|

市场调查报告书

商品编码

1755220

非酒精性脂肪性肝炎生物标记市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Non-alcoholic Steatohepatitis Biomarkers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

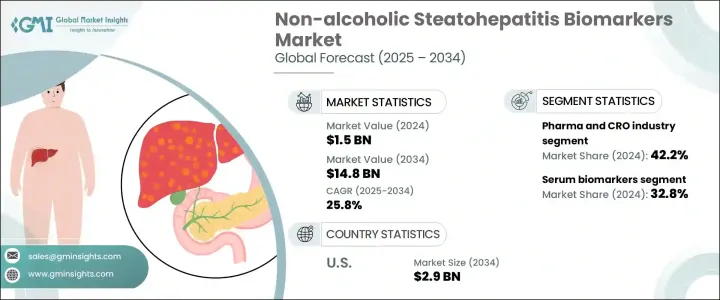

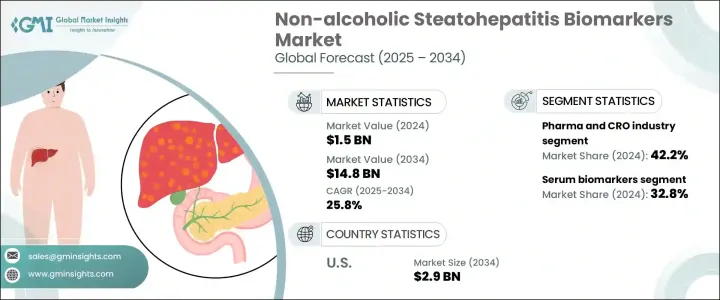

2024年,全球非酒精性脂肪性肝炎生物标记市场规模达15亿美元,预计2034年将以25.8%的复合年增长率成长至148亿美元。 NASH生物标记是帮助评估NASH存在和进展的生物指标。 NASH是一种由非酒精性脂肪肝病(NAFLD)演变而来的严重肝病。随着医疗保健提供者越来越重视早期发现和针对性干预,对此类生物标记的需求也大幅增长。针对高风险族群的临床建议不断发展,进一步推动了主动肝病筛检的发展。这其中包括患有肥胖症和2型糖尿病等代谢紊乱疾病的人群,他们更容易患上NASH。

随着人们对肝臟相关併发症的认识不断加深,医疗保健系统正在整合基于生物标记的诊断策略,以改善患者预后。这些工具可望监测病情进展、评估疗效,并识别最有可能从新兴疗法中获益的患者。它们在个人化医疗中日益重要的作用,推动了肝病诊断和治疗方式的重大转变。人们对微创方法的日益青睐,以及精准诊断在临床研究中的日益普及,进一步巩固了NASH生物标记在现代医疗保健中的重要性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15亿美元 |

| 预测值 | 148亿美元 |

| 复合年增长率 | 25.8% |

根据生物标记类型,市场细分为氧化压力生物标记、肝纤维化生物标记、血清生物标记、细胞凋亡生物标记等。其中,血清生物标记占最大份额,2024 年贡献了 32.8% 的收入。此细分市场的主导地位主要源于采血的便利性、非侵入性操作以及其在诊断、监测和预后中的频繁应用。血清生物标记因能够检测肝细胞损伤和其他与疾病进展相关的细胞反应,为肝臟健康提供重要资讯而受到认可。它们在临床和研究环境中的应用,进一步增强了其广泛的实用性和市场吸引力。

就最终用途而言,市场分为製药和合约研究组织 (CRO) 行业、医院、诊断实验室和学术研究机构。製药和 CRO 产业在 2024 年占据领先地位,占总收入的 42.2%。这种主导地位反映了该行业在药物发现、临床试验分层和治疗监测方面对经过验证的生物标记的高度依赖。随着药物开发商寻求加快进度并提高候选治疗药物的精准度,生物标记已成为整个开发週期中评估疗效和安全性的关键。另一方面,CRO 透过提供生物标记验证和测试的技术和监管专业知识来支持这些工作。他们的参与简化了从生物标记发现到临床应用的过渡,促进了标靶治疗的开发,并促进了更快的市场成长。

