|

市场调查报告书

商品编码

1755271

包络追踪晶片市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Envelope Tracking Chip Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

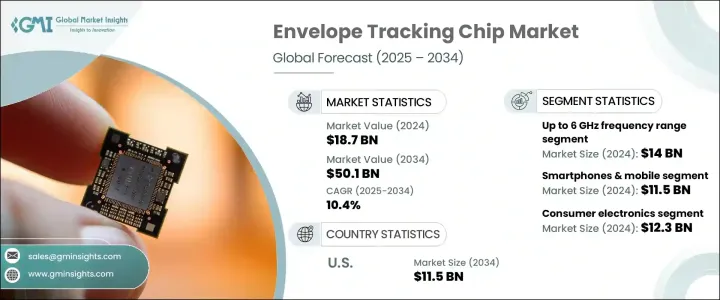

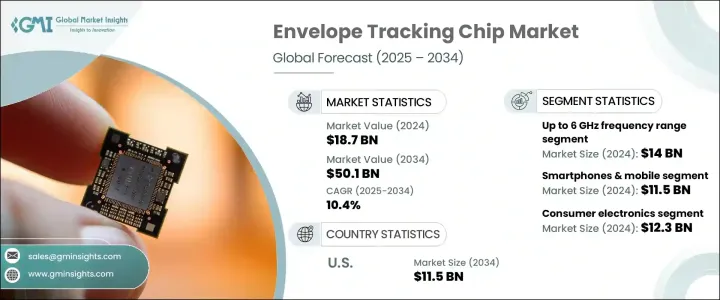

2024年,全球包络追踪晶片市场规模达187亿美元,预计到2034年将以10.4%的复合年增长率成长,达到501亿美元。 5G网路部署的激增显着增加了行动装置对节能射频组件的需求。对进口半导体征收关税的贸易政策提高了国内生产商的製造成本,促使全球供应链转变。这种转变鼓励了国内投资以及与印度、越南和台湾等国家和地区的战略合作,以减少依赖并降低关税相关风险。

包络追踪晶片使功率放大器的运行功耗降低高达 40%,这对于延长智慧型手机电池续航时间并保持热效率至关重要。这些晶片对于 5G 设备多频段射频系统实现最佳性能至关重要。全球对小型基地台和 5G 基地台的需求不断增长,进一步加速了市场扩张。开放式 RAN 架构中的节能优先顺序凸显了包络追踪在降低电信营运成本方面的作用。支援高容量 5G 网路的波束成形和大规模 MIMO 等技术也推动了对高效能功率放大器的需求,推动了包络追踪晶片在全球电信基础设施中的应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 187亿美元 |

| 预测值 | 501亿美元 |

| 复合年增长率 | 10.4% |

2024年,频率范围高达6 GHz的细分市场以140亿美元的估值领先市场。该细分市场因其在5G行动网路、LTE系统和Wi-Fi 6/7技术中的重要性而占据主导地位。这些包络追踪晶片对于提升射频前端设计中功率放大器的效率至关重要,可降低高达40%的功耗。随着网路营运商专注于覆盖范围优化,北美和亚太地区6 GHz以下5G网路的快速普及正在推动需求。 Skyworks Solutions、德州仪器和高通等公司持续创新包络追踪技术,以支援动态频谱共享和载波聚合。基于人工智慧的追踪演算法的增强也支援在频宽密集型环境中(尤其是在流量高峰期)实现最佳的功率性能。

预计到2034年,汽车领域的包络追踪晶片市场将以16.2%的复合年增长率成长。这一强劲增长得益于5G-V2X技术的日益普及以及自动驾驶技术的不断发展。包络追踪晶片用于优化汽车雷达和联网远端资讯处理系统的能耗,尤其是在用于导航和安全功能的24/77 GHz系统中。欧洲和中国等地区对V2X功能的监管要求,进一步推动了支援包络追踪的射频系统在车辆中的应用。英飞凌、恩智浦和高通等领先公司正在设计高可靠性的包络追踪晶片,以满足下一代汽车技术的车规级标准。

