|

市场调查报告书

商品编码

1755289

闸极驱动器 IC 市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Gate Driver IC Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

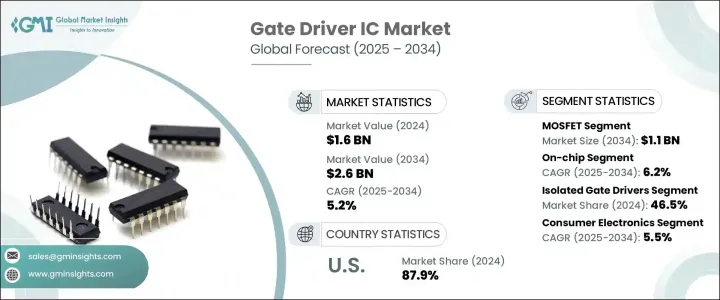

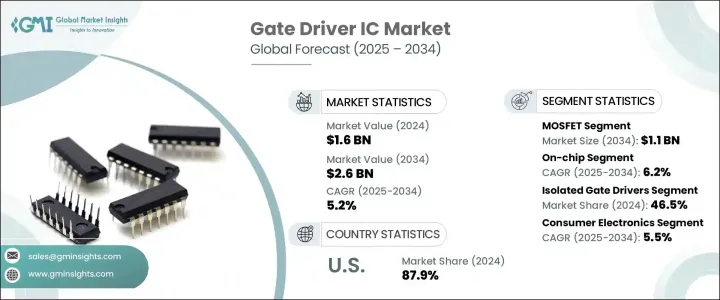

2024年,全球闸极驱动器IC市场规模达16亿美元,预计2034年将以5.2%的复合年增长率成长,达到26亿美元。这一增长主要源于电动和混合动力汽车(EV/HEV)的日益普及,以及工业自动化和机器人技术的日益普及。随着製造、物流和製程控制等行业向更高程度的自动化迈进,对高效可靠的电源管理解决方案的需求也随之激增。闸极驱动器IC对于自动化系统中的马达驱动器、执行器和电源转换器的供电至关重要,使其成为将製造设施转变为智慧生产中心的重要组成部分。

儘管市场需求强劲,但由于川普政府时期征收的关税,市场也面临挑战。这些关税,尤其是针对中国进口产品的关税,影响了全球半导体供应链和闸极驱动器IC製造商,其中许多製造商依赖中国零件。关税增加了生产成本和供应链的不确定性,促使企业寻求替代采购策略或实现生产多元化,以最大限度地降低成本影响。这些干扰一度减缓了市场成长,但也促使企业重新思考其全球供应链。随着工业自动化的发展和电动车的普及,闸极驱动器IC市场正在稳步扩张。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 16亿美元 |

| 预测值 | 26亿美元 |

| 复合年增长率 | 5.2% |

栅极驱动器IC市场进一步按电晶体类型细分,包括MOSFET、IGBT和其他类别。其中,MOSFET市场规模预计到2034年将达到11亿美元。 MOSFET(金属氧化物半导体场效电晶体)广泛应用于电力电子领域,尤其是在消费性电子、电源以及各种中低功率应用。其高效率和多功能性使其成为推动多个行业进步的关键元件。 GaN基MOSFET(氮化镓)应用的日益普及也促进了市场的成长。

闸极驱动器IC市场的另一个关键细分领域是连接方式,包括晶片和分立配置。预计到2034年,片上闸极驱动器IC市场的复合年增长率将达到6.2%,这反映了市场对更紧凑、整合度更高的解决方案日益增长的需求。片上闸极驱动器IC在同一晶片内整合了控制和保护功能,显着降低了系统复杂性并节省了宝贵的空间。这使得它们特别适合需要高整合度和小型化的应用,例如紧凑型电源模组、穿戴式装置和可携式电子设备。

在电动车市场、航太电子和工业自动化的推动下,美国闸极驱动器IC市场在2024年占据了87.9%的市场。支持国内半导体製造业的《晶片法案》(CHIPS Act)增加了研发资金,有助于进一步推动闸极驱动器IC技术的创新。此外,美国电动车新创公司和国防承包商的崛起也刺激了对高性能闸极驱动器IC的需求。

