|

市场调查报告书

商品编码

1755191

电信市场大数据分析机会、成长动力、产业趋势分析及 2025 - 2034 年预测Big Data Analytics in Telecom Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

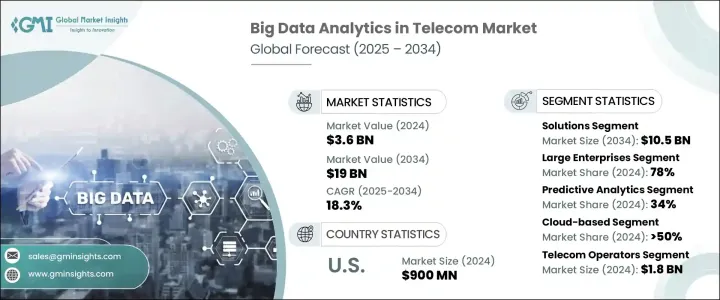

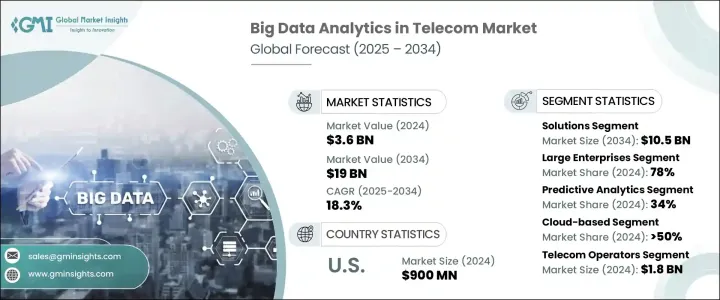

2024年,全球电信大数据分析市场规模达36亿美元,预计2034年将以18.3%的复合年增长率成长,达到190亿美元。受资料驱动业务决策的驱动,对即时分析的需求日益增长。电信公司日益需要分析大量客户和网路资料,以提高网路效率、改善客户体验并制定数据驱动的策略决策,这推动了这一成长。欧盟委员会旨在提高数位素养和互联互通水准的「数位十年」计划,也推动了对电信基础设施高级分析的需求。

随着电信网路不断扩展以满足智慧城市和物联网 (IoT) 日益增长的需求,对预测和即时分析的需求也日益重要。电信业者依靠这些先进的分析技术来提升网路效能、优化资源配置,并确保跨多个平台的无缝用户体验。在快速发展的电信产业中,能够预测并及时解决潜在的服务中断问题,从而在客户受到影响之前,是保持竞争优势的关键因素。即时资料分析使营运商能够监控网路流量、识别问题并立即实施纠正措施,从而确保高品质的服务交付和更高的客户满意度。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 36亿美元 |

| 预测值 | 190亿美元 |

| 复合年增长率 | 18.3% |

2024年,解决方案部门占据了55%的市场份额,预计到2034年将创造105亿美元的收入。解决方案部门包括资料管理工具、分析软体、资料视觉化平台和报告系统,帮助电信业者从其庞大的资料集中获得宝贵的洞察。这些平台使营运商能够即时监控网路效能,预测和预防网路中断,并改善客户分析。基于云端的分析解决方案的日益普及进一步支持了这项扩展,帮助电信公司降低营运成本,同时改善服务交付。

大型企业在2024年占了78%的市场。各大电信巨头利用巨量资料分析来管理庞大的客户群、复杂的网路基础设施并提供卓越的服务。透过利用预测分析,这些大型公司可以预测网路拥塞、中断或其他问题,并采取主动措施避免服务中断。这种预测能力,加上即时分析大量资料的能力,使电信业者能够做出明智的、数据驱动的策略决策。

2024年,美国电信市场大数据分析创收9亿美元。凭藉成熟的电信基础设施和对资料分析的大量投资,美国将继续在该领域占据主导地位。美国消费者的高资料消费水准催生了对分析解决方案的强烈需求,这些解决方案使电信公司能够更好地了解客户行为、减少客户流失并提供个人化服务。美国的电信业者正在利用巨量资料分析提供客製化服务套餐,提升顾客满意度并培养忠诚度。

