|

市场调查报告书

商品编码

1755190

固态电解质市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Solid-State Electrolytes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

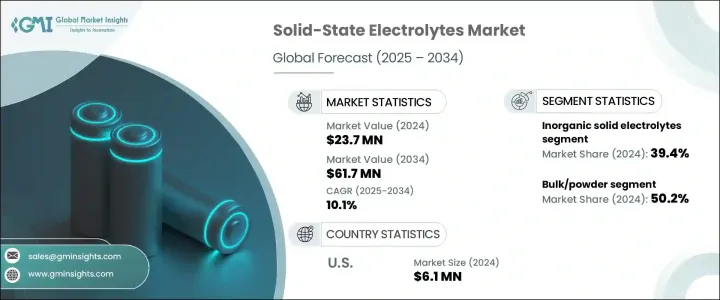

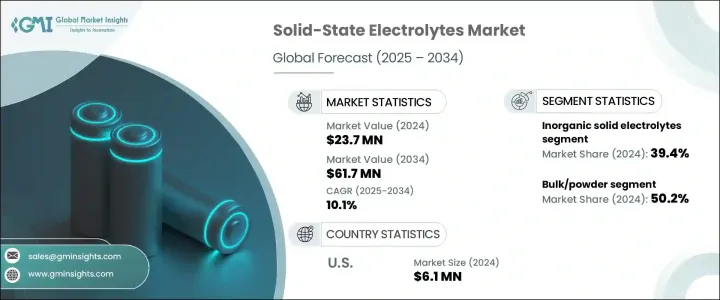

2024年,全球固态电解质市场规模达2,370万美元,预计2034年将以10.1%的复合年增长率成长,达到6,170万美元。这得益于对更高能量密度、更高安全性和更高性能的先进电池解决方案日益增长的需求。固态电解质取代了锂离子电池中使用的传统液体或凝胶电解质,提供了更安全、更有效率的替代方案。这些材料解决了诸如易燃性和洩漏等主要问题,降低了热失控和火灾事故的风险。它们能够支援更快的充电速度并延长电池寿命,使其成为电动车、消费性电子产品和下一代储能係统的关键创新。

材料的持续创新——尤其是陶瓷和聚合物复合硫化物离子导体——推动了市场的发展,并提高了离子电导率和材料相容性。随着对更安全、高容量电池的需求不断增长,尤其是电动车的普及以及政策对清洁能源技术的支持,固态电池正从概念走向商业化。相关法规的支持性加上技术进步,为市场扩张奠定了坚实的基础。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 2370万美元 |

| 预测值 | 6170万美元 |

| 复合年增长率 | 10.1% |

2024年,无机固体电解质市场占比39.4%。这些材料因其优异的离子电导率、热弹性和结构完整性而备受青睐,这在电动车电池和电网规模储能係统等高应力环境中至关重要。它们的稳定性以及与锂金属阳极的兼容性可提高能量密度并延长电池寿命。无机电解质(尤其是硫化物和氧化物基变体)也不易燃,从而消除了传统液体系统存在的火灾风险。将它们整合到当前的生产流程中,有助于简化製造流程并加速储能应用的部署。

2024年,固态电解质市场中块状或粉状电解质的份额为50.2%。粉末状电解质的广泛应用源自于其多功能性以及易于与各种电极材料整合的特性。这种形态有利于提高结构緻密性和活性物质的整合性,从而支持汽车和固定式应用的高效量产。硫代磷酸锂和石榴石基材料等粉末状化合物凭藉其出色的离子电导率和机械强度,越来越多地应用于下一代电池系统的试点项目,使其成为商业化规模化应用的最佳选择。

2024年,美国固态电解质市场产值达610万美元。旨在促进国内电池创新的联邦资金和政策措施对美国保持市场领先地位发挥关键作用。主要政府项目正在透过拨款、税收抵免以及《通膨削减法案》和《电池製造和回收补助计划》等立法下的研究支持来加速固态电解质市场的发展。这些措施促进了固态电池领域的创新,并鼓励美国企业扩大营运规模,减少对进口的依赖,并建立强大的本地供应链。

