|

市场调查报告书

商品编码

1755192

气管插管市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Endotracheal Tube Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

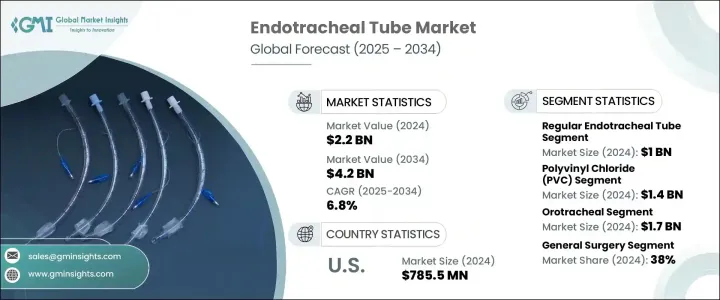

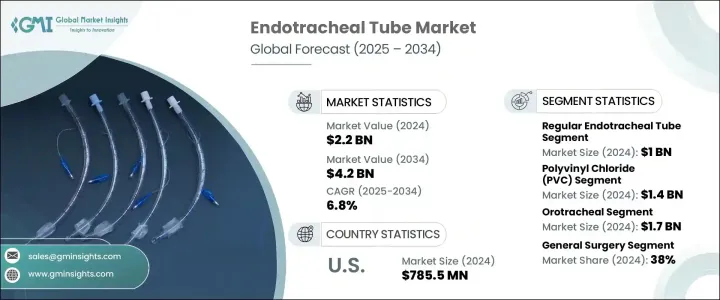

2024年,全球气管插管市场规模达22亿美元,预计2034年将以6.8%的复合年增长率成长,达到42亿美元。这一增长可归因于多种因素,包括需要插管的手术数量不断增加、ICU入院率和重症监护病例的增加,以及新兴地区医疗基础设施的建设。此外,全球气喘和慢性阻塞性肺病(COPD)等慢性呼吸系统疾病的发生率不断上升,尤其是在老年人群中,这也加剧了对气管插管的需求。

製造商正在透过添加抗菌涂层、新型袖口设计和声门下吸引等功能来增强这些产品的性能,以减少呼吸器相关性肺炎 (VAP) 等併发症。这些改进不仅惠及患者,也推动了全球医疗中心对这些设备的采用,从而促进了市场成长。气管插管是一种柔性装置,用于在手术、麻醉或重症监护期间透过经口或经鼻插入气管来保护气道。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 22亿美元 |

| 预测值 | 42亿美元 |

| 复合年增长率 | 6.8% |

它能够实现机械通气,并有助于在手术过程中保护气道。由于呼吸系统疾病的发生率不断上升、一次性导管的普及以及视讯喉镜等先进插管技术的日益普及,气管导管的需求正在增长。此外,在急诊和院外环境中,对带有抗菌和药物洗脱涂层的导管的需求也在增加。

2024年,常规气管插管市场规模达10亿美元。这些插管仍然是常规外科手术和急诊手术的首选,尤其是在资源匮乏的地区,因为与先进的替代产品相比,它们价格更实惠。它们设计简单,易于使用,大多数医疗专业人员都接受过高效操作的培训,确保了它们在临床环境中的广泛应用。

2024年,经口气管插管市场规模达17亿美元,预计2034年的复合年增长率将达7%。经口气管插管因其快速易行,是紧急情况下最常使用的气道管理方法。它适用于创伤、心臟骤停和重症监护等情况,在这些情况下,几分钟内建立气道至关重要。相较于经鼻气管插管,经口气管插管更受青睐,因为它可以避免鼻出血和鼻窦感染等併发症,并被认为对许多成年患者更安全。

2024年,美国气管插管市场规模达7.855亿美元。慢性阻塞性肺病 (COPD)、肺炎和急性呼吸窘迫症候群 (ARDS) 等呼吸系统疾病的盛行率不断上升,显着推动了美国对气管插管的需求。随着联邦医疗保险 (Medicare)、医疗补助 (Medicaid) 和私人保险公司出台的政策涵盖插管和机械通气程序,医院和外科中心更有可能采用气管插管 (ETT),而无需面临财务压力。这些报销政策在鼓励最佳实践和增加气管插管使用方面发挥关键作用,从而推动了市场成长。

全球气管插管市场的领先公司包括:Flexicare、Ambu、Fuji Systems、Medtronic、Medline、STERIMED、Teleflex、Romed HOLLAND、ANGIPLAST、Mercury Medical、INTERRACIAL、icumedical、VIGGOMEDICAL DEVICES、Wellead 和 TUORen。为了巩固市场地位,各公司正专注于几项关键策略。他们透过开发抗菌涂层和声门下吸引等先进功能来投资产品创新,以提高患者安全性并减少併发症。与医疗保健提供者建立合作伙伴关係以及拓展新兴市场的分销管道对于覆盖更广泛的受众也至关重要。此外,公司正在投资教育医疗保健专业人员了解其产品的优势,以推动其采用。此外,与医院和医疗保健系统的合作有助于确保更好的产品可近性和知名度。这些策略旨在提高市场渗透率并保持竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 需要插管的手术数量不断增加

- 气管插管技术的进步

- ICU入院人数和重症监护病患人数的成长

- 新兴市场医疗基础设施的扩张

- 产业陷阱与挑战

- 专用气管插管费用高昂

- 插管后併发症的风险

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 技术格局

- 报销场景

- 波特的分析

- PESTEL分析

- 差距分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 常规气管插管

- 加强型气管插管

- 已进行气管插管

- 双腔气管插管

第六章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 聚氯乙烯(PVC)

