|

市场调查报告书

商品编码

1755248

氟涂料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Fluorinated Coating Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

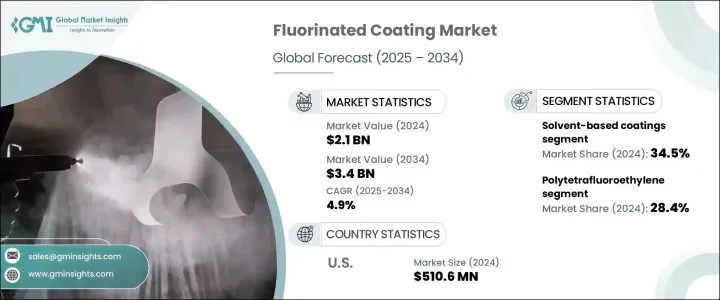

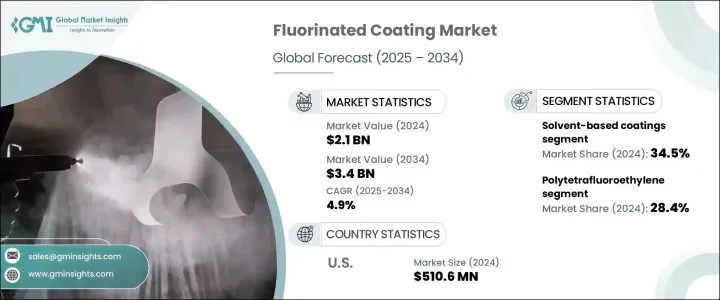

2024年,全球氟涂料市场规模达21亿美元,预计到2034年将以4.9%的复合年增长率成长,达到34亿美元。这类涂料主要采用氟聚合物材料配製而成,具有优异的耐久性、热稳定性以及耐化学性和耐腐蚀性。这些特性对于需要在各种操作环境下使用持久耐用、性能卓越的涂料的行业至关重要。从极端温度到化学反应性环境,氟涂料始终表现出色,尤其是在高湿度和环境压力较大的地区。

随着对能够抵抗环境侵蚀的先进材料的需求不断增长,这些涂料在註重材料效率和使用寿命的行业中正得到越来越广泛的应用。此外,交通运输和民用基础设施的投资也推动了防护涂料的使用,这些涂料旨在延长关键资产的使用寿命,同时降低长期维护成本。技术创新、监管向永续性的转变以及降低环境影响的动力,正在鼓励製造商采用环保涂料解决方案,包括水性和紫外光固化涂料。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 21亿美元 |

| 预测值 | 34亿美元 |

| 复合年增长率 | 4.9% |

就产品类型而言,聚四氟乙烯 (PTFE) 在 2024 年占据了全球市场的 28.4% 以上。 PTFE 以其低表面能和非反应性而闻名,已成为需要低摩擦、耐热性和强耐化学性应用的主要材料。其用途广泛,涵盖了经常暴露于极端温度和腐蚀性介质的终端使用领域。 PTFE 因其在应力下的稳定性而被广泛应用于製造工艺,使其成为承受机械磨损或化学腐蚀的部件的理想选择。

依技术分类,溶剂型涂料在2024年占了近34.5%的市场。其长期占据主导地位的原因是其优异的附着力、更长的使用寿命以及在恶劣工况下的韧性。这些涂料在恶劣环境下性能可靠,因此广泛应用于高机械负荷和热负荷的行业。儘管挥发性有机化合物(VOC)排放面临监管压力,但溶剂型涂料凭藉其行业优势仍保持着稳固的地位。然而,人们对环保解决方案日益增长的兴趣正在逐渐改变产业格局。水性涂料越来越受欢迎,尤其是在实施更严格排放标准的地区;而紫外光固化涂料凭藉其快速固化和低能耗的特点,在精密製造领域也越来越受欢迎。

