|

市场调查报告书

商品编码

1755212

自主货机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Autonomous Cargo Aircraft Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

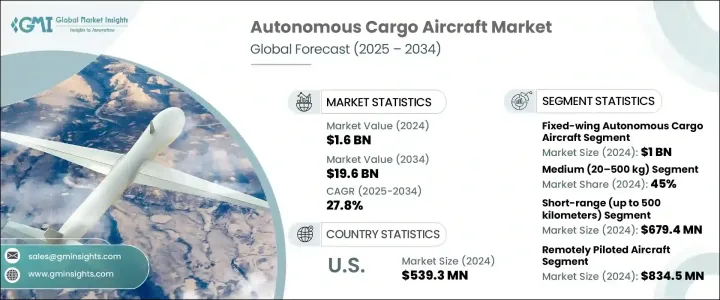

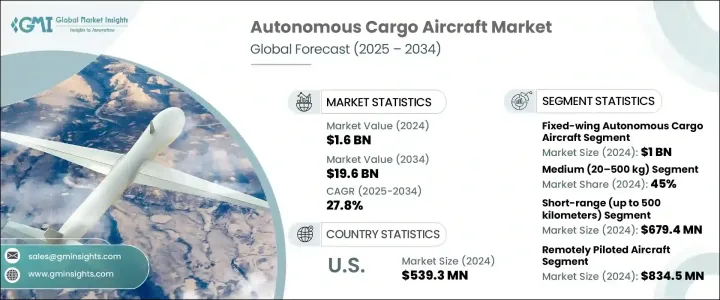

2024年,全球自动驾驶货运飞机市场价值为16亿美元,预计到2034年将以27.8%的复合年增长率成长,达到196亿美元。这得益于人们对「中间一英里」和「最后一英里」配送创新的日益关注、国防和军事应用的不断增长,以及新兴国家城市发展步伐的加快。在基础建设跟不上城市扩张步伐的城市,自动驾驶货运飞机正成为应对物流挑战的关键解决方案。它们能够绕过传统的交通拥堵,并在复杂的城市地形上快速运送货物,使其成为下一代供应链中的关键要素。

随着对更快配送速度的需求不断增长,空中货运平台对于克服传统地面运输无法解决的最后一哩低效率问题至关重要。自动驾驶货运飞机能够实现点对点配送,减少交接次数,有助于减少延误、提高供应链可视性并降低营运成本。在交通拥挤、地理障碍或道路基础设施有限的地区,传统卡车难以维持服务标准,而自动驾驶货运飞机的使用尤其具有变革意义。对于物流公司而言,这些飞机提供了简化营运并确保即使在需求高峰或紧急情况下也能及时交付的机会。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16亿美元 |

| 预测值 | 196亿美元 |

| 复合年增长率 | 27.8% |

到2034年,垂直起降 (VTOL) 市场将创造80亿美元的市场价值。其紧凑的占地面积、无需跑道即可飞行的能力以及快速的响应能力,使其非常适合人口密集的城市环境、偏远地区的配送任务以及医疗物流等时间敏感的需求。在电池效率和轻质复合材料方面的大量投资增强了 VTOL 飞机的可扩展性。透过在传统运输方式无法覆盖的地区运送货物,这些飞机正在重塑城市空中物流。

2024年,中型载重飞机占据45%的市场份额,支援对运能和航程有较高要求的物流场景。这些飞机具备适应区域配送路线的能力,越来越多地用于运输时效性要求高的货物,例如医疗用品、备件和零售库存。其可扩展性和成本效益使其能够频繁进行短途运输,在连接偏远地区和主要配送中心方面尤为重要。随着敏捷、分散式供应网络的需求日益增长,中等载重飞机类别有望成为已开发地区和发展中地区自主航空货运系统的骨干。

2024年,美国自主货机市场规模达5.393亿美元,这得益于联邦政府大力支持无人系统融入国家空域。美国在医疗物流、紧急应变和城市空中交通等领域的应用取得了重大进展。机器学习、基于人工智慧的路线规划和灾害应变感测器的快速发展正在提升营运效率,使美国成为该领域的领导者。政府的激励措施、不断完善的联邦航空管理局(FAA)指南以及私营部门的持续参与,都加速了无人货运飞机在商业和公共服务领域的部署。

空中巴士、亿航、Natilus、Elroy Air 和 Dronamics 正透过创新、合作伙伴关係和可扩展的技术平台积极塑造自动驾驶货运飞机市场的未来。这些公司着重于对以人工智慧为基础的导航系统、电力推进系统和模组化货物设计的研发投入。与物流网路和供应链营运商的策略合作正在帮助试点实际用例并扩大营运规模。许多公司也在多个地区获得监管部门的批准和适航认证,以扩大其全球影响力。这些公司专注于优化垂直起降 (VTOL) 设计并整合先进的感测器技术,正准备满足日益增长的安全、可持续和快速的自动驾驶货物运输需求。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业影响力量

- 成长动力

- 自然灾害和人道危机发生率上升

- 中英里和最后一英里配送解决方案日益普及

- 增加军事和国防投资

- 新兴经济体的快速都市化

- 人工智慧、导航和飞行控制系统的不断进步

- 产业陷阱与挑战

- 电动无人机的有效载荷和航程限制

- 网路安全威胁与通讯干扰

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略仪表板

第五章:市场估计与预测:依技术类型,2021-2034

- 主要趋势

- 固定翼自主货机

- VTOL(垂直起降)自主飞机

第六章:市场估计与预测:依酬载容量,2021-2034 年

- 主要趋势

- 小型(20公斤以下)

- 中型(20–500公斤)

- 大型(500公斤以上)

第七章:市场估计与预测:依范围,2021-2034

- 主要趋势

- 短程(最远500公里)

- 中程(500-2000公里)

- 远程(超过2000公里)

第八章:市场估计与预测:依自治级别,2021-2034 年

- 主要趋势

- 完全自主

- 遥控飞机

- 半自主

第九章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 电子商务与零售物流

- 工业和离岸物流

- 军事与国防

- 人道与灾难救援

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- Airbus

- Dronamics Group Limited

- Ehang

- Elroy Air

- Jestar Logistics

- MightyFly

- Natilus

- Pipistrel

- Pyka Inc.

