|

市场调查报告书

商品编码

1755306

眼科显微镜市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Ophthalmic Microscopes Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

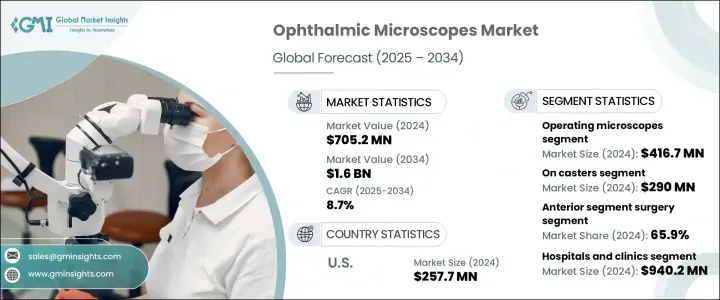

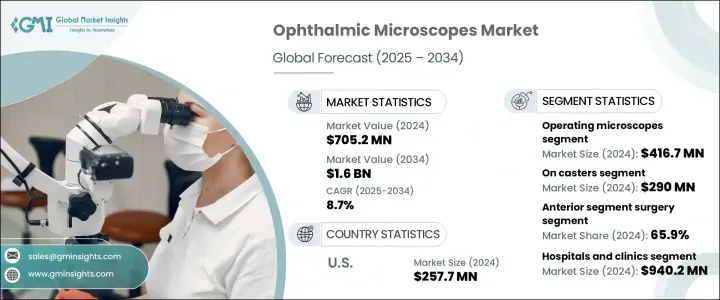

2024年,全球眼科显微镜市场规模达7.052亿美元,预计年复合成长率将达8.7%,2034年将达到16亿美元。这一大幅增长得益于眼科设备技术的不断进步、老年人口的不断增长以及人们对微创眼科手术日益增长的偏好。白内障、青光眼和老年性黄斑部病变等眼科疾病的日益流行,加速了先进外科手术的需求。

现代眼科显微镜现已配备3D视觉化、光学相干断层扫描 (OCT) 和扩增实境迭加技术,可提高手术精确度、增强训练效果并缩短手术时间。随着对设备精良、符合人体工学设计的手术器械的需求日益增长,这些配备高精度光学系统的显微镜也不断发展,功能更加多样,并在诊所和医院中广泛应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 7.052亿美元 |

| 预测值 | 16亿美元 |

| 复合年增长率 | 8.7% |

这些设备对于各种眼科手术至关重要,尤其是涉及眼前节和后节的手术。透过为外科医生提供高解析度的放大影像,它们有助于执行精准复杂的手术,例如白内障摘除术、角膜移植、视网膜手术和青光眼治疗。能够清楚地观察角膜、水晶体、视网膜和玻璃体等精细结构,使外科医生能够以无与伦比的精确度执行这些手术。这种高清成像技术确保即使是最复杂的手术也能以最小的风险进行,从而降低出错的可能性并改善患者的预后。

2024年,手术显微镜市场规模达4.167亿美元,领先市场。随着与年龄相关的眼部疾病发生率的上升,尤其是在老年人群中,眼科手术的需求激增。此外,门诊和日间手术的流行也推动了对紧凑、移动和多功能手术显微镜的需求。这些显微镜采用模组化组件设计,易于维护和移动,是门诊手术中心的理想选择。它们易于运输并在各个诊所使用,这与医疗保健领域对灵活、经济高效的解决方案日益增长的需求相契合。

医院和诊所细分市场在2024年占据最大份额,预计到2034年将达到9.402亿美元。随着专业眼科服务需求的增长,许多医院和多专科诊所正在设立专门的眼科科室,这些科室需要先进的手术显微镜来进行各种眼科手术。随着城市医疗基础设施(尤其是医疗中心)投资的增加,眼科显微镜的购买量显着增加。这些医疗中心优先考虑能够确保高手术准确性、安全性和整体患者疗效的设备。眼科显微镜不仅可以增强可视化效果,还可以最大限度地减少手术失误和术后併发症,从而推动了其需求。

2024年,美国眼科显微镜市场规模达2.577亿美元。白内障、青光眼和老年性黄斑部病变等眼科疾病发生率的上升,推动了对这些先进设备的需求。此外,美国对白内障手术的优惠报销政策,也支持医疗保健机构采用高阶手术系统。这种报销结构加速了对眼科手术新技术的投资,简化了成本回收。此外,美国是眼科显微镜市场领先製造商和创新者的聚集地。