- 硅

- 聚氨酯

- 其他材料

第七章:市场估计与预测:按插管途径,2021 - 2034 年

- 主要趋势

- 口气管

- 经鼻气管

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 一般外科

- 紧急治疗

- 治疗

- 新生儿和儿科护理

- 其他应用

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- ANGIPLAST

- Ambu

- Flexicare

- Fuji Systems

- icumedical

- INTERSURGCIAL

- Medline

- Medtronic

- Mercury Medical

- Romed HOLLAND

- STERIMED

- Teleflex

- TUORen

- VIGGOMEDICAL DEVICES

- Wellead

The Global Endotracheal Tube Market was valued at USD 2.2 billion in 2024 and is estimated to grow at a CAGR of 6.8% to reach USD 4.2 billion by 2034. This expansion can be attributed to several factors, including the rising number of surgeries requiring intubation, the increasing incidence of ICU admissions and critical care cases, and the growth of healthcare infrastructure in emerging regions. Additionally, the global rise in chronic respiratory conditions such as asthma and chronic obstructive pulmonary disease (COPD), particularly among older adults, is contributing to the demand for endotracheal tubes.

Manufacturers are enhancing these products by incorporating features like antimicrobial coatings, new cuff designs, and subglottic suction to reduce complications like ventilator-associated pneumonia (VAP). These improvements are not only benefiting patients but are also driving the adoption of these devices in healthcare centers worldwide, contributing to market growth. An endotracheal tube is a flexible device used to secure the airway during surgeries, anesthesia, or critical care by passing through the mouth or nose into the trachea.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.2 Billion |

| Forecast Value | $4.2 Billion |

| CAGR | 6.8% |

It enables mechanical ventilation and helps maintain airway protection during procedures. The demand for ETTs is growing due to the rising prevalence of respiratory disorders, the shift toward disposable tubes, and the rising adoption of advanced intubation techniques such as video laryngoscopy. Additionally, there's a growing demand for tubes with antimicrobial and drug-eluting coatings in emergency care and out-of-hospital settings.

In 2024, the regular endotracheal tubes segment generated USD 1 billion. These tubes remain the preferred choice for routine surgical and emergency procedures, especially in resource-limited settings, due to their affordability compared to advanced alternatives. Their simple design makes them easy to use, and most healthcare professionals are trained to operate them efficiently, ensuring their widespread use in clinical settings.

The orotracheal tube segment generated USD 1.7 billion in 2024 and is expected to grow at a CAGR of 7% during 2034. Orotracheal intubation is the most common method for airway management in emergencies due to its speed and ease of execution. It is useful in trauma, cardiac arrest, and critical care situations, where securing the airway within minutes is crucial. The method is preferred over nasotracheal intubation, as it avoids complications like nasal bleeding and sinus infections and is considered safer for many adult patients.

U.S. Endotracheal Tube Market was valued at USD 785.5 million in 2024. The rising prevalence of respiratory diseases such as COPD, pneumonia, and acute respiratory distress syndrome (ARDS) has significantly boosted the demand for endotracheal tubes in the country. With policies from Medicare, Medicaid, and private insurers covering intubation and mechanical ventilation procedures, hospitals and surgery centers are more likely to adopt ETTs without facing financial constraints. These reimbursement policies play a pivotal role in encouraging best practices and increasing the use of endotracheal tubes, driving market growth.

Leading companies in the Global Endotracheal Tube Market include: Flexicare, Ambu, Fuji Systems, Medtronic, Medline, STERIMED, Teleflex, Romed HOLLAND, ANGIPLAST, Mercury Medical, INTERRACIAL, icumedical, VIGGOMEDICAL DEVICES, Wellead, and TUORen. To strengthen their market position, companies are focusing on several key strategies. They invest in product innovation by developing advanced features such as antimicrobial coatings and subglottic suction to improve patient safety and reduce complications. Partnerships with healthcare providers and expanding distribution channels in emerging markets are also critical for reaching a broader audience. Additionally, companies are investing in educating healthcare professionals about the benefits of their products to drive adoption. Furthermore, collaborations with hospitals and healthcare systems help ensure better product accessibility and visibility. These strategies aim to improve market penetration and maintain a competitive edge.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing number of surgeries requiring intubation

- 3.2.1.2 Advancements in endotracheal tube technology

- 3.2.1.3 Growth in ICU admissions and critical care patients

- 3.2.1.4 Expansion of healthcare infrastructure in emerging markets

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with specialized endotracheal tube

- 3.2.2.2 Risk of post-intubation complications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Gap analysis

- 3.10 Future market trends

- 3.11 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Regular endotracheal tube

- 5.3 Reinforced endotracheal tube

- 5.4 Performed endotracheal tube

- 5.5 Double lumen endotracheal tube

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Polyvinyl chloride (PVC)

- 6.3 Silicon

- 6.4 Polyurethane

- 6.5 Other materials

Chapter 7 Market Estimates and Forecast, By Route of Intubation, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Orotracheal

- 7.3 Nasotracheal

Chapter 8 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 General surgery

- 8.3 Emergency treatment

- 8.4 Therapy

- 8.5 Neonatal and pediatric care

- 8.6 Other applications

Chapter 9 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 Hospitals

- 9.3 Ambulatory surgical centers

- 9.4 Other end use

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 Japan

- 10.4.3 India

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 ANGIPLAST

- 11.2 Ambu

- 11.3 Flexicare

- 11.4 Fuji Systems

- 11.5 icumedical

- 11.6 INTERSURGCIAL

- 11.7 Medline

- 11.8 Medtronic

- 11.9 Mercury Medical

- 11.10 Romed HOLLAND

- 11.11 STERIMED

- 11.12 Teleflex

- 11.13 TUORen

- 11.14 VIGGOMEDICAL DEVICES

- 11.15 Wellead