|

市场调查报告书

商品编码

1755281

二维过渡金属碳化物氮化物市场机会、成长动力、产业趋势分析及2025-2034年预测2D Transition Metal Carbides Nitrides Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

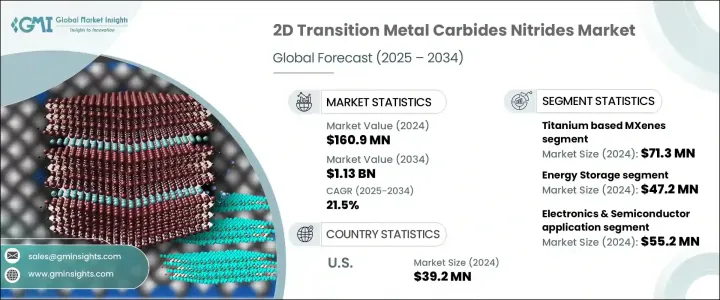

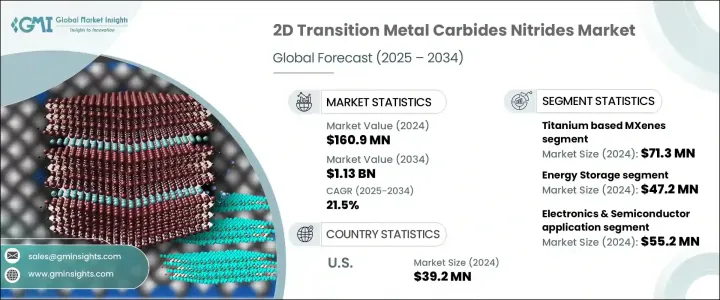

2024 年全球二维过渡金属碳化物氮化物市场价值为 1.609 亿美元,预计到 2034 年将以 21.5% 的复合年增长率成长,达到 11.3 亿美元。各行各业对先进奈米材料日益增长的需求推动了这一增长,其应用在下一代电子产品、储能係统和高性能复合材料中迅速涌现。这些二维材料被称为 MXenes,由于其独特的金属导电性、结构柔韧性和多功能表面化学性质的组合而备受关注。它们能够在保持高导电性和机械强度的同时对錶面进行工程设计,因此特别适合整合到商业系统中。来自全球机构的尖端研究和创新不断增强其商业化准备度,使 MXenes 能够顺利应用于多种工业应用。

2024年,钛基MXenes市场规模达7,130万美元,预计2025年至2034年期间的复合年增长率将达到20.9%。这些MXenes以其卓越的导电性、亲水性和层层结构而着称,使其在许多应用领域具有广泛的应用前景。它们支持高能量密度和稳定性的能力使其成为储能係统、电磁干扰屏蔽和生物感测技术中的重要组件。它们在加工过程中的非扩散特性和极低的毒性进一步支持了其日益广泛的应用,尤其是在电子和国防相关技术领域。人们对这些材料的广泛研究兴趣正在推动其商业化进程,有助于加速其在高影响力领域的部署。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1.609亿美元 |

| 预测值 | 11.3亿美元 |

| 复合年增长率 | 21.5% |

在储能应用领域,2024 年市场规模达 4,720 万美元,预计到 2034 年将以 26.4% 的复合年增长率成长。 MXene 凭藉其超大的表面积和优异的导电性,成为高性能超级电容器的理想选择。其可调的层间距可支援快速离子传输并提高充放电效率,这对于电动车和电网等可扩展储能解决方案至关重要。全球日益向永续能源基础设施转型,加速了对高效、可扩展储能材料的需求,而 MXene 凭藉其高功能性和适应性,在其中发挥关键作用。

电子和半导体应用领域在2024年的营收为5,520万美元,占29.6%的市场份额,预计预测期内的复合年增长率为20.7%。 MXene凭藉其卓越的电气性能和可调节的表面特性,在该领域日益不可或缺。这些特性有助于提升先进半导体装置的微型化、热管理和电路整合。受消费者对更快、更有效率设备日益增长的需求推动,半导体产业持续扩张,这推动了MXene被广泛应用于各种电子元件。

