|

市场调查报告书

商品编码

1755294

神经血管内线圈市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Neuroendovascular Coil Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

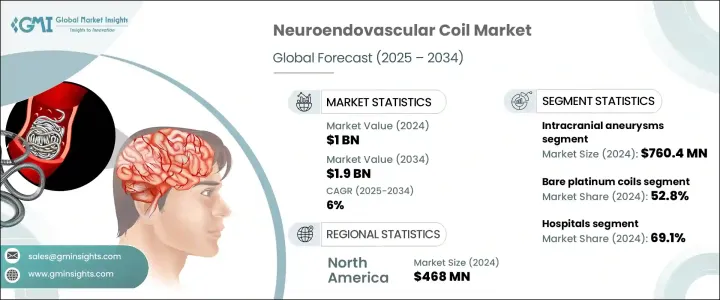

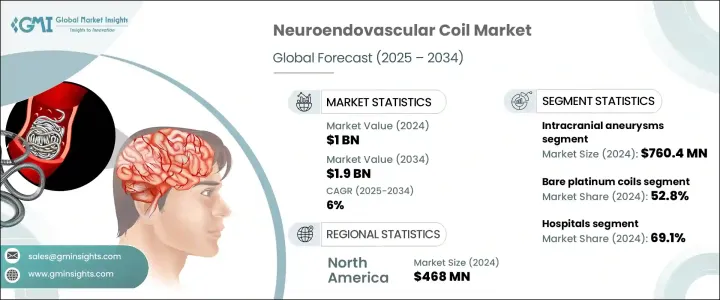

2024年,全球神经血管内弹簧圈市场规模达10亿美元,预计到2034年将以6%的复合年增长率成长,达到19亿美元。脑动脉瘤和缺血性中风的发生率不断上升,加上高血压、糖尿病和吸烟等风险因素,推动了神经血管内弹簧圈的需求。人口老化也导致脑动脉瘤诊断率上升。弹簧圈材料、设计和输送系统的创新使血管内治疗更加安全、准确和有效。近期技术进步促使美国食品药物管理局(FDA)批准了几种新型弹簧圈系统,这反映了该治疗方法的快速发展。

这些新型弹簧圈更贴合、易于拆卸且不透射线,使其适用于治疗动脉瘤,即使在复杂的血管解剖结构中也是如此。血管内弹簧圈已被证明比传统外科手术併发症风险更低,因此越来越多医生采用。微创治疗因其恢復时间更快、风险更低、住院时间更短,越来越受到医生和患者的青睐。美国心臟协会和美国中风协会推荐神经血管内弹簧圈作为大多数颅内动脉瘤类型的初始治疗,使其成为手术夹闭的重要替代方案。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 10亿美元 |

| 预测值 | 19亿美元 |

| 复合年增长率 | 6% |

2024年,裸铂线圈在神经血管内线圈市场的市占率为52.8%。这些线圈因其在治疗颅内动脉瘤方面已证实的临床有效性而被广泛应用。一旦置入,裸铂线圈即使随着时间推移也能提供可靠的动脉瘤闭塞。这些线圈长期的临床记录确保了最低的併发症发生率,使其成为许多病例的首选。其卓越的可靠性持续推动已开发市场和新兴市场的需求。此外,裸铂线圈的价格在医疗保健系统中也具有优势,因为这些系统注重成本敏感性,且报销并非总是可行。

医院在神经血管内弹簧圈市场中占据主导地位,2024 年占 69.1%。世界各地的医院正在越来越多地设立专门的中风和神经血管护理科室,以满足对动脉瘤栓塞等时间敏感型手术日益增长的需求。这些专科科室严重依赖神经血管内弹簧圈的稳定供应,而这些弹簧圈对于治疗脑血管疾病至关重要。随着神经系统护理和预防中风后併发症的日益普及,对先进弹簧圈设备的需求显着增长。在高收入国家,私人保险公司和公共医疗体系为医院内的血管内治疗提供支持性的报销政策。

美国神经血管内线圈市场预计到2034年将达到7.522亿。美国广泛的专业中风中心和神经外科网络促进了大量的神经血管内手术。强大的医疗基础设施促进了神经血管内线圈的广泛应用,并支持新技术的逐步推广。这些医疗机构的稳定成长以及神经血管内治疗技术的日益普及是推动美国神经血管内线圈市场扩张的关键因素。

全球神经血管内线圈市场的主要参与者包括:Acandis、Allium Medical、Balt、Boston Scientific、Cardinal Health、Cook Medical、Kaneka、Medtronic、MicroPort、MicroVention、Penumbra、Rapid Medical、Shape Memory Medical、Stryker 和 Terumo。为了巩固其在神经血管内线圈市场的地位,各公司正专注于多种策略。这些策略包括大力投资研发以引进先进的线圈技术,特别着重于提高安全性、精准度和输送机制。透过开发新的线圈材料和设计,製造商正在满足对复杂动脉瘤更有效治疗日益增长的需求。各公司也透过与医院和医疗中心建立合作伙伴关係和协作来扩大其地理覆盖范围,尤其是在医疗基础设施快速发展的地区。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 脑动脉瘤和中风发生率不断上升

