|

市场调查报告书

商品编码

1755261

癌症治疗设施市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Cancer Treatment Facilities Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

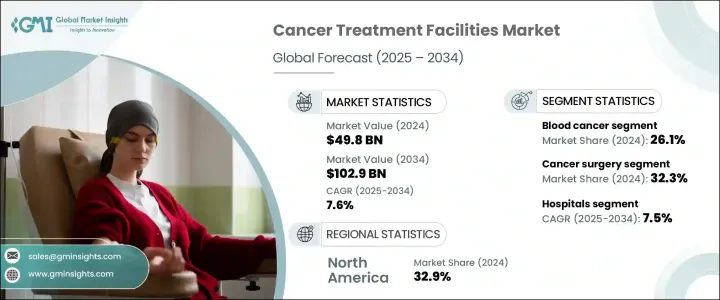

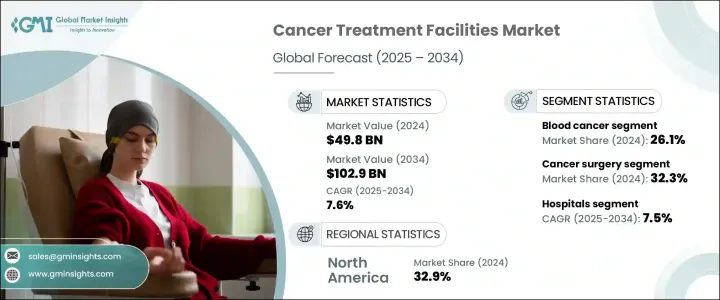

2024年,全球癌症治疗设施市场规模达498亿美元,预估年复合成长率达7.6%,2034年将达1,029亿美元。癌症治疗中心是专注于各类癌症诊断、治疗和持续管理的专业医疗机构。这些中心通常提供化疗、放射治疗、免疫治疗、外科手术和术后护理等服务。它们拥有由肿瘤科医生、外科医生、放射科医生和护理人员组成的多学科专业团队,以确保为每位患者提供量身定制的护理。

全球癌症发生率的上升是推动这一市场发展的主要动力。人口老化是癌症确诊数量不断增长的重要原因,这反过来又增加了对专科癌症治疗的需求。为了满足这些需求,治疗机构正在加强基础设施建设,并采用精准肿瘤学和多学科治疗模式等先进技术。这些创新旨在满足日益增长的老年人口的需求,而老年人口尤其容易患癌症。此外,医疗旅游业也促进了癌症治疗市场的扩张,尤其是在那些治疗方案价格合理、吸引寻求低成本高品质医疗服务的国际患者的地区。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 498亿美元 |

| 预测值 | 1029亿美元 |

| 复合年增长率 | 7.6% |

2024年,血癌领域占最大份额,达26.1%。这一增长得益于持续的临床需求以及治疗血液癌症所需的广泛基础设施,包括专科治疗设施。此外,复杂、昂贵且通常密集的治疗方案(包括化疗、骨髓移植和免疫疗法)也是市场扩张的主要推动因素。此外,对长期追踪护理的需求、多学科医疗团队的参与以及对先进诊断能力的需求,进一步凸显了这些专科治疗中心相对于专注于其他类型癌症的治疗中心的重要性。

2024年,医院占据最大的市场份额,达到67.5%,预计将以7.5%的复合年增长率持续成长。医院对癌症治疗设施的需求源于其拥有先进的检测工具以及包括化疗、放疗和荷尔蒙疗法在内的多种治疗方案。患者更青睐医院,因为医院提供全面的服务,并能获得多专业照护团队的协助。

2024年,美国癌症治疗市场规模达149亿美元,预计随着人口老化和癌症病例增加,该市场将持续成长。这促进了综合癌症中心的发展,这些中心提供机器人手术、免疫疗法和精准医疗等尖端治疗方案。 HCA Healthcare等主要产业参与者正在透过合作和人工智慧技术拓展业务范围。政府措施和基于价值的医疗模式进一步推动了市场成长。

全球癌症治疗设施市场的关键参与者包括 Alliance HealthCare Services、美国肿瘤研究所、阿波罗医院企业、美国癌症治疗中心、Compass Oncology、Curie Oncology、Fortis Healthcare、GenesisCare、HCA Healthcare、Healthcare Global Enterprises、IHH Healthcare Berhad、Narayana Hrudayalaya、OncoLife Hospitals、Ramcare Global Enterprises、IHH Healthcare Berhad、Narayana Hrudayalaya、OncoLife Hospitals、Ramsay Health Care 和 Tenet Healthcare。为了巩固市场地位,癌症治疗设施领域的公司正专注于整合人工智慧、机器人手术和精准医疗等先进技术。他们还透过与其他医疗保健提供者和组织建立策略合作伙伴关係来扩展服务。基于价值的照护模式的日益普及有助于改善患者的治疗效果并降低成本。许多组织正在建立综合癌症护理中心,提供从诊断到治疗后护理的全方位服务。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 癌症发生率上升

- 老年人口不断增加

- 医疗旅游兴起

- 政府措施和宣传计划增多

- 产业陷阱与挑战

- 缺乏熟练的肿瘤学人员

- 先进治疗和技术成本高昂

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

- 报销场景

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依治疗类型,2021 年至 2034 年

- 主要趋势

- 癌症手术

- 化疗

- 放射治疗

- 免疫疗法

- 骨髓移植

- 其他治疗类型

第六章:市场估计与预测:按癌症类型,2021 年至 2034 年

- 主要趋势

- 血癌

- 乳癌

- 摄护腺癌

- 胃肠道癌症

- 大肠直肠癌

- 肺癌

- 其他癌症类型

第七章:市场估计与预测:依供应商划分,2021 年至 2034 年

- 主要趋势

- 医院

- 癌症中心

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Alliance HealthCare Services

