|

市场调查报告书

商品编码

1755185

汽车门锁市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Car Door Latch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

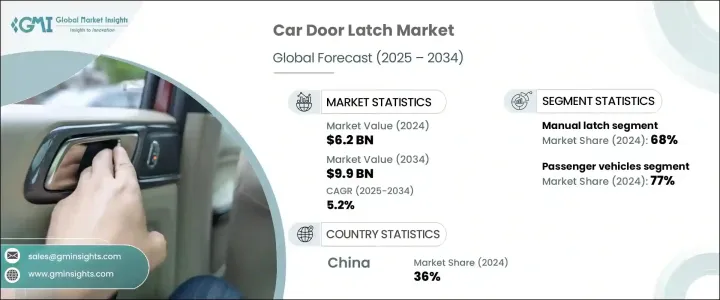

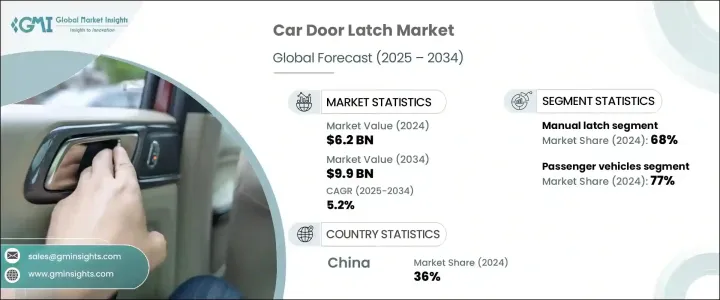

2024年,全球车门锁市场规模达62亿美元,预计2034年将以5.2%的复合年增长率成长,达到99亿美元。这得益于全球汽车产量的不断增长、消费者对增强安全功能的兴趣日益浓厚,以及监管标准不断提升,以推动碰撞安全性能的提升。汽车产业向电动化和高端化转型,加速了智慧和电子锁系统的普及,进一步刺激了产业扩张。随着汽车产量的成长,尤其是在巴西、中国和印度等快速成长的经济体,对车门锁等关键机械和安全零件的需求也在成长。中产阶级的壮大和城市的快速发展也推动了个人汽车保有量的增加,从而推动了对可靠锁系统的需求。

汽车安全性日益重要,持续影响市场的发展方向。随着政府法规日益严格以及消费者期望值不断提升,汽车製造商正在整合先进的门锁系统,以增强乘客保护。对提升儿童安全性和碰撞应变能力的电子和电动门锁的需求日益增长。随着汽车製造商更加重视安全性和便利性,门锁技术的创新势头强劲,尤其是在这些系统通常作为标配的高端汽车领域。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 62亿美元 |

| 预测值 | 99亿美元 |

| 复合年增长率 | 5.2% |

2024年,手动门锁市场占据68%的市场份额,预计到2034年将以4.5%的复合年增长率成长。手动门锁的主导地位源于其在中低阶车型中的简洁性、成本效益和适应性。与自动或电子门锁相比,手动门锁更易于安装、维护成本更低且更耐用。在消费者註重成本的地区,尤其是在发展中国家,汽车製造商依赖手动门锁系统,该系统无需复杂的先进电子设备即可提供功能。其坚固耐用和较长的使用寿命也使其在大批量生产中更具吸引力。

乘用车市场在2024年占据了77%的市场份额,预计由于全球产量巨大且销量不断增长,2034年的复合年增长率将达到5.5%。随着美国、欧洲、印度和中国等主要汽车市场的消费者越来越多地转向经济实惠的私家车,汽车製造商强调可扩展且高效的锁定技术。这些技术包括手动和电动锁定係统,可根据车型和市场偏好提供灵活性。

2024年,中国车门锁市场占据36%的市场份额,市场规模达10.2亿美元,这得益于中国庞大的汽车产能、不断增长的汽车保有量以及竞争激烈的供应链网络。该地区受益于较低的生产成本、强劲的本地需求以及政府扶持电动车的倡议。因此,电子锁系统的普及率正在不断提高。国内製造商正在加强研发力度,以适应全球市场不断发展的安全标准和智慧出行解决方案。