全球眼科显微镜市场的知名公司包括蔡司、爱尔康、HAAG-STREIT GROUP、HAI Laboratories、Inami、KARL KAPS、Keeler、LABOMED、徕卡、MOPTIM、Reichert、Rexxam、TAKAGI 和 TOPCON。在眼科显微镜市场,各公司正在采用多种关键策略来巩固其地位。这些措施包括不断创新产品功能,例如增强的数位整合、3D 成像功能和人体工学设计,以满足不断变化的手术需求。製造商正在投资先进技术,以提高显微镜的功能和精度,使其成为眼科手术不可或缺的工具。为了扩大市场份额,许多公司正在与医疗机构和诊所建立策略伙伴关係和合作关係。此外,该公司还瞄准新兴市场,提供符合当地医疗保健需求且确保卓越品质的经济高效的型号。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 眼科疾病盛行率上升

- 微创眼科手术的采用日益增多

- 技术进步

- 白内障和屈光手术数量激增

- 产业陷阱与挑战

- 先进的眼科显微镜成本高昂

- 严格的监管要求

- 成长动力

- 成长潜力分析

- 监管格局

- 我们

- 欧洲

- 技术格局

- 报销场景

- 定价分析

- 产品对比展望

- 波特的分析

- PESTEL分析

- 差距分析

- 价值链分析

第四章:竞争格局

- 介绍

- 公司矩阵分析

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 手术显微镜

- 检查显微镜

第六章:市场估计与预测:按方式,2021 - 2034 年

- 主要趋势

- 带脚轮

- 天花板式

- 桌面

- 壁挂式

第七章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 前段手术

- 白内障手术

- 屈光手术

- 青光眼手术

- 角膜手术

- 雷射眼科手术

- 后段手术

- 血管切除术

- 视网膜剥离修復

- 黄斑裂孔修復

- 黄斑病变手术

- 后巩膜切除术

- 放射状视神经切开术

- 黄斑移位手术

第八章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院和诊所

- 门诊手术中心

- 其他最终用途

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第十章:公司简介

- ZEISS

- Alcon

- HAAG-STREIT GROUP

- HAI Laboratories

- Inami

- KARL KAPS

- Keeler

- LABOMED

- Leica

- MOPTIM

- Reichert

- Rexxam

- TAKAGI

- TOPCON

The Global Ophthalmic Microscopes Market was valued at USD 705.2 million in 2024 and is estimated to grow at a CAGR of 8.7% to reach USD 1.6 billion by 2034. The substantial growth can be attributed to the rising technological advancements in ophthalmic equipment, the increasing geriatric population, and the growing preference for minimally invasive ophthalmic surgeries. The prevalence of eye-related conditions like cataracts, glaucoma, and age-related macular degeneration is accelerating the demand for advanced surgical interventions.

Modern ophthalmic microscopes now feature 3D visualization, optical coherence tomography (OCT), and augmented reality overlays that improve the precision of surgeries, enhance training, and reduce surgical time. As the demand for better-equipped, ergonomically designed surgical instruments increases, these microscopes, with their high-precision optics, continue to evolve, becoming more multifunctional and widely adopted across clinics and hospitals.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $705.2 Million |

| Forecast Value | $1.6 Billion |

| CAGR | 8.7% |

These devices are essential for a wide range of ophthalmic surgeries, particularly those involving both the anterior and posterior segments of the eye. By providing surgeons with high-resolution, magnified images, they facilitate precise and intricate procedures, such as cataract removal, corneal transplants, retinal surgeries, and glaucoma treatments. The ability to visualize delicate structures, such as the cornea, lens, retina, and vitreous, allows surgeons to perform these operations with unparalleled accuracy. This high-definition imaging ensures that even the most complex surgeries are conducted with minimal risk, reducing the likelihood of errors and improving patient outcomes.

In 2024, the operating microscope segment led the market, generating USD 416.7 million. With the increasing incidence of age-related eye diseases, particularly among the elderly, the demand for ophthalmic surgeries has surged. Moreover, the trend toward outpatient and daycare surgeries is driving the need for compact, mobile, and versatile operating microscopes. These microscopes are designed with modular components for easy maintenance and mobility, making them ideal for ambulatory surgery centers. Their ability to be easily transported and used across various clinics aligns with the growing need for flexible, cost-effective solutions in the healthcare sector.