- American Oncology Institute

- Apollo Hospitals Enterprise

- Cancer Treatment Centers of America

- Compass Oncology

- Curie Oncology

- Fortis Healthcare

- GenesisCare

- HCA Healthcare

- Healthcare Global Enterprises

- IHH Healthcare Berhad

- Narayana Hrudayalaya

- OncoLife Hospitals

- Ramsay Health Care

- Tenet Healthcare

The Global Cancer Treatment Facilities Market was valued at USD 49.8 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 102.9 billion by 2034. Cancer treatment centers are specialized healthcare institutions focused on the diagnosis, treatment, and ongoing management of various cancer types. These centers typically offer services such as chemotherapy, radiation therapy, immunotherapy, surgical treatments, and aftercare. They employ multidisciplinary teams of professionals, including oncologists, surgeons, radiologists, and nursing staff, to ensure tailored care for each patient.

The rising global prevalence of cancer is the main driver for this market. Aging populations significantly contribute to the growing number of cancer diagnoses, which in turn is increasing the demand for specialized cancer care. To meet these needs, treatment facilities are enhancing their infrastructure and adopting advanced technologies, such as precision oncology and multidisciplinary treatment models. These innovations aim to cater to the growing elderly demographic, which is particularly vulnerable to cancer. Additionally, medical tourism is contributing to the expansion of the cancer treatment market, particularly in regions where affordable treatment options attract international patients seeking high-quality care at lower costs.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $49.8 Billion |

| Forecast Value | $102.9 Billion |

| CAGR | 7.6% |

The blood cancer segment held the largest share of 26.1% in 2024. This growth is driven by the ongoing clinical demand and the extensive infrastructure required to treat hematological cancers, including specialized treatment facilities. Moreover, the complex, costly, and often intensive treatment protocols, which involve chemotherapy, bone marrow transplants, and immunotherapy, are major contributors to the market's expansion. Moreover, the requirement for long-term follow-up care, the involvement of multidisciplinary medical teams, and the need for advanced diagnostic capabilities further emphasize the importance of these specialized treatment centers over those focused on other cancer types.

In 2024, the hospitals segment held the largest market share, accounting for 67.5% share, and is expected to continue growing at a CAGR of 7.5%. The demand for cancer treatment facilities in hospitals is driven by the availability of advanced detection tools and a wide range of treatment options, including chemotherapy, radiation, and hormone therapy. Patients prefer hospitals for their comprehensive services and access to multidisciplinary care teams.

U.S. Cancer Treatment Market was valued at USD 14.9 billion in 2024 and is expected to see continued growth due to an aging population and an increase in cancer cases. This has led to the development of integrated cancer centers that provide cutting-edge treatments like robotic surgery, immunotherapy, and precision medicine. Major industry players, such as HCA Healthcare, are expanding their reach through partnerships and incorporating AI technologies. Government initiatives and value-based care models further drive market growth.

Key players in the Global Cancer Treatment Facilities Market include Alliance HealthCare Services, American Oncology Institute, Apollo Hospitals Enterprise, Cancer Treatment Centers of America, Compass Oncology, Curie Oncology, Fortis Healthcare, GenesisCare, HCA Healthcare, Healthcare Global Enterprises, IHH Healthcare Berhad, Narayana Hrudayalaya, OncoLife Hospitals, Ramsay Health Care, Tenet Healthcare. To strengthen their market position, companies in the cancer treatment facilities sector are focusing on the integration of advanced technologies such as AI, robotic surgery, and precision medicine. They are also expanding their services through strategic partnerships with other healthcare providers and organizations. The increasing adoption of value-based care models helps improve patient outcomes while reducing costs. Many organizations are building integrated cancer care centers to offer comprehensive services, from diagnosis to post-treatment care.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of cancer

- 3.2.1.2 Growing geriatric population

- 3.2.1.3 Rise in medical tourism

- 3.2.1.4 Increase in government initiatives and awareness programs

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Lack of skilled oncology personnel

- 3.2.2.2 High cost of advanced treatments and technologies

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Reimbursement Scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Treatment Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Cancer surgery

- 5.3 Chemotherapy

- 5.4 Radiation therapy

- 5.5 Immunotherapy

- 5.6 Bone marrow transplantation

- 5.7 Other treatment types

Chapter 6 Market Estimates and Forecast, By Cancer Type, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Blood cancer

- 6.3 Breast cancer

- 6.4 Prostate cancer

- 6.5 Gastrointestinal cancer

- 6.6 Colorectal cancer

- 6.7 Lung cancer

- 6.8 Other cancer types

Chapter 7 Market Estimates and Forecast, By Provider, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Cancer centers

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Alliance HealthCare Services

- 9.2 American Oncology Institute

- 9.3 Apollo Hospitals Enterprise

- 9.4 Cancer Treatment Centers of America

- 9.5 Compass Oncology

- 9.6 Curie Oncology

- 9.7 Fortis Healthcare

- 9.8 GenesisCare

- 9.9 HCA Healthcare

- 9.10 Healthcare Global Enterprises

- 9.11 IHH Healthcare Berhad

- 9.12 Narayana Hrudayalaya

- 9.13 OncoLife Hospitals

- 9.14 Ramsay Health Care

- 9.15 Tenet Healthcare