|

市场调查报告书

商品编码

1755304

自动驾驶汽车模拟解决方案市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Autonomous Vehicle Simulation Solutions Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

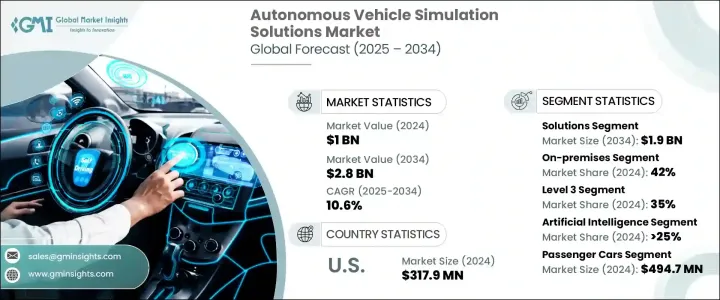

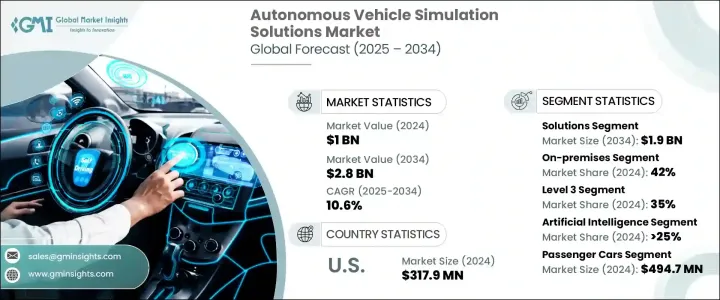

2024年,全球自动驾驶汽车模拟解决方案市场规模达10亿美元,预计到2034年将以10.6%的复合年增长率成长,达到28亿美元。该市场在支援自动驾驶系统的演进、评估和部署方面发挥关键作用。模拟平台如今已成为开发流程中不可或缺的一部分,使汽车製造商和技术供应商能够在可控且可重复的虚拟环境中测试和验证复杂的自动驾驶功能。这些平台复製了真实的驾驶场景,使工程师能够在车辆上路行驶之前就发现并解决关键挑战。随着自动驾驶系统日益先进和精细化,设计、开发和安全验证的各个阶段都需要模拟工具。

在道路安全依然备受关注的当今世界,模拟技术被视为减少交通事故伤亡人数的实际的解决方案。传统的测试方法通常耗时、昂贵且风险高,尤其是在重现危险或不常见场景时。模拟技术弥补了这一缺陷,提供了一种经济高效且可扩展的物理测试替代方案,可以在不危及人员生命的情况下分析数千种极端情况。由于人为失误是造成交通事故的主要原因,开发比人类驾驶更安全、更可预测的自动化系统日益迫切。基于模拟的工具使得在各种条件下测试这些系统成为可能,包括那些在现实世界中过于危险或罕见而无法复製的条件。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 10亿美元 |

| 预测值 | 28亿美元 |

| 复合年增长率 | 10.6% |

随着人工智慧、机器学习和高效能运算技术的不断发展,模拟平台也变得更加先进、精准且可扩展。如今的解决方案已远远超越了基本的环境建模;它们支援即时驾驶员在环测试和云端仿真,从而支援自动驾驶汽车开发的整个生命週期。从产生复杂场景到验证决策演算法,这些工具正在彻底改变产业建构和测试安全自动驾驶系统的方式。

按组件划分,市场可细分为解决方案和服务。 2024年,解决方案部分占据全球市场的68%,预计到2034年将创造19亿美元的收入。该领域对高阶软体的需求正在快速增长,这主要得益于其提供动态虚拟环境的能力。这些软体平台使工程师能够模拟从交通场景到各种环境条件下的系统响应等所有方面。开发人员使用这些工具来复製现实世界的挑战,优化系统效能,并确保合规性,而不会产生物理风险或限制。

从部署方式来看,市场分为本地部署、云端部署和混合部署模式。本地部署解决方案占据主导地位,2024 年市占率达 42%。需要高资料保密性、低延迟运算和完全控制模拟参数的公司更倾向于这些部署方式。对于进行即时模拟或测试敏感专有技术的公司来说尤其如此。