The hospitals and clinics segment held the largest share in 2024 and is expected to reach USD 940.2 million by 2034. As demand for specialized ophthalmology services rises, many hospitals and multi-specialty clinics are establishing dedicated ophthalmic units, which require advanced surgical microscopes for a variety of eye procedures. With increasing investments in urban healthcare infrastructure, particularly in healthcare hubs, there has been a marked rise in the purchase of ophthalmic microscopes. These medical centers prioritize equipment that ensures high surgical accuracy, safety, and overall patient outcomes. Ophthalmic microscopes not only enhance visualization but also minimize surgical errors and postoperative complications, driving their demand.

U.S. Ophthalmic Microscopes Market was valued at USD 257.7 million in 2024. The rising incidence of ophthalmic conditions such as cataracts, glaucoma, and age-related macular degeneration is boosting the demand for these advanced devices. Furthermore, favorable reimbursement policies for cataract surgeries in the U.S. support the adoption of high-end surgical systems by healthcare providers. This reimbursement structure accelerates the investment in new technologies for ophthalmic procedures, streamlining cost recovery. Additionally, the U.S. serves as a hub for leading manufacturers and innovators in the ophthalmic microscopes market.

Prominent companies operating in the Global Ophthalmic Microscopes Market include ZEISS, Alcon, HAAG-STREIT GROUP, HAI Laboratories, Inami, KARL KAPS, Keeler, LABOMED, Leica, MOPTIM, Reichert, Rexxam, TAKAGI, and TOPCON. In the ophthalmic microscopes market, companies are employing several key strategies to solidify their positions. These include ongoing innovation in product features, such as enhanced digital integration, 3D imaging capabilities, and ergonomic designs, to cater to evolving surgical needs. Manufacturers are investing in advanced technologies to improve the functionality and precision of microscopes, making them indispensable tools for eye surgeries. To expand market share, many companies are forming strategic partnerships and collaborations with healthcare institutions and clinics. Additionally, firms are targeting emerging markets with cost-effective models that meet local healthcare demands while ensuring superior quality.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of ophthalmic disorders

- 3.2.1.2 Growing adoption of minimally invasive ophthalmic surgeries

- 3.2.1.3 Technological advancements

- 3.2.1.4 Surge in cataract and refractive surgery volumes

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost associated with advanced ophthalmic microscopes

- 3.2.2.2 Stringent regulatory requirements

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 U.S.

- 3.4.2 Europe

- 3.5 Technology landscape

- 3.6 Reimbursement scenario

- 3.7 Pricing analysis

- 3.8 Product comparison outlook

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

- 3.11 Gap analysis

- 3.12 Value chain analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company matrix analysis

- 4.3 Company market share analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Operating microscopes

- 5.3 Examination microscopes

Chapter 6 Market Estimates and Forecast, By Modality, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 On casters

- 6.3 Ceiling-mounted

- 6.4 Table-top

- 6.5 Wall-mounted

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Anterior segment surgery

- 7.2.1 Cataract surgery

- 7.2.2 Refractive surgery

- 7.2.3 Glaucoma surgery

- 7.2.4 Corneal surgery

- 7.2.5 Laser eye surgery

- 7.3 Posterior segment surgery

- 7.3.1 Virectomy

- 7.3.2 Retinal detachment repair

- 7.3.3 Macular hole repair

- 7.3.4 Maculopathy surgery

- 7.3.5 Posterior scelerectomy

- 7.3.6 Radial optic neurotomy

- 7.3.7 Macular translocaion surgery

Chapter 8 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 8.1 Key trends

- 8.2 Hospitals and clinics

- 8.3 Ambulatory surgical centres

- 8.4 Other end use

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 Japan

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 South Africa

- 9.6.2 Saudi Arabia

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 ZEISS

- 10.2 Alcon

- 10.3 HAAG-STREIT GROUP

- 10.4 HAI Laboratories

- 10.5 Inami

- 10.6 KARL KAPS

- 10.7 Keeler

- 10.8 LABOMED

- 10.9 Leica

- 10.10 MOPTIM

- 10.11 Reichert

- 10.12 Rexxam

- 10.13 TAKAGI

- 10.14 TOPCON