|

市场调查报告书

商品编码

1755197

即时脂质测试市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Point of Care Lipid Test Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

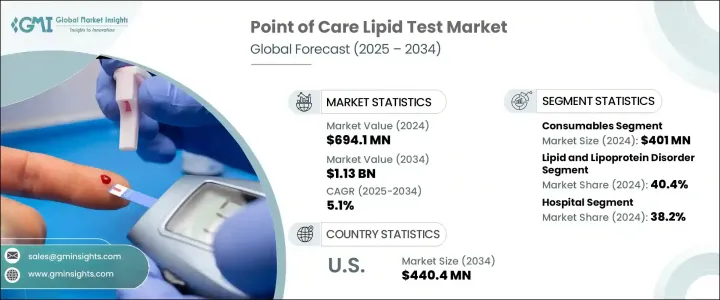

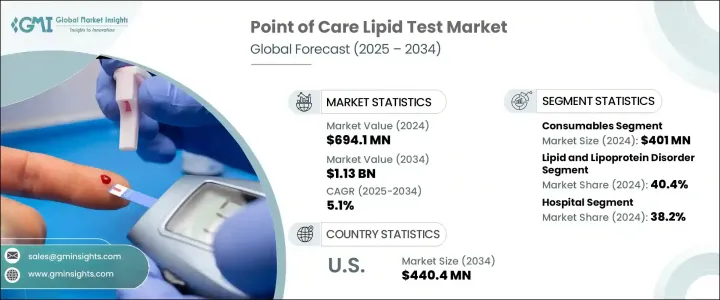

2024年,全球即时血脂检测市场规模达6.941亿美元,预计到2034年将以5.1%的复合年增长率成长,达到11.3亿美元。该市场涵盖便携式诊断解决方案,旨在在传统实验室环境之外测量血脂水平,例如三酸甘油酯和胆固醇。这些工具能够提供即时结果,使其成为临床实践、一般医疗环境以及家庭个人使用中不可或缺的工具。心血管疾病通常与血脂水平异常相关,全球心血管疾病负担日益加重,这持续推动对便捷检测替代方案的需求。

随着人们越来越重视主动管理健康,快速且方便的检测方法也越来越受到人们的追捧。随着预防保健和早期检测的日益受到重视,人们对操作简单、快速且准确地检测结果的可靠设备的需求也日益增长。持续的技术进步使这些设备更加精准、便捷,进一步提升了它们的吸引力。从传统诊断到按需血脂分析的转变重塑了医疗保健格局,因为人们渴望在不依赖传统医疗预约的情况下掌控自己的健康状况。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.941亿美元 |

| 预测值 | 11.3亿美元 |

| 复合年增长率 | 5.1% |

2024年,耗材市场规模达4.01亿美元,预计2034年将以5%的复合年增长率成长。正如国际卫生组织所强调的,全球心血管疾病发生率的上升是血脂检测产品需求激增的重要驱动因素。试剂盒和试纸等耗材是每次血脂检测的必需品,且一次性使用,因此重复购买频率较高。随着即时诊断技术日益融入门诊中心、初级保健诊所和个人健康机构等各种医疗环境,对可靠的一次性组件的需求也日益增长。人们对快速、卫生、精准的检测解决方案的日益青睐,也促进了耗材的普及。

由于血脂异常(包括遗传性和后天性脂质失衡)的盛行率不断上升,脂质和脂蛋白紊乱领域在2024年占据了最大的市场份额,达到40.4%。这些紊乱在心臟相关疾病的发展中起着核心作用,而心臟相关疾病仍然是全球死亡的主要原因。诊断和管理脂质异常的紧迫性强化了即时脂质检测的广泛应用。医疗专业人员,尤其是内科和心臟病学专业人士,都严重依赖这些检测来支持早期介入。定期监测脂质的需求使得这些诊断方法成为专科和普通医疗保健的基本工具。

预计到2034年,美国即时脂质检测市场规模将达4.404亿美元。大众对心血管风险的日益关注,促使人们普遍认识到脂质检测的重要性,这推动了便捷易用的诊断试剂盒的普及。随着越来越多的人致力于主动管理自身健康,人们正在加速向即时居家检测的转变。全美脂质疾病发生率的上升,加剧了对可靠、便捷解决方案的需求。随着人们意识的不断增强,市场受益于对紧凑型诊断工具的需求激增,这些工具可以进行定期筛检,无需正式就诊实验室。

推动全球即时脂质检测产业创新和扩张的主要参与者包括罗氏製药 (F. Hoffmann-La Roche)、VivaChek Biotech、Kanlife、雅培实验室 (Abbott Laboratories)、SD Biosensor、三诺生物 (Sinocare)、Callegari、MiCoBio、Nova Biomedical 和美纳里尼集团 (Menarini Group)。为了巩固市场地位,主要参与者正在实施以持续产品创新和技术改进为中心的策略。各公司正在投资开发先进的诊断设备,以提供更快、更准确的结果,同时增强使用者友善性。许多公司正在透过与医疗保健分销商和诊所建立合作伙伴关係和策略合作来扩大其地理覆盖范围。这些联盟有助于提高脂质检测试剂盒在各市场的可近性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 心血管疾病盛行率不断上升