就自动驾驶等级而言,市场涵盖了从 1 级到 5 级以上的等级。 3 级细分市场(即有条件自动驾驶)在 2024 年占据了 35% 的市场。此等级要求车辆在特定条件下处理大多数驾驶功能,但在需要时仍需依赖人工干预。由于 3 级系统在手动和自动控制之间引入了更复杂的过渡场景,因此模拟在测试这些生命週期过渡以确保系统之间安全切换方面发挥关键作用。支援这些系统的服务细分市场预计将在预测期内以约 9.5% 的复合年增长率扩张。

按技术划分,市场涵盖人工智慧、机器学习、扩增实境/虚拟实境 (AR/VR)、大数据分析等。人工智慧领域在 2024 年占据超过 25% 的市场份额,占据市场主导地位。人工智慧透过支援智慧场景生成和预测建模来增强模拟环境。它使模拟响应更快、更逼真,并能够模拟车辆、行人和环境之间的复杂互动。人工智慧还能帮助高效扩展模拟规模,使开发人员能够在更广泛的条件下训练和验证系统。

根据车辆类型,市场分为乘用车、商用车以及两轮车和送货机器人。乘用车市场在2024年规模最大,产值达4.947亿美元。随着半自动驾驶功能在消费车辆中的日益普及,模拟解决方案对于验证自适应巡航控制、车道维持和自动停车等驾驶辅助功能至关重要。这些解决方案可协助製造商在实际部署之前确保这些系统的可靠性和安全性。

从地区来看,美国在北美市场占据领先地位,2024 年的营收达到 3.179 亿美元。这一增长得益于其强大的创新生态系统以及支援自动驾驶汽车测试和部署的优惠政策。领先的美国本土公司正在积极投资模拟技术,以加快开发进度并降低与实体测试相关的风险。美国的监管框架也促进了基于模拟的验证,使其成为全球领域的领导者。

主要市场参与者正在采取合作、併购和研发投资等策略性倡议,以增强其模拟能力。这些努力专注于开发结合人工智慧、机器学习和数位孪生技术的尖端平台,以提高测试覆盖率、可扩展性和准确性。各公司也与原始设备製造商 (OEM) 和监管机构密切合作,使其解决方案符合不断发展的行业标准,并加速自动驾驶汽车的商业化进程。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 云端平台提供者

- 场景生成和管理服务提供者

- 硬体在环 (HiL) 和软体在环 (SiL) 测试提供商

- 数位孪生和虚拟车辆服务提供商

- 验证和安全合规服务提供者

- 利润率

- 成本结构

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 供应商格局

- 技术与创新格局

- 当前的技术趋势

- 人工智慧驱动的场景产生和测试

- 即时感测器融合模拟

- 基于云端的模拟和可扩展性

- 数位孪生与虚拟原型

- 新兴技术

- 基于物理和数据驱动的混合模拟模型

- 用于车载即时验证的边缘人工智慧

- 使用生成式人工智慧产生合成资料

- 用于资料完整性和模拟可追溯性的区块链

- 先进材料科学

- 当前的技术趋势

- 定价趋势

- 用例

- 最佳情况

- 重要新闻和倡议

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 对部队的影响

- 成长动力

- 人工智慧和机器学习演算法的进步

- ADAS 和自动驾驶系统日益复杂

- 需要高保真感测器建模和环境真实感

- 虚拟测试的可扩展性和成本效益

- 产业陷阱与挑战

- 复製现实世界的复杂性和边缘情况的挑战

- 高保真模拟的计算要求高

- 市场机会

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

- 永续性和环境方面

- 永续实践

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 竞争定位矩阵

- 战略展望矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划和资金

第五章:市场估计与预测:按组件,2021 - 2034 年

- 主要趋势

- 软体

- 场景生成工具

- 感测器仿真软体

- 3D建模和视觉化

- 基于物理的模拟器

- 人工智慧和机器学习模拟平台

- 服务

- 咨询与整合服务

- 支援与维护

- 模拟即服务 (SaaS)

第六章:市场估计与预测:依自主水平,2021 年至 2034 年

- 主要趋势

- 1级

- 2级

- 3级

- 4级

- 5级以上

第七章:市场估计与预测:依技术分类,2021 - 2034 年

- 主要趋势

- 人工智慧

- 机器学习

- 扩增实境/虚拟实境(AR/VR)

