|

市场调查报告书

商品编码

1755196

非公路车辆引擎市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Off Highway Vehicle Engines Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

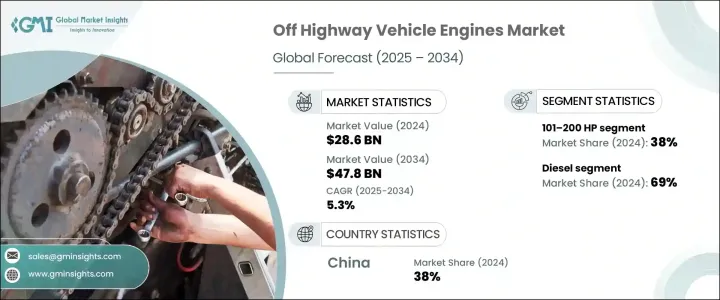

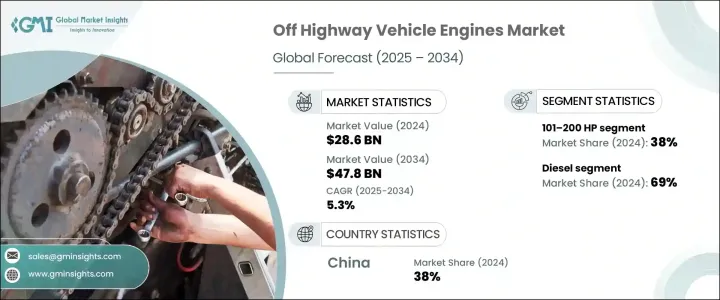

2024年,全球非公路用车引擎市场规模达286亿美元,预计2034年将以5.3%的复合年增长率成长,达到478亿美元。市场扩张主要得益于基础设施的持续改进、农业机械化程度的提高以及采矿作业对设备需求的不断增长。这些引擎对于重型应用至关重要,随着各行各业寻求兼具耐用性和营运效率的高性能解决方案,其重要性也日益凸显。随着各国政府对重大公共发展项目的投资,以及全球农业和工业产出的持续成长,非公路用车领域对强劲高效引擎的需求也日益迫切。

这一成长背后的关键驱动力之一是对节能低排放技术的日益重视。随着製造商投资于更清洁、混合动力和电动动力系统替代方案,市场正在经历显着的转变。原始设备製造商越来越关注整合下一代引擎系统,这些系统能够在满足严格排放法规的同时降低油耗。这种转变不仅是出于环保考虑,也源自于燃油成本的上涨以及全球对永续实践的推动。因此,先进的引擎平台在对动力和可靠性要求极高的核心产业中越来越受欢迎。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 286亿美元 |

| 预测值 | 478亿美元 |

| 复合年增长率 | 5.3% |

对高输出、节油引擎的需求日益增长,尤其是在重型设备在极端条件下运作的行业。各行各业使用的设备必须提供高扭力和强劲性能,同时又不影响燃油经济性。这些功能性要求促使引擎製造商不断创新和升级现有系统,以提高燃油效率、降低排放并提升性能。原始设备製造商 (OEM) 正在积极采用尖端技术,并建立合作伙伴关係,以设计满足非公路用车不断变化的需求的引擎。

2024年,输出功率在101至200马力之间的引擎将引领全球市场,占据约38%的总份额。预计该细分市场在整个预测期内的复合年增长率将超过5.8%。此类引擎的受欢迎程度源于其在强度和效率之间的平衡,使其适用于多个行业的各种中型设备。其适应性确保了其在各种工作环境下的可靠性能,从而使该细分市场始终处于需求的前沿。

从燃料角度来看,柴油引擎在2024年仍占据全球市场份额的69%左右,占据榜首位置。预计该细分市场在2025年至2034年期间的复合年增长率将超过6.5%。柴油凭藉其无与伦比的扭矩和能量输出,尤其是在持续高功率运行至关重要的环境中,仍然是首选。全球柴油供应基础设施成熟且易于获取,尤其是在偏远地区或发展中地区。因此,柴油引擎将继续成为非公路用车应用的支柱,製造商正在优先研究符合新兴环保标准的先进柴油技术,同时又不牺牲可靠性或动力。

在应用方面,受基础建设和全球城镇化活动增加的推动,建筑设备类别在2024年成为领先细分市场。住房、交通网络和商业基础设施投资的不断增加,转化为对搭载强劲发动机系统的重型机械的需求增长。这些机械需要在严苛条件下高效运行,而对可靠引擎性能的要求使该细分市场成为市场成长的持续贡献者。

就引擎类型而言,内燃机 (ICE) 在 2024 年保持主导地位。其广泛应用得益于其长期的可靠性和完善的基础设施。内燃机仍然是一个受欢迎的选择,尤其是在充电设施稀少或不稳定的地区。这些引擎能够不间断运行,这在大规模、持续使用的环境中具有显着优势。它们在恶劣和偏远环境中的出色表现确保了其需求持续强劲,尤其是在工业化和发展日益发展的地区。