- 预防性医疗保健日益受到重视

- POC 脂质检测设备的技术进步

- 新兴经济体的采用率不断提高

- 产业陷阱与挑战

- 严格的监管情景

- 农村地区认识有限

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 仪器

- 耗材

第六章:市场估计与预测:按疾病适应症,2021 - 2034 年

- 主要趋势

- 脂质和脂蛋白紊乱

- 内源性高血脂症

- 丹吉尔病

- 高脂蛋白血症

- 家族性高胆固醇血症

- 其他脂质和脂蛋白疾病

- 动脉粥状硬化

- 肝臟和肾臟疾病

- 糖尿病

- 其他疾病指征

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 诊所

- 诊断实验室

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- Callegari

- F. Hoffmann-La Roche

- Kanlife

- Menarini Group

- MiCoBio

- Nova Biomedical

- SD Biosensor

- Sinocare

- VivaChek Biotech

The Global Point of Care Lipid Test Market was valued at USD 694.1 million in 2024 and is estimated to grow at a CAGR of 5.1% to reach USD 1.13 billion by 2034. This market encompasses portable diagnostic solutions designed to measure blood lipid levels, such as triglycerides and cholesterol, outside traditional laboratory settings. These tools provide real-time results, making them essential in clinical practice, general healthcare environments, and for personal use at home. The mounting global burden of cardiovascular conditions, which are often linked with abnormal lipid levels, continues to drive demand for easily accessible testing alternatives.

Rapid and user-friendly testing methods are becoming increasingly sought after as individuals seek to manage health proactively. With a greater emphasis on preventive care and early detection, there's been a noticeable push for reliable devices that are simple to operate and provide fast, accurate outcomes. Ongoing technological improvements are making these devices more precise and user-friendly, reinforcing their growing appeal. The move away from traditional diagnostics and toward on-demand lipid profiling reshape the healthcare landscape, as people demand control over their wellness without depending on conventional healthcare appointments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $694.1 Million |

| Forecast Value | $1.13 Billion |

| CAGR | 5.1% |

In 2024, the consumables segment generated USD 401 million and is projected to grow at a 5% CAGR through 2034. The increasing global incidence of cardiovascular ailments, as highlighted by international health organizations, is a significant driver behind the surge in demand for lipid testing products. Consumables such as reagent cartridges and test strips are essential for every lipid profile test and are intended for single use, resulting in high repurchase frequency. As point-of-care diagnostics become more integrated into various healthcare environments like outpatient centers, primary care offices, and personal health setups, the necessity for reliable, disposable components is rising. The growing preference for fast, hygienic, and accurate testing solutions is enhancing the uptake of consumables.

The lipid and lipoprotein disorder segment accounted for the largest market share in 2024, holding 40.4% due to the rising prevalence of dyslipidemia, including genetic and acquired lipid imbalances. These disorders play a central role in the development of heart-related illnesses, which continue to be the foremost cause of mortality worldwide. The urgency of diagnosing and managing lipid irregularities reinforces the widespread use of point-of-care lipid panels. Medical professionals-particularly those specializing in internal medicine and cardiology-heavily rely on these tests to support early interventions. The demand for regular lipid monitoring has made these diagnostics a fundamental tool in both specialized and general healthcare.

United States Point of Care Lipid Test Market is anticipated to reach USD 440.4 million by 2034. Increasing public concern regarding cardiovascular risk has sparked widespread awareness about the importance of lipid testing, which is pushing the adoption of convenient, easy-to-use diagnostic kits. The shift toward immediate, at-home testing is accelerating as more individuals aim to manage their health proactively. The rising incidence of lipid disorders across the country is intensifying the need for dependable, accessible solutions. As awareness continues to grow, the market is benefiting from a surge in demand for compact diagnostic tools that allow regular screening without the need for formal lab visits.

Major industry participants driving innovation and expansion in the Global Point of Care Lipid Test Industry include F. Hoffmann-La Roche, VivaChek Biotech, Kanlife, Abbott Laboratories, SD Biosensor, Sinocare, Callegari, MiCoBio, Nova Biomedical, and Menarini Group. To strengthen their market positioning, key players are implementing strategies centered around continuous product innovation and technological enhancement. Companies are investing in the development of advanced diagnostic devices that deliver faster and more accurate results while enhancing user-friendliness. Many are expanding their geographic reach through partnerships and strategic collaborations with healthcare distributors and clinics. These alliances help improve accessibility to lipid testing kits across various markets.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.3 Growth drivers

- 3.3.1 Increasing prevalence of cardiovascular diseases

- 3.3.2 Rising shift towards preventive healthcare

- 3.3.3 Technological advancements in POC lipid testing devices

- 3.3.4 Growing adoption in emerging economies

- 3.4 Industry pitfalls and challenges

- 3.4.1 Stringent regulatory scenario

- 3.4.2 Limited awareness in rural areas

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.7 Technological landscape

- 3.8 Future market trends

- 3.9 Gap analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Instruments

- 5.3 Consumables

Chapter 6 Market Estimates and Forecast, By Disease Indication, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Lipid and lipoprotein disorder

- 6.2.1 Endogenous hyperlipemia

- 6.2.2 Tangier disease

- 6.2.3 Hyperlipoproteinemia

- 6.2.4 Familial hypercholesterolemia

- 6.2.5 Other lipid and lipoprotein disorders

- 6.3 Atherosclerosis

- 6.4 Liver and renal diseases

- 6.5 Diabetes mellitus

- 6.6 Other disease indication

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Clinics

- 7.4 Diagnostic laboratories

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Callegari

- 9.3 F. Hoffmann-La Roche

- 9.4 Kanlife

- 9.5 Menarini Group

- 9.6 MiCoBio

- 9.7 Nova Biomedical

- 9.8 SD Biosensor

- 9.9 Sinocare

- 9.10 VivaChek Biotech