|

市场调查报告书

商品编码

1755265

海洋动态定位系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Marine Dynamic Positioning System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

2024年,全球船舶动态定位系统 (DPS) 市场规模达92亿美元,预计到2034年将以12.6%的复合年增长率成长,达到293亿美元。该市场正在快速扩张,预计未来将保持强劲成长,这主要得益于海上勘探和生产活动、海事研究以及专用海军舰艇的增加。这些舰艇需要通用或专用的动态定位系统 (DPS) 来确保高精度的定位能力。控制系统、感测器和自动化技术的最新创新提高了DPS的性能和可靠性,使其成为现代海上作业不可或缺的工具。

此外,未来强大的动态定位系统的发展将在很大程度上依赖基于人工智慧的控制技术和预测性维护软体。这些进步将降低营运风险,优化燃料消耗,并利用即时资料提高营运效率。由于对海上基础设施和再生能源项目的大量投资,亚太地区正成为动态定位系统(DPS)的重要市场。该地区各国优先发展先进的海上能力,包括不依赖传统锚泊方式的船舶。随着技术和营运考量的不断发展,在全球对海洋和水上作业安全和效率的重视的推动下,DPS市场有望大幅成长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 92亿美元 |

| 预测值 | 293亿美元 |

| 复合年增长率 | 12.6% |

2024年,控制系统占据市场主导地位,占据45%的份额,预计到2034年该领域将创造110亿美元的市场价值。随着海上作业日益复杂,控制系统也不断发展,以满足现代DPS日益增长的需求。这些系统已显着改进,拥有增强的演算法、直觉的人机介面和自动化功能,使船舶即使在最具挑战性的条件下也能保持稳定。

2024年,2级动力定位系统占据了55%的市场。 2级动态定位系统广泛应用于海上钻井、海底施工和其他关键海洋环境,在这些环境中,维护系统完整性至关重要。这些系统以其运作可靠性、定位精度和应对极端作业条件的能力而闻名。 2级系统配备先进的控制功能和冗余功能,即使在发生严重故障时也能继续运作。其高可靠性和成本效益使其成为营运商的首选,因为它们提供强大的定位功能,而无需像3级系统那样复杂且成本更高。

2024年,美国海洋动态定位系统(DPS)市场规模达20亿美元。美国在该领域占据主导地位,这得益于大量的海上石油和天然气活动,尤其是在需要高精度以确保安全高效作业的地区。美国先进的海洋基础设施和顶级海上服务提供者的存在进一步促进了不同产业对不同等级DPS的需求。除了支援石油和天然气作业外,美国也越来越注重为海军作业、离岸风电场等再生能源专案以及其他专业应用开发DPS解决方案。

全球船舶动态定位系统 (DPS) 产业的主要参与者包括 ABB、L3 Harris、劳斯莱斯、康斯伯格、Volvo遍达、Marine Technologies、瓦锡兰、Xenta Systems 和 GE Vernova。为了巩固市场地位,船舶动态定位系统产业的公司正专注于产品创新,投资人工智慧控制系统的研发,并增强预测性维护能力。透过整合尖端感测器、自动化技术和即时资料分析,这些公司正在提高其係统的性能和效率。此外,一些参与者正在扩展其产品范围,以满足对再生能源解决方案(例如离岸风电场)日益增长的需求。策略伙伴关係、收购和区域扩张也是增强市场占有率和利用新成长机会的关键策略。

