|

市场调查报告书

商品编码

1755300

硬质工业包装市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Rigid Industrial Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

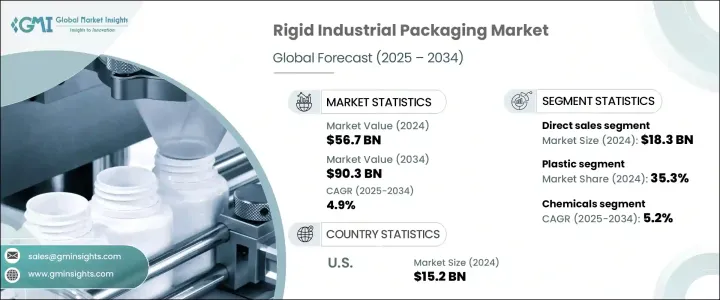

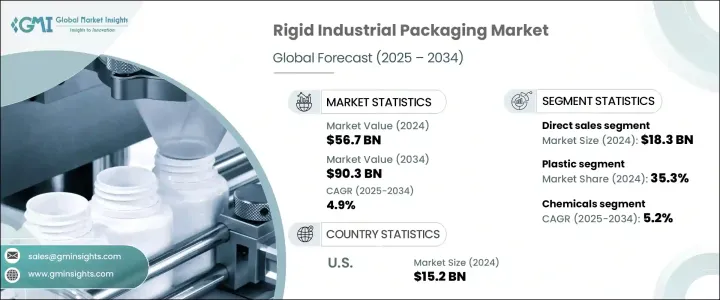

2024年,全球硬质工业包装市场价值为567亿美元,预计到2034年将以4.9%的复合年增长率增长,达到903亿美元,这主要得益于化工、汽车、製药和食品加工等关键行业的持续需求。中型散装容器 (IBC)、圆桶和桶等硬质包装解决方案在安全高效地运输危险和非危险材料方面继续发挥至关重要的作用。

化学品出口的不断增长以及全球危险物质运输法规的日益严格,为该行业的长期增长提供了支撑。这些转变促使企业投资于高效能、耐用的包装解决方案,这些解决方案既符合合规标准,又能确保成本效益和永续性。儘管对进口铝和钢征收的关税提高了生产成本并扰乱了供应链,但市场已透过重新调整定价策略和探索国内采购来适应变化。行业发展和强劲的跨行业整合为全球硬包装生产商保持了强劲的发展势头。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 567亿美元 |

| 预测值 | 903亿美元 |

| 复合年增长率 | 4.9% |

随着汽车、农业、石化和建筑等行业的扩张,对耐用、安全且经济高效的包装解决方案的需求也随之成长。这些产业需要能够在极端环境条件下维持产品完整性的大容量运输和储存系统,这使得硬包装不可或缺。此外,全球製造生态系统的整合也促进了包装形式的标准化,简化了物流流程,并提高了营运效率。

2023年,桶装容器市场产值达154亿美元,反映出其作为石油和化学工业液体产品首选容器的稳固地位。这些桶装容器安全可靠、可堆迭、可重复使用,符合安全法规,尤其适用于散装运输。它们因其在储存、搬运和运输应用中的强度和效率而备受推崇。

预计到2024年,塑胶基硬质包装市场将贡献35.3%的份额。塑胶的受欢迎程度源自于其耐腐蚀性、轻质性以及在食品和化学品等终端使用领域的适应性。可回收和环保塑胶的创新进一步巩固了其市场地位,这与对永续工业包装替代品日益增长的需求相一致。

2024年,美国硬质工业包装市场价值达152亿美元,主要驱动力来自製药和化学工业,这些产业高度依赖高完整性包装。美国对环保材料的重视以及先进物流基础设施的不断扩张,为可重复使用的硬质包装创造了有利条件。完善的基础设施和数位化的运输网络,将助力符合环保和营运目标的高性能包装的广泛应用。

该领域的领先企业包括SCHUTZ GmbH & Co. KGaA、Mauser Packaging Solutions和Greif, Inc.。为了在硬质工业包装市场保持竞争优势,各公司优先考虑可重复使用和永续材料的创新,同时增强其全球供应链的韧性。他们投资智慧包装技术和自动化製造流程,以提高效率并降低营运成本。与化学、食品和製药行业的关键客户建立合作伙伴关係,使我们能够开发符合特定合规性和安全标准的客製化产品。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 川普政府关税分析

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供应方影响(原料)

- 主要材料价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供应方影响(原料)

- 受影响的主要公司

- 策略产业反应

- 供应链重组

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 供应商格局

- 利润率分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 新兴经济体工业化进程不断加速

- 化工和石化产业蓬勃发展

- 可持续性和可重复使用性趋势

- 严格的安全和运输法规

- 工业品电子商务的成长

- 产业陷阱与挑战

- 原物料价格波动

- 可重复使用解决方案的初始投资较高

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021-2034

- 主要趋势

- 鼓

- 中型散装容器(IBC)

