|

市场调查报告书

商品编码

1755258

展示包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Display Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

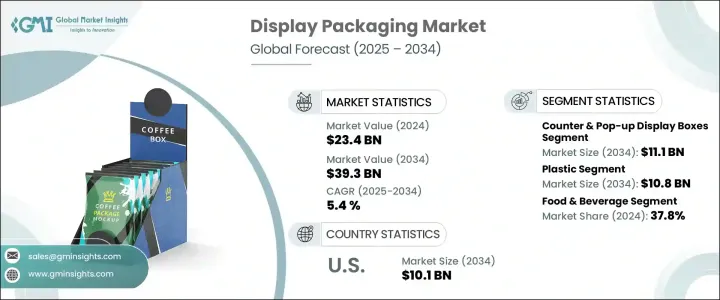

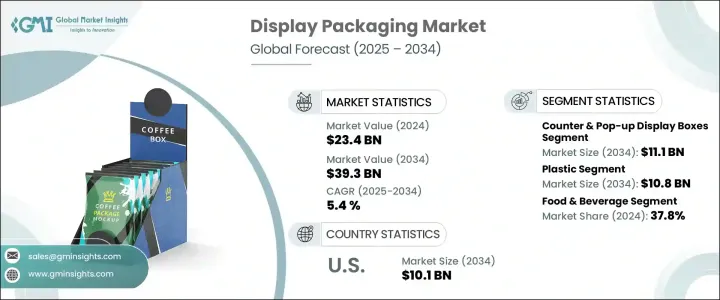

2024年,全球展示包装市场规模达234亿美元,预计到2034年将以5.4%的复合年增长率成长,达到393亿美元。这得益于电子商务的快速成长,该领域持续对视觉吸引力强的包装的需求,以提升产品曝光度并促进消费者参与。随着越来越多的消费者选择线上购物,创意和品牌化的展示包装已成为推动销售的关键因素。社群媒体趋势,尤其是开箱内容,更凸显了美观包装的重要性。

然而,全球贸易紧张局势和关税——尤其是川普政府时期发起的关税——扰乱了供应链,导致纸板和塑胶等原材料成本上涨。这些扰乱导致生产延误,对製造商和供应商都产生了影响。客製化仍然是展示包装成功的关键,因为它有助于品牌脱颖而出,并与消费者建立情感联繫。市场的发展与永续性密切相关,人们对可回收材料和环保设计的兴趣日益浓厚。随着企业转向更环保的解决方案,展示包装领域的创新也不断涌现,以应对不断变化的消费者偏好和环境法规。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 234亿美元 |

| 预测值 | 393亿美元 |

| 复合年增长率 | 5.4% |

展示包装产业涵盖旨在提升产品展示效果和提升消费者参与度的各种形式,包括端盖式展示架、托盘式展示架、透明包装、落地式展示架以及柜檯式和弹出式展示盒。每种类型在零售环境中都有其独特的用途。预计到2034年,柜檯式和弹出式展示盒市场规模将达到111亿美元,成为最具影响力和商业成功的形式之一。这些展示方式兼具视觉吸引力和多功能性。品牌青睐将这些装置放置在销售点,因为其鲜明的图形、富有创意的形状和策略性的摆放位置会显着影响购买决策。

从材料使用情况来看,塑胶仍然是整个产业的首选,预计到2034年其市场价值将达到108亿美元。消费者对透明包装的日益增长的偏好推动了这一增长,因为消费者更倾向于购买可见的产品。这种透明度能够建立信任并提升货架吸引力。同时,该行业正在向更环保的塑胶替代品转型。为了满足日益严格的环保标准和消费者对永续包装的需求,各大品牌纷纷采用可回收和可生物降解的塑胶。

预计到2034年,德国展示包装市场的复合年增长率将达到4.9%。德国在工程和製造领域根深蒂固的专业知识正在推动包装解决方案的创新,尤其是在轻盈耐用的纸板材料方面。德国公司专注于紧凑型展示设计,以在不占用过多空间的情况下提供最大的可视性。自动化和数位印刷技术的整合可实现快速客製化和可扩展生产,进一步巩固德国在欧洲展示包装领域的领先地位。

塑造竞争格局的关键参与者包括 Smurfit Kappa、Mondi Group、DS Smith、International Paper 和 WestRock Company。为了巩固市场地位,领先的展示包装公司正在实施以创新、策略合作伙伴关係和永续实践为重点的策略。他们投资研发,开发符合全球环保标准的环保包装解决方案。与零售商和品牌所有者的合作,使其能够提供满足不断变化的消费者偏好的客製化设计。各公司也透过收购和设施升级来扩大其全球影响力,从而提高生产效率和地理覆盖范围。拥抱智慧包装和自动化生产线等数位技术,是提升快速变化的零售环境中可扩展性和回应能力的另一个核心倡议。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 价格波动

- 供应链重组

- 生产成本影响

- 需求面影响

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 电子商务零售的成长

- 消费者对增强产品可见度的需求不断增长

- 转向可持续包装材料

- 消费者偏好方便易用的包装

- 包装解决方案的技术进步

- 产业陷阱与挑战

- 客製化和创新成本高

- 设计复杂性和消费者期望

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依包装类型,2021-2034

- 主要趋势

- 柜檯和弹出式展示盒

- 落地式展示架

- 托盘展示

- 端盖显示器

- 透明包装

第六章:市场估计与预测:依材料类型,2021-2034 年

- 主要趋势

- 塑胶

- 纸和纸板

- 玻璃

- 金属

- 其他的

- 灵活的

第七章:市场估计与预测:按最终用途产业,2021-2034 年

- 主要趋势

- 食品和饮料

- 化妆品和个人护理

- 製药

- 电子产品和家用电器

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- alphaglobalpackaging

- Amcor plc

- CustomBoxline

- DS Smith

- Graphic Packaging International, LLC

- Ibex Packaging

- International Paper

- Mondi Group

- Orora Visual

- Packaging Corporation of America

- PakFactory

- Rengo Co.

