|

市场调查报告书

商品编码

1755247

固体火箭发动机市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Solid Rocket Motors Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

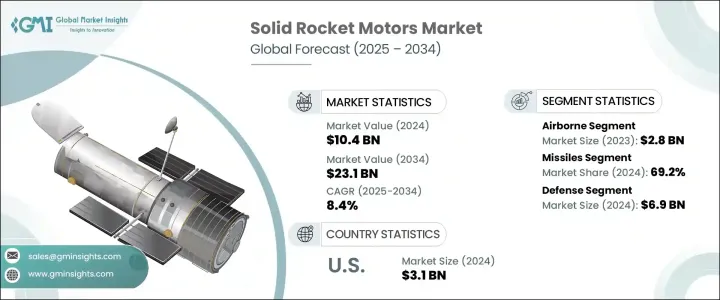

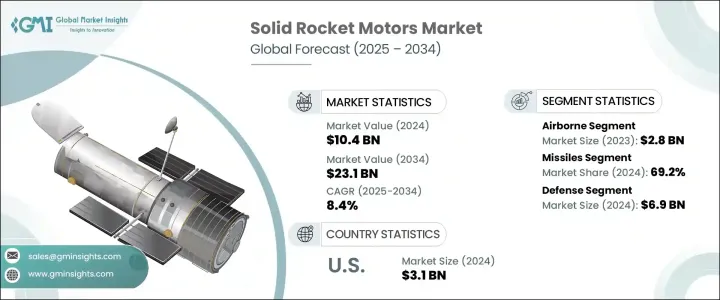

2024年,全球固体火箭发动机市场规模达104亿美元,预计到2034年将以8.4%的复合年增长率增长,达到231亿美元,这主要得益于全球国防预算的不断增长以及对现代导弹和运载火箭系统的需求。固体火箭发动机因其结构简单、推力输出高、点火速度快和使用寿命长等特点,正日益受到青睐,成为军事和航太领域的理想选择。经济和政治发展影响了供应链,并推高了零件成本,进一步影响了市场趋势。儘管面临这些挑战,各国仍在继续大力投资国家安全计画和飞弹技术,这进一步增强了对可靠且可扩展推进系统的需求。

固体火箭发动机是国防项目的重要组成部分,其紧凑的外形尺寸可提供高性能,适用于地对空飞弹、战术弹道飞弹和拦截飞弹系统。模组化和适应性强的推进技术正变得至关重要,因为它们能够支援特定的任务需求,同时优化成本。市场受益于持续的创新,这些创新旨在提高引擎的机动性、射程和发射精度。随着各国加强对威慑和太空能力的关注,固体发动机仍然是全球国防和航太基础设施中不可或缺的一部分。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 104亿美元 |

| 预测值 | 231亿美元 |

| 复合年增长率 | 8.4% |

预计到2024年,卫星运载火箭市场将占据30.8%的份额,这得益于对经济高效、高可靠性发射解决方案日益增长的需求。固体推进系统因其维护成本低且易于部署,在中小型发射平台上广受青睐。随着公共和私人卫星部署项目的增多,固体火箭发动机的使用也日益增多,以满足快速可靠的轨道发射需求。

2024年,国防领域产值达69亿美元,成为固体火箭引擎市场的主要终端用途类别。对先进战术武器系统和飞弹升级的持续需求,直接源自于全球军事力量对快速反应能力和技术优势的重视。固体火箭引擎以其高推重比、极低的维护要求和可靠的储存能力而闻名,与这些目标高度契合。多个地区武装部队的持续现代化,加上战略防御倡议,进一步扩大了固体推进系统的采用。

2024年,美国固体火箭引擎市场产值达31亿美元,巩固了美国在固体推进技术领域的全球领先地位。国防和航太计画雄厚的预算拨款持续推动着这一发展势头。对高超音速系统、下一代飞弹平台和可重复使用运载火箭的投资,正在协助推动固体引擎技术的国内生产和创新。美国军方积极部署先进飞弹系统的时间表,以及美国国家航空暨太空总署(NASA)对深空探索的重新重视,正在推动对紧凑型高效推进解决方案的需求。

航空喷射火箭动力公司 (Aerojet Rocketdyne)、L3Harris Technologies, Inc.、诺斯罗普·格鲁曼公司 (Northrop Grumman) 和拉斐尔先进防御系统有限公司 (RAFAEL Advanced Defense Systems Ltd.) 等领先公司正在创新固体推进系统,以支持各种平台的政府和商业应用。为了巩固市场地位,主要公司正在投资模组化引擎技术,以增强不同发射和防御系统的灵活性和可扩展性。各公司专注于提高製造效率、降低生产成本并扩大下一代复合材料的研发。与航太和国防机构的合作有助于根据不断变化的任务需求客製化固体推进解决方案,而战略合约和收购则可以实现更深层的市场渗透。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 全球国防开支增加

- 卫星发射计画激增

- 优惠的政府合约和研发资金

- 在高超音速和战术飞弹系统中的应用

- 推进剂和材料的技术进步

- 产业陷阱与挑战

- 严格的监管和安全合规性

- 开发成本高且可重复使用性有限

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依发布平台,2021-2034 年

- 主要趋势

- 空降

- 地面

- 海军

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 卫星运载火箭

- 飞弹

第七章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 防御

- 航太机构

- 商业空间

第八章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Anduril Industries

- AVIO SPA

- BrahMos Aerospace Private Limited

- General Dynamics Corporation

- Hanwha Group

- ISRO

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries

- Nammo AS

- Northrop Grumman

- RAFAEL Advanced Defense Systems Ltd.