- 巨量资料分析

- 其他的

第八章:市场估计与预测:依车型,2021 - 2034 年

- 主要趋势

- 搭乘用车

- 萨丹

- 掀背车

- 越野车

- 商用车

- 轻型商用车

- 重型商用车

- 公车和长途客车

- 两轮车和送货机器人

第九章:市场估计与预测:依部署,2021 - 2034 年

- 主要趋势

- 本地

- 基于云端

- 杂交种

第 10 章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 测试与验证

- 培训与教育

- 系统整合

- 资料註释和标记

- 效能最佳化

第 11 章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 汽车原厂设备製造商

- 一级和二级供应商

- 科技公司

- 政府和监管机构

第 12 章:市场估计与预测:按地区,2021 年至 2034 年

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 比利时

- 瑞典

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 韩国

- 东南亚

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十三章:公司简介

- aiMotive

- Altair

- Ansys

- Applied Intuition

- Aptiv

- AVL List

- Cambridge Systematics

- Cognata

- Dassault

- dSPACE

- Foretellix

- Green Hills

- Hexagon

- IPG Automotive

- LG

- LHP Engineering

- MathWorks

- Mechanical Simulation

- rFpro

- Siemens

- Synopsys

The Global Autonomous Vehicle Simulation Solutions Market was valued at USD 1 billion in 2024 and is estimated to grow at a CAGR of 10.6% to reach USD 2.8 billion by 2034. This market plays a pivotal role in supporting the evolution, evaluation, and deployment of autonomous driving systems. Simulation platforms are now an essential part of the development process, allowing automotive manufacturers and technology providers to test and validate complex automated driving functions in controlled and repeatable virtual environments. These platforms replicate real-world driving scenarios, enabling engineers to identify and resolve critical challenges long before vehicles hit the road. As autonomous systems become increasingly advanced and nuanced, simulation tools are needed across all phases of design, development, and safety validation.

In a world where road safety remains a major concern, simulation technologies are seen as a practical solution to reduce the staggering toll of traffic-related injuries and fatalities. Traditional testing methods are often time-consuming, expensive, and risky, especially when recreating dangerous or uncommon scenarios. Simulations bridge this gap by offering a cost-effective and scalable alternative to physical testing, where thousands of edge cases can be analyzed without endangering human life. With human error accounting for the majority of traffic incidents, there is a growing urgency to develop automated systems that can operate more safely and predictably than human drivers. Simulation-based tools make it possible to test these systems under an infinite variety of conditions, including those that are too hazardous or rare to replicate in the real world.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1 Billion |

| Forecast Value | $2.8 Billion |

| CAGR | 10.6% |

As artificial intelligence, machine learning, and high-performance computing technologies continue to progress, simulation platforms have become more advanced, accurate, and scalable. Today's solutions go far beyond basic environmental modeling; they enable real-time, driver-in-the-loop testing and cloud-powered simulations that support the full lifecycle of autonomous vehicle development. From generating complex scenarios to validating decision-making algorithms, these tools are transforming how the industry builds and tests safe autonomous systems.

By component, the market is segmented into solutions and services. In 2024, the solutions segment accounted for 68% of the global market and is expected to generate USD 1.9 billion in revenue by 2034. The demand for advanced software in this segment is growing rapidly, primarily due to its ability to offer dynamic virtual environments. These software platforms allow engineers to simulate everything from traffic scenarios to system responses under various environmental conditions. Developers use these tools to replicate real-world challenges, optimize system performance, and ensure regulatory compliance without physical risks or limitations.

Deployment-wise, the market is divided into on-premises, cloud-based, and hybrid models. On-premises solutions dominated the segment with a 42% market share in 2024. Companies requiring high data confidentiality, low-latency computing, and full control over simulation parameters prefer these setups. This is especially true for firms conducting real-time simulations or testing sensitive, proprietary technologies.

