|

市场调查报告书

商品编码

1755312

国防电子淘汰市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Defense Electronics Obsolescence Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

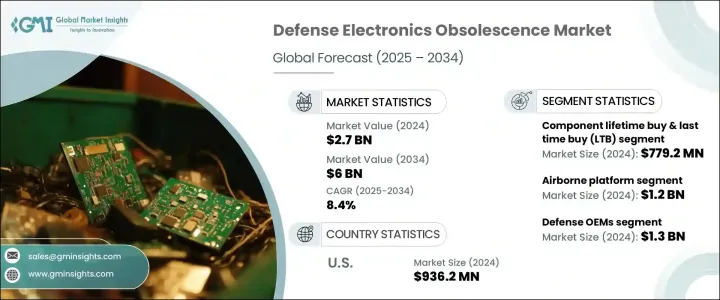

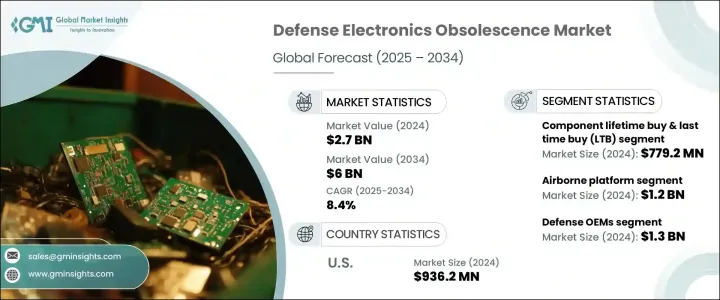

2024年,全球国防电子产品淘汰市场价值27亿美元,预计到2034年将以8.4%的复合年增长率增长,达到60亿美元,这得益于全球国防预算的不断增长以及数位孪生技术和预测分析应用的日益普及。随着军队持续现代化,同时严重依赖长期服役的平台,为老化的电子元件系统提供支援的需求变得至关重要。永续性、系统升级和元件相容性方面的努力不断加强,这推动了对生命週期管理和缓解电子元件淘汰解决方案的需求。同时,旨在增强工业基础韧性的采购改革和策略正在鼓励整个国防工业的国内采购和数位转型。

多年来,结构现代化策略和遗留系统的持续使用促使人们更加重视旧电子设备的维护和支援。推广主动生命週期管理的政策催生了更灵活、技术更先进的电子元件报废预测方法。对平台寿命的重视催生了强大的DMSMS(减少製造来源和材料短缺)计画。由于国防平台的服役週期长达数十年,较短的组件生命週期与较长的系统寿命之间的不匹配使得报废管理至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 27亿美元 |

| 预测值 | 60亿美元 |

| 复合年增长率 | 8.4% |

2024年,组件生命週期和最后一次购买 (LTB) 细分市场的价值为7.792亿美元。这些策略有助于满足日益增长的对旧系统支援的需求,尤其是在国防平台普遍使用商用现货 (COTS) 零件的情况下。由于电子组件的生命週期通常限制在5-10年,生命週期和最后一次购买策略有助于弥补与可能服役超过40年的平台之间的差距。地缘政治不确定性、出口限制和半导体短缺加速了对LTB策略的依赖,以避免供应中断。

2024年,机上平台市场价值达12亿美元。随着对延长空中平台使用寿命的需求不断增长,推动了对航空电子设备、雷达系统和电子战 (EW) 升级的投资。将新技术整合到现有系统所带来的相容性挑战,加剧了对外形尺寸和功能匹配的替换以及传统组件模拟的需求。此外,无人机和支援飞机依赖COTS零件以降低成本,这使其容易过早淘汰,并依赖强大的售后市场采购。

2024年,美国国防电子产品淘汰市场规模达9.362亿美元,主因是军用舰队老化,需要持续维护过时的电子系统。国防机构对维护计画和现代化措施的投资,以及预测分析和数位孪生技术的快速实施,正在推动市场向前发展。

市场上的知名企业包括 Lynx、RTX、Thales Group、SMT Corp、Mercury Systems、Leonardo、Northrop Grumman、Boeing Defense、Teledyne Technologies、TT Electronics、Lockheed Martin、Saab RDS、L3Harris Technologies、Rheinmetall、AT Engine Controls 和 Bae Systems。为了巩固市场地位,国防电子报废市场正在采取多项关键策略,包括争取长期政府合同,以及强调终身采购和最后一次采购,以确保零件的供应。许多企业正在大力投资人工智慧预测和数位孪生等数位工具,以改善报废预测能力。此外,各供应链之间的合作也正在加强,以减少对外国来源的依赖。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 川普政府关税

- 对贸易的影响

- 贸易量中断

- 报復措施

- 对产业的影响

- 供给侧影响

- 关键零件价格波动

- 供应链重组

- 生产成本影响

- 需求面影响(售价)

- 价格传导至终端市场

- 市占率动态

- 消费者反应模式

- 供给侧影响

- 受影响的主要公司

- 策略产业反应

- 供应链重构

- 定价和产品策略

- 政策参与

- 展望与未来考虑

- 对贸易的影响

- 产业衝击力

- 成长动力

- 老化的军事平台

- 增加国防预算

- 电子技术进步

- 地缘政治紧张局势与威胁现代化

- 数位孪生和预测分析的采用日益增多

- 产业陷阱与挑战

- 有限的预测工具

- 智慧财产权(IP)限制

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按解决方案类型,2021 - 2034 年

- 主要趋势

- 过时监控和预测

- 组件终身购买和最后一次购买 (LTB)