2024年,中国引领亚太非公路用车引擎市场,占约38%的区域份额,创造约44亿美元的收入。中国快速的工业成长和广泛的基础设施建设是其保持领先地位的关键因素。中国开发和采矿业对重型机械的需求持续成长,推动引擎的销售。此外,中国广阔的农业基础也增加了对高效耐用、能够满足多个垂直行业不断增长的产量需求的引擎的需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 原物料供应商

- 零件製造商

- 发动机製造商(OEM)

- 汽车製造商(非公路车辆原始设备製造商)

- 经销商和售后服务供应商

- 利润率分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 其他国家的报復措施

- 对产业的影响

- 主要材料价格波动

- 供应链重组

- 电力输出和成本影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和电力输出策略

- 展望与未来考虑

- 对贸易的影响

- 技术与创新格局

- 价格趋势

- 成本細項分析

- 专利分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 基础建设不断推进

- 引擎设计的技术进步

- 对电动和混合动力非公路车的需求不断增长

- 采矿业的成长

- 增加对智慧农业的投资

- 产业陷阱与挑战

- 设备初始成本高

- 维护和耐用性问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依发电量,2021 - 2034

- 主要趋势

- 低于50 HP

- 50–100 生命值

- 101–200 马力

- 201–400 马力

- 400 匹马力以上

第六章:市场估计与预测:按燃料,2021 - 2034 年

- 主要趋势

- 柴油引擎

- 汽油

- 其他的

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 建筑设备

- 采矿设备

- 农业设备

- 林业设备

第八章:市场估计与预测:按引擎,2021 - 2034 年

- 主要趋势

- 内燃机(ICE)

- 油电混合发动机

- 电动发动机

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 北欧人

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳新银行

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 阿联酋

- 沙乌地阿拉伯

- 南非

第十章:公司简介

- Caterpillar

- CNH Industrial

- Cummins

- Deere & Company

- Doosan Infracore

- FPT Industrial

- Hatz Diesel

- Honda Motor

- Isuzu Motors

- Kohler

- Komatsu

- Kubota

- MAN

- Mitsubishi Heavy Industries

- Perkins Engines

- Scania

- Shaanxi Fast Gear

- Tata Motors

- Volvo

- Yanmar

The Global Off-Highway Vehicle Engines Market was valued at USD 28.6 billion in 2024 and is estimated to grow at a CAGR of 5.3% to reach USD 47.8 billion by 2034. Market expansion is largely attributed to ongoing infrastructure advancements, increased mechanization in farming, and the rising demand for equipment in mining operations. These engines are essential for heavy-duty applications, and their importance continues to grow as industries seek high-performance solutions that can deliver both durability and operational efficiency. As governments invest in major public development projects and as agricultural and industrial output continue to rise globally, the need for powerful, efficient engines across these off-highway segments is becoming more critical.

One of the key drivers behind this growth is the increased emphasis on energy-efficient and low-emission technologies. The market is witnessing a notable shift as manufacturers invest in cleaner, hybrid, and electric powertrain alternatives. OEMs are increasingly focusing on the integration of next-generation engine systems that can reduce fuel usage while meeting stringent emissions regulations. This shift is motivated not only by environmental concerns but also by the rising cost of fuel and the global push toward sustainable practices. As a result, advanced engine platforms are gaining popularity in core industries where power and reliability remain non-negotiable.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $28.6 Billion |

| Forecast Value | $47.8 Billion |

| CAGR | 5.3% |

Demand for high-output, fuel-efficient engines is on the rise, especially in sectors where heavy-duty equipment operates under extreme conditions. Equipment used across various industries must deliver high torque and strong performance without compromising fuel economy. These functional requirements are pushing engine manufacturers to innovate and upgrade existing systems with enhanced fuel efficiency, lower emissions, and improved performance capabilities. OEMs are taking an active role in adopting cutting-edge technologies and are forming partnerships to design engines that meet the evolving demands of off-highway operations.

In 2024, engines with a power output ranging between 101 and 200 horsepower led the global market, securing approximately 38% of the total share. This segment is projected to grow at a CAGR of over 5.8% throughout the forecast timeline. The popularity of engines in this category stems from their balance between strength and efficiency, making them suitable for a wide range of mid-sized equipment across multiple industries. Their adaptability ensures reliable performance in diverse work environments, which keeps this segment at the forefront of demand.