In terms of autonomy level, the market includes level 1 through more than level 5 classifications. The level 3 segment-conditional automation-held 35% of the market in 2024. This level requires the vehicle to handle most driving functions under specific conditions but still relies on human intervention when prompted. As level 3 systems introduce more complex transition scenarios between manual and automated control, simulation plays a critical role in testing these life-cycle transitions to ensure safe handoffs between systems. The services segment supporting these systems is expected to expand at a CAGR of around 9.5% over the forecast period.

By technology, the market covers Artificial Intelligence, Machine Learning, AR/VR, Big Data Analytics, and others. The Artificial Intelligence segment led the market with over 25% share in 2024. AI enhances simulation environments by enabling intelligent scenario generation and predictive modeling. It makes simulations more responsive, realistic, and capable of representing complex interactions among vehicles, pedestrians, and the environment. AI also helps scale simulations efficiently, allowing developers to train and validate systems on a wider range of conditions.

Based on vehicle type, the market is categorized into passenger cars, commercial vehicles, and two-wheelers & delivery bots. The passenger cars segment was the largest in 2024, generating USD 494.7 million. With the rising integration of semi-autonomous features in consumer vehicles, simulation solutions are essential for validating driver-assistance functions like adaptive cruise control, lane keeping, and autonomous parking. These solutions help manufacturers ensure the reliability and safety of these systems before real-world deployment.

Regionally, the U.S. led the North American market with revenue of USD 317.9 million in 2024. This growth is fueled by a robust ecosystem of innovation and favorable policies supporting autonomous vehicle testing and deployment. Leading domestic companies are actively investing in simulation technologies to accelerate their development timelines and reduce risks associated with physical testing. Regulatory frameworks in the U.S. also promote simulation-based validation, positioning the country as a front-runner in the global landscape.

Key market players are pursuing strategic initiatives such as partnerships, mergers, acquisitions, and R&D investments to enhance their simulation capabilities. These efforts are focused on developing cutting-edge platforms that combine AI, machine learning, and digital twin technologies to improve test coverage, scalability, and accuracy. Companies are also working closely with OEMs and regulatory bodies to align their solutions with evolving industry standards and accelerate the commercialization of autonomous vehicles.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model.

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 – 2034

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Component

- 2.2.3 Autonomy level

- 2.2.4 Technology

- 2.2.5 Vehicle

- 2.2.6 Deployment

- 2.2.7 Application

- 2.2.8 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Cloud platform providers

- 3.1.1.2 Scenario generation & management service providers

- 3.1.1.3 Hardware-in-the-loop (HiL) & software-in-the-loop (SiL) testing providers

- 3.1.1.4 Digital twin & virtual vehicle service providers

- 3.1.1.5 Validation & safety compliance service providers

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.2.1 Current technological trends

- 3.2.1.1 AI-driven scenario generation and testing

- 3.2.1.2 Real-time sensor fusion simulation

- 3.2.1.3 Cloud-based simulation and scalability

- 3.2.1.4 Digital twin and virtual prototyping

- 3.2.2 Emerging Technologies

- 3.2.2.1 Physics-based and data-driven hybrid simulation models

- 3.2.2.2 Edge AI for in-vehicle real-time validation

- 3.2.2.3 Synthetic data generation using generative AI

- 3.2.2.4 Blockchain for data integrity and simulation traceability

- 3.2.3 Advanced material sciences

- 3.2.1 Current technological trends

- 3.3 Pricing trend

- 3.4 Use cases

- 3.5 Best-case scenario

- 3.6 Key news & initiatives

- 3.7 Regulatory landscape

- 3.7.1 North America

- 3.7.2 Europe

- 3.7.3 Asia Pacific

- 3.7.4 Latin America

- 3.7.5 Middle East & Africa

- 3.8 Impact on forces

- 3.8.1 Growth drivers

- 3.8.1.1 Advancements in AI and machine learning algorithms

- 3.8.1.2 Growing complexity of ADAS and autonomous systems

- 3.8.1.3 Need for high-fidelity sensor modeling and environmental realism

- 3.8.1.4 Scalability and cost-effectiveness of virtual testing

- 3.8.2 Industry pitfalls & challenges

- 3.8.2.1 Challenges in replicating real-world complexity and edge cases

- 3.8.2.2 High computational requirements for high-fidelity simulations

- 3.8.3 Market opportunity

- 3.8.1 Growth drivers

- 3.9 Growth potential analysis

- 3.10 Porter's analysis

- 3.11 PESTEL analysis

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Energy efficiency in production