电信市场大数据分析的主要参与者包括埃森哲、亚马逊网路服务 (AWS)、ATOS、Alphabet、IBM、华为技术、微软、甲骨文、SAP 和腾讯。为了巩固市场地位,电信业大巨量资料分析公司正专注于透过采用高阶分析功能来扩展其服务产品。这些参与者正在整合基于云端的分析解决方案,以提供可扩展、经济高效的服务,以满足日益增长的即时资料处理需求。他们还利用人工智慧和机器学习技术提供更准确的预测见解,使电信业者能够优化网路效能、防止停机并增强客户体验。与电信业者的策略合作伙伴关係也帮助这些公司获得有价值的资料,而研发投资使他们能够开发出满足电信业不断变化的需求的创新解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 云端平台提供者

- 数据整合和管理提供商

- 分析解决方案提供商

- 应用程式提供者

- 最终用户

- 利润率分析。

- 供应商格局

- 川普政府关税的影响

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组。

- 生产成本影响

- 需求面影响(售价)

- 价格传输至终端市场。

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 策略产业反应

- 供应链重组。

- 对贸易的影响

- 定价和产品策略

- 技术与创新格局

- 当前的技术趋势

- 人工智慧驱动的网路优化

- 支援5G的边缘运算

- 电信云端编排和自动化

- 新兴技术

- 用于电信分析的量子计算

- 整合AI的6G网络

- 区块链驱动的网路安全

- 智慧虚拟网路功能

- 先进材料科学

- 当前的技术趋势

- 定价策略

- 专利分析

- 用例。

- 重要新闻和倡议

- 监管格局

- 对部队的影响

- 成长动力

- 高速资料处理能力

- 先进的网路优化技术

- 即时分析以增强客户体验

- 与新兴科技(AI、IoT、5G)的融合

- 产业陷阱与挑战

- 基础设施和维护成本高

- 资料整合和管理的复杂性

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 解决方案

- 资料管理

- 分析软体

- 数据视觉化

- 报告工具

- 其他的

- 服务

- 专业服务

- 託管服务

- 咨询与培训

第六章:市场估计与预测:按分析,2021 - 2034 年

- 主要趋势

- 描述性分析

- 诊断分析

- 预测分析

- 规范分析

第七章:市场估计与预测:依组织规模,2021 - 2034 年

- 主要趋势

- 中小型企业(SME)

- 大型企业

第八章:市场估计与预测:按部署,2021 - 2034 年

- 主要趋势

- 本地

- 基于云端

- 公共云端

- 私有云端

- 混合云端

第九章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 客户分析

- 客户流失预测

- 客户终身价值分析

- 客户区隔

- 网路分析

- 网路最佳化

- 故障管理

- 交通管理

- 营运分析

- 资源最佳化

- 流程自动化

- 市场分析

- 行销活动管理

- 社群媒体分析

- 收入分析

- 诈欺侦测

- 收入保障

- 其他的

第十章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 电信服务供应商

- 网际网路服务供应商 (ISP)

- 行动虚拟网路营运商(MVNO)

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十二章:公司简介

- Accenture

- Alibaba

- Alphabet

- Altair Engineering

- Amazon Web Services (AWS)

- ATOS SE

- Databricks

- Hewlett Packard Enterprise Development

- Huawei Technologies

- IBM

- Informatica

- Infosys

- L&T

- Microsoft

- Oracle

- SAP

- Snowflake

- TATA Consultancy Services

- Tencent

- Wipro

The Global Big Data Analytics in Telecom Market was valued at USD 3.6 billion in 2024 and is estimated to grow at a CAGR of 18.3% to reach USD 19 billion by 2034, driven by the dependency on data to drive business decisions, the demand for real-time analytics is growing. This expansion is fueled by the increasing need for telecom companies to analyze massive amounts of customer and network data to enhance network efficiencies, improve customer experience, and make data-driven strategic decisions. The European Commission's Digital Decade initiative, aiming to increase digital literacy and connectivity, is also driving the demand for advanced analytics in telecom infrastructure.