在美国,2024 年二维过渡金属碳化物氮化物市场规模达 3,920 万美元,预计 2025 年至 2034 年的复合年增长率将达到 21.9%。该地区受益于政府在材料科学和奈米技术领域的大力支持,以及强大的电子和国防製造业基础。这些因素,加上国内生产能力和强劲的进出口动态,使美国成为这个不断发展的市场的关键参与者。研究投入、与学术机构的合作以及成熟的产业生态系统,进一步支持了 MXene 在各领域的快速应用。

中国在全球市场持续保持强劲地位,这得益于其不断扩张的清洁能源和电动汽车产业,这些产业是先进材料的主要终端用户。中国在MXene基组件和技术的供应链中扮演着至关重要的角色,尤其是在亚太和欧洲地区。中国对材料创新的战略重点及其大规模生产能力使其能够满足国内外对这些新兴材料的需求。

全球领先的市场参与者正将投资导向生物电子学、新一代能源设备和功能性涂层等领域的研究驱动型产品开发。各公司在材料产品中优先考虑客製化和品质,并在各种应用领域推动创新。合作开发、专有合成方法和独家授权协议正在帮助利害关係人巩固竞争优势,推动MXenes在未来十年的进一步发展和更广泛的商业应用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL分析

- 价格趋势

- 按地区

- 按产品

- 未来市场趋势

- 科技与创新格局

- 当前的技术趋势

- 新兴技术

- 专利态势

- 贸易统计资料(HS 编码)(註:仅提供主要国家的贸易统计数据

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 竞争格局

- 公司概况

- 产品组合和规格

- SWOT分析

- 公司市占率分析

- 各公司全球市场占有率

- 区域市占率分析

- 产品组合份额分析

- 策略倡议

- 併购

- 伙伴关係和合作

- 产品发布和创新

- 扩张计划和投资

- 公司标竿分析

- 产品创新标桿

- 定价策略比较

- 配电网路比较

- 客户服务和支援比较

第五章:市场估计与预测:按材料类型,2021 - 2034 年

- 主要趋势

- 钛基MXenes

- 碳化钛

- 碳化钛

- Ti3CN

- 其他钛基MXenes

- 铌基MXenes

- Nb2C

- Nb4C3

- 其他铌基MXenes

- 钒基MXenes

- V2C

- V4C3

- 其他钒基MXenes

- 钼基MXenes

- Mo2C

- 其他钼基MXenes

- 钽基MXenes

- 碳化钽

- 其他钽基MXenes

- 其他MXene类型

第六章:市场估计与预测:依综合方法,2021 - 2034 年

- 主要趋势

- 氢氟酸(HF)蚀刻

- 氟盐+HCl蚀刻

- 氟化锂 + 盐酸

- 氟化钠+盐酸

- 钾+盐酸

- 其他氟化盐组合

- 电化学蚀刻

- 熔盐蚀刻

- 其他合成方法

第七章:市场估计与预测:依形式,2021 - 2034

- 主要趋势

- 粉末

- 分散体/油墨

- 水性分散体

- 有机溶剂分散体

- 其他分散类型

- 电影

- 独立式薄膜

- 支援影片

- 其他影片类型

- 复合材料

- 其他形式

第八章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 储能

- 电池

- 锂离子电池

- 钠离子电池

- 其他电池类型

- 超级电容器

- 其他储能应用

- 电池

- 电子与光电子

- 透明导电薄膜

- 场效电晶体

- 电磁干扰(EMI)屏蔽

- 其他电子应用

- 感测器和生物感测器

- 气体感测器

- 生物感测器

- 压力/应变感测器

- 其他感测器应用

- 催化

- 电催化

- 光催化

- 其他催化应用

- 环境修復

- 水净化

- 气体分离

- 其他环境应用

- 生物医学应用

- 药物输送

- 生物影像

- 光热疗法

- 其他生物医学应用

- 复合材料和涂料

- 其他应用

第九章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 电子和半导体

- 能源与电力

- 医疗保健和製药

- 汽车与运输

- 环境与水处理

- 航太与国防

- 研究与学术

- 其他最终用途产业

第十章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第 11 章:公司简介

- Drexel University (Technology Transfer)

- 2D Materials Pte Ltd.

- Nanochemazone

- ACS Material, LLC

- Alfa Chemistry

- American Elements

- Sigma-Aldrich (Merck KGaA)

- Ossila Ltd.

- Nanografi Nano Technology

- SkySpring Nanomaterials, Inc.