- 3.12.3 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

- 4.5 Key developments

- 4.5.1 Mergers & acquisitions

- 4.5.2 Partnerships & collaborations

- 4.5.3 New product launches

- 4.5.4 Expansion plans and funding

Chapter 5 Market Estimates & Forecast, By Component, 2021 - 2034 ($Bn)

- 5.1 Key trends

- 5.2 Software

- 5.2.1 Scenario generation tools

- 5.2.2 Sensor simulation software

- 5.2.3 3D modeling and visualization

- 5.2.4 Physics-based simulators

- 5.2.5 AI & ML simulation platforms

- 5.3 Services

- 5.3.1 Consulting & integration services

- 5.3.2 Support & maintenance

- 5.3.3 Simulation-as-a-Service (SaaS)

Chapter 6 Market Estimates & Forecast, By Autonomy level, 2021 - 2034 ($Bn)

- 6.1 Key trends

- 6.2 Level 1

- 6.3 Level 2

- 6.4 Level 3

- 6.5 Level 4

- 6.6 Level 5 and above

Chapter 7 Market Estimates & Forecast, By Technology, 2021 - 2034 ($Bn)

- 7.1 Key trends

- 7.2 Artificial intelligence

- 7.3 Machine learning

- 7.4 Augmented reality / virtual reality (AR/VR)

- 7.5 Big data analytics

- 7.6 Others

Chapter 8 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn)

- 8.1 Key trends

- 8.2 Passenger cars

- 8.2.1 Sadan

- 8.2.2 Hatchback

- 8.2.3 SUV

- 8.3 Commercial vehicles

- 8.3.1 Light commercial vehicle

- 8.3.2 Heavy commercial vehicle

- 8.3.3 Buses & coaches

- 8.4 Two-wheelers & delivery bots

Chapter 9 Market Estimates & Forecast, By Deployment, 2021 - 2034 ($Bn)

- 9.1 Key trends

- 9.2 On-premises

- 9.3 Cloud-based

- 9.4 Hybrid

Chapter 10 Market Estimates & Forecast, By Application, 2021 - 2034 ($Bn)

- 10.1 Key trends

- 10.2 Testing & validation

- 10.3 Training & education

- 10.4 System integration

- 10.5 Data annotation & labeling

- 10.6 Performance optimization

Chapter 11 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn)

- 11.1 Key trends

- 11.2 Automotive OEMs

- 11.3 Tier 1 & tier 2 suppliers

- 11.4 Tech companies

- 11.5 Government & regulatory bodies

Chapter 12 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn)

- 12.1 North America

- 12.1.1 U.S.

- 12.1.2 Canada

- 12.2 Europe

- 12.2.1 UK

- 12.2.2 Germany

- 12.2.3 France

- 12.2.4 Italy

- 12.2.5 Spain

- 12.2.6 Belgium

- 12.2.7 Sweden

- 12.3 Asia Pacific

- 12.3.1 China

- 12.3.2 India

- 12.3.3 Japan

- 12.3.4 Australia

- 12.3.5 Singapore

- 12.3.6 South Korea

- 12.3.7 Southeast Asia

- 12.4 Latin America

- 12.4.1 Brazil

- 12.4.2 Mexico

- 12.4.3 Argentina

- 12.5 MEA

- 12.5.1 South Africa

- 12.5.2 Saudi Arabia

- 12.5.3 UAE

Chapter 13 Company Profiles

- 13.1 aiMotive

- 13.2 Altair

- 13.3 Ansys

- 13.4 Applied Intuition

- 13.5 Aptiv

- 13.6 AVL List

- 13.7 Cambridge Systematics

- 13.8 Cognata

- 13.9 Dassault

- 13.10 dSPACE

- 13.11 Foretellix

- 13.12 Green Hills

- 13.13 Hexagon

- 13.14 IPG Automotive

- 13.15 LG

- 13.16 LHP Engineering

- 13.17 MathWorks

- 13.18 Mechanical Simulation

- 13.19 rFpro

- 13.20 Siemens

- 13.21 Synopsys