|

市场调查报告书

商品编码

1755213

摇臂开关市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Rocker Switch Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

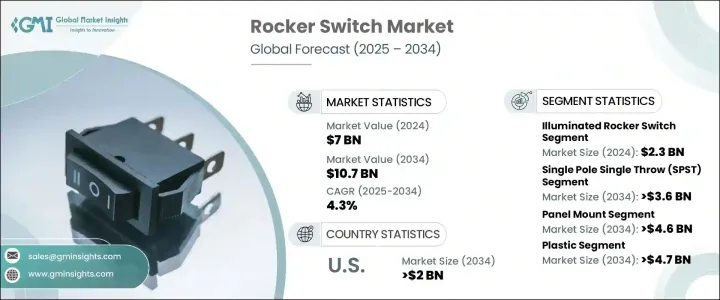

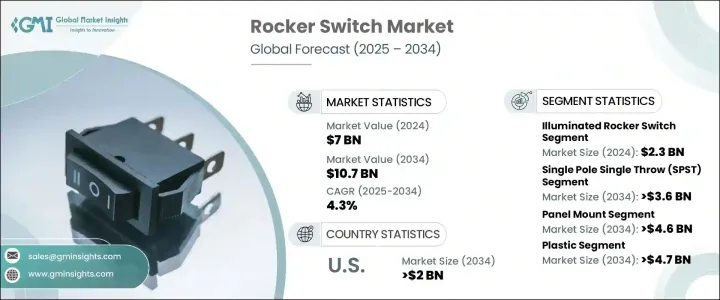

2024年,全球摇臂开关市场规模达70亿美元,预计到2034年将以4.3%的复合年增长率成长,达到107亿美元,这得益于不断变化的需求动态和不断演变的监管环境。针对摇臂开关生产中使用的塑胶、金属和电子接点等材料的贸易关税大幅提高了製造成本。这些进口壁垒影响全球供应链,尤其对依赖跨国采购的原始设备製造商(OEM)而言,最终将减缓产品创新,并降低其在全球市场的成本竞争力。

儘管如此,由于电动车 (EV) 和智慧家居解决方案的普及,需求仍在持续成长。随着电动车产量的扩大,翘板开关凭藉其可靠且直觉的设计,在照明、暖气和车窗控制等车辆功能中发挥关键作用。此外,政府主导的电动车税收优惠和基础设施建设等倡议,也推动了汽车应用中翘板开关的需求。同样,智慧家庭的普及也引发了人们对用于控制照明、暖通空调系统和安全设备的响应式、用户友好型介面日益增长的兴趣。这一趋势正在加速智慧翘板开关融入日常家庭自动化系统,提供兼具功能性、美观性和便利性的产品。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 70亿美元 |

| 预测值 | 107亿美元 |

| 复合年增长率 | 4.3% |

2024年,发光摇桿开关市场规模达23亿美元,凸显了人们对具有视觉指示和功能的开关日益增长的偏好。这些开关配有内部照明,可指示其工作状态,使其在能见度低的环境中特别有用。它们在汽车内饰、船舶应用和家用电器中的应用日益广泛,增强了安全性和用户互动性。

预计到2034年,面板安装开关市场规模将达到46亿美元,这得益于其在工业机械和汽车系统中的普及。这些开关设计易于操作且经久耐用,并配有安全的面板安装机制,可确保在高使用率环境下始终如一的性能。其坚固耐用和操作简便的特性使其成为需要可靠用户互动的设备的首选。

预计到2034年,美国摇臂开关市场规模将达到20亿美元,这得益于汽车、航太和智慧家庭领域的持续需求。随着家庭自动化的不断发展和工业建筑的现代化改造,摇臂开关整合仍然至关重要。此外,国防部门对坚固可靠的开关係统的需求也提升了其应用前景。国内创新正在支持弹性供应链的发展,并推动智慧开关技术取得新的进步。