全球车门锁市场的主要参与者包括麦格纳、U-Shin、博泽汽车、Huf Hulsbeck & Furst、白木工业株式会社、凯毅德股份公司、恩坦华产品公司、WITTE 汽车、爱信株式会社和三井金属ACT。为了巩固其在全球车门锁市场的地位,各公司纷纷投资研发电子和智慧锁技术,以满足不断变化的安全和便利需求。与汽车製造商的策略联盟有助于确保在车辆开发过程中整合新系统。製造和供应业务的全球扩张支持了区域需求,而轻量化、节能零件的创新则与永续发展目标相契合。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件及子零件製造商

- 汽车门锁製造商

- 汽车原厂设备製造商

- 售后市场供应商/经销商

- 利润率分析

- 技术与创新格局

- 价格趋势

- 成本細項分析

- 永续性和 ESG 趋势

- 门锁生产对环境的影响

- 使用可回收/环保材料

- 製造过程中的能源效率

- 创新与研发分析

- 消费者行为与购买趋势

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 全球汽车产量和销售量不断成长

- 车辆安全的需求不断增加

- 电气化和智慧锁系统

- 机电一体化技术进步

- 电动车 (EV) 和自动驾驶汽车 (AV) 的兴起

- 产业陷阱与挑战

- 原料成本上涨

- 先进系统的整合复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 手动闩锁

- 电子锁存器(E-latch)

第六章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 掀背车

- 轿车

- 越野车

- 商用车

- 轻型商用车(LCV)

- 中型商用车(MCV)

- 重型商用车(HCV)

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 侧门闩锁

- 后挡板闩锁

- 引擎盖锁扣

- 后门闩锁

第八章:市场估计与预测:按机制,2021 - 2034 年

- 主要趋势

- 电缆锁扣

- 桿锁

- 锁闩

- 弹簧锁

第九章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 原始设备製造商(OEM)

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第 11 章:公司简介

- AISIN Corporation

- Brose Fahrzeugteile

- Continental AG

- Dura Automotive Systems

- Eberhard Manufacturing

- Huf Hulsbeck & Furst

- IFB Automotive

- Inteva Products

- Kiekert AG

- Magna

- Minda VAST Access Systems

- Mitsui Kinzoku ACT

- Prabha Engineering

- Robert Bosch

- Sandhar Technologie

- Shiroki Corporation

- Shivani Locks

- STRATTEC Security Corporation

- U-Shin

- WITTE Automotive

The Global Car Door Latch Market was valued at USD 6.2 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 9.9 billion by 2034, fueled by increasing vehicle production worldwide, stronger consumer interest in enhanced safety features, and regulatory standards that push for improved crash safety performance. The shift toward electric and high-end vehicles has accelerated the adoption of smart and electronic latching systems, further stimulating industry expansion. As automotive production rises, particularly across fast-growing economies such as Brazil, China, and India, so does the demand for essential mechanical and safety components like door latches. Middle-class expansion and rapid urban development are increasing personal vehicle ownership, driving the need for dependable latch systems.

The growing importance of safety in automobiles continues to influence this market's direction. With more stringent government regulations and heightened consumer expectations, automakers are integrating advanced latch systems to enhance passenger protection. Demand rises for electronic and power latches that improve child safety and crash response. As automakers focus on security and convenience, innovation in latch technology is gaining momentum, particularly in the premium vehicle segment where these systems are often standard.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $6.2 billion |

| Forecast Value | $9.9 billion |

| CAGR | 5.2% |

The manual latches segment held a 68% share in 2024 and is forecasted to grow at 4.5% CAGR through 2034. Their dominance stems from simplicity, cost-efficiency, and adaptability in lower and mid-range vehicles. Compared to automatic or electronic alternatives, manual latches are easier to install, require less maintenance, and are more durable. In regions where cost-conscious consumers dominate, especially in developing nations, automakers rely on manual latch systems that deliver functionality without the complexity of advanced electronics. Their ruggedness and long service life add to their appeal in high-volume manufacturing.

Passenger vehicles segment accounted for 77% share in 2024 and is expected to grow at a CAGR of 5.5% during 2034 due to massive global output and rising sales volume. As consumers in major automotive markets such as the U.S., Europe, India, and China increasingly turn to affordable, personal vehicles, automakers emphasize scalable and efficient latching technologies. These include manual and powered systems that provide flexibility for vehicle classes and market preferences.