从基材来看,金属在2024年占据全球市场领先地位。金属广泛应用于製造业,其易受天气、化学物质和高温的影响,使其成为氟涂层的理想选择。氟涂层能够有效防止腐蚀和氧化,是延长结构部件和设备使用寿命的关键。其他基材,例如塑胶、复合材料和混凝土,也正经历日益增长的需求,尤其是在需要耐候涂层的基础设施项目中。

就性能属性而言,耐化学性在2024年引领市场。许多工业领域需要处理腐蚀性化学品,在这些环境中使用的设备必须进行涂层处理才能承受此类暴露。氟涂层因其可防止表面老化、设备故障和污染风险而备受青睐。它们能够作为储罐、管道和加工设备的可靠内衬,确保不间断运作和安全。热稳定性、电绝缘性和低摩擦表面等特性也对其应用做出了重要贡献,尤其是在高精度和高性能应用中。

从应用角度来看,航太和国防领域在2024年成为主导类别。这些产业需要能够耐受极端环境的材料,而氟涂层凭藉其耐热性、轻量化性能和长期保护特性满足了这一需求。同时,由于在暴露于腐蚀性物质和高温的机械设备中广泛使用涂层,工业设备占据了最大的市场份额。随着商业和住宅应用对不沾黏、易清洁表面的需求不断增长,食品相关领域也保持强劲成长。

从区域分析来看,美国氟涂料市场规模在2024年超过5.106亿美元。凭藉其稳固的工业基础、稳步的技术进步以及对产品性能的持续关注,美国继续在北美保持领先地位。基础设施和製造业的不断发展进一步扩大了对高品质、耐用涂料的需求。消费者对易于维护材料的偏好也推动了家用和户外产品应用的成长。

市场保持适度整合,几家关键企业占据了相当大的份额。竞争焦点集中在产品创新、法规合规性以及针对特定产业的客製化解决方案。领先企业正在持续提升表面保护能力,并拓展其在高成长应用领域的覆盖范围。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 贸易统计(HS编码)

- 主要出口国

- 主要进口国

註:以上贸易统计仅针对重点国家。

- 衝击力

- 市场驱动因素

- 市场限制

- 市场机会

- 市场挑战

- 产品概述

- 含氟聚合物化学与结构

- 性能特征

- 耐化学性

- 热稳定性

- 不沾黏和低摩擦特性

- 耐候性和耐用性

- 与其他涂层技术的比较

- 製造流程分析

- 树脂生产

- 配方技术

- 申请方法

- 固化过程

- 品质控製程式

- 监管格局

- 成长潜力分析

- 2021-2034年价格分析(美元/吨)