- 桶

- 罐头

- 盒子和箱子

- 其他的

第六章:市场估计与预测:依材料类型,2021-2034 年

- 主要趋势

- 塑胶

- 金属

- 纤维

- 木头

第七章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- 直销

- 经销商

- 线上B2B平台

- 其他的

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 化学品

- 製药

- 食品和饮料配料

- 农业

- 汽车

- 电子产品

- 其他的

第九章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- Balmer Lawrie

- Berry Global

- DS Smith Rigid

- Greif

- HOYER

- Mauser Packaging Solutions

- Mauser-Werke

- Nefab

- Rikutec Group

- Schoeller Allibert

- SCHUTZ

- Thielmann Group

- Time Technoplast

- Tosca Services

The Global Rigid Industrial Packaging Market was valued at USD 56.7 billion in 2024 and is estimated to grow at a CAGR of 4.9% to reach USD 90.3 billion by 2034, driven by the consistent demand from key industries such as chemicals, automotive, pharmaceuticals, and food processing. Rigid packaging solutions like intermediate bulk containers (IBCs), drums, and barrels continue to play a crucial role in transporting both hazardous and non-hazardous materials safely and efficiently.

The long-term growth of the sector is supported by expanding chemical exports and stricter global regulations regarding the transport of dangerous substances. These shifts push companies to invest in high-performance, durable packaging solutions that meet compliance standards while ensuring cost-effectiveness and sustainability. Although tariffs on imported aluminum and steel raised production costs and disrupted supply chains, the market has adapted by recalibrating pricing strategies and exploring domestic sourcing. Industrial development and robust cross-sector integration keep the momentum strong for rigid packaging producers worldwide.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $56.7 Billion |

| Forecast Value | $90.3 Billion |

| CAGR | 4.9% |

As sectors like automotive, agriculture, petrochemicals, and construction expand, the demand for durable, safe, and cost-efficient packaging solutions rises in parallel. These industries require high-volume transportation and storage systems that maintain product integrity under extreme environmental conditions, making rigid packaging indispensable. Moreover, integrating global manufacturing ecosystems prompts standardized packaging formats, streamlining logistics, and driving operational efficiencies.

In 2023, the drums segment generated USD 15.4 billion, reflecting its solid role as a preferred container for liquid products across the oil and chemical sectors. These drums offer safe, stackable, and reusable solutions that comply with safety regulations, especially for bulk transport. They are highly valued for their strength and efficiency in storage, handling, and transit applications.

Plastic-based rigid packaging segment is expected to contribute 35.3% share in 2024. The popularity of plastic stems from its corrosion resistance, lightweight, and adaptability across end-use sectors, including food and chemicals. Innovations in recyclable and eco-friendly plastics further strengthen its market position, aligning with the rising demand for sustainable industrial packaging alternatives.

U.S. Rigid Industrial Packaging Market was valued at USD 15.2 billion in 2024 fueled by the pharmaceutical and chemical sectors, which rely heavily on high-integrity containers. The country's focus on eco-conscious materials and expanding advanced logistics infrastructure create favorable conditions for reusable rigid packaging. Enhanced infrastructure and digitalized shipping networks support the wide adoption of high-performance packaging that meets environmental and operational goals.

The leading players in this space include SCHUTZ GmbH & Co. KGaA, Mauser Packaging Solutions, and Greif, Inc. To maintain a competitive edge in the rigid industrial packaging market, companies prioritize innovation in reusable and sustainable materials while enhancing their global supply chain resilience. They invest in smart packaging technologies and automated manufacturing processes to increase efficiency and reduce operational costs. Partnerships with key clients across chemical, food, and pharma industries allow tailored product development that meets specific compliance and safety standards.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021-2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Trump administration tariff analysis

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Supplier landscape

- 3.4 Profit margin analysis

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Rising industrialization across emerging economies

- 3.7.1.2 Boom in chemical and petrochemical industries

- 3.7.1.3 Sustainability and reusability trends

- 3.7.1.4 Stringent safety and transport regulations

- 3.7.1.5 Growth in E-commerce for industrial goods

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 Volatility in raw material prices

- 3.7.2.2 High initial investment for reusable solutions

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021-2034 (USD Million)

- 5.1 Key trends

- 5.2 Drums

- 5.3 Intermediate Bulk Containers (IBCs)

- 5.4 Pails

- 5.5 Cans

- 5.6 Boxes & bins

- 5.7 Others

Chapter 6 Market Estimates & Forecast, By Material Type, 2021-2034 (USD Million)

- 6.1 Key trends

- 6.2 Plastic

- 6.3 Metal

- 6.4 Fiber

- 6.5 Wood

Chapter 7 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Million)

- 7.1 Key trends

- 7.2 Direct sales

- 7.3 Distributors

- 7.4 Online B2B platforms

- 7.5 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Million)

- 8.1 Key trends

- 8.2 Chemicals

- 8.3 Pharmaceuticals

- 8.4 Food & beverage ingredients

- 8.5 Agriculture

- 8.6 Automotive

- 8.7 Electronics

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021-2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Balmer Lawrie

- 10.2 Berry Global

- 10.3 DS Smith Rigid

- 10.4 Greif

- 10.5 HOYER

- 10.6 Mauser Packaging Solutions

- 10.7 Mauser-Werke

- 10.8 Nefab

- 10.9 Rikutec Group

- 10.10 Schoeller Allibert

- 10.11 SCHUTZ

- 10.12 Thielmann Group

- 10.13 Time Technoplast

- 10.14 Tosca Services