|

市场调查报告书

商品编码

1755227

智慧轮椅市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Smart Wheelchair Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

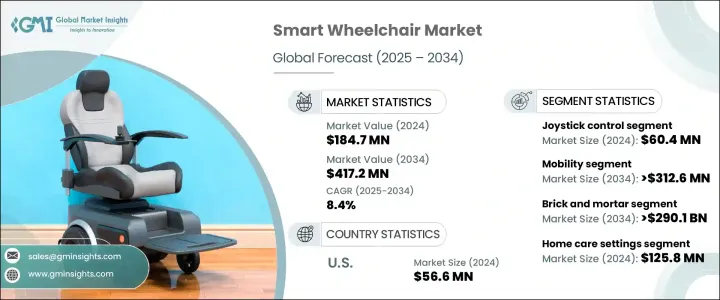

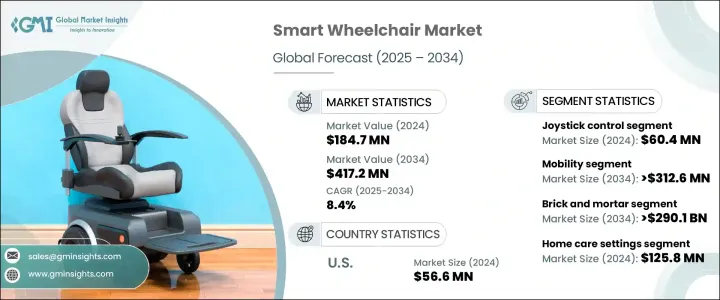

2024年,全球智慧轮椅市场规模达1.847亿美元,预计到2034年将以8.4%的复合年增长率成长,达到4.172亿美元。这一增长归因于老龄人口激增、残疾率上升、家庭医疗保健模式的扩展,以及政府和非营利组织对残疾人融合的支持力度加大。关节炎、神经肌肉疾病和骨质疏鬆症等疾病常使老年人行动不便。因此,对智慧轮椅等先进行动解决方案的需求日益增长。这些设备提供远端控制、障碍物侦测和自动导航等功能,显着提高老年使用者的独立性和移动能力。

同时,全球残疾(包括后天残疾和先天残疾)的数量持续上升。如今,医疗保健系统更加重视康復,这推动了智慧轮椅作为重要出行解决方案的应用。这些轮椅有助于增强行动障碍人士的自由、融入日常生活的能力以及整体生活品质。智慧轮椅整合智慧技术,帮助使用者更安全有效地在周围环境中导航。这些系统消除了物理障碍,增强了自主性,从而为依赖助行器的个人带来了更好的生活水平。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.847亿美元 |

| 预测值 | 4.172亿美元 |

| 复合年增长率 | 8.4% |

2024年,操纵桿控制的智慧轮椅市场规模达6,040万美元。其广受欢迎的原因在于其价格实惠、操控直观,非常适合上肢力量和协调性较强的使用者。操纵桿式轮椅设计简洁,学习週期短,在临床和居家照护环境中广泛应用。这些设备拥有多种符合人体工学的形状,并可轻鬆自订反应速度,适合不同年龄层的用户,包括老年人和儿童。

实体分销市场预计将以 8.2% 的复合年增长率成长,预计到 2034 年收入将达到 2.901 亿美元。包括復健中心和医疗用品专卖店在内的实体店提供个人化咨询、评估和产品试用。买家可以获得专家指导,并在购买前评估舒适度、可调节性和性能。这些实体店还提供售后服务,并与医疗保健提供者和保险公司密切合作,使其成为获得认证医疗级设备的可靠来源。

2024年,美国智慧轮椅市场规模达到5,660万美元,预计2034年将以7.3%的复合年增长率成长。由于完善的医疗基础设施和医疗行动装置领域的强劲创新,美国将继续引领市场。脊髓损伤和关节炎等慢性疾病的高发生率,加上老龄人口的不断增长,导緻美国对智慧轮椅的需求不断增长。

全球智慧轮椅市场的主要活跃公司包括:LUCI、SCEWO、Airwheel、YAMAHA、QUANTUM、ottobock、WHILL、KARMA、permobil 和 INVACARE。为了巩固竞争格局,领先的製造商正在利用产品创新、以用户为中心的设计和增强的软体整合等策略性倡议。许多公司正在投资基于人工智慧的导航和障碍物检测等技术,以使其产品更具差异化。扩大零售业务并与医院和復健中心建立合作关係,有助于公司建立品牌信誉并提升消费者信任。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 人口老化和残疾率上升

