|

市场调查报告书

商品编码

1755249

3D 列印义肢市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测3D Printed Prosthetics Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

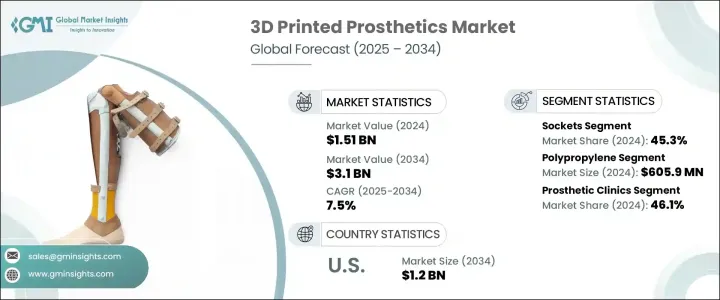

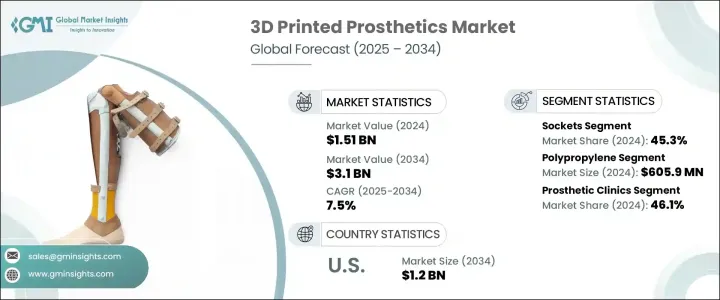

2024年,全球3D列印义肢市场规模达15.1亿美元,预计2034年将以7.5%的复合年增长率成长,达到31亿美元。这主要得益于患者对高度个人化义肢解决方案日益增长的需求,因为患者寻求根据自身特定解剖结构和日常需求量身定制的义肢。与通常速度慢、成本高且需要多次试戴的传统製造方法不同,3D列印技术提供了一种更快速、更经济的方法。这些客製化解决方案不仅提升了整体使用者体验,也缩短了生产时间。个人化订製对儿科患者尤其重要,因为他们的需求会随着成长而不断变化,需要更频繁地更换义肢。先进的3D列印义肢技术在满足全球医疗机构对个人化医疗器材需求方面迈出了一大步。

积层製造技术的进步,包括立体光固化成型 (SLA)、选择性雷射烧结 (SLS) 和熔融沈积成型 (FDM),正在协助打造耐用、轻巧且功能齐全的义肢组件。随着美国食品药物管理局 (FDA) 等监管机构批准多种 3D 列印义肢,该技术正不断获得认可和发展。医用级聚合物和合金等生物相容性材料的出现,进一步提升了义肢的耐用性、舒适性和适应性。这些创新不仅缩短了生产週期,还提高了义肢的品质和精确度,使医护人员和患者都能更轻鬆地获得义肢。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 15.1亿美元 |

| 预测值 | 31亿美元 |

| 复合年增长率 | 7.5% |

聚丙烯凭藉其良好的强度重量比、抗疲劳性和化学稳定性,在2024年占据材料领域的领先地位,产值达6.059亿美元。聚丙烯广泛应用于医疗製造领域,因其生物相容性和抗灭菌性能而备受推崇。它被广泛用于製造义肢接受腔、手术导板和矫形支架。随着3D列印技术对轻量化和个人化医疗解决方案的需求不断增长,聚丙烯的应用也随之不断扩大。其兼具柔软性和功能性,使其成为以患者为中心的设计的首选。

2024年,义肢诊所市占率达46.1%。这些专科中心正越来越多地整合3D列印技术,以应对日益增长的患者数量,尤其是在糖尿病和血管疾病等慢性疾病导致截肢率较高的地区。诊所受益于3D列印的高效性,因为它可以快速修改并频繁更换义肢——这对儿科患者尤其重要。这些机构通常提供一体化服务,包括復健、培训和后续服务,从而鼓励更多人采用3D列印义肢。其集中式方法简化了使用者体验,并在寻求长期解决方案的患者中建立了信任。