- Skydio, Inc.

- UAVOS

- Unmanned Systems Technology

- Xwing

- Zipline

The Global Autonomous Cargo Aircraft Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 27.8% to reach USD 19.6 billion by 2034 fueled by the increasing focus on middle-mile and last-mile delivery innovation, rising defense and military adoption, and the accelerating pace of urban development across emerging nations. In cities where infrastructure development can't keep pace with urban expansion, autonomous cargo aircraft are emerging as a critical solution to logistical challenges. Their ability to bypass traditional traffic congestion and deliver goods quickly over complex urban terrain makes them a pivotal element in next-gen supply chains.

As demand for faster fulfillment grows, aerial cargo platforms are essential to overcoming last-mile inefficiencies that conventional ground transport cannot resolve. Autonomous cargo aircraft enable point-to-point delivery with fewer handoffs, which helps reduce delays, improve supply chain visibility, and lower operational costs. Their use is particularly transformative in areas prone to traffic congestion, geographic barriers, or limited road infrastructure, where traditional trucks struggle to maintain service standards. For logistics companies, these aircraft present an opportunity to streamline operations and ensure timely delivery even during peak demand or emergencies.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $19.6 Billion |

| CAGR | 27.8% |

The Vertical Take-off and Landing (VTOL) segment will generate USD 8 billion by 2034. Its compact footprint, ability to operate without runways, and responsiveness make it highly suitable for dense urban settings, remote delivery missions, and time-sensitive needs like medical logistics. Significant investments in battery efficiency and lightweight composite materials enhance VTOL aircraft's scalability. By delivering cargo where conventional transport fails, these aircraft are reshaping urban air logistics.

The medium payload segment held a 45% share in 2024, supporting logistics scenarios that require capacity and range. With capabilities suited to regional delivery lanes, these aircraft are increasingly used to transport time-sensitive goods like medical supplies, spare parts, and retail inventory. Their scalability and cost-effectiveness allow frequent short-haul operations, making them especially valuable in bridging gaps between remote locations and major distribution centers. As the need for agile, decentralized supply networks grows, the medium payload category is well-positioned to become the backbone of autonomous air freight systems in developed and developing regions.

United States Autonomous Cargo Aircraft Market generated USD 539.3 million in 2024, supported by strong federal backing for unmanned systems integration into national airspace. The country is making major strides in adopting these aircraft for healthcare logistics, emergency response, and urban air mobility. Rapid growth in machine learning, AI-based routing, and disaster-response sensors is boosting operational efficiency, making the U.S. a leader in this segment. Government incentives, evolving FAA guidelines, and rising private-sector participation contribute to accelerated deployment across commercial and public service applications.

Airbus, eHang, Natilus, Elroy Air, and Dronamics are actively shaping the future of the autonomous cargo aircraft market through innovation, partnerships, and scalable technology platforms. These companies emphasize R&D investments in AI-based navigation systems, electric propulsion, and modular cargo designs. Strategic collaborations with logistics networks and supply chain operators are helping to pilot real-world use cases and scale operations. Many are also securing regulatory approvals and airworthiness certifications across multiple geographies to expand their global reach. With a focus on optimizing VTOL designs and integrating advanced sensor technologies, these firms are preparing to meet the growing demand for safe, sustainable, and fast autonomous cargo delivery.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry Impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising incidences of natural disasters & humanitarian crises

- 3.3.1.2 Growing proliferation of middle-mile and last-mile delivery solutions

- 3.3.1.3 Increased military and defense investments

- 3.3.1.4 Rapid urbanization in emerging economies

- 3.3.1.5 Growing advancement in AI, navigation & flight control systems

- 3.3.2 Industry pitfalls & challenges

- 3.3.2.1 Payload and range limitations of electric UAVs

- 3.3.2.2 Cybersecurity threats and communication interference

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic dashboard

Chapter 5 Market Estimates & Forecast, By Technology Type, 2021-2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 Fixed-wing autonomous cargo aircraft

- 5.3 VTOL (vertical take-off and landing) autonomous aircraft)

Chapter 6 Market Estimates & Forecast, By Payload Capacity, 2021-2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 Small (up to 20 kg)

- 6.3 Medium (20–500 kg)

- 6.4 Large (500 kg and above)

Chapter 7 Market Estimates & Forecast, By Range, 2021-2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Short-range (Up to 500 kilometers)

- 7.3 Medium-range (500-2,000 kilometers)

- 7.4 Long-range (Over 2,000 kilometers)

Chapter 8 Market Estimates & Forecast, By Autonomy Level, 2021-2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Fully autonomous

- 8.3 Remotely piloted aircraft

- 8.4 Semi-autonomous

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 E-commerce & retail logistics

- 9.3 Industrial & offshore logistics

- 9.4 Military & defense

- 9.5 Humanitarian and disaster relief

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Million & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Airbus

- 11.2 Dronamics Group Limited

- 11.3 Ehang

- 11.4 Elroy Air

- 11.5 Jestar Logistics

- 11.6 MightyFly

- 11.7 Natilus

- 11.8 Pipistrel

- 11.9 Pyka Inc.

- 11.10 Skydio, Inc.

- 11.11 UAVOS

- 11.12 Unmanned Systems Technology

- 11.13 Xwing

- 11.14 Zipline