目录

第一章:方法论

- 市场范围和定义

- 研究设计

- 研究方法

- 资料收集方法

- 资料探勘来源

- 全球的

- 地区/国家

- 基础估算与计算

- 基准年计算

- 市场评估的主要趋势

- 初步研究和验证

- 主要来源

- 预测模型

- 研究假设和局限性

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商概况

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 海上安全需求不断成长

- 海上交通和全球贸易增加

- 海军和军队现代化

- 海上能源勘探开发增加

- 产业陷阱与挑战

- 技术复杂性与缺乏技术人员

- 初始成本和维护成本高

- 市场机会

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 技术和创新格局

- 当前的技术趋势

- 先进感测器融合系统的集成

- 使用冗余和故障安全架构

- 即时远端监控和诊断

- 基于人工智慧的动态控制演算法

- 新兴技术

- 整合 DP 的自主船舶导航

- 用于DP仿真的数位孪生技术

- 混合动力整合和绿色DP系统

- DP日誌资料完整性的区块链

- 当前的技术趋势

- 价格趋势

- 按地区

- 按设备

- 成本細項分析

- 专利分析

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按设备,2021 - 2034 年

- 主要趋势

- 控制系统

- DP控制台

- 位置参考系统

- 运动感应器

- 电力系统

- 产生器

- 配电盘

- 电源管理系统

- 推进器系统

- 隧道推进器

- 方位推进器

- 福伊特施耐德螺旋桨

第六章:市场估计与预测:按系统,2021 - 2034 年

- 主要趋势

- 1级

- 2级

- 3级

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 近海船舶

- 平台供应船(PSV)

- 锚处理拖船供应船(AHTSV)

- 潜水支援船(DSV)

- ROV支援船

- 海上平台

- 浮式生产储卸油装置(FPSO)

- 半潜式钻井平台

- 钻孔机

- 海军舰艇

- 研究和勘测船

- 扫雷者

- 其他的

- 游轮

- 渡轮

- 电缆敷设船

- 风电场安装船

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 石油和天然气

- 海上再生能源

- 国防与海军

- 海洋研究

- 商业运输

第九章:市场估计与预测:依销售管道,2021 - 2034 年

- 主要趋势

- OEM

- 售后市场

第十章:市场估计与预测:按地区,2021 - 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 比利时

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第 11 章:公司简介

- ABB

- Alphatron Marine

- GE Vernova

- Japan Radio Company

- Kongsberg

- L3 Harris

- Marine Technologies

- Navis Engineering

- Norr Systems

- Praxis Automation Technology

- RH Marine

- Rolls Royce

- Royal IHC

- Sonardyne

- Thrustmaster of Texas

- Twin Disc

- Veethree

- Volvo Penta

- Wartsila

- Xenta Systems

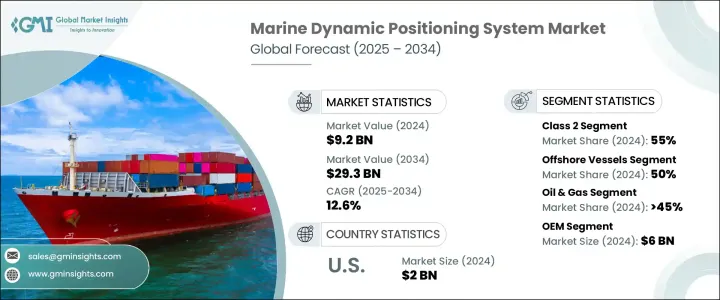

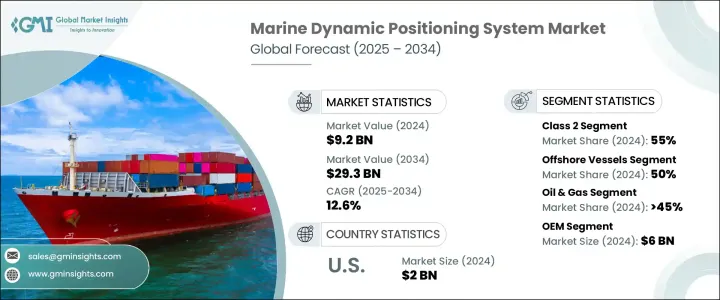

The Global Marine Dynamic Positioning System Market was valued at USD 9.2 billion in 2024 and is estimated to grow at a CAGR of 12.6% to reach USD 29.3 billion by 2034. The market is expanding rapidly and is expected to maintain strong growth in the future, driven by an increase in offshore exploration and production activities, maritime research, and specialized naval vessels. These vessels require either general-purpose or specialized dynamic positioning systems (DPS) to ensure high-precision station-keeping capabilities. Recent innovations in control systems, sensors, and automation technologies have improved the performance and reliability of DPS, positioning them as essential tools in modern maritime operations.

