|

市场调查报告书

商品编码

1755299

视讯作为感测器的市场机会、成长动力、产业趋势分析以及 2025 - 2034 年预测Video as a Sensor Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

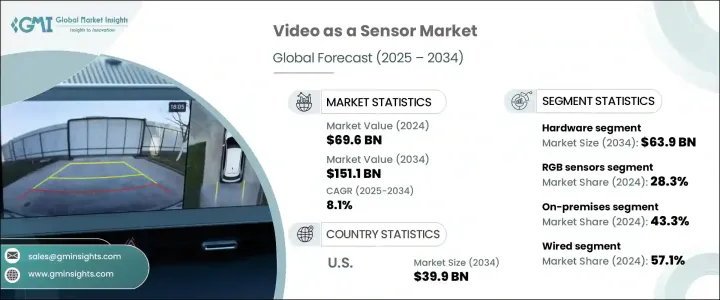

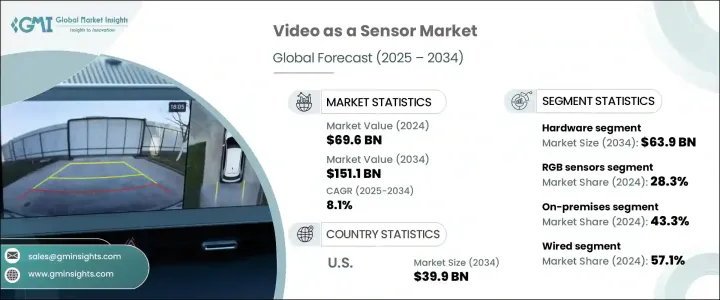

2024年,全球视讯感测器市场规模达696亿美元,预计2034年将以8.1%的复合年增长率成长,达到1511亿美元。这一成长主要源自于各行各业对态势感知日益增长的需求。随着各行各业重视即时环境监测和快速决策,视讯感测器正部署为将视觉资料转化为可操作洞察的关键工具。人工智慧与视讯来源的整合提升了监控效率,从而能够更快地进行解读并改善安全响应。国防、工业自动化和医疗保健等行业正在将智慧视讯感测器整合到其现有基础设施中,以提升营运控制、安全标准和响应能力,从而巩固市场的成长势头。

对进口中国零件征收关税造成了成本压力,尤其是在摄影机模组和成像感测器等硬体方面。这些贸易变化扰乱了供应链,延长了交货时间,导致生产和采购延迟。通货膨胀加剧和政府预算紧缩为采购流程带来了新的复杂性,往往导致审批时间延长,并推迟了先进监控技术的实施。这些经济限制因素给公共部门机构带来了压力,迫使其优先安排支出,这可能会影响视讯感测器解决方案在关键产业的推广速度。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 696亿美元 |

| 预测值 | 1511亿美元 |

| 复合年增长率 | 8.1% |

硬体市场正在经历显着成长,预计到2034年将达到639亿美元。这一成长主要源自于对能够即时进行设备资料分析的智慧、整合AI的成像系统的需求激增。此类系统对于降低延迟、最大限度地减少网路负载以及在动态营运环境中实现快速自主决策至关重要。

随着热视讯感测器在医院、边境检查站和大型公共场所等敏感环境中得到更广泛的应用,预计到2034年,热感测器市场规模将达到444亿美元。这些感测器不仅在增强安全性和监控方面发挥至关重要的作用,而且还透过在故障发生前识别工业设备的温度异常来支援预测性维护操作。

到2034年,美国视讯感测器市场规模将达到399亿美元。智慧城市基础设施、国防现代化以及国土安全日益受到重视等因素的融合,正在塑造这一应用曲线。这些发展,加上基于边缘的视讯分析技术的创新,正在推动该技术在政府和私营部门的应用领域成为主流。

影响该市场的关键公司包括Teledyne Technologies、OmniVision Technologies Inc.、佳能公司、索尼公司和意法半导体。视讯感测器产业的领先公司正专注于创新、合作伙伴关係和人工智慧集成,以增强其全球影响力。各公司正在扩大研发计划,以打造具有边缘处理能力的下一代影像解决方案,从而实现更快、更安全的资料处理。他们正在与国防、医疗保健和工业领域的企业建立策略联盟与合作关係,以根据特定产业的需求客製化产品。製造商也在本地化零件采购,以减少对不稳定供应链的依赖,并抵消贸易关税的影响。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 价格波动

- 供应链重组

- 生产成本影响

- 需求面影响

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 对即时态势感知的需求不断增长

- 智慧城市和基础设施项目的扩展

- 安全和监控要求增加

- 人工智慧视讯分析的普及

- 军事预算成长

- 产业陷阱与挑战

- 与遗留系统的整合复杂性

- 即时处理中的延迟

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依组件,2021-2034

- 主要趋势

- 硬体

- 软体

- 服务

第六章:市场估计与预测:按感测器类型,2021-2034

- 主要趋势

- RGB感测器

- 红外线(IR)感测器

- 热感应器

- 深度感测器

- 多光谱感测器

第七章:市场估计与预测:依部署模式,2021-2034

- 主要趋势

- 本地

- 基于云端

- 基于边缘

第八章:市场估计与预测:依连结性,2021-2034

- 主要趋势

- 有线

- 无线的

第九章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 安防与监控

- 交通监控与智慧移动

- 工业自动化与机器人技术

- 零售分析

- 医疗保健和患者监测

- 环境监测

- 农业和畜牧业监控

- 其他的

第十章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第 11 章:公司简介

- Avnet EMEA

- BAE Systems plc

- Canon Inc.

- Excelitas Technologies Corp.

- FLUKE Corporation

- Hamamatsu Photonics KK

- InfraTec GmbH

- Intevac, Inc.