固态电解质市场的知名企业包括三星SDI、丰田汽车公司、LG化学、QuantumScape和辉能科技。为了扩大市场份额,这些公司投入研发资金,以推进固态电解质化学技术并提升电池性能。与汽车原始设备製造商和储能公司的合作有助于确保长期合约和早期应用机会。与研究机构和政府机构建立策略伙伴关係,加速了原型开发和规模化进程。各公司专注于精简製造能力并部署试点生产线,以确保在商用固态电池部署中占据先发优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计资料(HS 编码) 註:以上贸易统计仅提供主要国家。

- 主要出口国

- 主要进口国

- 衝击力

- 市场驱动因素

- 高能量密度电池的需求不断成长

- 越来越关注电池安全

- 电动车普及率不断上升

- 固态电解质材料的进展

- 市场限制

- 製造成本高

- 扩大生产面临的技术挑战

- 介面稳定性问题

- 来自先进液体电解质的竞争

- 市场机会

- 新型固体电解质材料的开发

- 穿戴式装置中的新兴应用

- 与再生能源储存的整合

- 政府措施和资金

- 市场挑战

- 在室温下实现高离子电导率

- 解决电极-电解质界面问题

- 锂枝晶的形成与生长

- 量产与降低成本

- 市场驱动因素

- 监管框架和政府倡议

- 电池材料安全法规

- 环境法规

- 政府资助和研究计划

- 区域监管差异

- 未来监理展望

- 成长潜力分析

- 2021-2034年价格分析(美元/吨)

- 製造和生产流程

- 固相合成

- 溶胶-凝胶工艺

- 机械化学合成

- 薄膜沉积技术

- 聚合物加工方法

- 可扩展的製造方法

- 材料表征技术

- X射线绕射分析

- 阻抗光谱

- 扫描式电子显微镜

- 核磁共振

- 热分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 市占率分析

- 战略框架

- 併购

- 合资与合作

- 新产品开发

- 扩张策略

- 竞争基准测试

- 供应商格局

- 竞争定位矩阵

- 战略仪表板

- 专利分析与创新评估

- 新参与者的市场进入策略

- 配电网路分析

第五章:市场估计与预测:按材料,2021-2034 年

- 主要趋势

- 无机固体电解质

- 氧化物基电解质

- LISICON型

- NASICON型

- 钙钛矿型

- 石榴石型(LLZO)

- 其他的

- 硫化物基电解质

- 硫代-LISICON

- 银锑矿型

- Li2S-P2S5微晶玻璃

- 其他的

- 卤化物基电解质

- 其他的

- 氧化物基电解质

- 聚合物基固态电解质

- 聚环氧乙烷(PEO)基

- 聚偏氟乙烯 (PVDF) 基

- 聚碳酸酯基

- 其他的

- 复合固态电解质

- 聚合物陶瓷复合材料

- 聚合物-无机盐复合材料

- 陶瓷-陶瓷复合材料

- 其他的

- 混合固体电解质

第六章:市场估计与预测:依形式,2021-2034 年

- 主要趋势

- 散装/粉末

- 薄膜

- 片材/膜

- 其他的

第七章:市场估计与预测:按应用,2021-2034 年

- 主要趋势

- 电动车

- 搭乘用车

- 商用车

- 两轮车

- 消费性电子产品

- 智慧型手机和平板电脑

- 笔记型电脑和桌上型电脑

- 穿戴式装置

- 其他的

- 储能係统

- 住宅

- 商业的

- 公用事业规模

- 医疗器材

- 植入式装置

- 便携式医疗设备

- 其他的

- 航太和国防

- 其他的

第八章:市场估计与预测:按地区,2021-2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Ampcera

- Cymbet Corporation

- Idemitsu Kosan

- Ilika

- ION Storage Systems

- LG Energy

- Murata Manufacturing

- NEI Corporation

- Ohara

- ProLogium Technology

- QuantumScape

- Samsung SDI

- Solid Power

- TDK Corporation

- Toyota Motor Corporation

The Global Solid-State Electrolytes Market was valued at USD 23.7 million in 2024 and is estimated to grow at a CAGR of 10.1% to reach USD 61.7 million by 2034, driven by rising demand for advanced battery solutions that offer higher energy density, enhanced safety, and improved performance. Solid-state electrolytes replace the conventional liquid or gel-based electrolytes used in lithium-ion batteries, providing a safer and more efficient alternative. These materials address major concerns like flammability and leakage, reducing the risks of thermal runaway and fire incidents. Their ability to support faster charging and extend battery lifespan makes them a crucial innovation for electric vehicles, consumer electronics, and next-generation energy storage systems.