- 永续性和环境影响评估

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 市占率分析

- 战略框架

- 併购

- 合资与合作

- 新产品开发

- 扩张策略

- 竞争基准测试

- 供应商格局

- 竞争定位矩阵

- 战略仪表板

- 专利分析与创新评估

- 新参与者的市场进入策略

- 配电网路分析

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 聚四氟乙烯

- 纯PTFE涂层

- PTFE基复合涂层

- 改质PTFE涂层

- 聚偏氟乙烯

- PVDF均聚物涂料

- PVDF共聚物涂层

- 改质PVDF涂料

- 氟化乙丙烯

- 全氟烷氧基烷烃

- 乙烯四氟乙烯

- 乙烯氯三氟乙烯

- 聚氯三氟乙烯

- 其他的

第六章:市场估计与预测:按技术,2021 - 2034 年

- 主要趋势

- 溶剂型涂料

- 水性涂料

- 粉末涂料

- 紫外线固化涂料

- 其他的

第七章:市场估计与预测:按基材,2021 - 2034

- 主要趋势

- 金属

- 钢

- 铝

- 其他的

- 塑胶和复合材料

- 玻璃

- 混凝土和砖石

- 其他的

第八章:市场估计与预测:按性能属性,2021 - 2034 年

- 主要趋势

- 耐化学性

- 耐候性

- 不沾/低摩擦

- 热稳定性

- 电绝缘

- 防腐蚀

- 其他的

第九章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 工业设备

- 化学加工设备

- 石油和天然气设备

- 食品加工设备

- 製药设备

- 其他的

- 建筑与施工

- 建筑涂料

- 屋顶材料

- 外墙和覆层

- 其他的

- 汽车与运输

- 外部元件

- 内装部件

- 底层应用程式

- 其他的

- 炊具和食品接触

- 不沾锅

- 烘焙用具

- 食品加工设备

- 其他的

- 电学

- PCB涂层

- 电线电缆涂料

- 半导体应用

- 其他的

- 航太与国防

- 海洋

- 医疗保健

- 其他的

第 10 章:市场估计与预测:按最终用途产业,2021 年至 2034 年

- 主要趋势

- 工业製造

- 化学

- 石油和天然气

- 发电

- 其他的

- 建筑与施工

- 汽车与运输

- 消费品

- 炊具和厨具

- 家电

- 其他的

- 电子和半导体

- 航太与国防

- 食品和饮料

- 医疗保健和製药

- 其他的

第 11 章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十二章:公司简介

- 3M Company

- AFT Fluorotec

- AGC Chemicals Americas

- AGC Inc.

- AkzoNobel NV

- Arkema

- Beckers Group

- Daikin Industries

- Dow

- DuPont

- Fluorotherm Polymers

- Gujarat Fluorochemicals

- Jotun A/S

- Nippon Paint Holdings

- PPG Industries, Inc.

- Sherwin-Williams Company

- Solvay SA

- The Chemours Company

- Whitford Corporation

The Global Fluorinated Coating Market was valued at USD 2.1 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 3.4 billion by 2034. These coatings are primarily formulated using fluoropolymer materials that offer outstanding durability, thermal stability, and resistance to chemicals and corrosion. These properties make them vital for industries that demand long-lasting, high-performance coatings across various operational environments. From extreme temperatures to chemically reactive surroundings, fluorinated coatings continue to demonstrate strong performance, particularly in regions prone to high humidity and environmental stress.

As the demand for advanced materials capable of resisting environmental degradation grows, these coatings are seeing increased adoption across sectors that prioritize efficiency and longevity in materials. Moreover, investments in transportation and civil infrastructure have led to greater use of protective coatings designed to increase the service life of key assets while also reducing long-term maintenance costs. Technological innovations, regulatory shifts toward sustainability, and the push for lower environmental impact are encouraging manufacturers to adopt eco-conscious coating solutions, including water-based and UV-curable alternatives.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.1 Billion |

| Forecast Value | $3.4 Billion |

| CAGR | 4.9% |

In terms of product type, polytetrafluoroethylene (PTFE) accounted for over 28.4% of the global market in 2024. Known for its low surface energy and non-reactive nature, PTFE has become a staple material for applications that require minimal friction, thermal endurance, and strong chemical resistance. Its utility spans a broad spectrum of end-use sectors where exposure to extreme temperatures and corrosive agents is common. PTFE is widely used in manufacturing processes due to its stable behavior under stress, making it ideal for components exposed to mechanical wear or chemical exposure.

When categorized by technology, solvent-based coatings captured nearly 34.5% of the market share in 2024. Their long-standing dominance is attributed to superior adhesion, extended service life, and resilience in tough operating conditions. These coatings perform reliably under aggressive environments, which explains their widespread use in sectors involving high mechanical and thermal loads. Despite regulatory pressure around volatile organic compound (VOC) emissions, solvent-based coatings continue to maintain a solid presence due to their industrial advantages. However, rising interest in eco-friendly solutions is gradually shifting the industry landscape. Waterborne coatings are gaining traction, especially in regions enforcing stricter emission norms, while UV-curable coatings are becoming increasingly viable in precision manufacturing thanks to their rapid curing and low energy requirements.

Based on substrate, metal held the leading position in the global market in 2024. Metals are extensively used in manufacturing, and their exposure to weather, chemicals, and heat makes them suitable candidates for fluorinated coatings. These coatings provide a barrier against corrosion and oxidation, making them essential for extending the life of structural components and equipment. Other substrates such as plastics, composites, and concrete are also witnessing growing demand, particularly in infrastructure projects requiring weather-resistant finishes.