- 辅助科技和自主科技的采用日益增多

- 政府和非政府组织推动残疾人融合的倡议

- 越来越重视家庭医疗保健

- 产业陷阱与挑战

- 成本高且报销有限

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势与机会

- 差距分析

- 波特的分析

- PESTEL分析

- 专利分析

- 报销场景

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按控制系统,2021 - 2034 年

- 主要趋势

- 摇桿控制

- 蓝牙已连接

- 触控萤幕介面

- 语音控制

- 其他控制系统

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 行动性

- 神经系统疾病

第七章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 实体店面

- 电子商务

第八章:市场估计与预测:依最终用途 2021 - 2034

- 主要趋势

- 居家照护环境

- 医疗保健设施

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Airwheel

- INVACARE

- KARMA

- LUCI

- ottobock

- permobil

- QUANTUM

- SCEWO

- WHILL

- YAMAHA

The Global Smart Wheelchair Market was valued at USD 184.7 million in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 417.2 million by 2034. The growth is attributed to a surge in the aging population, rising disability rates, expanding home healthcare models, and increasing support from governments and nonprofit organizations for disability inclusion. Conditions like arthritis, neuromuscular disorders, and osteoporosis often make movement difficult for elderly individuals. As a result, the demand for advanced mobility solutions such as smart wheelchairs is increasing. These devices offer features like remote control, obstacle detection, and automated navigation, significantly improving independence and mobility for aging users.

At the same time, the number of individuals living with disabilities-both acquired and congenital-continues to rise globally. Healthcare systems today are more focused on rehabilitation, which has driven the adoption of smart wheelchairs as a vital mobility solution. These chairs help in enhancing freedom, integration into daily life, and overall quality of living for people with mobility impairments. Smart wheelchairs integrate intelligent technology to help users navigate their surroundings more safely and effectively. These systems eliminate physical barriers and enhance autonomy, enabling a better standard of living for individuals relying on mobility aids.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $184.7 Million |

| Forecast Value | $417.2 Million |

| CAGR | 8.4% |

In 2024, the joystick-controlled smart wheelchairs segment generated USD 60.4 million. Their widespread popularity is fueled by their affordability and intuitive control, making them ideal for users with upper-body strength and coordination. Joystick models are commonly adopted in clinical and homecare environments due to their straightforward design and short learning curve. These devices are available in various ergonomic shapes and can be easily customized for responsiveness, making them suitable for different age groups, including seniors and children.

The brick-and-mortar distribution segment is set to grow at a CAGR of 8.2%, with revenue expected to reach USD 290.1 million by 2034. Physical stores, including rehabilitation centers and medical supply outlets, offer personalized consultations, assessments, and hands-on product trials. Buyers benefit from expert guidance and can evaluate comfort, adjustability, and performance before purchasing. These stores also offer after-sales service and work closely with healthcare providers and insurers, making them a reliable source for certified medical-grade equipment.

United States Smart Wheelchair Market reached USD 56.6 million in 2024 and is anticipated to grow at a CAGR of 7.3% through 2034. The US continues to lead the market, supported by a well-developed healthcare infrastructure and robust innovation in medical mobility devices. The high prevalence of chronic conditions like spinal cord injuries and arthritis, combined with a growing elderly population, contributes to the increasing demand for smart wheelchairs across the country.

Key companies active in the Global Smart Wheelchair Market include: LUCI, SCEWO, Airwheel, YAMAHA, QUANTUM, ottobock, WHILL, KARMA, permobil, and INVACARE. To solidify their position in the competitive landscape, leading manufacturers are leveraging strategic initiatives such as product innovation, user-centric design, and enhanced software integration. Many are investing in technologies like AI-based navigation and obstacle detection to differentiate their offerings. Expanding their retail presence and forming partnerships with hospitals and rehabilitation centers are helping companies build brand credibility and improve consumer trust.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Aging population and increasing disability rates

- 3.2.1.2 Growing adoption of assistive and autonomous technologies

- 3.2.1.3 Government and NGO initiatives for disability inclusion

- 3.2.1.4 Increasing focus on home-based healthcare

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost and limited reimbursement

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technology landscape

- 3.6 Future market trends and opportunities

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Patent analysis

- 3.11 Reimbursement scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Control System, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Joystick control

- 5.3 Bluetooth connected

- 5.4 Touchscreen interface

- 5.5 Voice control

- 5.6 Other control systems

Chapter 6 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Mobility

- 6.3 Neurological conditions

Chapter 7 Market Estimates and Forecast, By Distribution Channel, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Brick and mortar

- 7.3 E-commerce

Chapter 8 Market Estimates and Forecast, By End Use 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Home care settings

- 8.3 Healthcare facilities

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Airwheel

- 10.2 INVACARE

- 10.3 KARMA

- 10.4 LUCI

- 10.5 ottobock

- 10.6 permobil

- 10.7 QUANTUM

- 10.8 SCEWO

- 10.9 WHILL

- 10.10 YAMAHA