|

市场调查报告书

商品编码

1755238

航空物联网市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测IoT in Aviation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

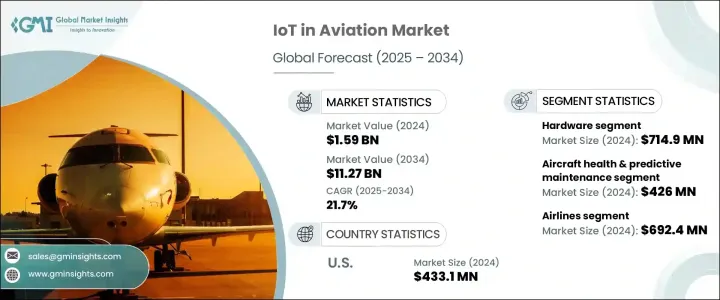

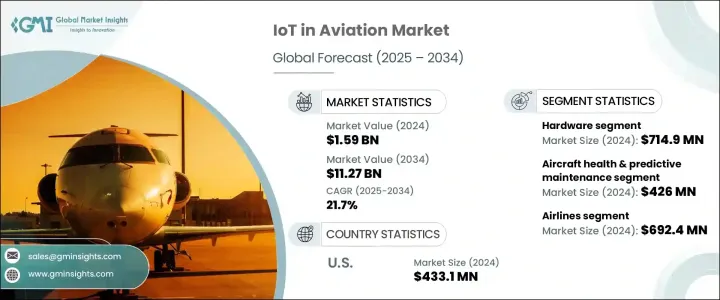

2024 年全球航空物联网市场价值为 15.9 亿美元,预计到 2034 年将以 21.7% 的复合年增长率增长至 112.7 亿美元。这一增长是由对营运效率、降低成本和即时决策日益增长的需求推动的,航空利益相关者正在采用物联网实现营运现代化。对电子和半导体元件征收关税导致生产成本大幅上涨,影响了物联网设备的可用性和供应链的灵活性。这些增加的成本要么被製造商吸收,要么转嫁给最终用户,从而减缓了物联网的广泛采用。航空电子硬体、感测器和连接模组等关键飞机技术受到的影响尤其严重,促使人们转向国内采购。儘管国内供应商的产能有限,但这种转变刺激了短期摩擦,但最终鼓励了美国市场的自主创新。这一中断凸显了关键技术领域在地化生产的挑战和战略优势。

即时感测器技术使飞机运营商能够更有效地监控机载系统、优化飞行路径并管理燃油消耗。物联网支援的预测性维护透过追踪引擎健康状况、结构完整性和系统性能,减少停机时间并提高安全性。机场和航空公司利用连网技术驱动的自动化系统,简化机组人员规划和行李物流,从而降低营运成本并提高可靠性。透过物联网提供的增强型乘客服务也能提升旅客的品牌忠诚度。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15.9亿美元 |

| 预测值 | 112.7亿美元 |

| 复合年增长率 | 21.7% |

2024年,硬体市场规模达到7.149亿美元,这主要得益于对感测器、执行器和通讯模组的需求,这些模组能够实现飞机系统和控制中心之间稳健的资料流。 RFID和信标技术支援行李追踪和库存控制,而航空电子级模组则确保飞行过程中的不间断连接。机载边缘运算解决方案可在本地处理关键资料,从而最大限度地减少延迟和对外部网路的依赖。这些技术能够提高营运安全性,并提高机上和地面服务的效率。

2024年,飞机健康和预测性维护应用领域的价值为4.26亿美元。该领域使用感测器资料和高级分析技术来即时评估零件磨损、引擎性能和系统诊断。预测模型有助于减少意外故障,更好地规划维修任务,并延长飞机资产的使用寿命。

2024年,美国航空物联网市场规模达4.331亿美元。由于其航空基础设施中互联技术的广泛整合,美国始终保持领先地位。包括通用电气航空、思科系统公司、西门子、霍尼韦尔国际公司和国际商业机器公司在内的主要航太公司已率先开发用于飞机和机场营运的物联网系统。美国航空业在智慧客舱环境、维护自动化和机场优化方面的进步,使其在全球航空物联网应用领域中处于领先地位。

为了增强竞争优势,物联网航空领域的领先公司正专注于扩大感测器创新、即时分析和边缘运算的研发投入。与航太製造商和机场管理部门的策略合作,使得物联网系统能够在新旧机队中更快部署。这些公司将网路安全放在首位,以确保飞行关键系统中资料传输的安全。此外,各公司正在投资整合人工智慧的物联网框架,以提供预测性诊断并简化客运和货运运营,从而进一步巩固其市场领先地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析(硬体)

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 价格波动

- 供应链重组

- 生产成本影响

- 需求面影响

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 提高营运效率并节省成本

- 改善乘客体验和个人化

- 预测性维护与安全的进步

- 智慧机场与互联生态系的发展

- 产业陷阱与挑战

- 实施成本高

- 网路安全漏洞

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按解决方案,2021 - 2034 年

- 主要趋势

- 硬体

- 软体

- 服务

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 供应炼和物流

- 机场和地面运营

- 乘客体验与连通性

- 航班营运和机队管理

- 飞机健康与预测性维护

- 飞机製造和组装

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 航空

- 机场

- MRO 提供者

- 飞机製造商

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Honeywell International Inc.