全球闸极驱动器 IC 市场的主要参与者包括英飞凌科技、Allegro Microsystems、博通、Diodes Incorporated 和 ADI 公司。为了巩固市场地位,闸极驱动器 IC 市场的公司专注于提高产品性能和能源效率的创新。大量的研发投资开发了新的闸极驱动器 IC 技术,这些技术可以提供更快的开关速度、更高的可靠性和更好的热管理。与汽车、航太和工业自动化等行业主要参与者的策略合作正在帮助公司扩大产品供应。许多公司正在实现供应链多元化,以减轻关税等地缘政治因素的影响,同时国内生产能力满足不断增长的需求。此外,该公司正在努力加强其在新兴市场的影响力,这些市场的工业自动化和电动车普及率正在迅速增长,有助于巩固其全球影响力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 电动和混合动力汽车(EV/HEV)的普及率不断提高

- 再生能源系统需求不断成长

- 增加工业自动化和机器人技术的部署

- 消费性电子及家电业务扩张

- 智慧电网和配电系统中闸极驱动器 IC 的集成

- 产业陷阱与挑战

- 设计复杂性高,整合挑战大

- 散热和热管理问题增加

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- Pestel 分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场预估与预测:依电晶体类型,2021 - 2034

- 主要趋势

- 场效电晶体

- 绝缘栅双极电晶体(IGBT)

- 其他的

第六章:市场估计与预测:按附着方式,2021 - 2034 年

- 主要趋势

- 片上

- 离散的

第七章:市场估计与预测:依隔离类型,2021 - 2034

- 主要趋势

- 隔离闸极驱动器

- 光隔离

- 磁隔离

- 电容隔离

- 非隔离闸极驱动器

第八章:市场估计与预测:按最终用途产业,2021 - 2034 年

- 主要趋势

- 消费性电子产品

- 汽车

- 能源与电力

- 电信

- 其他的

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第十章:公司简介

- Allegro Microsystems

- Analog Devices

- Broadcom

- Diodes Incorporated

- Infineon Technologies

- Littelfuse

- Microchip Technology

- NXP Semiconductors

- Onsemi

- Renesas Electronics

- Rohm Semiconductor

- Semikron Danfoss

- Skyworks Solutions

- STMicroelectronics

- Texas Instruments

- Toshiba

- Vishay Intertechnology

- Wolfspeed

The Global Gate Driver IC Market was valued at USD 1.6 billion in 2024 and is estimated to grow at a CAGR of 5.2% to reach USD 2.6 billion by 2034. The growth is driven by the rising adoption of electric and hybrid electric vehicles (EV/HEV), alongside the growing implementation of industrial automation and robotics. As industries move toward greater automation in manufacturing, logistics, and process control, the need for efficient and reliable power management solutions has surged. Gate driver ICs are critical for powering motor drives, actuators, and power converters in automated systems, making them an essential component for transforming manufacturing facilities into smart production hubs.

While the market is witnessing robust demand, it has faced challenges due to tariffs imposed during the Trump administration. These tariffs, particularly on Chinese imports, impacted the global semiconductor supply chain and gate driver IC manufacturers, many of whom relied on Chinese components. The tariffs increased production costs and supply chain uncertainties, prompting businesses to seek alternative sourcing strategies or diversify their production to minimize cost impacts. These disruptions slowed market growth for a time but also led companies to rethink their global supply chains. As industrial automation grows and EV adoption accelerates, the market for gate driver ICs is steadily expanding.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.6 Billion |

| Forecast Value | $2.6 Billion |

| CAGR | 5.2% |

The gate driver IC market is further segmented by transistor type, which includes MOSFET, IGBT, and other categories. Among these, the MOSFET segment is expected to reach USD 1.1 billion by 2034. MOSFETs (Metal-Oxide-Semiconductor Field-Effect Transistors) are widely utilized in power electronics, particularly in consumer electronics, power supplies, and various low to mid-power applications. Their efficiency and versatility have made them a key component in driving advancements across several sectors. The increasing use of GaN-based (Gallium Nitride) MOSFETs has also contributed to market growth.