预计到2034年,美国包络追踪晶片市场规模将达到115亿美元。联邦政府旨在提升国内半导体製造能力的措施推动了这一成长。智慧型手机中人工智慧驱动的包络追踪功能的日益整合是关键的成长动力。各大电信业者持续推动5G网路建设,持续推动高效能射频组件的需求。包括ADI公司和Qorvo在内的美国主要製造商继续以尖端的GaN基包络追踪解决方案引领市场,尤其是在卫星系统和国防应用领域。

全球包络追踪晶片产业值得关注的参与者包括德州仪器 (TI)、ADI 公司、Qorvo 公司、高通技术公司和 Skyworks Solutions 公司。在包络追踪晶片市场营运的公司正专注于开发节能且整合 AI 的射频组件,以支援高速 5G 基础设施和下一代行动装置。在监管激励措施的推动下,对国内製造业的策略性投资正在帮助企业减少对全球供应链的依赖。主要参与者还在扩大与电信和汽车原始设备製造商 (OEM) 的合作,以提供客製化的、特定于应用的包络追踪解决方案。研发工作旨在提高 6 GHz 以下和毫米波频段的晶片效率,同时改善热性能。各公司正在扩大基于 GaN 的设计创新,以用于航太和国防用途。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 价格波动

- 供应链重组

- 生产成本影响

- 需求面影响

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 节能 5G 智慧型手机的需求不断增长

- 5G基础设施和开放式RAN(无线存取网路)部署的扩展

- 汽车雷达和 V2X 通讯的成长

- 国防和卫星通讯现代化

- 产业陷阱与挑战

- 开发成本高

- 复杂设计集成

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依频率范围,2021-2034 年

- 主要趋势

- 高达 6 GHz

- 6 - 24 GHz

- 24 GHz 以上

第六章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 智慧型手机和行动装置

- 基地台和电信基础设施

- 物联网和穿戴式装置

- 车辆

- 军用雷达

- 医疗器材

- 其他的

第七章:市场估计与预测:按最终用途产业,2021-2034 年

- 消费性电子产品

- 电信

- 汽车

- 工业的

- 国防与航太

- 卫生保健

- 其他的

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- Analog Devices, Inc.

- Broadcom Inc

- MediaTek

- Murata Manufacturing Co., Ltd.

- Qorvo, Inc.

- Qualcomm Technologies, Inc.

- R2 Semiconductor, Inc.

- Samsung

- Skyworks Solutions, Inc.

- Texas Instruments

The Global Envelope Tracking Chip Market was valued at USD 18.7 billion in 2024 and is estimated to grow at a CAGR of 10.4% to reach USD 50.1 billion by 2034. The surge in 5G network deployments is significantly increasing the demand for power-efficient RF components in mobile devices. Trade policies that imposed tariffs on imported semiconductors raised manufacturing costs for domestic producers, prompting a shift in the global supply chain. This transition encouraged domestic investments and strategic collaborations with countries like India, Vietnam, and Taiwan to reduce dependency and mitigate tariff-related risks.

Envelope tracking chips enable power amplifiers to operate with up to 40% less energy consumption, which plays a vital role in extending smartphone battery life while maintaining thermal efficiency. These chips are critical to achieving optimal performance in multiband RF systems for 5G devices. The rising demand for small cells and 5G base stations worldwide is further accelerating market expansion. Energy-saving priorities in open RAN architectures are highlighting the role of envelope tracking in lowering telecom operational costs. Technologies such as beamforming and massive MIMO that support high-capacity 5G networks are also boosting the need for efficient power amplifiers, propelling the use of ET chips across telecom infrastructure globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $18.7 Billion |

| Forecast Value | $50.1 Billion |

| CAGR | 10.4% |

In 2024, the frequency range up to 6 GHz segment led the market with a valuation of USD 14 billion. This segment dominates due to its importance in 5G mobile networks, LTE systems, and Wi-Fi 6/7 technology. These ET chips are essential for boosting power amplifier efficiency in RF front-end designs, offering energy reductions of up to 40%. Rapid adoption of Sub-6 GHz 5G in North America and Asia-Pacific is driving demand, as network operators focus on coverage optimization. Players such as Skyworks Solutions, Texas Instruments, and Qualcomm continue to innovate ET technologies that support dynamic spectrum sharing and carrier aggregation. Enhancements in AI-based tracking algorithms also support optimal power performance in bandwidth-intensive environments, particularly during peak traffic.