从地理来看,美国已成为NASH生物标记领域的关键成长引擎。光是美国市场在2024年的估值就达3.088亿美元,预计到2034年将飙升至约29亿美元。这一显着成长趋势由多种因素促成,包括日益加重的肝臟相关疾病负担,以及能够支持先进诊断技术的强大医疗基础设施。人口老化也是一个主要驱动因素,因为老年人面临更高的慢性肝病风险,需要及时的诊断干预。医疗保健部门在诊断领域的投资不断增加,加上对非侵入性解决方案的关注,进一步推动了对生物标记技术的需求。对精准早期检测工具的需求从未如此强烈,而美国凭藉着快速的技术进步和新一代检测方案的整合,在满足这一需求方面处于领先地位。

NASH 生物标记市场的竞争格局依然较为分散。专业的生物标记公司和诊断解决方案提供者正在积极塑造这一市场格局,领先的参与者合计占了约 40% 的市场份额。这些公司正在透过整合新技术和建立合作伙伴关係来推动该领域的发展,旨在提升精准医疗能力。多路復用平台和人工智慧整合分析等创新正在改变生物标记资料在临床和研究环境中的收集、解读和应用方式。随着市场的不断发展,技术升级和跨产业合作预计将加速采用更有效率、可扩展且以患者为中心的生物标记解决方案。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 非酒精性脂肪性肝炎(NASH)盛行率上升

- 诊断技术的进步

- 提高对肝臟疾病的认识和筛检倡议

- 产业陷阱与挑战

- 生物标记验证成本高且复杂

- 严格的监管情景

- 成长动力

- 成长潜力分析

- 监管格局

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 各国应对措施

- 对产业的影响

- 供应方影响(製造成本)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(消费者成本)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(製造成本)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 血清生物标记

- 肝纤维化生物标记

- 细胞凋亡生物标誌物

- 氧化压力生物标誌物

- 其他类型

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 製药和CRO行业

- 医院

- 诊断实验室

- 学术研究机构

第七章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第八章:公司简介

- BioPredictive

- GENFIT

- Glycotest

- Labcorp

- Nordic Bioscience

- Prometheus Laboratories

- Quest Diagnostics

- Siemens Healthineers

- SomaLogic

- Zora Biosciences

The Global Non-alcoholic Steatohepatitis Biomarkers Market was valued at USD 1.5 billion in 2024 and is estimated to grow at a CAGR of 25.8% to reach USD 14.8 billion by 2034. NASH biomarkers are biological indicators that help evaluate the presence and progression of NASH, a severe liver condition that evolves from non-alcoholic fatty liver disease (NAFLD). As healthcare providers increasingly prioritize early detection and targeted interventions, the demand for such biomarkers has grown considerably. The push for proactive liver disease screening is further reinforced by evolving clinical recommendations targeting at-risk populations. This includes individuals with metabolic disorders such as obesity and type 2 diabetes, who are more likely to develop NASH.

As awareness of liver-related complications continues, healthcare systems are integrating biomarker-based diagnostic strategies to improve patient outcomes. These tools offer the potential to monitor disease progression, assess treatment efficacy, and identify patients most likely to benefit from emerging therapies. Their growing role in personalized medicine drives a significant shift in how liver diseases are diagnosed and managed. Increasing preference for minimally invasive methods and growing adoption of precision diagnostics in clinical research have further cemented the importance of NASH biomarkers in modern healthcare.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.5 Billion |

| Forecast Value | $14.8 Billion |

| CAGR | 25.8% |

The market is segmented by biomarker type into oxidative stress biomarkers, hepatic fibrosis biomarkers, serum biomarkers, apoptosis biomarkers, and others. Among these, serum biomarkers accounted for the largest share of revenue, contributing 32.8% in 2024. This segment's dominance is primarily due to the convenience of blood sampling, non-invasive procedures, and their frequent use in diagnosis, monitoring, and prognosis. Serum-based biomarkers are recognized for offering vital insights into liver health by detecting hepatocyte injury and other cellular responses linked to disease progression. Their application across both clinical settings and research environments adds to their widespread utility and market traction.