As telecom networks expand to accommodate the growing demands of smart cities and the Internet of Things (IoT), the need for predictive and real-time analytics has become increasingly essential. Telecom operators are relying on these advanced analytics to enhance network performance, optimize resource allocation, and ensure seamless user experience across multiple platforms. The ability to predict and address potential service disruptions before they impact customers is a key factor in maintaining a competitive edge in the rapidly evolving telecom landscape. Real-time data analytics allow operators to monitor network traffic, identify issues, and implement corrective measures instantly, ensuring high-quality service delivery and greater customer satisfaction.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $3.6 Billion |

| Forecast Value | $19 Billion |

| CAGR | 18.3% |

In 2024, the solutions segment dominated the market with a 55% share, and it is expected to generate USD 10.5 billion in revenue by 2034. The solutions segment includes data management tools, analytics software, data visualization platforms, and reporting systems, which help telecom operators gain valuable insights from their vast data sets. These platforms enable operators to monitor network performance in real-time, predict and prevent network disruptions, and improve customer analytics. The growing adoption of cloud-based analytics solutions further supports this expansion, helping telecom companies reduce operational costs while improving service delivery.

The large enterprises segment accounted for a 78% share in 2024. Major telecom giants leverage big data analytics to handle vast customer bases, manage complex network infrastructures, and deliver superior services. By utilizing predictive analytics, these large companies can anticipate network congestion, outages, or other issues and take proactive measures to avoid service disruptions. This predictive capability, coupled with the ability to analyze large volumes of data in real time, enables telecom operators to make well-informed, data-driven strategic decisions.

U.S. Big Data Analytics in Telecom Market generated USD 900 million in 2024. The U.S. continues to be a dominant player in this space due to its established telecommunications infrastructure and significant investment in data analytics. High data consumption levels by consumers in the U.S. create a strong need for analytics solutions, allowing telecom companies to better understand customer behavior, reduce churn, and personalize services. Telecom operators in the U.S. are leveraging big data analytics to offer tailored service packages, enhance customer satisfaction, and foster loyalty.

Major players in the Big Data Analytics in Telecom Market include Accenture, Amazon Web Services (AWS), ATOS, Alphabet, IBM, Huawei Technologies, Microsoft, Oracle, SAP, and Tencent. To strengthen their market position, companies in big data analytics for the telecom sector are focusing on expanding their service offerings by adopting advanced analytics capabilities. These players are integrating cloud-based analytics solutions to offer scalable, cost-effective services that can handle the growing demand for real-time data processing. They are also leveraging AI and machine learning technologies to deliver more accurate predictive insights, allowing telecom operators to optimize network performance, prevent downtimes, and enhance customer experience. Strategic partnerships with telecom operators are also helping these companies access valuable data, while R&D investments are enabling them to develop innovative solutions that cater to the evolving needs of the telecommunications industry.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model.

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Cloud platform providers

- 3.1.1.2 Data integration and management providers

- 3.1.1.3 Analytics solution providers

- 3.1.1.4 Application provider

- 3.1.1.5 End users

- 3.1.2 Profit margin analysis.

- 3.1.1 Supplier landscape

- 3.2 Impact of Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring.

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets.

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Strategic industry responses

- 3.2.3.1 Supply chain reconfiguration.

- 3.2.1 Impact on trade

- 3.3 Pricing and product strategies

- 3.4 Technology & innovation landscape

- 3.4.1 Current technological trends

- 3.4.1.1 AI-powered network optimization

- 3.4.1.2 5G-enabled edge computing

- 3.4.1.3 Telecom cloud orchestration and automation

- 3.4.2 Emerging Technologies

- 3.4.2.1 Quantum computing for telecom analytics

- 3.4.2.2 6G networks with AI integration

- 3.4.2.3 Blockchain-driven network security

- 3.4.2.4 Intelligent virtual network functions

- 3.4.3 Advanced material sciences

- 3.4.1 Current technological trends

- 3.5 Pricing strategies

- 3.6 Patent analysis

- 3.7 Use cases.