Moreover, the future development of powerful dynamic positioning systems will rely heavily on artificial intelligence-based control technologies and predictive maintenance software. These advancements will reduce operational risks, optimize fuel consumption, and leverage real-time data for greater operational efficiency. The Asia-Pacific region is becoming a significant market for DPS due to substantial investments in offshore infrastructure and renewable energy projects. Countries in the region are prioritizing advanced maritime capabilities, including ships that don't rely on traditional anchoring methods. As technological and operational considerations evolve, the DPS market is poised to experience substantial growth, driven by global priorities surrounding safety and efficiency in oceanic and aquatic operations.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.2 Billion |

| Forecast Value | $29.3 Billion |

| CAGR | 12.6% |

In 2024, control systems led the market, accounting for 45% of the share, with expectations for the segment to generate USD 11 billion by 2034. As offshore operations become more sophisticated, control systems continue to evolve to meet the increasing demands of modern DPS. These systems have significantly improved with enhanced algorithms, intuitive human-machine interfaces, and automation features that allow vessels to remain steady in even the most challenging conditions.

In 2024, the Class 2 segment held a 55% market share. Class 2 dynamic positioning systems are widely used in offshore drilling, subsea construction, and other critical marine environments, where maintaining system integrity is paramount. These systems are known for their operational reliability, accuracy in maintaining position, and ability to handle extreme operational conditions. Equipped with advanced control features and redundancy, Class 2 systems can continue to operate even during critical failures. Their high reliability and cost-effectiveness make them the preferred choice for operators, as they provide strong positioning without the complexity and higher costs associated with Class 3 systems.

United States Marine Dynamic Positioning System Market was valued at USD 2 billion in 2024. The U.S. plays a dominant role in this sector, driven by substantial offshore oil and gas activities, particularly in regions where high precision is necessary to ensure safe and efficient operations. The country's advanced marine infrastructure and the presence of top offshore service providers further contribute to the demand for various levels of DPS across different industries. In addition to supporting oil and gas operations, the U.S. is also increasingly focusing on developing DPS solutions for naval operations, renewable energy projects, such as offshore wind farms, and other specialized applications.

Key players operating in the Global Marine Dynamic Positioning System Industry include ABB, L3 Harris, Rolls Royce, Kongsberg, Volvo Penta, Marine Technologies, Wartsila, Xenta Systems, and GE Vernova. To solidify their market positions, companies in the marine dynamic positioning system industry are focusing on product innovation, investing in R&D for AI-powered control systems, and enhancing predictive maintenance capabilities. By integrating cutting-edge sensors, automation technologies, and real-time data analytics, these companies are improving the performance and efficiency of their systems. Additionally, some players are expanding their product offerings to cater to the growing demand for renewable energy solutions, such as offshore wind farms. Strategic partnerships, acquisitions, and regional expansion are also key strategies to enhance market presence and leverage new growth opportunities.

Table of Contents

Chapter 1 Methodology

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Equipment

- 2.2.3 System

- 2.2.4 Application

- 2.2.5 End use

- 2.2.6 Sales Channel

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for maritime safety

- 3.2.1.2 Increased maritime traffic and global trade

- 3.2.1.3 Naval and military modernization

- 3.2.1.4 Increase in offshore energy exploration and development

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Technological complexity and lack of skilled personnel

- 3.2.2.2 High initial and maintenance costs

- 3.2.3 Market opportunity

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.1.1 Integration of advanced sensor fusion systems