In terms of end use, the market is divided into the pharmaceutical and contract research organization (CRO) industry, hospitals, diagnostic laboratories, and academic research institutes. The pharmaceutical and CRO industry held the leading position in 2024, generating 42.2% of the overall revenue. This dominance reflects the industry's strong reliance on validated biomarkers for drug discovery, clinical trial stratification, and treatment monitoring. As drug developers seek to accelerate timelines and increase the precision of their therapeutic candidates, biomarkers have become essential in assessing efficacy and safety throughout the development cycle. CROs, on the other hand, support these efforts by offering technical and regulatory expertise for biomarker validation and testing. Their involvement has streamlined the transition from biomarker discovery to clinical application, bolstering the development of targeted treatments and contributing to faster market growth.

Geographically, the United States has emerged as a key growth engine within the NASH biomarkers space. The US market alone was valued at USD 308.8 million in 2024 and is anticipated to surge to approximately USD 2.9 billion by 2034. Several factors contribute to this significant trajectory, including a rising burden of liver-related conditions and a robust healthcare infrastructure capable of supporting advanced diagnostic technologies. The growing aging population is also a major driver, as older individuals face a higher risk of chronic liver diseases and require timely diagnostic interventions. Increasing healthcare investments in diagnostics, coupled with a focus on non-invasive solutions, are further driving demand for biomarker technologies. The need for accurate and early detection tools has never been greater, and the US is at the forefront of meeting this demand with rapid technological advancements and integration of next-generation testing protocols.

The competitive landscape of the NASH biomarkers market remains moderately fragmented. A mix of specialized biomarker firms and diagnostic solution providers is actively shaping the space, with leading players collectively capturing around 40% of the total market share. These companies are advancing the field by incorporating novel technologies and forming partnerships aimed at enhancing precision medicine capabilities. Innovations such as multiplexed platforms and AI-integrated analytics are transforming how biomarker data is collected, interpreted, and applied in both clinical and research settings. As the market continues to evolve, technological upgrades and cross-industry collaborations are expected to accelerate the adoption of more efficient, scalable, and patient-centered biomarker solutions.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of non-alcoholic steatohepatitis (NASH)

- 3.2.1.2 Advancements in diagnostic technologies

- 3.2.1.3 Increased awareness and screening initiatives for liver diseases

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and complexity of biomarker validation

- 3.2.2.2 Stringent regulatory scenario

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Trump administration tariffs

- 3.5.1 Impact on trade

- 3.5.1.1 Trade volume disruptions

- 3.5.1.2 Country-wise response

- 3.5.2 Impact on the industry

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.2.1.1 Price volatility in key materials

- 3.5.2.1.2 Supply chain restructuring

- 3.5.2.1.3 Production cost implications

- 3.5.2.2 Demand-side impact (cost to consumers)

- 3.5.2.2.1 Price transmission to end markets

- 3.5.2.2.2 Market share dynamics

- 3.5.2.2.3 Consumer response patterns

- 3.5.2.1 Supply-side impact (cost of manufacturing)

- 3.5.3 Key companies impacted

- 3.5.4 Strategic industry responses

- 3.5.4.1 Supply chain reconfiguration

- 3.5.4.2 Pricing and product strategies

- 3.5.4.3 Policy engagement

- 3.5.5 Outlook and future considerations

- 3.5.1 Impact on trade

- 3.6 Technological landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Serum biomarkers

- 5.3 Hepatic fibrosis biomarkers

- 5.4 Apoptosis biomarkers

- 5.5 Oxidative stress biomarkers

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Pharma and CRO industry

- 6.3 Hospitals

- 6.4 Diagnostic labs

- 6.5 Academic research institutes

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Spain

- 7.3.5 Italy

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 India

- 7.4.3 Japan

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 Saudi Arabia

- 7.6.2 South Africa

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 BioPredictive

- 8.2 GENFIT

- 8.3 Glycotest

- 8.4 Labcorp

- 8.5 Nordic Bioscience

- 8.6 Prometheus Laboratories

- 8.7 Quest Diagnostics

- 8.8 Siemens Healthineers

- 8.9 SomaLogic

- 8.10 Zora Biosciences