Another key area of segmentation in the gate driver IC market is the mode of attachment, which includes on-chip and discrete configurations. The on-chip gate driver IC segment is expected to grow at a CAGR of 6.2% through 2034, reflecting the increasing demand for more compact and integrated solutions. On-chip gate driver ICs integrate control and protection functions within the same chip, significantly reducing system complexity and saving valuable space. This makes them particularly suitable for applications that require high integration and miniaturization, such as in compact power modules, wearables, and portable electronics.

United States Gate Driver IC Market accounted for 87.9% share in 2024 driven by the electric vehicle market, aerospace electronics, and industrial automation. The CHIPS Act, which supports domestic semiconductor manufacturing, has increased R&D funding, helping to further drive innovation in gate driver IC technologies. Additionally, the rise of electric vehicle startups and defense contractors in the U.S. boosts the demand for high-performance gate driver ICs.

Key players in the Global Gate Driver IC Market include Infineon Technologies, Allegro Microsystems, Broadcom, Diodes Incorporated, and Analog Devices. To strengthen their market position, companies in the gate driver IC market focus on innovations that improve product performance and energy efficiency. Significant R&D investments developed new gate driver IC technologies that offer faster switching speeds, higher reliability, and better thermal management. Strategic collaborations with key players in industries like automotive, aerospace, and industrial automation are helping companies expand their product offerings. Many companies are diversifying their supply chains to mitigate the impact of geopolitical factors such as tariffs, while domestic production capacity meets rising demand. Moreover, companies are working to enhance their presence in emerging markets, where industrial automation and electric vehicle adoption are rapidly growing, helping to solidify their global footprint.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1.1 Supply chain reconfiguration

- 3.2.4.1.2 Pricing and product strategies

- 3.2.4.1.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growing adoption of electric and hybrid electric vehicles (EV/HEV)

- 3.3.1.2 Rising demand for renewable energy systems

- 3.3.1.3 Increasing deployment of industrial automation and robotics

- 3.3.1.4 Expansion of consumer electronics and home appliances

- 3.3.1.5 Integration of gate driver ICs in smart grid and power distribution systems

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 High design complexity and integration challenges

- 3.3.2.2 Increased heat dissipation and thermal management issues

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 Pestel analysis

Chapter 4 Competitive landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Transistor Type, 2021 - 2034 (USD Million & Units)

- 5.1 Key trends

- 5.2 MOSFET

- 5.3 IGBT

- 5.4 Others

Chapter 6 Market Estimates & Forecast, By Mode of Attachment, 2021 - 2034 (USD Million & Units)

- 6.1 Key trends

- 6.2 On-chip

- 6.3 Discrete

Chapter 7 Market Estimates & Forecast, By Isolation Type, 2021 - 2034 (USD Million & Units)

- 7.1 Key trends

- 7.2 Isolated gate drivers

- 7.2.1 Opto-isolated

- 7.2.2 Magnetic-isolated

- 7.2.3 Capacitive-isolated

- 7.3 Non-Isolated gate drivers

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034 (USD Million & Units)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Energy & power

- 8.5 Telecommunications

- 8.6 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million & Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Allegro Microsystems

- 10.2 Analog Devices

- 10.3 Broadcom

- 10.4 Diodes Incorporated

- 10.5 Infineon Technologies

- 10.6 Littelfuse

- 10.7 Microchip Technology

- 10.8 NXP Semiconductors

- 10.9 Onsemi

- 10.10 Renesas Electronics

- 10.11 Rohm Semiconductor

- 10.12 Semikron Danfoss

- 10.13 Skyworks Solutions

- 10.14 STMicroelectronics

- 10.15 Texas Instruments

- 10.16 Toshiba

- 10.17 Vishay Intertechnology

- 10.18 Wolfspeed