Regarding performance attributes, chemical resistance led the market in 2024. Many industrial sectors handle aggressive chemicals, and equipment used in these settings must be coated to withstand such exposure. Fluorinated coatings are preferred because they prevent surface degradation, equipment failure, and contamination risks. Their ability to act as reliable linings for tanks, pipelines, and processing equipment ensures uninterrupted operation and safety. Properties like thermal stability, electrical insulation, and low-friction surfaces also contribute significantly to their adoption, particularly in high-precision and high-performance applications.

By application, the aerospace and defense segment emerged as the dominant category in 2024. These industries require materials that can endure extreme environments, and fluorinated coatings meet that demand by offering heat resistance, lightweight performance, and long-term protection. Meanwhile, industrial equipment claimed the largest share of the market due to the widespread use of coatings in machinery exposed to corrosive substances and elevated temperatures. The food-related segment also remains strong as demand for non-stick, easy-clean surfaces grows in commercial and residential applications.

In regional analysis, the United States fluorinated coating market surpassed USD 510.6 million in 2024. The country continues to lead in North America, backed by a well-established industrial base, steady technological advancements, and an ongoing focus on product performance. The need for high-quality, durable coatings is further amplified by the continuous development of infrastructure and manufacturing sectors. Consumer trends favoring easy-maintenance materials also support growth in household and outdoor product applications.

The market remains moderately consolidated, with several key players commanding significant shares. Competitive focus revolves around product innovation, regulatory compliance, and customized solutions tailored for specific industries. Leading companies are consistently enhancing surface protection capabilities and expanding their reach across high-growth application areas.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Trade statistics (HS Code)

- 3.3.1 Major exporting countries

- 3.3.2 Major importing countries

Note: the above trade statistics will be provided for key countries only.

- 3.4 Impact forces

- 3.4.1 Market drivers

- 3.4.2 Market restraints

- 3.4.3 Market opportunities

- 3.4.4 market challenges

- 3.5 Product overview

- 3.5.1 Fluoropolymer chemistry & structure

- 3.5.2 Performance characteristics

- 3.5.3 Chemical resistance properties

- 3.5.4 Thermal stability

- 3.5.5 Non-stick & low friction properties

- 3.5.6 Weather resistance & durability

- 3.5.7 Comparison with other coating technologies

- 3.6 Manufacturing process analysis

- 3.6.1 Resin production

- 3.6.2 Formulation techniques

- 3.6.3 Application methods

- 3.6.4 Curing processes

- 3.6.5 Quality control procedures

- 3.7 Regulatory landscape

- 3.8 Growth potential analysis

- 3.9 Pricing analysis (USD/Tons) 2021-2034

- 3.10 Sustainability & environmental impact assessment

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Market share analysis

- 4.2 Strategic framework

- 4.2.1 Mergers & acquisitions

- 4.2.2 Joint ventures & collaborations

- 4.2.3 New product developments

- 4.2.4 Expansion strategies

- 4.3 Competitive benchmarking

- 4.4 Vendor landscape

- 4.5 Competitive positioning matrix

- 4.6 Strategic dashboard

- 4.7 Patent analysis & innovation assessment

- 4.8 Market entry strategies for new players

- 4.9 Distribution network analysis

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polytetrafluoroethylene

- 5.2.1 Pure PTFE coatings

- 5.2.2 PTFE-based composite coatings

- 5.2.3 Modified PTFE coatings

- 5.3 Polyvinylidene fluoride

- 5.3.1 PVDF homopolymer coatings

- 5.3.2 PVDF copolymer coatings

- 5.3.3 Modified PVDF coatings

- 5.4 Fluorinated ethylene propylene

- 5.5 Perfluoroalkoxy alkane

- 5.6 Ethylene tetrafluoroethylene

- 5.7 Ethylene chlorotrifluoroethylene

- 5.8 Polychlorotrifluoroethylene

- 5.9 Others

Chapter 6 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Solvent-based coatings

- 6.3 Water-based coatings

- 6.4 Powder coatings

- 6.5 UV-curable coatings

- 6.6 Others

Chapter 7 Market Estimates and Forecast, By Substrate, 2021 - 2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Metal

