|

市场调查报告书

商品编码

1755203

神经病学设备市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Neurology Devices Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

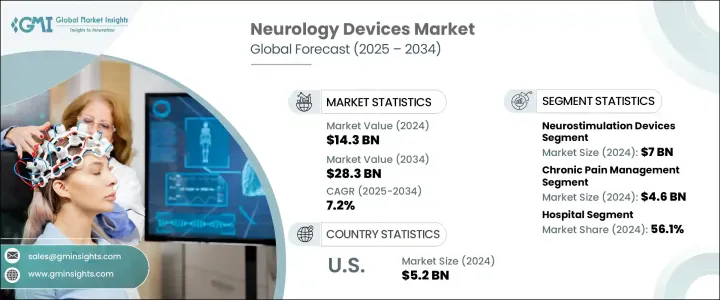

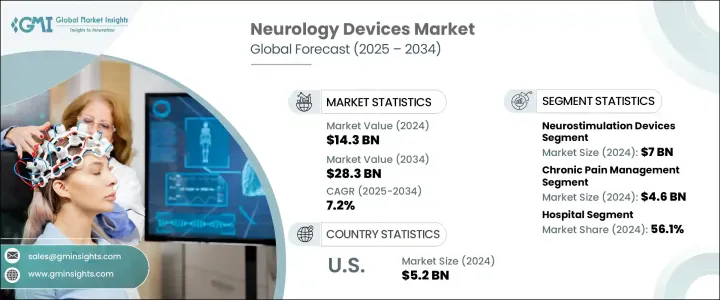

2024 年全球神经病学设备市场价值为 143 亿美元,预计到 2034 年将以 7.2% 的复合年增长率增长,达到 283 亿美元,这得益于技术创新、神经系统疾病发病率上升、医疗保健支出增加以及医疗服务可及性改善等多种因素。人工智慧远端监控和脑机介面系统的发展显着改善了患者的照护效果。此外,便携式脑电图监测器和增强刺激系统等新兴微创神经技术正在改变神经系统的治疗和诊断。这些进步使得更精确、更安全和更有效的治疗介入成为可能,促进了神经病学设备产业的全面扩张。神经病学设备包括可植入工具、手术器材和诊断技术,用于治疗影响神经系统的疾病,例如大脑、脊椎和周边神经。

神经病学设备包括用于治疗影响神经系统疾病(例如大脑、脊椎和周边神经)的植入式工具、手术器材和诊断技术。这些设备旨在辅助检测、监测、治疗和復健神经系统疾病,例如癫痫、帕金森氏症、阿兹海默症、多发性硬化症、脑肿瘤和创伤性脑损伤。它们在从常规神经系统评估到复杂的神经外科手术等一系列临床环境中发挥关键作用。脑电图系统和神经影像技术等诊断工具有助于早期准确地识别神经系统疾病,而神经刺激器等植入式设备则为患有慢性和进行性疾病的患者提供长期治疗益处。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 143亿美元 |

| 预测值 | 283亿美元 |

| 复合年增长率 | 7.2% |

在主要类别中,神经刺激设备领域在2024年创造了70亿美元的市场规模。这些设备包括脊髓刺激器和迷走神经刺激器等系统,旨在治疗运动障碍、慢性疼痛、精神疾病和癫痫。闭环系统、相容MRI的植入物以及微型解决方案等新型设备改善了患者的治疗效果,拓宽了治疗应用,从而增强了该领域的成长。

按最终用途划分,医院在2024年以56.1%的市场份额占据市场主导地位,这得益于其完善的基础设施和处理复杂神经系统病例的能力。医院承担大部分诊断和治疗程序,使其成为神经影像和神经调节系统应用的关键枢纽。医院在处理癫痫、中风和创伤等紧急神经系统事件方面发挥着重要作用,确保了对尖端设备的持续需求。

2024年,美国神经病学设备市场规模达52亿美元,这得益于神经系统疾病盛行率的上升、强大的临床研究基础设施以及大量的政府资金投入。主要的联邦政府措施和研究经费持续支持神经义肢和脑机介面系统的进步。老龄人口的成长以及神经科专业人员的短缺,也促使人们更加依赖先进的设备来满足日益增长的医疗需求。

积极塑造神经病学设备产业格局的关键参与者包括 Synchron、B BRAUN、LivaNova、NeuroPace、ZYLOX TONBRIDGE、雅培实验室、MicroTransponder、KARL STROZ、美敦力、史赛克、Bioness、奈夫罗、波士顿科学、Enterra Medical 和 Paradromics。为了巩固其在神经病学设备市场的地位,领先的公司正专注于研究驱动的产品创新和人工智慧整合系统的开发。这些公司正在透过微创设备和针对特定患者的解决方案来扩展其产品组合,以提高安全性和精准度。战略合作伙伴关係、监管部门的批准以及增加对神经技术研发的投资也是他们的核心策略。企业正在改进设备与成像系统的兼容性,并追求紧凑、便携的格式,以实现更广泛的临床应用。此外,主要参与者正在扩大製造能力并开展全球合作,以赢得合约、提升地理影响力并与旨在提供更智慧的神经病学护理的医疗保健系统保持一致。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 神经系统疾病盛行率上升