- 3.8 Key news & initiatives

- 3.9 Regulatory landscape

- 3.10 Impact on forces

- 3.10.1 Growth drivers

- 3.10.1.1 High-speed data processing capabilities

- 3.10.1.2 Advanced network optimization techniques

- 3.10.1.3 Real-time analytics for enhanced customer experience

- 3.10.1.4 Integration with emerging technologies (AI, IoT, 5G)

- 3.10.2 Industry pitfalls & challenges

- 3.10.2.1 High infrastructure and maintenance costs

- 3.10.2.2 Complexity of data integration and management

- 3.10.1 Growth drivers

- 3.11 Growth potential analysis

- 3.12 Porter's analysis

- 3.13 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Solution

- 5.2.1 Data management

- 5.2.2 Analytics software

- 5.2.3 Data visualization

- 5.2.4 Reporting tools

- 5.2.5 Others

- 5.3 Services

- 5.3.1 Professional services

- 5.3.2 Managed services

- 5.3.3 Consulting & training

Chapter 6 Market Estimates & Forecast, By Analytics, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Descriptive analytics

- 6.3 Diagnostic analytics

- 6.4 Predictive analytics

- 6.5 Prescriptive analytics

Chapter 7 Market Estimates & Forecast, By Organization Size, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Small & medium-sized enterprises (SME)

- 7.3 Large Enterprises

Chapter 8 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 On-premises

- 8.3 Cloud-based

- 8.3.1 Public cloud

- 8.3.2 Private cloud

- 8.3.3 Hybrid cloud

Chapter 9 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 Customer analysis

- 9.2.1 Customer churn prediction

- 9.2.2 Customer lifetime value analysis

- 9.2.3 Customer segmentation

- 9.3 Network analysis

- 9.3.1 Network optimization

- 9.3.2 Fault management

- 9.3.3 Traffic management

- 9.4 Operational analysis

- 9.4.1 Resource optimization

- 9.4.2 Process automation

- 9.5 Marketing analysis

- 9.5.1 Campaign management

- 9.5.2 Social media analytics

- 9.6 Revenue analysis

- 9.6.1 Fraud detection

- 9.6.2 Revenue assuranc

- 9.7 Others

Chapter 10 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 Telecom service providers

- 10.3 Internet service providers (ISPs)

- 10.4 Mobile virtual network operators (MVNOs)

- 10.5 Others

Chapter 11 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 11.1 North America

- 11.1.1 U.S.

- 11.1.2 Canada

- 11.2 Europe

- 11.2.1 UK

- 11.2.2 Germany

- 11.2.3 France

- 11.2.4 Italy

- 11.2.5 Spain

- 11.2.6 Belgium

- 11.2.7 Sweden

- 11.3 Asia Pacific

- 11.3.1 China

- 11.3.2 India

- 11.3.3 Japan

- 11.3.4 Australia

- 11.3.5 Singapore

- 11.3.6 South Korea

- 11.3.7 Southeast Asia

- 11.4 Latin America

- 11.4.1 Brazil

- 11.4.2 Mexico

- 11.4.3 Argentina

- 11.5 MEA

- 11.5.1 South Africa

- 11.5.2 Saudi Arabia

- 11.5.3 UAE

Chapter 12 Company Profiles

- 12.1 Accenture

- 12.2 Alibaba

- 12.3 Alphabet

- 12.4 Altair Engineering

- 12.5 Amazon Web Services (AWS)

- 12.6 ATOS SE

- 12.7 Databricks

- 12.8 Hewlett Packard Enterprise Development

- 12.9 Huawei Technologies

- 12.10 IBM

- 12.11 Informatica

- 12.12 Infosys

- 12.13 L&T

- 12.14 Microsoft

- 12.15 Oracle

- 12.16 SAP

- 12.17 Snowflake

- 12.18 TATA Consultancy Services

- 12.19 Tencent

- 12.20 Wipro