- Cheap Tubes Inc.

The Global 2D Transition Metal Carbides Nitrides Market was valued at USD 160.9 million in 2024 and is estimated to grow at a CAGR of 21.5% to reach USD 1.13 billion by 2034. The rising demand for advanced nanomaterials across industries is fueling this growth, with applications rapidly emerging in next-generation electronics, energy storage systems, and high-performance composite materials. Known as MXenes, these two-dimensional materials are gaining prominence due to their unique combination of metallic conductivity, structural flexibility, and versatile surface chemistry. The ability to engineer their surfaces while retaining high conductivity and mechanical strength makes them especially suitable for integration into commercial systems. Cutting-edge research and innovation from global institutions continue to enhance their commercial readiness, enabling the smooth adaptation of MXenes across multiple industrial applications.

The titanium-based MXenes segment stood at USD 71.3 million in 2024 and is expected to record a CAGR of 20.9% between 2025 and 2034. These MXenes are recognized for their outstanding conductivity, hydrophilic nature, and layer-by-layer structure, making them highly relevant for a wide array of applications. Their capability to support high energy density and stability positions them as valuable components in energy storage systems, electromagnetic interference shielding, and biosensing technologies. Their non-diffusive behavior during processes and minimal toxicity further support their growing adoption, particularly in electronics and defense-related technologies. The widespread research interest in these materials is driving commercialization efforts, helping accelerate their deployment across high-impact sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $160.9 million |

| Forecast Value | $1.13 billion |

| CAGR | 21.5% |

In the energy storage application segment, the market was valued at USD 47.2 million in 2024 and is projected to grow at a CAGR of 26.4% through 2034. Thanks to their ultra-large surface area and superior conductivity, MXenes are ideal candidates for high-performance supercapacitors. Their tunable interlayer spacing supports fast ion transport and enhances charge-discharge efficiency, which is crucial for scalable storage solutions such as electric vehicles and power grids. The growing global shift toward sustainable energy infrastructure is accelerating the demand for efficient and scalable energy storage materials, where MXenes play a critical role due to their high functionality and adaptability.

The electronics and semiconductor application segment accounted for USD 55.2 million in 2024, capturing a market share of 29.6%, and is estimated to register a CAGR of 20.7% during the forecast period. MXenes are increasingly indispensable in this field owing to their exceptional electrical performance and tunable surface characteristics. These attributes contribute to improved miniaturization, heat management, and circuit integration in advanced semiconductor devices. The continued expansion of the semiconductor sector, driven by growing consumer demand for faster and more efficient devices, is propelling the inclusion of MXenes in a wide range of electronic components.

In the United States, the 2D transition metal carbides nitrides market was valued at USD 39.2 million in 2024 and is projected to grow at a CAGR of 21.9% from 2025 to 2034. The region benefits from significant government backing in materials science and nanotechnology, along with a strong base in electronics and defense manufacturing. These factors, combined with domestic production capabilities and robust import-export dynamics, make the U.S. a key player in this evolving market. Investments in research, partnerships with academic institutions, and the presence of a mature industrial ecosystem further support the rapid adoption of MXenes across various domains.

China continues to maintain a strong foothold in the global market, driven by its expanding clean energy and electric vehicle sectors, which are major end-users of advanced materials. The country plays a crucial role in the supply chain for MXene-based components and technologies, particularly in the Asia Pacific and European regions. China's strategic focus on materials innovation and its large-scale production capabilities enable it to meet both domestic and international demand for these emerging materials.

Globally, leading market participants are channeling investments toward research-driven product development in areas such as bioelectronics, next-gen energy devices, and functional coatings. Companies are prioritizing customization and quality in their material offerings, pushing innovation across various use cases. Collaborative developments, proprietary synthesis methods, and exclusive licensing agreements are helping stakeholders solidify their competitive edge, fueling further advancements and broader commercial uptake of MXenes in the coming decade.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Material Type

- 2.2.3 Form

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.6.1 Technology and Innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Competitive landscape

