|

市场调查报告书

商品编码

1755268

塑胶袋邮寄市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Polybag Mailers Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

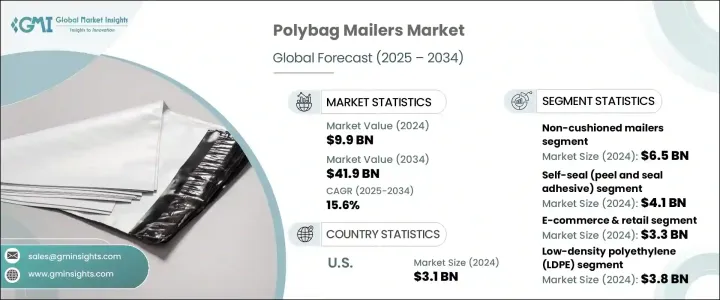

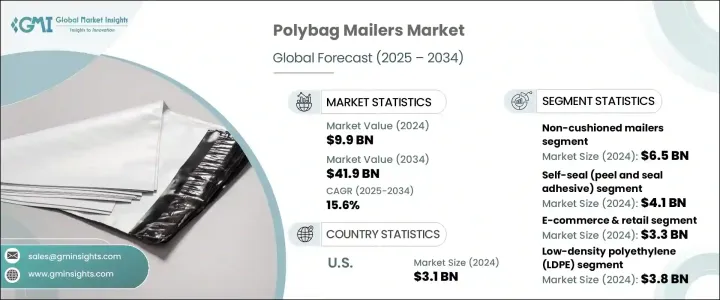

2024年,全球塑胶袋邮寄袋市场价值为99亿美元,预计到2034年将以15.6%的复合年增长率增长,达到419亿美元,这得益于电子商务的持续增长以及零售和时尚行业塑料袋邮寄袋使用量的不断增加。在美国对包括塑胶袋邮寄袋在内的某些进口塑胶製品征收关税后,市场出现了混乱。这些贸易措施推高了进口成本,扰乱了供应链,并增加了零售商和物流供应商的营运费用。虽然本土製造商面临的海外竞争有所减弱,但他们在扩大产量和应对材料价格上涨方面仍面临挑战。这种情况促使企业实现采购多元化,并提高国内製造能力,从而重塑了更具韧性的供应格局。

对自动化包装系统的日益依赖推动了塑胶袋邮寄袋的普及,因为这些产品可以无缝整合到高速包装生产线。诸如双密封胶带之类的增强型产品功能正成为标配,尤其是在电子产品、个人护理和服装等电商类别中。这些功能升级支援轻鬆退货,缩短运输时间,并满足消费者对可持续便捷包装日益增长的期望。随着包裹数量的持续攀升,品牌优先考虑紧凑、自动化的邮寄袋,以支援高效的物流并提高客户满意度。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 99亿美元 |

| 预测值 | 419亿美元 |

| 复合年增长率 | 15.6% |

在材料领域,低密度聚乙烯 (LDPE) 占据市场主导地位,2024 年市场规模达 38 亿美元。 LDPE 价格实惠、强度高、适应性强,是电商领域中小型企业的首选材料。其热塑性特性使其具备客製化、印刷和生产灵活性。自封盖和防篡改功能可增强产品在运输过程中的安全性,这在当今高风险环境中至关重要。 LDPE 良好的性价比使其成为可扩展包装解决方案的首选材料。

按产品类型划分,无衬垫邮寄袋占最大市场份额,2024 年价值达 65 亿美元。随着线上时尚和消费品的兴起,这类产品的使用量也在增长,而这些产品通常只需要极少的内部保护。这些轻量、经济高效的邮寄袋有助于降低运输成本,并支援大量配送模式。较新的款式包括可重复密封封口和双黏合条,以支援简化的退货处理,尤其是在逆向物流在客户服务中发挥关键作用的行业。