- Siemens

- General Electric Company

- International Business Machines Corporation

- Cisco Systems Inc.

- SITA

- Airbus

- The Boeing Company

- Thales

- Lufthansa Technik

- Collins Aerospace

- Panasonic Avionics Corporation

- SAP SE

- Microsoft

- Amadeus IT Group SA

- Palantir Technologies

- Tata Communications Limited

The Global IoT in Aviation Market was valued at USD 1.59 billion in 2024 and is estimated to grow at a CAGR of 21.7% to reach USD 11.27 billion by 2034. The growth is driven by the increasing demand for operational efficiency, cost reduction, and real-time decision-making, aviation stakeholders are embracing IoT to modernize their operations. The implementation of tariffs on electronics and semiconductor components caused a significant uptick in production costs, disrupting IoT device availability and supply chain agility. These increased costs were either absorbed by manufacturers or shifted to end users, slowing widespread adoption. Key aircraft technologies such as avionics hardware, sensors, and connectivity modules were particularly impacted, prompting a shift toward domestic sourcing. Although domestic suppliers offered limited capacity, this transition stimulated short-term friction but eventually encouraged self-reliant innovation in the U.S. market. The disruption highlighted the challenges and strategic advantages of localizing production in critical technology sectors.

Real-time sensor technology allows aircraft operators to monitor onboard systems, optimize flight paths, and manage fuel consumption more effectively. Predictive maintenance enabled by IoT reduces downtime and enhances safety by tracking engine health, structural integrity, and system performance. Airports and airlines streamline crew planning and baggage logistics using automation powered by connected technologies, cutting operational costs and improving reliability. Enhanced passenger services delivered through IoT also foster stronger brand loyalty among travelers.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.59 Billion |

| Forecast Value | $11.27 Billion |

| CAGR | 21.7% |

The hardware segment reached USD 714.9 million in 2024, driven by demand for sensors, actuators, and communication modules that enable robust data flow between aircraft systems and control centers. RFID and beacon technology support baggage tracking and inventory control, while avionics-grade modules ensure uninterrupted connectivity in flight. Edge computing solutions installed onboard process critical data locally, minimizing latency and dependency on external networks. These technologies enable safer operations and better in-flight and ground service efficiency.

The aircraft health and predictive maintenance application segment was valued at USD 426 million in 2024. This area uses sensor data and advanced analytics to evaluate component wear, engine performance, and system diagnostics in real-time. Predictive modeling helps reduce unexpected breakdowns, allows better planning of maintenance tasks, and extends the operational lifespan of aircraft assets.

United States IoT in Aviation Market was valued at USD 433.1 million in 2024. The country maintains a leading role owing to the extensive integration of connected technologies across its aviation infrastructure. Major aerospace companies including GE Aviation, Cisco Systems Inc., Siemens, Honeywell International Inc., and International Business Machines Corporation have spearheaded the development of IoT systems for aircraft and airport operations. U.S. aviation advancements in smart cabin environments, maintenance automation, and airport optimization have pushed the country to the forefront of global IoT adoption in aviation.

To strengthen their competitive edge, leading companies in the IoT aviation sector are focusing on scaling R&D investments in sensor innovation, real-time analytics, and edge computing. Strategic collaborations with aerospace manufacturers and airport authorities allow faster deployment of IoT systems across new and existing fleets. These firms prioritize cybersecurity to ensure safe data transmission in flight-critical systems. Additionally, companies are investing in AI-integrated IoT frameworks to deliver predictive diagnostics and streamline passenger and cargo operations, further solidifying their market leadership.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis (Hardware)

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact

- 3.2.1.3.1.1 Price volatility

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Enhanced operational efficiency and cost savings

- 3.3.1.2 Improved passenger experience and personalization

- 3.3.1.3 Advancements in predictive maintenance and safety

- 3.3.1.4 Growth of smart airports and connected ecosystems

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High implementation costs

- 3.3.2.2 Cybersecurity vulnerabilities

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Solution, 2021 - 2034 (USD million)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 (USD million)

- 6.1 Key trends

- 6.2 Supply chain & logistics

- 6.3 Airport & ground operations

- 6.4 Passenger experience & connectivity

- 6.5 Flight operations & fleet management

- 6.6 Aircraft health & predictive maintenance

- 6.7 Aircraft manufacturing & assembly

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034 (USD million)

- 7.1 Key trends

- 7.2 Airlines

- 7.3 Airports

- 7.4 Mro providers

- 7.5 Aircraft manufacturers

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Honeywell International Inc.

- 9.2 Siemens

- 9.3 General Electric Company

- 9.4 International Business Machines Corporation

- 9.5 Cisco Systems Inc.

- 9.6 SITA

- 9.7 Airbus

- 9.8 The Boeing Company

- 9.9 Thales

- 9.10 Lufthansa Technik

- 9.11 Collins Aerospace

- 9.12 Panasonic Avionics Corporation

- 9.13 SAP SE

- 9.14 Microsoft

- 9.15 Amadeus IT Group SA

- 9.16 Palantir Technologies

- 9.17 Tata Communications Limited