Continuous innovation in materials-particularly ceramic and polymer composite sulfide ion conductors-has pushed the market forward, improving ionic conductivity and material compatibility. As demand for safer, high-capacity batteries rises, especially with broader EV adoption and policy support for clean energy technologies, solid-state batteries are moving from concept to commercialization. Supportive regulations, combined with technological advancement, create a strong foundation for market expansion.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.7 Million |

| Forecast Value | $61.7 Million |

| CAGR | 10.1% |

The inorganic solid electrolytes segment accounted for a 39.4% share in 2024. These materials are preferred for their excellent ionic conductivity, thermal resilience, and structural integrity, essential in high-stress environments such as electric vehicle batteries and grid-scale energy storage systems. Their stability and compatibility with lithium metal anodes enhance energy density and extend battery life. Inorganic electrolytes-especially sulfide and oxide-based variants-are also non-combustible, eliminating the fire risks associated with traditional liquid systems. Their integration into current production workflows helps streamline manufacturing and accelerates deployment across energy storage applications.

The bulk or powder form segment in the solid-state electrolytes market held a 50.2% share in 2024. The widespread use of powdered electrolytes stems from their versatility and ease of integration with various electrode materials. This form allows for better structural compactness and active material incorporation, supporting efficient mass production for automotive and stationary applications. Powdered compounds such as lithium thiophosphate and garnet-based materials are increasingly used in pilot projects for next-generation battery systems, due to their outstanding ionic conductivity and mechanical strength, making them an optimal choice for commercial scaling.

U.S. Solid-State Electrolytes Market generated USD 6.1 million in 2024. Federal funding and policy initiatives aimed at domestic battery innovation play a key role in the country's market leadership. Major government programs are accelerating development through grants, tax credits, and research support under legislation such as the Inflation Reduction Act and Battery Manufacturing and Recycling Grant Program. These efforts boost innovation in the solid-state battery segment and encourage U.S.-based companies to scale up operations, reduce import dependence, and create robust local supply chains.

Prominent players in the Solid-State Electrolytes Market include Samsung SDI, Toyota Motor Corporation, LG Chem, QuantumScape, and ProLogium Technology. To expand their market presence, these companies invest in R&D to advance solid electrolyte chemistry and enhance battery performance. Collaborations with automotive OEMs and energy storage firms help secure long-term contracts and early adoption opportunities. Strategic partnerships with research institutions and government entities accelerate prototype development and scaling processes. Firms focus on streamlining manufacturing capabilities and deploying pilot production lines to ensure early-mover advantage in commercial solid-state battery deployment.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code) Note: the above trade statistics will be provided for key countries only.