- 7.2.1 Steel

- 7.2.2 Aluminum

- 7.2.3 Others

- 7.3 Plastic & composites

- 7.4 Glass

- 7.5 Concrete & masonry

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Performance Attribute, 2021 - 2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Chemical resistance

- 8.3 Weather resistance

- 8.4 Non-stick/low friction

- 8.5 Thermal stability

- 8.6 Electrical insulation

- 8.7 Corrosion protection

- 8.8 Others

Chapter 9 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 Industrial equipment

- 9.2.1 Chemical processing equipment

- 9.2.2 Oil & gas equipment

- 9.2.3 Food processing equipment

- 9.2.4 Pharmaceutical equipment

- 9.2.5 Others

- 9.3 Building & construction

- 9.3.1 Architectural coatings

- 9.3.2 Roofing materials

- 9.3.3 Facades & cladding

- 9.3.4 Others

- 9.4 Automotive & transportation

- 9.4.1 Exterior components

- 9.4.2 Interior components

- 9.4.3 Under-the-hood applications

- 9.4.4 Others

- 9.5 Cookware & food contact

- 9.5.1 Non-Stick cookware

- 9.5.2 Bakeware

- 9.5.3 Food processing equipment

- 9.5.4 Others

- 9.6 Electronics & electrical

- 9.6.1 PCB coatings

- 9.6.2 Wire & cable coatings

- 9.6.3 Semiconductor applications

- 9.6.4 Others

- 9.7 Aerospace & defense

- 9.8 Marine

- 9.9 Healthcare & medical

- 9.10 Others

Chapter 10 Market Estimates and Forecast, By End Use Industry, 2021 - 2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 Industrial manufacturing

- 10.2.1 Chemical

- 10.2.2 Oil & gas

- 10.2.3 Power generation

- 10.2.4 Others

- 10.3 Building & construction

- 10.4 Automotive & transportation

- 10.5 Consumer goods

- 10.5.1 Cookware & kitchenware

- 10.5.2 Appliances

- 10.5.3 Others

- 10.6 Electronics & semiconductors

- 10.7 Aerospace & defense

- 10.8 Food & beverage

- 10.9 Healthcare & pharmaceutical

- 10.10 Others

Chapter 11 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion) (Kilo Tons)

- 11.1 Key trends

- 11.2 North America

- 11.2.1 U.S.

- 11.2.2 Canada

- 11.3 Europe

- 11.3.1 Germany

- 11.3.2 UK

- 11.3.3 France

- 11.3.4 Spain

- 11.3.5 Italy

- 11.3.6 Rest of Europe

- 11.4 Asia Pacific

- 11.4.1 China

- 11.4.2 India

- 11.4.3 Japan

- 11.4.4 Australia

- 11.4.5 South Korea

- 11.4.6 Rest of Asia Pacific

- 11.5 Latin America

- 11.5.1 Brazil

- 11.5.2 Mexico

- 11.5.3 Argentina

- 11.5.4 Rest of Latin America

- 11.6 Middle East and Africa

- 11.6.1 Saudi Arabia

- 11.6.2 South Africa

- 11.6.3 UAE

- 11.6.4 Rest of Middle East and Africa

Chapter 12 Company Profiles

- 12.1 3M Company

- 12.2 AFT Fluorotec

- 12.3 AGC Chemicals Americas

- 12.4 AGC Inc.

- 12.5 AkzoNobel N.V.

- 12.6 Arkema

- 12.7 Beckers Group

- 12.8 Daikin Industries

- 12.9 Dow

- 12.10 DuPont

- 12.11 Fluorotherm Polymers

- 12.12 Gujarat Fluorochemicals

- 12.13 Jotun A/S

- 12.14 Nippon Paint Holdings

- 12.15 PPG Industries, Inc.

- 12.16 Sherwin-Williams Company

- 12.17 Solvay S.A.

- 12.18 The Chemours Company

- 12.19 Whitford Corporation