- IRCameras LLC

- L3Harris Technologies

- Leonardo DRS

- Lynred

- New Imaging Technologies (NIT)

- OmniVision Technologies Inc.

- Photonis Technologies

- Sony Corporation

- STMicroelectronics

- Teledyne Technologies Incorporated

- Thales Group

- Xenics NV

The Global Video as a Sensor Market was valued at USD 69.6 billion in 2024 and is estimated to grow at a CAGR of 8.1% to reach USD 151.1 billion by 2034. The growth is driven by the rising demand for situational awareness across various sectors. As industries prioritize real-time environmental monitoring and rapid decision-making, video sensors are being deployed as critical tools that convert visual data into actionable insights. Integration of AI with video feeds enhances surveillance efficiency, allowing for faster interpretation and improved safety responses. Industries such as defense, industrial automation, and healthcare are integrating smart video sensors into their existing infrastructure to elevate operational control, security standards, and responsiveness, reinforcing the market's upward trajectory.

The imposition of tariffs on imported Chinese components has created cost pressures, particularly on hardware like camera modules and imaging sensors. These trade shifts disrupted the supply chain and extended lead times, resulting in delayed production and procurement. Rising inflation and tightening government budgets have introduced new layers of complexity to procurement processes, often resulting in longer approval times and delayed implementation of advanced surveillance technologies. These economic constraints are placing pressure on public sector agencies to prioritize spending, which may impact the pace at which video as a sensor solution is rolled out across critical sectors.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $69.6 Billion |

| Forecast Value | $151.1 Billion |

| CAGR | 8.1% |

The hardware component of the market is experiencing notable traction, projected to reach USD 63.9 billion by 2034. This growth is largely driven by the surge in demand for intelligent, AI-integrated imaging systems capable of real-time, on-device data analysis. Such systems are pivotal for reducing latency, minimizing network load, and enabling quick, autonomous decision-making in dynamic operational settings.

The thermal sensors segment is expected to reach USD 44.4 billion by 2034 as thermal video sensors are witnessing broader integration across sensitive environments like hospitals, border checkpoints, and large-scale public spaces. These sensors play a vital role not only in enhancing safety and monitoring but also in supporting predictive maintenance operations by identifying temperature anomalies in industrial equipment before failure occurs.

United States Video as a Sensor Market reached USD 39.9 billion by 2034. The adoption curve is being shaped by the convergence of smart city infrastructure, defense modernization, and heightened emphasis on homeland security. These developments, alongside innovation in edge-based video analytics, are pushing the technology into the mainstream across both government and private sector applications.

Key companies influencing this market include Teledyne Technologies, OmniVision Technologies Inc., Canon Inc., Sony Corporation, and STMicroelectronics. Leading firms in the video as a sensor industry are focusing on innovation, partnerships, and AI integration to strengthen their global footprint. Companies are expanding R&D initiatives to create next-gen imaging solutions with edge-processing capabilities for faster and more secure data handling. Strategic alliances and collaborations are being formed with defense, healthcare, and industrial players to tailor offerings for sector-specific needs. Manufacturers are also localizing component sourcing to reduce reliance on volatile supply chains and counteract trade tariff impacts.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.2.1.1 Price volatility

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw material)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Rising demand for real-time situational awareness

- 3.3.1.2 Expansion of smart cities and infrastructure projects

- 3.3.1.3 Increased security and surveillance requirements

- 3.3.1.4 Proliferation of AI-powered video analytics

- 3.3.1.5 Growth in military budget

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Integration complexity with legacy systems

- 3.3.2.2 Latency in real-time processing

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Component, 2021-2034 (USD Billion)

- 5.1 Key trends

- 5.2 Hardware

- 5.3 Software

- 5.4 Services

Chapter 6 Market Estimates & Forecast, By Sensor Type, 2021-2034 (USD Billion)

- 6.1 Key trends

- 6.2 RGB sensors

- 6.3 Infrared (IR) sensors

- 6.4 Thermal sensors

- 6.5 Depth sensors

- 6.6 Multispectral sensors

Chapter 7 Market Estimates & Forecast, By Deployment Mode, 2021-2034 (USD Billion)

- 7.1 Key trends

- 7.2 On-premises

- 7.3 Cloud-based

- 7.4 Edge-based

Chapter 8 Market Estimates & Forecast, By Connectivity, 2021-2034 (USD Billion)

- 8.1 Key trends

- 8.2 Wired

- 8.3 Wireless

Chapter 9 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion)

- 9.1 Key trends

- 9.2 Security & surveillance

- 9.3 Traffic monitoring & smart mobility

- 9.4 Industrial automation & robotics

- 9.5 Retail analytics

- 9.6 Healthcare & patient monitoring

- 9.7 Environmental monitoring

- 9.8 Agriculture & livestock monitoring

- 9.9 Others

Chapter 10 Market Estimates and Forecast, By Region, 2021 – 2034 (USD Billion)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Netherlands

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

Chapter 11 Company Profiles

- 11.1 Avnet EMEA

- 11.2 BAE Systems plc

- 11.3 Canon Inc.

- 11.4 Excelitas Technologies Corp.

- 11.5 FLUKE Corporation

- 11.6 Hamamatsu Photonics K.K.

- 11.7 InfraTec GmbH

- 11.8 Intevac, Inc.

- 11.9 IRCameras LLC

- 11.10 L3Harris Technologies

- 11.11 Leonardo DRS

- 11.12 Lynred

- 11.13 New Imaging Technologies (NIT)

- 11.14 OmniVision Technologies Inc.

- 11.15 Photonis Technologies

- 11.16 Sony Corporation

- 11.17 STMicroelectronics

- 11.18 Teledyne Technologies Incorporated

- 11.19 Thales Group

- 11.20 Xenics NV