2024年,美国塑胶袋邮寄袋市场产值达31亿美元,这得益于市场对塑胶袋邮寄袋等轻量化、柔性包装解决方案日益增长的需求。由于注重营运效率和更快的配送週期,塑胶袋邮寄袋已成为大型电子零售商和物流供应商包装策略的核心。此外,当日达和隔日达的日益普及,促使企业选择紧凑、经济高效的包装,以减轻运输重量并提高物流灵活性。

全球塑胶袋邮寄袋市场的主要参与者包括 PAC Worldwide Corporation、Sealed Air、BRAVO PACK INC.、Jflexy Packaging、Crown Packaging Corp.、EcoEnclose LLC、Polycell International、深圳市鸿翔包装有限公司、Novolex、Polypak Packaging、WHWHaging、Abricoan、Project、Awywash、Awaiam。各公司在研发方面投入大量资金,以生产符合自动化要求和永续发展目标的邮寄袋。主要参与者正在将再生和可回收材料整合到其产品线中,同时提高耐用性和防篡改能力。许多公司正在扩大国内生产能力,以降低供应链风险并提高对需求高峰的回应能力。此外,与电商平台和第三方物流供应商建立策略合作伙伴关係也有助于提升市场渗透率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 电子商务产业快速扩张

- 中小企业和D2C品牌的成长

- 环境法规推动材料创新

- 对经济高效包装的需求不断增长

- 零售和服饰业的采用率不断提高

- 产业陷阱与挑战

- 环境问题和塑胶禁令

- 回收基础设施缺口

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按材料,2021 年至 2034 年

- 主要趋势

- 低密度聚乙烯(LDPE)

- 高密度聚乙烯(HDPE)

- 共挤聚乙烯

- 再生聚乙烯

- 其他的

第六章:市场估计与预测:按产品,2021 年至 2034 年

- 主要趋势

- 加垫邮件

- 无衬垫邮件

第七章:市场估计与预测:按关闭类型,2021 年至 2034 年

- 主要趋势

- 自密封

- 热封

- 拉炼/滑块密封

- 纽带或繫带闭合

第 8 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 电子商务与零售

- 服装和鞋类

- 电子产品及配件

- 医疗保健和製药

- 其他的

第九章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Abriso Jiffy

- BRAVO PACK INC.

- Crown Packaging Corp.

- EcoEnclose LLC

- International Plastics

- Intertape Polymer Group Inc.

- Jflexy Packaging

- Novolex

- PAC Worldwide Corporation

- Polycell International

- Polypak Packaging

- Pregis LLC

- ProAmpac

- Sealed Air

- Shenzhen Hongxiang Packaging Co., Ltd

- WH Packaging

The Global Polybag Mailers Market was valued at USD 9.9 billion in 2024 and is estimated to grow at a CAGR of 15.6% to reach USD 41.9 billion by 2034, driven by the continued surge in e-commerce, paired with increasing use across the retail and fashion industries. The market saw disruptions following US tariffs on certain imported plastic goods, including polybag mailers. These trade measures inflated import costs, disrupted supply chains, and increased operating expenses for retailers and logistics providers. While local manufacturers faced less overseas competition, they encountered challenges in scaling output and handling rising material prices. This scenario prompted businesses to diversify sourcing and ramp up domestic manufacturing capacity, leading to a reshaped and more resilient supply landscape.

Increased reliance on automated packaging systems drives polybag mailer adoption, as these products seamlessly integrate into high-speed packing lines. Enhanced product features like double-seal adhesive strips are becoming standard, particularly in e-commerce categories such as electronics, personal care, and clothing. These functional upgrades support easy returns, reduce shipping time, and meet growing consumer expectations for sustainable, convenient packaging. As parcel volumes continue to climb, brands prioritize compact, automation-ready mailers that support efficient logistics and enhance customer satisfaction.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $9.9 Billion |

| Forecast Value | $41.9 Billion |

| CAGR | 15.6% |

Among materials, low-density polyethylene (LDPE) dominated the market, generating USD 3.8 billion in 2024. LDPE's affordability, strength, and adaptability make it the preferred choice, especially for small and mid-sized enterprises in e-commerce. Its thermoplastic nature allows for customization, printing, and production flexibility. Self-sealing closures and tamper-resistant options enhance product security during delivery, essential in today's heightened risk environments. LDPE's favorable cost-to-performance ratio ensures it remains the material of choice for scalable packaging solutions.

