbin, NH Research, Midtronics, and Neware Technology Limited are pursuing strategic initiatives focused on product innovation, global expansion, and collaboration. Many are investing in R&D to enhance test precision and support evolving battery chemistry. Firms such as Maccor and Bitrode are launching scalable, modular testing platforms that address diverse customer needs. Additionally, several players are integrating AI-driven analytics and cloud connectivity to offer intelligent diagnostic tools. Partnerships with research institutes and OEMs, along with customized service offerings, are also helping these companies gain competitive advantages in a dynamic, innovation-driven market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material providers

- 3.1.1.2 Component providers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 Distribution channel analysis

- 3.1.1.6 End use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Impact of trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration

- 3.2.3.2 Pricing and product strategies

- 3.2.1 Impact on trade

- 3.3 Technology & innovation landscape

- 3.4 Patent analysis

- 3.5 Regulatory landscape

- 3.6 Cost breakdown analysis

- 3.7 Key news & initiatives

- 3.8 Impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Rising demand for rechargeable batteries

- 3.8.1.2 Growth in electric vehicle (EV) adoption

- 3.8.1.3 Expansion of energy storage systems

- 3.8.1.4 Technological advancements in battery testing

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 High Initial Investment Costs

- 3.8.2.2 Complexity of Battery Technologies

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Mn)

- 5.1 Key trends

- 5.2 Stationary

- 5.3 Portable

Chapter 6 Market Estimates & Forecast, By Function, 2021 - 2034 ($Mn)

- 6.1 Key trends

- 6.2 Cell testing

- 6.3 Module testing

- 6.4 Pack testing

Chapter 7 Market Estimates & Forecast, By Equipment, 2021 - 2034 ($Mn)

- 7.1 Key trends

- 7.2 Capacity tester

- 7.3 Safety testing equipment

- 7.4 Temperature tester

- 7.5 Resistance tester

- 7.6 Voltage monitor

- 7.7 Fault tracker

- 7.8 Others

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn)

- 8.1 Key trends

- 8.2 Automotive

- 8.3 Consumer electronics

- 8.4 Energy and utility

- 8.5 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 France

- 9.3.3 UK

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 AMETEK

- 10.2 Amprobe

- 10.3 Arbin Instruments

- 10.4 BatteryDAQ

- 10.5 Bio-Logic Science

- 10.6 Bitrode

- 10.7 Cadex Electronics

- 10.8 Chroma ATE

- 10.9 Digatron Power Electronics

- 10.10 FLIR Systems

- 10.11 HIOKI E.E.

- 10.12 ITECH Electronic

- 10.13 Keysight Technologies

- 10.14 Maccor

- 10.15 Megger

- 10.16 Midtronics

- 10.17 Neware

- 10.18 NH Research

- 10.19 Pine Research

- 10.20 Tenmars