- 微创手术的采用日益增多

- 技术进步

- 增加资金和投资

- 产业陷阱与挑战

- 设备和手术成本高昂

- 设备故障和併发症的风险

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 技术格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 报销场景

- 波特的分析

- PESTEL分析

- 差距分析

- 未来市场趋势

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按设备,2021 - 2034 年

- 主要趋势

- 神经刺激装置

- 脊髓刺激器

- 深部脑部刺激器

- 迷走神经刺激器

- 荐神经刺激器

- 胃电刺激器

- 神经外科设备

- 立体定位系统

- 神经内视镜

- 超音波吸引器

- 动脉瘤夹

- 介入性神经病学设备

- 动脉瘤栓塞及栓塞治疗

- 栓塞线圈

- 导流装置

- 液态栓塞剂

- 神经血栓切除术

- 血块取出器

- 吸引装置

- 响弦装置

- 神经血管导管

- 微导管

- 微导丝

- 脑球囊血管成形术和支架

- 颈动脉支架

- 过滤装置

- 球囊封堵装置

- 脑脊髓液管理设备

- 脑分流术

- 脑外引流

- 动脉瘤栓塞及栓塞治疗

- 脑机介面设备

- 非侵入式脑机接口

- 部分侵入式脑机接口

- 完全侵入式脑机接口

- 其他设备

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 慢性疼痛管理

- 帕金森氏症

- 癫痫

- 中风管理与康復

- 阿兹海默症

- 其他应用

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- B BRAUN

- Bioness

- Boston Scietific

- enterra medical

- KARL STROZ

- LivaNova

- Medtronic

- MicroTransponder

- NeuroPace

- nevro

- Paradromics

- stryker

- synchron

- ZYLOX TONBRIDGE

The Global Neurology Devices Market was valued at USD 14.3 billion in 2024 and is estimated to grow at a CAGR of 7.2% to reach USD 28.3 billion by 2034, fueled by a combination of technological innovation, rising rates of neurological conditions, increased healthcare spending, and improved access to medical services. Developments in AI-powered remote monitoring and brain-computer interface systems have significantly improved patient care outcomes. In addition, emerging minimally invasive neurotechnologies-such as portable EEG monitors and enhanced stimulation systems-are transforming neurological treatment and diagnosis. These advances have made it possible to deliver more precise, safer, and efficient therapeutic interventions, contributing to the overall expansion of the neurology devices sector. Neurology devices include implantable tools, surgical instruments, and diagnostic technologies used to manage conditions affecting the nervous system, such as the brain, spine, and peripheral nerves.

Neurology devices include implantable tools, surgical instruments, and diagnostic technologies used to manage conditions affecting the nervous system, such as the brain, spine, and peripheral nerves. These devices are designed to aid in the detection, monitoring, treatment, and rehabilitation of neurological disorders, including epilepsy, Parkinson's disease, Alzheimer's disease, multiple sclerosis, brain tumors, and traumatic brain injuries. They serve a critical role across a range of clinical settings, from routine neurological assessments to complex neurosurgical procedures. Diagnostic tools such as EEG systems and neuroimaging technologies help in the early and accurate identification of neurological conditions, while implantable devices like neurostimulators offer long-term therapeutic benefits for patients suffering from chronic and progressive diseases.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $14.3 Billion |

| Forecast Value | $28.3 Billion |

| CAGR | 7.2% |

Among the main categories, the neurostimulation devices segment generated USD 7 billion in 2024. These include systems like spinal cord stimulators and vagus nerve stimulators, designed to address movement disorders, chronic pain, psychiatric issues, and epilepsy. Newer models, such as closed-loop systems, MRI-compatible implants, and miniaturized solutions, have improved patient outcomes and broadened therapeutic applications, reinforcing growth in this segment.

By end use, hospitals led the market in 2024 with a dominant share of 56.1%, driven by their comprehensive infrastructure and ability to handle complex neurological cases. Hospitals conduct a majority of diagnostic and therapeutic procedures, making them key hubs for the adoption of neuroimaging and neuromodulation systems. Their role in managing emergency neurological events such as seizures, strokes, and traumatic injuries ensures constant demand for cutting-edge equipment.