受肥胖、糖尿病和周边动脉疾病发病率上升的推动,美国3D列印义肢市场预计到2034年将达到12亿美元,凸显了对先进义肢解决方案的迫切需求。远距医疗、云端工作流程和远距病患扫描等数位医疗创新技术的融合,为3D列印义肢的推广创造了肥沃的土壤。这些发展使临床医生能够提供更准确、更及时的护理,从而促进其在整个医疗保健领域的广泛应用。

影响 3D 列印义肢产业的关键参与者包括 YouBionic、WillowWood、Mercuris、Limbitless Solutions、Stratasys、Bionic Prosthetics and Orthotics、Create Prosthetics、UNYQ、Protosthetics、Prothea、Open Bionics、Eqwal Group (Steeper Group)、Material Motor、Exthea、Open Bionics、Eqwal Group (Steeper Group)、Materials、Exthea、Material、Exone 和 Motoreper Group)、Material、Exone 和)为巩固市场地位,3D 列印义肢领域的公司正在实施多种策略方针。主要重点是透过利用先进的软体和扫描技术扩大产品客製化。公司还在投资研发,以提高材料品质和舒适度。与医院、復健中心和研究机构的策略合作有助于增加可近性并加速创新。此外,公司正在增强数位化工作流程,例如远端肢体扫描和基于云端的设计,以简化生产并透过线上平台和在地化列印中心进行地理扩展。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 对个人化和可负担义肢解决方案的需求不断增加

- 3D列印和材料的技术进步

- 因糖尿病、创伤和血管疾病导致肢体缺失的发生率不断上升

- 非营利组织和人道主义倡议的支持日益增多

- 产业陷阱与挑战

- 缺乏标准化法规和品质控制

- 熟练的专业人员和技术知识有限

- 成长动力

- 成长潜力分析

- 差距分析

- 技术格局

- 未来市场趋势

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 专利分析

- 定价分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 竞争市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 - 2034 年

- 主要趋势

- 四肢

- 插座

- 关节

- 其他类型

第六章:市场估计与预测:按材料,2021 - 2034 年

- 主要趋势

- 聚丙烯

- 聚乙烯

- 丙烯酸树脂

- 聚氨酯

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 復健中心

- 义肢诊所

- 其他最终用途

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Bionic Prosthetics and Orthotics

- Create Prosthetics

- Eqwal Group (Steeper Group)

- Exone

- Limbitless Solutions

- Materialise

- Mercuris

- Motorica

- Open Bionics

- Prothea

- Protosthetics

- Stratasys

- UNYQ

- WillowWood

- YouBionic

The Global 3D Printed Prosthetics Market was valued at USD 1.51 billion in 2024 and is estimated to grow at a CAGR of 7.5% to reach USD 3.1 billion by 2034, driven by the increasing demand for highly personalized prosthetic solutions, as patients seek devices tailored to their specific anatomy and day-to-day needs. Unlike conventional manufacturing methods-which are often slow and expensive and involve numerous fitting sessions-3D printing technology offers a faster and more cost-efficient approach. These custom solutions improve the overall user experience while cutting down production time. Personalization is especially valuable for pediatric patients, whose needs change frequently as they grow, requiring replacements more often. Advanced 3D printing in prosthetics is a major leap forward in meeting global healthcare demands for individualized medical devices.