China Car Door Latch Market held a 36% share in 2024 and generated USD 1.02 billion in 2024 attributed to China's massive vehicle production capacity, rising car ownership, and competitive supply chain network. The region benefits from lower production costs, high local demand, and government initiatives favoring electric vehicles. As a result, there's a growing adoption of electronic latch systems. Domestic manufacturers ramp up research and development to align with evolving safety standards and smart mobility solutions in the global market.

Major players in the Global Car Door Latch Market include Magna, U-Shin, Brose Fahrzeugteile, Huf Hulsbeck & Furst, Shiroki Corporation, Kiekert AG, Inteva Products, WITTE Automotive, AISIN Corporation, Mitsui Kinzoku ACT. To strengthen their position in the global car door latch market, companies invest in R&D for electronic and smart latch technologies that meet evolving safety and convenience demands. Strategic alliances with vehicle manufacturers help ensure the integration of new systems during vehicle development. Global expansion of manufacturing and supply operations supports regional demand, while innovation in lightweight, energy-efficient components aligns with sustainability goals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component & sub-component manufacturers

- 3.2.3 Car door latch manufacturers

- 3.2.4 Automotive original equipment manufacturers

- 3.2.5 Aftermarket suppliers/distributors

- 3.3 Profit margin analysis

- 3.4 Technology & innovation landscape

- 3.5 Price trends

- 3.6 Cost breakdown analysis

- 3.7 Sustainability & ESG trends

- 3.7.1 Environmental impact of latch production

- 3.7.2 Use of recycled/eco-friendly materials

- 3.7.3 Energy efficiency in manufacturing processes

- 3.8 Innovation & R&D analysis

- 3.9 Consumer behavior & buying trends

- 3.10 Patent analysis

- 3.11 Key news & initiatives

- 3.12 Regulatory landscape

- 3.13 Impact forces

- 3.13.1 Growth drivers

- 3.13.1.1 Increasing global vehicle production and sales

- 3.13.1.2 Increasing demand for vehicle safety

- 3.13.1.3 Electrification and smart locking systems

- 3.13.1.4 Technological advancements in mechatronics

- 3.13.1.5 Rise of electric vehicles (EVs) and autonomous vehicles (AVs)

- 3.13.2 Industry pitfalls & challenges

- 3.13.2.1 Rising raw material costs

- 3.13.2.2 Integration complexity of advanced systems

- 3.13.1 Growth drivers

- 3.14 Growth potential analysis

- 3.15 Porter's analysis

- 3.16 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Manual latch

- 5.3 Electronic latch (E-latch)

Chapter 6 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Passenger vehicles

- 6.2.1 Hatchback

- 6.2.2 Sedan

- 6.2.3 SUV

- 6.3 Commercial vehicles

- 6.3.1 Light Commercial Vehicles (LCV)

- 6.3.2 Medium Commercial Vehicles (MCV)

- 6.3.3 Heavy Commercial Vehicles (HCV)

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Side door latch

- 7.3 Tailgate latch

- 7.4 Hood latch

- 7.5 Back door latch

Chapter 8 Market Estimates & Forecast, By Mechanism, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Cable latch

- 8.3 Rod latch

- 8.4 Deadbolt latch

- 8.5 Spring-loaded latch

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 Original Equipment Manufacturers (OEM)

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 ANZ

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 Saudi Arabia

- 10.6.3 South Africa

Chapter 11 Company Profiles

- 11.1 AISIN Corporation

- 11.2 Brose Fahrzeugteile

- 11.3 Continental AG

- 11.4 Dura Automotive Systems

- 11.5 Eberhard Manufacturing

- 11.6 Huf Hulsbeck & Furst

- 11.7 IFB Automotive

- 11.8 Inteva Products

- 11.9 Kiekert AG

- 11.10 Magna

- 11.11 Minda VAST Access Systems

- 11.12 Mitsui Kinzoku ACT

- 11.13 Prabha Engineering

- 11.14 Robert Bosch

- 11.15 Sandhar Technologie

- 11.16 Shiroki Corporation

- 11.17 Shivani Locks

- 11.18 STRATTEC Security Corporation

- 11.19 U-Shin

- 11.20 WITTE Automotive