- ROKETSAN

- Roxel Group

- Tata Advanced Systems Limited

- URSA MAJOR TECHNOLOGIES INC

The Global Solid Rocket Motors Market was valued at USD 10.4 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 23.1 billion by 2034, driven by rising global defense budgets and the need for modern missile and launch vehicle systems. Solid rocket motors are gaining traction due to their simplicity, high-thrust output, fast ignition, and long shelf life, making them ideal for military and aerospace use. Economic and political developments have affected supply chains and increased component costs, further influencing market trends. Despite these challenges, countries continue to invest heavily in national security initiatives and missile technologies, reinforcing the demand for reliable and scalable propulsion systems.

Solid rocket motors are vital components across defense programs, offering high performance in a compact form factor suitable for surface-to-air, tactical ballistic, and interceptor missile systems. Modular and adaptable propulsion technologies are becoming essential as they support specific mission requirements while optimizing cost. The market benefits from ongoing innovations to enhance maneuverability, range, and launch precision. As nations intensify their focus on deterrence and space capabilities, solid motors remain an indispensable part of defense and aerospace infrastructure worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $10.4 Billion |

| Forecast Value | $23.1 Billion |

| CAGR | 8.4% |

The satellite launch vehicle segment is projected to hold a 30.8% share in 2024, driven by the growing need for cost-efficient, high-reliability launch solutions. Solid propulsion systems are widely favored in small to medium-sized launch platforms due to their minimal maintenance and ease of deployment. As both public and private initiatives in satellite deployment grow, solid rocket motors are increasingly used to meet the needs of rapid and dependable orbital launches.

In 2024, the defense segment generated USD 6.9 billion, establishing itself as the dominant end-use category in the solid rocket motors market. The consistent demand for advanced tactical weapon systems and missile upgrades is a direct result of global military forces prioritizing rapid response capabilities and technological superiority. Solid rocket motors, known for their high thrust-to-weight ratio, minimal maintenance requirements, and dependable storage, align well with these objectives. Ongoing modernization of armed forces across several regions, coupled with strategic defense initiatives, has further amplified the adoption of solid propulsion systems.

United States Solid Rocket Motors Market generated USD 3.1 billion in 2024, reinforcing the country's role as a global leader in solid propulsion technologies. A robust budget allocation toward national defense and aerospace programs continues to drive this momentum. Investments in hypersonic systems, next-generation missile platforms, and reusable launch vehicles are helping fuel domestic production and innovation in solid motor technologies. The U.S. military's aggressive timeline for deploying advanced missile systems and NASA's renewed emphasis on deep space exploration are pushing demand for compact, high-efficiency propulsion solutions.

Leading firms such as Aerojet Rocketdyne, L3Harris Technologies, Inc., Northrop Grumman, and RAFAEL Advanced Defense Systems Ltd. are innovating solid motor systems that support government and commercial applications across various platforms. To solidify their market position, key companies are investing in modular motor technologies that provide enhanced flexibility and scalability across different launch and defense systems. Firms focus on improving manufacturing efficiencies, reducing production costs, and expanding R&D in next-gen composite materials. Collaborations with space and defense agencies help tailor solid propulsion solutions to evolving mission profiles, while strategic contracts and acquisitions enable deeper market penetration.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increased defense expenditure globally

- 3.7.1.2 Surge in satellite launch programs

- 3.7.1.3 Favorable government contracts and R&D funding

- 3.7.1.4 Adoption in hypersonic and tactical missile systems

- 3.7.1.5 Technological advancements in propellants and materials

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Stringent regulatory and safety compliance

- 3.7.2.2 High development costs and limited reusability

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Launch Platform, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Airborne

- 5.3 Ground-based

- 5.4 Naval

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Satellite launch vehicles

- 6.3 Missiles

Chapter 7 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Defense

- 7.3 Space agencies

- 7.4 Commercial space

Chapter 8 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 Germany

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Russia

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 South Korea

- 8.4.5 Australia

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.6 MEA

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Anduril Industries

- 9.2 AVIO SPA

- 9.3 BrahMos Aerospace Private Limited

- 9.4 General Dynamics Corporation

- 9.5 Hanwha Group

- 9.6 ISRO

- 9.7 L3Harris Technologies, Inc.

- 9.8 Lockheed Martin Corporation

- 9.9 Mitsubishi Heavy Industries

- 9.10 Nammo AS

- 9.11 Northrop Grumman

- 9.12 RAFAEL Advanced Defense Systems Ltd.

- 9.13 ROKETSAN

- 9.14 Roxel Group

- 9.15 Tata Advanced Systems Limited

- 9.16 URSA MAJOR TECHNOLOGIES INC