United States Neurology Devices Market was valued at USD 5.2 billion in 2024, supported by increasing neurological disease prevalence, robust clinical research infrastructure, and substantial government funding. Major federal initiatives and research grants continue to back advancements in neuroprosthetics and brain-computer interface systems. A growing elderly population and a shortage of specialized neurology professionals are also pushing greater reliance on advanced devices to meet the rising demand for care.

Key players actively shaping The Neurology Devices Industry landscape include Synchron, B BRAUN, LivaNova, NeuroPace, ZYLOX TONBRIDGE, Abbott Laboratories, MicroTransponder, KARL STROZ, Medtronic, stryker, Bioness, nevro, Boston Scientific, Enterra Medical, and Paradromics. To strengthen their position in the neurology devices market, leading companies are focusing on research-driven product innovation and the development of AI-integrated systems. These firms are expanding their portfolios with minimally invasive devices and patient-specific solutions that enhance safety and precision. Strategic partnerships, regulatory approvals, and increased investments in neurotechnology R&D are also central to their approach. Businesses are refining device compatibility with imaging systems and pursuing compact, portable formats for broader clinical use. Additionally, major players are scaling up manufacturing capabilities and entering into global collaborations to secure contracts, boost geographic presence, and align with healthcare systems aiming for smarter neurological care delivery.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of neurological disorders

- 3.2.1.2 Growing adoption of minimally invasive procedure

- 3.2.1.3 Technological advancements

- 3.2.1.4 Increased funding and investments

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices and procedures

- 3.2.2.2 Risk of device failure and complications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Trump administration tariffs

- 3.6.1 Impact on trade

- 3.6.1.1 Trade volume disruptions

- 3.6.1.2 Retaliatory measures

- 3.6.2 Impact on the Industry

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.2.1.1 Price volatility in key materials

- 3.6.2.1.2 Supply chain restructuring

- 3.6.2.1.3 Production cost implications

- 3.6.2.2 Demand-side impact (selling price)

- 3.6.2.2.1 Price transmission to end markets

- 3.6.2.2.2 Market share dynamics

- 3.6.2.2.3 Consumer response patterns

- 3.6.2.1 Supply-side impact (raw materials)

- 3.6.3 Key companies impacted

- 3.6.4 Strategic industry responses

- 3.6.4.1 Supply chain reconfiguration

- 3.6.4.2 Pricing and product strategies

- 3.6.4.3 Policy engagement

- 3.6.5 Outlook and future considerations

- 3.6.1 Impact on trade

- 3.7 Reimbursement scenario

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Gap analysis

- 3.11 Future market trends

- 3.12 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Device, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Neurostimulation devices

- 5.2.1 Spinal cord stimulators

- 5.2.2 Deep brain stimulators

- 5.2.3 Vagus nerve stimulators

- 5.2.4 Sacral nerve stimulators

- 5.2.5 Gastric electrical stimulators

- 5.3 Neurosurgical devices

- 5.3.1 Stereotactic systems

- 5.3.2 Neuroendoscopes

- 5.3.3 Ultrasonic aspirators

- 5.3.4 Aneurysm clips

- 5.4 Interventional neurology devices

- 5.4.1 Aneurysm coiling and embolisation

- 5.4.1.1 Embolic coils

- 5.4.1.2 Flow diversion devices

- 5.4.1.3 Liquid embolic reagents

- 5.4.2 Neurothromobectomy

- 5.4.2.1 Clot retrievers

- 5.4.2.2 Suction aspiration devices

- 5.4.2.3 Snare devices

- 5.4.3 Neurovascular catheters

- 5.4.3.1 Micro catheters

- 5.4.3.2 Micro guidewires

- 5.4.4 Cerebral balloon angioplasty and stents

- 5.4.4.1 Carotid artery stents

- 5.4.4.2 Filter devices

- 5.4.4.3 Balloon occlusion devices

- 5.4.5 Csf management devices

- 5.4.5.1 Cerebral shunts

- 5.4.5.2 Cerebral external drainage

- 5.4.1 Aneurysm coiling and embolisation

- 5.5 Brain-computer interface devices

- 5.5.1 Non-invasive BCI

- 5.5.2 Partially invasive BCI

- 5.5.3 Fully invasive BCI

- 5.6 Other devices

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Chronic pain management

- 6.3 Parkinson’s disease

- 6.4 Epilepsy

- 6.5 Stroke management and recovery

- 6.6 Alzheimer

- 6.7 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Japan

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 B BRAUN

- 9.3 Bioness

- 9.4 Boston Scietific

- 9.5 enterra medical

- 9.6 KARL STROZ

- 9.7 LivaNova

- 9.8 Medtronic

- 9.9 MicroTransponder

- 9.10 NeuroPace

- 9.11 nevro

- 9.12 Paradromics

- 9.13 stryker

- 9.14 synchron

- 9.15 ZYLOX TONBRIDGE