- 4.1.1 Company overview

- 4.1.2 Product portfolio and specifications

- 4.1.3 SWOT analysis

- 4.2 Company market share analysis, 2024

- 4.2.1 Global market share by company

- 4.2.2 Regional market share analysis

- 4.2.3 Product portfolio share analysis

- 4.3 Strategic initiative

- 4.3.1 Mergers and acquisitions

- 4.3.2 Partnerships and collaborations

- 4.3.3 Product launches and innovations

- 4.3.4 Expansion plans and investments

- 4.4 Company benchmarking

- 4.4.1 Product innovation benchmarking

- 4.4.2 Pricing strategy comparison

- 4.4.3 Distribution network comparison

- 4.4.4 Customer service and support comparison

Chapter 5 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Titanium based MXenes

- 5.2.1 Ti3C2

- 5.2.2 Ti2C

- 5.2.3 Ti3CN

- 5.2.4 Other Titanium based MXenes

- 5.3 Niobium based MXenes

- 5.3.1 Nb2C

- 5.3.2 Nb4C3

- 5.3.3 Other Niobium based MXenes

- 5.4 Vanadium Based MXenes

- 5.4.1 V2C

- 5.4.2 V4C3

- 5.4.3 Other Vanadium based MXenes

- 5.5 Molybdenum based MXenes

- 5.5.1 Mo2C

- 5.5.2 Other Molybdenum based MXenes

- 5.6 Tantalum based MXenes

- 5.6.1 Ta4C3

- 5.6.2 Other tantalum based MXenes

- 5.7 Other MXene types

Chapter 6 Market Estimates & Forecast, By Synthesis Method, 2021 - 2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Hydrofluoric acid (HF) etching

- 6.3 Fluoride salt + HCl etching

- 6.3.1 LiF + HCl

- 6.3.2 NaF + HCl

- 6.3.3 KF + HCl

- 6.4 Other fluoride salt combinations

- 6.5 Electrochemical etching

- 6.6 Molten salt etching

- 6.7 Other synthesis methods

Chapter 7 Market Estimates & Forecast, By Form, 2021 - 2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Powder

- 7.3 Dispersion/ink

- 7.3.1 Aqueous dispersions

- 7.3.2 Organic solvent dispersions

- 7.3.3 Other dispersion types

- 7.4 Film

- 7.4.1 Free standing films

- 7.4.2 Supported films

- 7.4.3 Other film types

- 7.5 Composite materials

- 7.6 Other forms

Chapter 8 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Energy storage

- 8.2.1 Batteries

- 8.2.1.1 Lithium ion batteries

- 8.2.1.2 Sodium ion batteries

- 8.2.1.3 Other battery types

- 8.2.2 Supercapacitors

- 8.2.3 Other energy storage applications

- 8.2.1 Batteries

- 8.3 Electronics & optoelectronics

- 8.3.1 Transparent conductive films

- 8.3.2 Field effect transistors

- 8.3.3 Electromagnetic interference (emi) shielding

- 8.3.4 Other electronics applications

- 8.4 Sensors & biosensors

- 8.4.1 Gas sensors

- 8.4.2 Biosensors

- 8.4.3 Pressure/strain sensors

- 8.4.4 Other sensor applications

- 8.5 Catalysis

- 8.5.1 Electrocatalysis

- 8.5.2 Photocatalysis

- 8.5.3 Other catalytic applications

- 8.6 Environmental remediation

- 8.6.1 Water purification

- 8.6.2 Gas separation

- 8.6.3 Other environmental applications

- 8.7 Biomedical applications

- 8.7.1 Drug delivery

- 8.7.2 Bioimaging

- 8.7.3 Photothermal therapy

- 8.7.4 Other biomedical applications

- 8.8 Composites & coatings

- 8.9 Other applications

Chapter 9 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Electronics & semiconductor

- 9.3 Energy & power

- 9.4 Healthcare & pharmaceuticals

- 9.5 Automotive & transportation

- 9.6 Environmental & water treatment

- 9.7 Aerospace & defense

- 9.8 Research & academia

- 9.9 Other end use industries

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 Drexel University (Technology Transfer)

- 11.2 2D Materials Pte Ltd.

- 11.3 Nanochemazone

- 11.4 ACS Material, LLC

- 11.5 Alfa Chemistry

- 11.6 American Elements

- 11.7 Sigma-Aldrich (Merck KGaA)

- 11.8 Ossila Ltd.

- 11.9 Nanografi Nano Technology

- 11.10 SkySpring Nanomaterials, Inc.

- 11.11 Cheap Tubes Inc.