全球翘板开关市场的领导者包括 Leviton Manufacturing Co., Inc.、OTTO Engineering、Carling Technologies、Eaton Corporation、TE Connectivity 和 Honeywell International Inc.。为了巩固其市场地位,主要企业优先考虑开关设计的创新,专注于为互联环境量身定制的智慧照明功能。他们也加大研发投入,以提高性能、缩小尺寸并提升能源效率。与电动车製造商和智慧家庭开发商的策略合作,有助于实现更好的整合和更快的跨产业部署。此外,企业正在加强区域製造,以最大限度地减少关税影响并增强供应链的韧性。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商矩阵

- 利润率分析

- 技术与创新格局

- 专利分析

- 重要新闻和倡议

- 产业衝击力

- 成长动力

- 电动车采用

- 智慧家庭与消费性电子扩张

- 工业自动化成长

- 小型化和客製化需求

- 新兴市场製造业成长

- 产业陷阱与挑战

- 商品化带来的价格压力

- 供应链中断与关税风险

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 - 2034 年

- 发光翘板开关

- 不发光翘板开关

- 密封/防水摇臂开关

- 微型/微型摇臂开关

- 智慧翘板开关

第六章:市场估计与预测:按开关配置,2021 - 2034 年

- 单刀单掷(SPST)

- 单刀双掷(SPDT)

- 双刀单掷(DPST)

- 双刀双掷(DPDT)

- 其他的

第七章:市场估计与预测:按安装类型,2021 - 2034 年

- 面板安装

- PCB安装

- 表面贴装

第八章:市场估计与预测:按材料,2021 - 2034 年

- 塑胶

- 金属

- 合成的

第九章:市场估计与预测:依最终用途,2021 - 2034 年

- 汽车

- 消费性电子产品

- 工业设备和机械

- 航太与国防

- 电信

- 其他的

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Eaton Corporation

- Honeywell International Inc.

- TE Connectivity

- Carling Technologies (a Littelfuse brand)

- OTTO Engineering

- Leviton Manufacturing Co., Inc.

- APEM (part of IDEC Group)

- C&K Components

- NKK Switches Co., Ltd.

- Schurter AG

- Omron Corporation

- Panasonic Corporation

- ABB Ltd.

- Schneider Electric SE

- Marquardt GmbH

- HELLA GmbH & Co. KGaA

- Zippy Technology Corp.

- E-Switch Inc.

- Bulgin Ltd.

- ALPS Alpine Co., Ltd.

- Defond Group

The Global Rocker Switch Market was valued at USD 7 billion in 2024 and is estimated to grow at a CAGR of 4.3% to reach USD 10.7 billion by 2034, driven by shifting demand dynamics and evolving regulatory environments. Trade tariffs on materials like plastics, metals, and electronic contacts used in rocker switch production have significantly raised manufacturing costs. These import barriers impact global supply chains, especially for OEMs that depend on cross-border sourcing, ultimately slowing product innovation and reducing cost competitiveness in global markets.

Nonetheless, demand continues to rise due to the increased adoption of electric vehicles (EVs) and smart home solutions. As EV production expands, rocker switches play a critical role in vehicle functions such as lighting, heating, and window controls, owing to their reliable and intuitive design. Additionally, government-led initiatives such as tax incentives and infrastructure development for EVs are boosting the demand for rocker switches in automotive applications. Similarly, the proliferation of smart homes has sparked a growing interest in responsive and user-friendly interfaces for controlling lighting, HVAC systems, and security devices. This trend is accelerating the integration of smart rocker switches into everyday home automation systems, offering a combination of functionality, aesthetics, and convenience.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $7 Billion |

| Forecast Value | $10.7 Billion |

| CAGR | 4.3% |

The illuminated rocker switch segment generated USD 2.3 billion in 2024, underscoring the expanding preference for switches that offer visual indication and functionality. These switches are equipped with internal lighting that signals their operational status, making them especially useful in environments with low visibility. Their presence is increasingly felt across automotive interiors, marine applications, and home appliances, where they enhance both safety and user interaction.

The panel mount switches segment is projected to achieve USD 4.6 billion by 2034, driven by their popularity in industrial machinery and automotive systems. These switches are designed to be easily accessible and durable, with a secure panel-mounting mechanism that ensures consistent performance in high-use environments. Their robustness and simplicity make them a preferred choice for equipment requiring reliable user interaction.