- Salazar Packaging

- Smurfit Kappa

- Stora Enso

- WestRock Company

The Global Display Packaging Market was valued at USD 23.4 billion in 2024 and is estimated to grow at a CAGR of 5.4% to reach USD 39.3 billion by 2034, driven by the rapid growth in e-commerce continues to demand visually appealing packaging that enhances product visibility and encourages consumer engagement. As more shoppers opt for online purchases, the appeal of creative and branded display packaging becomes a key sales driver. Social media trends, particularly unboxing content, have amplified the importance of aesthetic packaging.

However, global trade tensions and tariffs-especially those initiated during the Trump administration-have disrupted supply chains by increasing the cost of raw materials like paperboard and plastic. These disruptions have resulted in production delays, impacting manufacturers and suppliers alike. Customization remains central to the success of display packaging as it helps brands differentiate and connect emotionally with consumers. The market's evolution is closely tied to sustainability, with rising interest in recyclable materials and eco-friendly design. As companies shift toward greener solutions, innovations in display packaging continue to emerge in response to changing consumer preferences and environmental regulations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $23.4 Billion |

| Forecast Value | $39.3 Billion |

| CAGR | 5.4% |

The display packaging industry encompasses formats designed to enhance product presentation and drive consumer engagement. These include endcap displays, pallet displays, transparent packaging, floor stand displays, and counter & pop-up display boxes. Each type serves a distinct purpose within the retail environment, The counter & pop-up display boxes segment is projected to reach USD 11.1 billion by 2034, emerging as one of the most impactful and commercially successful formats. These displays are driven by their ability to combine visual appeal with functional versatility. Brands favor these units for point-of-sale locations, where vibrant graphics, creative shapes, and strategic placement significantly influence purchase decisions.

Based on material usage, the plastic segment remains a leading choice across the industry and is expected to achieve a market value of USD 10.8 billion by 2034. The growing preference for transparent packaging has been instrumental in this growth, as consumers are more inclined to purchase items when the product is visible. This transparency builds trust and enhances shelf appeal. Simultaneously, the industry is undergoing a transition toward more eco-friendly plastic alternatives. Brands adopt recyclable and biodegradable plastics to meet tightening environmental standards and consumer demand for sustainable packaging.

Germany Display Packaging Market is forecasted to grow at a CAGR of 4.9% through 2034. The country's deep-rooted expertise in engineering and manufacturing is fueling innovation in packaging solutions, especially in lightweight yet durable cardboard materials. German companies focus on compact display designs that deliver maximum visibility without occupying excessive floor space. Integrating automation and digital printing technologies allows for rapid customization and scalable production, further solidifying Germany's position as a leader in the European display packaging landscape.

Key players shaping the competitive landscape include Smurfit Kappa, Mondi Group, DS Smith, International Paper, and WestRock Company. To solidify their market presence, leading display packaging companies are implementing strategies focused on innovation, strategic partnerships, and sustainable practices. They invest in R&D to develop eco-friendly packaging solutions that align with global environmental standards. Collaboration with retailers and brand owners allows for tailored designs that meet evolving consumer preferences. Companies are also expanding their global footprint through acquisitions and facility upgrades, enhancing production efficiency and geographic reach. Embracing digital technologies, such as smart packaging and automated production lines, is another core move to boost scalability and responsiveness in the fast-changing retail landscape.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth of e-commerce retailing

- 3.3.1.2 Rising consumer demand for enhanced product visibility

- 3.3.1.3 Shift towards sustainable packaging materials

- 3.3.1.4 Consumer preference for convenience and easy-to-use packaging

- 3.3.1.5 Technological advancements in packaging solutions

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High cost of customization and innovation

- 3.3.2.2 Design complexity and consumer expectations

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Packaging Type, 2021-2034 (USD Billion & Kilo Tons)

- 5.1 Key trends

- 5.2 Counter & pop-up display boxes

- 5.3 Floor stand displays

- 5.4 Pallet displays

- 5.5 Endcap displays

- 5.6 Transparent packaging

Chapter 6 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Billion & Kilo Tons)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Paper & paperboard

- 6.4 Glass

- 6.5 Metal

- 6.6 Others

- 6.7 Flexible

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion & Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.3 Cosmetics & personal care

- 7.4 Pharmaceuticals

- 7.5 Electronics & appliances

- 7.6 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Bn & Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 alphaglobalpackaging

- 9.2 Amcor plc

- 9.3 CustomBoxline

- 9.4 DS Smith

- 9.5 Graphic Packaging International, LLC

- 9.6 Ibex Packaging

- 9.7 International Paper

- 9.8 Mondi Group

- 9.9 Orora Visual

- 9.10 Packaging Corporation of America

- 9.11 PakFactory

- 9.12 Rengo Co.

- 9.13 Salazar Packaging

- 9.14 Smurfit Kappa

- 9.15 Stora Enso

- 9.16 WestRock Company