- 线圈设计与传输系统的技术进步

- 老年人口不断增加

- 影像导引和血管内手术的采用日益增多

- 产业陷阱与挑战

- 神经血管内手术和设备成本高昂

- 手术相关併发症和动脉瘤復发的风险

- 成长动力

- 成长潜力分析

- 技术格局

- 未来市场趋势

- 监管格局

- 专利分析

- 波特的分析

- PESTEL分析

- 报销场景

第四章:竞争格局

- 介绍

- 竞争市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 裸铂线圈

- 水凝胶涂层弹簧圈

- 其他类型

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 颅内动脉瘤

- 动静脉畸形

- 其他应用

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院

- 门诊手术中心

- 专科诊所

- 学术和研究机构

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Acandis

- Allium Medical

- Balt

- Boston Scientific

- Cardinal Health

- Cook Medical

- Kaneka

- Medtronic

- MicroPort

- MicroVention

- Penumbra

- Rapid Medical

- Shape Memory Medical

- Stryker

- Terumo

The Global Neuroendovascular Coil Market was valued at USD 1 billion in 2024 and is estimated to grow at a CAGR of 6% to reach USD 1.9 billion by 2034. The increasing prevalence of brain aneurysms and ischemic strokes, coupled with risk factors like hypertension, diabetes, and smoking, is fueling the demand for neuroendovascular coils. The aging population is also contributing to the rise in cerebral aneurysm diagnoses. Innovations in coil materials, designs, and delivery systems have made endovascular therapy safer, more accurate, and more effective. Recent advancements in technology have led to FDA approvals for several new coiling systems, which reflect the rapid development of this treatment method.

These new coils are more conformable, detachable, and radiopaque, making them suitable for treating aneurysms, even in complex vascular anatomies. Endovascular coiling has been shown to have a lower risk of procedural complications than traditional surgical approaches, contributing to its growing adoption by physicians. Minimally invasive treatments are increasingly favored by both doctors and patients because they involve quicker recovery times, fewer risks, and shorter hospital stays. The American Heart Association and American Stroke Association recommend neuroendovascular coiling for the initial treatment of most intracranial aneurysm types, making it an important alternative to surgical clipping.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $1.9 Billion |

| CAGR | 6% |

The bare platinum coils segment in the neuroendovascular coil market held 52.8% share in 2024. These coils are widely used due to their proven clinical effectiveness in treating intracranial aneurysms. Once placed, bare platinum coils provide reliable aneurysm occlusion over time, even as they age. The long-standing clinical track record of these coils ensures minimal complication rates, making them the preferred choice for many cases. Their established reliability continues to drive demand in both developed and emerging markets. Additionally, the price point of bare platinum coils offers an advantage in healthcare systems where cost sensitivity is a significant factor, and reimbursement is not always available.

Hospitals represented the dominant segment in the neuroendovascular coil market, contributing a 69.1% share in 2024. Hospitals worldwide are increasingly setting up dedicated units for stroke and neurovascular care to meet the growing demand for time-sensitive procedures such as aneurysm coiling. These specialized units rely heavily on a steady supply of neuroendovascular coils, which are essential for treating cerebrovascular diseases. With the focus on neurological care and preventing complications after stroke, the demand for advanced coiling devices has risen significantly. In high-income nations, private insurance providers and public healthcare systems offer supportive reimbursement policies for hospital-based endovascular therapies.

U.S Neuroendovascular Coil Market is expected to reach 752.2 million by 2034. The country's extensive network of specialized stroke centers and neurosurgical departments facilitates a high volume of neuroendovascular procedures. This robust healthcare infrastructure promotes the widespread use of neuroendovascular coils and supports the adoption of new technologies over time. The steady growth of these healthcare facilities and the increasing uptake of neuroendovascular treatment technologies are key factors contributing to the market's expansion in the U.S.

Key players in the Global Neuroendovascular Coil Market include: Acandis, Allium Medical, Balt, Boston Scientific, Cardinal Health, Cook Medical, Kaneka, Medtronic, MicroPort, MicroVention, Penumbra, Rapid Medical, Shape Memory Medical, Stryker, Terumo. To solidify their position in the neuroendovascular coil market, companies are focusing on multiple strategies. These include heavy investments in research and development to introduce advanced coil technologies, with a particular focus on improving safety, precision, and delivery mechanisms. By developing new coil materials and designs, manufacturers are responding to the growing demand for more effective treatments for complex aneurysms. Companies are also expanding their geographic reach through partnerships and collaborations with hospitals and medical centers, particularly in regions where healthcare infrastructure is rapidly developing.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing incidence of cerebral aneurysms and stroke

- 3.2.1.2 Technological advancements in coil design and delivery systems

- 3.2.1.3 Rising geriatric population

- 3.2.1.4 Growing adoption of image-guided and endovascular procedures

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of neuroendovascular procedures and devices

- 3.2.2.2 Risk of procedure-related complications and recurrence of aneurysms

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

- 3.10 Reimbursement scenario

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Bare platinum coils

- 5.3 Hydrogel-coated coils

- 5.4 Other types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Intracranial aneurysms

- 6.3 Arteriovenous malformation

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals

- 7.3 Ambulatory surgical centers

- 7.4 Specialty clinics

- 7.5 Academic and research institutes

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Acandis

- 9.2 Allium Medical

- 9.3 Balt

- 9.4 Boston Scientific

- 9.5 Cardinal Health

- 9.6 Cook Medical

- 9.7 Kaneka

- 9.8 Medtronic

- 9.9 MicroPort

- 9.10 MicroVention

- 9.11 Penumbra

- 9.12 Rapid Medical

- 9.13 Shape Memory Medical

- 9.14 Stryker

- 9.15 Terumo