Technological advancements in additive manufacturing, including Stereolithography (SLA), Selective Laser Sintering (SLS), and Fused Deposition Modeling (FDM), are enabling the creation of durable, lightweight, and functional prosthetic components. With the approval of multiple 3D printed prosthetic devices by regulatory bodies like the U.S. FDA, the technology continues gaining credibility and momentum. The availability of biocompatible materials such as medical-grade polymers and alloys has further enhanced the durability, comfort, and adaptability of prosthetic devices. These innovations not only reduce production cycles but also elevate the quality and precision of prosthetics, making them more accessible for medical professionals and patients alike.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.51 Billion |

| Forecast Value | $3.1 Billion |

| CAGR | 7.5% |

Polypropylene led the material segment generating USD 605.9 million in 2024, owing to its favorable strength-to-weight ratio, fatigue resistance, and chemical stability. Widely adopted in medical manufacturing, polypropylene is valued for its biocompatibility and ability to withstand sterilization. It is extensively used to fabricate prosthetic sockets, surgical guides, and orthotic supports. As demand rises for lightweight and personalized medical solutions via 3D printing, the utilization of polypropylene continues to expand. Its blend of softness and functionality makes it a preferred choice in patient-centric designs.

The prosthetic clinics segment held a 46.1% share in 2024. These specialized centers are increasingly integrating 3D printing to manage growing patient volumes, especially in regions with high rates of amputation caused by chronic conditions like diabetes and vascular disease. Clinics benefit from 3D printing's efficiency, as it allows for quick modifications and frequent replacements-particularly vital for pediatric patients. These facilities often serve as all-in-one providers, offering rehabilitation, training, and follow-up services, encouraging greater adoption of 3D printed prosthetics. Their centralized approach simplifies the user experience and builds trust among patients seeking long-term solutions.

U.S. 3D Printed Prosthetics Market is expected to reach USD 1.2 billion by 2034 driven by rising incidences of obesity, diabetes, and peripheral artery disease, underscoring the urgent need for advanced prosthetic solutions. The integration of digital health innovations such as telehealth, cloud-based workflows, and remote patient scanning is creating fertile ground for the expansion of 3D printed prosthetics. These developments allow clinicians to deliver more accurate and timely care, contributing to broader adoption across the healthcare landscape.

Key players shaping the 3D Printed Prosthetics Industry include YouBionic, WillowWood, Mercuris, Limbitless Solutions, Stratasys, Bionic Prosthetics and Orthotics, Create Prosthetics, UNYQ, Protosthetics, Prothea, Open Bionics, Eqwal Group (Steeper Group), Materialise, Exone, and Motorica. To strengthen their market foothold, companies in the 3D printed prosthetics space are implementing multiple strategic approaches. A primary focus is expanding product customization by leveraging advanced software and scanning technologies. Firms are also investing in R&D to improve material quality and comfort. Strategic collaborations with hospitals, rehabilitation centers, and research institutions are helping to increase access and accelerate innovation. In addition, companies are enhancing digital workflows, such as remote limb scanning and cloud-based design, to streamline production and expand geographically through online platforms and localized printing hubs.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for personalized and affordable prosthetic solutions

- 3.2.1.2 Technological advancements in 3D printing and materials

- 3.2.1.3 Rising incidence of limb loss due to diabetes, trauma, and vascular diseases

- 3.2.1.4 Growing support from non-profits and humanitarian initiatives

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of standardized regulations and quality control

- 3.2.2.2 Limited availability of skilled professionals and technical knowledge

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Gap analysis

- 3.5 Technology landscape

- 3.6 Future market trends

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.8 Patent analysis

- 3.9 Pricing analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Limbs

- 5.3 Sockets

- 5.4 Joints

- 5.5 Other types

Chapter 6 Market Estimates and Forecast, By Material, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Polypropylene

- 6.3 Polyethylene

- 6.4 Acrylics

- 6.5 Polyurethane

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Rehabilitation centers

- 7.4 Prosthetic clinics

- 7.5 Other end use

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Bionic Prosthetics and Orthotics

- 9.2 Create Prosthetics

- 9.3 Eqwal Group (Steeper Group)

- 9.4 Exone

- 9.5 Limbitless Solutions

- 9.6 Materialise

- 9.7 Mercuris

- 9.8 Motorica

- 9.9 Open Bionics

- 9.10 Prothea

- 9.11 Protosthetics

- 9.12 Stratasys

- 9.13 UNYQ

- 9.14 WillowWood

- 9.15 YouBionic