By product type, non-cushioned mailers held the largest market share, valued at USD 6.5 billion in 2024. Their use has grown alongside the rise of online fashion and consumer goods, which typically require minimal interior protection. These lightweight, cost-efficient mailers help reduce shipping expenses and support high-volume distribution models. Newer variations include resealable closures and dual adhesive strips to support streamlined return handling, especially in sectors where reverse logistics play a critical role in customer service.

United States Polybag Mailers Market generated USD 3.1 billion in 2024, driven by the increasing demand for lightweight, flexible packaging solutions like polybag mailers. Focusing on operational efficiency and faster fulfillment cycles has placed polybag mailers at the center of packaging strategies for major e-retailers and logistics providers. In addition, the rising popularity of same-day and next-day deliveries is pushing companies to opt for compact, cost-effective packaging that reduces shipping weight and improves logistics agility.

Key players in the Global Polybag Mailers Market include PAC Worldwide Corporation, Sealed Air, BRAVO PACK INC., Jflexy Packaging, Crown Packaging Corp., EcoEnclose LLC, Polycell International, Shenzhen Hongxiang Packaging Co., Ltd, Novolex, Polypak Packaging, WH Packaging, Abriso Jiffy, ProAmpac, Pregis LLC, Intertape Polymer Group Inc., and International Plastics. Companies invest heavily in R&D to produce mailers that align with automation requirements and sustainability goals. Major players are integrating recycled and recyclable materials into their product lines while enhancing durability and tamper resistance. Many firms are expanding production capabilities domestically to reduce supply chain risks and improve responsiveness to demand spikes. Additionally, strategic partnerships with e-commerce platforms and third-party logistics providers are helping boost market penetration.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and Future Considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rapid expansion of e-commerce industry

- 3.3.1.2 Growth of SMEs and D2C brands

- 3.3.1.3 Environmental regulations driving material innovation

- 3.3.1.4 Growing demand for cost effective packaging

- 3.3.1.5 Increasing adoption in retail and apparel industry

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Environmental concerns and plastic bans

- 3.3.2.2 Recycling infrastructure gaps

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Material, 2021 – 2034 (USD Million & Million Units)

- 5.1 Key trends

- 5.2 Low-density polyethylene (LDPE)

- 5.3 High-density polyethylene (HDPE)

- 5.4 Co-extruded polyethylene

- 5.5 Recycled polyethylene

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Product, 2021 – 2034 (USD Million & Million Units)

- 6.1 Key trends

- 6.2 Cushioned mailers

- 6.3 Non-cushioned mailers

Chapter 7 Market Estimates and Forecast, By Closure Type, 2021 – 2034 (USD Million & Million Units)

- 7.1 Key trends

- 7.2 Self-seal

- 7.3 Heat seal

- 7.4 Zip/slider seal

- 7.5 Button or tie closure

Chapter 8 Market Estimates and Forecast, By Application, 2021 – 2034 (USD Million & Million Units)

- 8.1 Key trends

- 8.2 E-commerce & retail

- 8.3 Apparel & footwear

- 8.4 Electronics & accessories

- 8.5 Healthcare & pharmaceuticals

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Million & Million Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Abriso Jiffy

- 10.2 BRAVO PACK INC.

- 10.3 Crown Packaging Corp.

- 10.4 EcoEnclose LLC

- 10.5 International Plastics

- 10.6 Intertape Polymer Group Inc.

- 10.7 Jflexy Packaging

- 10.8 Novolex

- 10.9 PAC Worldwide Corporation

- 10.10 Polycell International

- 10.11 Polypak Packaging

- 10.12 Pregis LLC

- 10.13 ProAmpac

- 10.14 Sealed Air

- 10.15 Shenzhen Hongxiang Packaging Co., Ltd

- 10.16 WH Packaging