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

- 3.4 Impact forces

- 3.4.1 Market drivers

- 3.4.1.1 Growing demand for high-energy density batteries

- 3.4.1.2 increasing focus on battery safety

- 3.4.1.3 Rising adoption of electric vehicles

- 3.4.1.4 Advancements in solid-state electrolyte materials

- 3.4.2 Market restraints

- 3.4.2.1 High manufacturing costs

- 3.4.2.2 technical challenges in scaling production

- 3.4.2.3 Interface stability issues

- 3.4.2.4 Competition from advanced liquid electrolytes

- 3.4.3 Market opportunities

- 3.4.3.1 Development of new solid electrolyte materials

- 3.4.3.2 Emerging applications in wearable devices

- 3.4.3.3 Integration with renewable energy storage

- 3.4.3.4 Government initiatives and funding

- 3.4.4 Market challenges

- 3.4.4.1 Achieving high ionic conductivity at room temperature

- 3.4.4.2 Addressing electrode-electrolyte interface issues

- 3.4.4.3 Lithium dendrite formation and growth

- 3.4.4.4 Mass production and cost reduction

- 3.4.1 Market drivers

- 3.5 Regulatory framework and government initiatives

- 3.5.1 Safety regulations for battery materials

- 3.5.2 Environmental regulations

- 3.5.3 Government funding and research initiatives

- 3.5.4 Regional regulatory variations

- 3.5.5 Future regulatory outlook

- 3.6 Growth potential analysis

- 3.7 Pricing analysis (USD/Tons) 2021-2034

- 3.8 Manufacturing and production processes

- 3.8.1 Solid-state synthesis

- 3.8.2 Sol-gel processing

- 3.8.3 Mechanochemical synthesis

- 3.8.4 Thin film deposition techniques

- 3.8.5 Polymer processing methods

- 3.8.6 Scalable manufacturing approaches

- 3.9 Material characterization techniques

- 3.9.1 X-ray diffraction analysis

- 3.9.2 Impedance spectroscopy

- 3.9.3 Scanning electron microscopy

- 3.9.4 Nuclear magnetic resonance

- 3.9.5 Thermal analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis

- 4.2 Strategic framework

- 4.2.1 Mergers & acquisitions

- 4.2.2 Joint ventures & collaborations

- 4.2.3 New product developments

- 4.2.4 Expansion strategies

- 4.3 Competitive benchmarking

- 4.4 Vendor landscape

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Patent analysis & innovation assessment

- 4.8 Market entry strategies for new players

- 4.9 Distribution network analysis

Chapter 5 Market Estimates and Forecast, By Material, 2021–2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Inorganic solid electrolytes

- 5.2.1 Oxide-based electrolytes

- 5.2.1.1 LISICON-type

- 5.2.1.2 NASICON- type

- 5.2.1.3 Perovskite- type

- 5.2.1.4 Garnet- type (LLZO)

- 5.2.1.5 Others

- 5.2.2 Sulfide- based electrolytes

- 5.2.2.1 Thio-LISICON

- 5.2.2.2 Argyrodite- type

- 5.2.2.3 Li2S-P2S5 glass-ceramics

- 5.2.2.4 Others

- 5.2.3 Halide- based electrolytes

- 5.2.4 Others

- 5.2.1 Oxide-based electrolytes

- 5.3 Polymer-based solid electrolytes

- 5.3.1 Polyethylene oxide (PEO)-based

- 5.3.2 Polyvinylidene fluoride (PVDF)- based

- 5.3.3 Polycarbonate- based

- 5.3.4 Others

- 5.4 Composite solid electrolytes

- 5.4.1 Polymer-ceramic composites

- 5.4.2 Polymer-inorganic salt composites

- 5.4.3 Ceramic-ceramic composites

- 5.4.4 Others

- 5.5 Hybrid solid electrolytes

Chapter 6 Market Estimates and Forecast, By Form, 2021–2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Bulk/powder

- 6.3 Thin films

- 6.4 Sheets/membranes

- 6.5 Others

Chapter 7 Market Estimates and Forecast, By Application, 2021–2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Electric vehicles

- 7.2.1 Passenger vehicles

- 7.2.2 Commercial vehicles

- 7.2.3 Two-wheelers

- 7.3 Consumer electronics

- 7.3.1 Smartphones and tablets

- 7.3.2 Laptops and computers

- 7.3.3 Wearable devices

- 7.3.4 Others

- 7.4 Energy storage systems

- 7.4.1 Residential

- 7.4.2 Commercial

- 7.4.3 Utility-Scale

- 7.5 Medical devices

- 7.5.1 Implantable devices

- 7.5.2 Portable medical equipment

- 7.5.3 Others

- 7.6 Aerospace and defense

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021–2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Ampcera

- 9.2 Cymbet Corporation

- 9.3 Idemitsu Kosan

- 9.4 Ilika

- 9.5 ION Storage Systems

- 9.6 LG Energy

- 9.7 Murata Manufacturing

- 9.8 NEI Corporation

- 9.9 Ohara

- 9.10 ProLogium Technology

- 9.11 QuantumScape

- 9.12 Samsung SDI

- 9.13 Solid Power

- 9.14 TDK Corporation

- 9.15 Toyota Motor Corporation