The envelope tracking chip market from the automotive segment is set to grow at a CAGR of 16.2% through 2034. This strong growth is linked to the increasing deployment of 5G-V2X and the progression of autonomous driving. ET chips are used to optimize energy use in automotive radar and connected telematics, particularly in 24/77 GHz systems for navigation and safety functions. Regulatory mandates requiring V2X functionality in regions such as Europe and China are further boosting the use of ET-enabled RF systems in vehicles. Leading companies like Infineon, NXP, and Qualcomm are designing high-reliability ET chips to meet automotive-grade standards for next-generation vehicle technologies.

U.S. Envelope Tracking Chip Market is expected to reach USD 11.5 billion by 2034. Growth is supported by federal initiatives aimed at increasing domestic semiconductor manufacturing capacity. The rising integration of AI-driven envelope tracking in smartphones is a key growth driver. Ongoing 5G expansion by national telecom providers is sustaining demand for high-performance RF components. Major manufacturers in the U.S., including Analog Devices and Qorvo, continue to lead with cutting-edge GaN-based ET solutions, particularly for satellite systems and defense applications.

Noteworthy participants in the Global Envelope Tracking Chip Industry include Texas Instruments, Analog Devices, Qorvo, Inc., Qualcomm Technologies, Inc., and Skyworks Solutions, Inc. Companies operating in the envelope-tracking chip market are focusing on developing energy-efficient and AI-integrated RF components to support high-speed 5G infrastructure and next-gen mobile devices. Strategic investments in domestic manufacturing, driven by regulatory incentives, are helping firms reduce dependency on global supply chains. Major players are also expanding their partnerships with telecom and automotive OEMs to deliver custom, application-specific envelope-tracking solutions. R&D efforts are being directed at enhancing chip efficiency across sub-6 GHz and mmWave bands while improving thermal performance. Firms are scaling innovations in GaN-based designs for aerospace and defense uses.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.1.3 Impact on the industry

- 3.2.1.3.1 Supply-side impact

- 3.2.1.3.1.1 Price volatility

- 3.2.1.3.1.2 Supply chain restructuring

- 3.2.1.3.1.3 Production cost implications

- 3.2.1.3.2 Demand-side impact

- 3.2.1.3.2.1 Price transmission to end markets

- 3.2.1.3.2.2 Market share dynamics

- 3.2.1.3.2.3 Consumer response patterns

- 3.2.1.3.1 Supply-side impact

- 3.2.1.4 Key companies impacted

- 3.2.1.5 Strategic industry responses

- 3.2.1.5.1 Supply chain reconfiguration

- 3.2.1.5.2 Pricing and product strategies

- 3.2.1.5.3 Policy engagement

- 3.2.1.6 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for energy-efficient 5G smartphones

- 3.3.1.2 Expansion of 5G infrastructure and open RAN (radio access network) deployments

- 3.3.1.3 Growth in automotive radar and V2X communication

- 3.3.1.4 Defense and satellite communications modernization

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High development costs

- 3.3.2.2 Complex design integration

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Frequency Range, 2021-2034 (USD Billion & Units)

- 5.1 Key trends

- 5.2 Up to 6 GHz

- 5.3 6 - 24 GHz

- 5.4 Above 24 GHz

Chapter 6 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion & Units)

- 6.1 Key trends

- 6.2 Smartphones & mobile devices

- 6.3 Base stations & telecom infrastructure

- 6.4 IoT & wearables

- 6.5 Vehicles

- 6.6 Military radars

- 6.7 Medical devices

- 6.8 Others

Chapter 7 Market Estimates & Forecast, By End Use Industry, 2021-2034 (USD Billion & Units)

- 7.1 Consumer electronics

- 7.2 Telecom

- 7.3 Automotive

- 7.4 Industrial

- 7.5 Defense & aerospace

- 7.6 Healthcare

- 7.7 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion & Units)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Analog Devices, Inc.

- 9.2 Broadcom Inc

- 9.3 MediaTek

- 9.4 Murata Manufacturing Co., Ltd.

- 9.5 Qorvo, Inc.

- 9.6 Qualcomm Technologies, Inc.

- 9.7 R2 Semiconductor, Inc.

- 9.8 Samsung

- 9.9 Skyworks Solutions, Inc.

- 9.10 Texas Instruments