- 3.7.1.2 Use of redundant and fail-safe architectures

- 3.7.1.3 Real-time remote monitoring & diagnostics

- 3.7.1.4 AI-based dynamic control algorithms

- 3.7.2 Emerging technologies

- 3.7.2.1 Autonomous vessel navigation with integrated DP

- 3.7.2.2 Digital twin technology for DP simulation

- 3.7.2.3 Hybrid power integration & green DP systems

- 3.7.2.4 Blockchain for data integrity in DP logs

- 3.7.1 Current technological trends

- 3.8 Price trend

- 3.8.1 By region

- 3.8.2 By equipment

- 3.9 Cost breakdown analysis

- 3.10 Patent analysis

- 3.11 Sustainability and environmental aspects

- 3.11.1 Sustainable practices

- 3.11.2 Waste reduction strategies

- 3.11.3 Energy efficiency in production

- 3.11.4 Eco-friendly initiatives

- 3.11.5 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.7 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Equipment, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Control system

- 5.2.1 DP control console

- 5.2.2 Position reference system

- 5.2.3 Motion sensors

- 5.3 Power system

- 5.3.1 Generators

- 5.3.2 Switchboards

- 5.3.3 Power management system

- 5.4 Thruster system

- 5.4.1 Tunnel thrusters

- 5.4.2 Azimuth thrusters

- 5.4.3 Voith schneider propellers

Chapter 6 Market Estimates & Forecast, By System, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Class 1

- 6.3 Class 2

- 6.4 Class 3

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Offshore Vessels

- 7.2.1 Platform supply vessels (PSVs)

- 7.2.2 Anchor handling tug supply vessels (AHTSVs)

- 7.2.3 Dive support vessels (DSVs)

- 7.2.4 ROV support vessels

- 7.3 Offshore Platforms

- 7.3.1 Floating production storage and offloading (FPSO) Units

- 7.3.2 Semi-submersibles

- 7.3.3 Drilling rigs

- 7.4 Naval Vessels

- 7.4.1 Research and survey vessels

- 7.4.2 Mine hunters

- 7.5 Others

- 7.5.1 Cruise ships

- 7.5.2 Ferries

- 7.5.3 Cable-laying ships

- 7.5.4 Wind farm installation vessels

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Oil & Gas

- 8.3 Offshore renewable energy

- 8.4 Defense & Naval

- 8.5 Marine research

- 8.6 Commercial shipping

Chapter 9 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 OEM

- 9.3 Aftermarket

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 10.1 North America

- 10.1.1 U.S.

- 10.1.2 Canada

- 10.2 Europe

- 10.2.1 UK

- 10.2.2 Germany

- 10.2.3 France

- 10.2.4 Italy

- 10.2.5 Spain

- 10.2.6 Russia

- 10.2.7 Belgium

- 10.2.8 Sweden

- 10.3 Asia Pacific

- 10.3.1 China

- 10.3.2 India

- 10.3.3 Japan

- 10.3.4 Australia

- 10.3.5 Singapore

- 10.3.6 South Korea

- 10.3.7 Southeast Asia

- 10.4 Latin America

- 10.4.1 Brazil

- 10.4.2 Mexico

- 10.4.3 Argentina

- 10.5 MEA

- 10.5.1 South Africa

- 10.5.2 Saudi Arabia

- 10.5.3 UAE

Chapter 11 Company Profiles

- 11.1 ABB

- 11.2 Alphatron Marine

- 11.3 GE Vernova

- 11.4 Japan Radio Company

- 11.5 Kongsberg

- 11.6 L3 Harris

- 11.7 Marine Technologies

- 11.8 Navis Engineering

- 11.9 Norr Systems

- 11.10 Praxis Automation Technology

- 11.11 RH Marine

- 11.12 Rolls Royce

- 11.13 Royal IHC

- 11.14 Sonardyne

- 11.15 Thrustmaster of Texas

- 11.16 Twin Disc

- 11.17 Veethree

- 11.18 Volvo Penta

- 11.19 Wartsila

- 11.20 Xenta Systems