U.S. Rocker Switch Market is expected to generate USD 2 billion by 2034, fueled by sustained demand from the automotive, aerospace, and smart home sectors. As home automation continues to evolve and industrial construction undergoes modernization, rocker switch integration remains essential. Additionally, the defense sector's demand for rugged and reliable switch systems enhances the application landscape. Domestic innovation is supporting the development of resilient supply chains and pushing new advancements in smart switching technologies.

Leading players in the Global Rocker Switch Market include Leviton Manufacturing Co., Inc., OTTO Engineering, Carling Technologies, Eaton Corporation, TE Connectivity, and Honeywell International Inc. To strengthen their presence in the market, key companies are prioritizing innovation in switch design, focusing on smart and illuminated functionalities tailored for connected environments. They are also increasing investment in R&D to improve performance, reduce size, and enhance energy efficiency. Strategic collaborations with EV manufacturers and smart home developers allow for better integration and quicker deployment across industries. Additionally, players are strengthening regional manufacturing to minimize tariff impact and boost supply chain resilience.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Vendor matrix

- 3.4 Profit margin analysis

- 3.5 Technology & innovation landscape

- 3.6 Patent analysis

- 3.7 Key news and initiatives

- 3.8 Industry impact forces

- 3.8.1 Growth drivers

- 3.8.1.1 Electric vehicle adoption

- 3.8.1.2 Smart home & consumer electronics expansion

- 3.8.1.3 Industrial automation growth

- 3.8.1.4 Miniaturization & customization demand

- 3.8.1.5 Emerging market manufacturing growth

- 3.8.2 Industry pitfalls and challenges

- 3.8.2.1 Price pressure from commoditization

- 3.8.2.2 Supply chain disruptions & tariff risks

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Regulatory landscape

- 3.11 Technology landscape

- 3.12 Future market trends

- 3.13 Gap analysis

- 3.14 Porter's analysis

- 3.15 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Type, 2021 - 2034 (USD Million)

- 5.1 Illuminated rocker switch

- 5.2 Non-Illuminated rocker switch

- 5.3 Sealed/Waterproof rocker switch

- 5.4 Miniature/Micro rocker switch

- 5.5 Smart rocker switch

Chapter 6 Market estimates & forecast, By Switch Configuration, 2021 - 2034 (USD Million)

- 6.1 Single Pole Single Throw (SPST)

- 6.2 Single Pole Double Throw (SPDT)

- 6.3 Double Pole Single Throw (DPST)

- 6.4 Double Pole Double Throw (DPDT)

- 6.5 Others

Chapter 7 Market estimates & forecast, By Mounting Type, 2021 - 2034 (USD Million)

- 7.1 Panel mount

- 7.2 PCB mount

- 7.3 Surface mount

Chapter 8 Market Estimates & Forecast, By Material, 2021 - 2034 (USD Million)

- 8.1 Plastic

- 8.2 Metal

- 8.3 Composite

Chapter 9 Market estimates & forecast, By End Use, 2021 - 2034 (USD Million)

- 9.1 Automotive

- 9.2 Consumer electronics

- 9.3 Industrial equipment & machinery

- 9.4 Aerospace & defense

- 9.5 Telecommunications

- 9.6 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Eaton Corporation

- 11.2 Honeywell International Inc.

- 11.3 TE Connectivity

- 11.4 Carling Technologies (a Littelfuse brand)

- 11.5 OTTO Engineering

- 11.6 Leviton Manufacturing Co., Inc.

- 11.7 APEM (part of IDEC Group)

- 11.8 C&K Components

- 11.9 NKK Switches Co., Ltd.

- 11.10 Schurter AG

- 11.11 Omron Corporation

- 11.12 Panasonic Corporation

- 11.13 ABB Ltd.

- 11.14 Schneider Electric SE

- 11.15 Marquardt GmbH

- 11.16 HELLA GmbH & Co. KGaA

- 11.17 Zippy Technology Corp.

- 11.18 E-Switch Inc.

- 11.19 Bulgin Ltd.

- 11.20 ALPS Alpine Co., Ltd.

- 11.21 Defond Group