From a fuel perspective, diesel-powered engines retained the top position in 2024, making up about 69% of the global market. This segment is forecasted to grow at a CAGR exceeding 6.5% between 2025 and 2034. Diesel remains the preferred choice due to its unmatched torque and energy output, especially in environments where consistent, high-power operation is vital. The global infrastructure for diesel supply is mature and widely accessible, particularly in remote or developing regions. As a result, diesel engines continue to be the backbone of off-highway applications, and manufacturers are prioritizing research into advanced diesel technologies that align with emerging environmental standards without sacrificing reliability or power.

On the application front, the construction equipment category emerged as the leading segment in 2024, driven by increased activity in infrastructure development and global urbanization. Rising investments in housing, transportation networks, and commercial infrastructure are translating into heightened demand for heavy machinery powered by robust engine systems. These machines need to operate efficiently under tough conditions, and the requirement for dependable engine performance makes this segment a consistent contributor to market growth.

Regarding engine type, internal combustion engines (ICEs) maintained their dominance in 2024. Their widespread use can be attributed to their long-standing reliability and established infrastructure. ICEs remain a popular choice, especially in regions where electrical charging facilities are sparse or inconsistent. These engines provide uninterrupted operation, which is a significant advantage in large-scale, continuous-use settings. Their ability to perform in harsh and remote environments ensures that demand remains strong, particularly in regions with growing industrialization and development.

In 2024, China led the Asia-Pacific off-highway vehicle engines market, capturing around 38% of the regional share and generating approximately USD 4.4 billion in revenue. The country's rapid industrial growth and extensive infrastructure rollout are key contributors to this leadership position. High demand for heavy machinery within the nation's development and mining sectors continues to drive engine sales. Moreover, China's expansive agricultural base adds to the requirement for efficient, durable engines capable of meeting rising output demands across multiple verticals.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates and calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimates

- 1.3 Forecast model

- 1.4 Primary research & validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Supplier landscape

- 3.2.1 Raw material suppliers

- 3.2.2 Component manufacturers

- 3.2.3 Engine manufacturers (OEMs)

- 3.2.4 Vehicle manufacturers (Off-Highway OEMs)

- 3.2.5 Distributors & aftermarket service providers

- 3.3 Profit margin analysis

- 3.4 Trump administration tariffs

- 3.4.1 Impact on trade

- 3.4.1.1 Trade volume disruptions

- 3.4.1.2 Retaliatory measures by other countries

- 3.4.2 Impact on the industry

- 3.4.2.1 Price Volatility in key materials

- 3.4.2.2 Supply chain restructuring

- 3.4.2.3 Power output and cost implications

- 3.4.3 Key companies impacted

- 3.4.4 Strategic industry responses

- 3.4.4.1 Supply chain reconfiguration

- 3.4.4.2 Pricing and Power output strategies

- 3.4.5 Outlook and future considerations

- 3.4.1 Impact on trade

- 3.5 Technology & innovation landscape

- 3.6 Price trends

- 3.7 Cost breakdown analysis

- 3.8 Patent analysis

- 3.9 Key news & initiatives

- 3.10 Regulatory landscape

- 3.11 Impact forces

- 3.11.1 Growth drivers

- 3.11.1.1 Rising infrastructure development

- 3.11.1.2 Technological advancements in engine design

- 3.11.1.3 Growing demand for electric and hybrid off-highway vehicles

- 3.11.1.4 Growth in the mining sector

- 3.11.1.5 Increased investment in smart agricultures

- 3.11.2 Industry pitfalls & challenges

- 3.11.2.1 High initial cost of equipment

- 3.11.2.2 Maintenance and durability issues

- 3.11.1 Growth drivers

- 3.12 Growth potential analysis

- 3.13 Porter's analysis

- 3.14 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Power output, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Below 50 HP

- 5.3 50–100 HP

- 5.4 101–200 HP

- 5.5 201–400 HP

- 5.6 Above 400 HP

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Diesel

- 6.3 Gasoline

- 6.4 Others

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Construction equipment

- 7.3 Mining equipment

- 7.4 Agricultural equipment

- 7.5 Forestry equipment

Chapter 8 Market Estimates & Forecast, By Engine, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Internal combustion engines (ICE)

- 8.3 Hybrid engines

- 8.4 Electric engines

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 ANZ

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles

- 10.1 Caterpillar

- 10.2 CNH Industrial

- 10.3 Cummins

- 10.4 Deere & Company

- 10.5 Doosan Infracore

- 10.6 FPT Industrial

- 10.7 Hatz Diesel

- 10.8 Honda Motor

- 10.9 Isuzu Motors

- 10.10 Kohler

- 10.11 Komatsu

- 10.12 Kubota

- 10.13 MAN

- 10.14 Mitsubishi Heavy Industries

- 10.15 Perkins Engines

- 10.16 Scania

- 10.17 Shaanxi Fast Gear

- 10.18 Tata Motors

- 10.19 Volvo

- 10.20 Yanmar