- 重新设计与改造解决方案

- 仿真与模拟

- 替代采购(售后市场、经纪人)

- 软体和韧体更新

第六章:市场估计与预测:按平台,2021 - 2034 年

- 主要趋势

- 空降

- 海军

- 土地

- 空间

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 国防原始设备製造商

- MRO 提供者

- 政府和国防机构

第八章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 荷兰

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

第九章:公司简介

- AT Engine Controls

- Bae Systems

- Boeing Defense

- L3Harris Technologies

- Leonardo

- Lockheed Martin

- Lynx

- Mercury Systems

- Northrop Grumman

- Rheinmetall

- RTX

- Saab RDS

- SMT Corp

- Teledyne Technologies

- Thales Group

- TT Electronics

The Global Defense Electronics Obsolescence Market was valued at USD 2.7 billion in 2024 and is estimated to grow at a CAGR of 8.4% to reach USD 6 billion by 2034, driven by a rising global defense budget and the increasing use of digital twin technology and predictive analytics. As military forces continue modernizing while relying heavily on long-serving platforms, the need to support aging systems with obsolete electronic components has become critical. Efforts toward sustainability, system upgrades, and component compatibility have intensified, prompting demand for lifecycle management and obsolescence mitigation solutions. In parallel, procurement reforms and strategies aimed at reinforcing industrial base resilience are encouraging domestic sourcing and digital transformation across the defense sector.

Over the years, structural modernization strategies and the continued use of legacy systems have prompted increased focus on maintaining and supporting older electronics. Policies promoting proactive lifecycle management have led to a more agile and technologically advanced approach to forecasting electronic component obsolescence. The emphasis on platform longevity has resulted in robust DMSMS (Diminishing Manufacturing Sources and Material Shortages) programs. As defense platforms remain active for decades, the mismatch between short component life cycles and long system lifespans has made obsolescence management essential.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.7 Billion |

| Forecast Value | $6 Billion |

| CAGR | 8.4% |

The component lifetime and last-time buy (LTB) segment was valued at USD 779.2 million in 2024. These strategies help address the growing need to secure legacy system support, especially as commercial off-the-shelf (COTS) parts are used across defense platforms. With electronic component lifecycles often limited to 5-10 years, lifetime and last-time buys help bridge the gap with platforms that may remain in service for over four decades. Geopolitical uncertainties, restricted exports, and semiconductor shortages accelerate reliance on LTB strategies to avoid supply disruptions.

The airborne platform segment was valued at USD 1.2 billion in 2024. Increased demand for extended service life of air platforms has fueled investments in avionics, radar systems, and electronic warfare (EW) upgrades. Compatibility challenges with integrating newer technologies into existing systems have amplified the need for form-fit-function replacements and legacy component emulation. Additionally, UAVs and support aircraft depend on COTS parts for affordability, making them vulnerable to early obsolescence and dependent on strong aftermarket sourcing.

United States Defense Electronics Obsolescence Market generated USD 936.2 million in 2024 driven by an aging military fleet that requires constant support for outdated electronic systems. Investments in sustainment programs and modernization initiatives, alongside the rapid implementation of predictive analytics and digital twin technologies by defense agencies, are pushing the market forward.

The prominent players in the market include Lynx, RTX, Thales Group, SMT Corp, Mercury Systems, Leonardo, Northrop Grumman, Boeing Defense, Teledyne Technologies, TT Electronics, Lockheed Martin, Saab RDS, L3Harris Technologies, Rheinmetall, AT Engine Controls, and Bae Systems. To strengthen its market foothold, the Defense Electronics Obsolescence Market is adopting several key strategies. These include securing long-term government contracts and emphasizing lifetime and last-time buys to ensure component availability. Many are investing heavily in digital tools like AI-powered forecasting and digital twins to improve obsolescence prediction. Collaborations across supply chains are being strengthened to reduce dependency on foreign sources.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 industry ecosystem analysis

- 3.2 trump administration tariffs

- 3.2.1 impact on trade

- 3.2.1.1 trade volume disruptions

- 3.2.1.2 retaliatory measures

- 3.2.2 impact on the industry

- 3.2.2.1 supply-side impact

- 3.2.2.1.1 price volatility in key components

- 3.2.2.1.2 supply chain restructuring

- 3.2.2.1.3 production cost implications

- 3.2.2.2 demand-side impact (selling price)

- 3.2.2.2.1 price transmission to end markets

- 3.2.2.2.2 market share dynamics

- 3.2.2.2.3 consumer response patterns

- 3.2.2.1 supply-side impact

- 3.2.3 key companies impacted

- 3.2.4 strategic industry responses

- 3.2.4.1 supply chain reconfiguration

- 3.2.4.2 pricing and product strategies

- 3.2.4.3 policy engagement

- 3.2.5 outlook and future considerations

- 3.2.1 impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Aging military platforms

- 3.3.1.2 Increasing defense budgets

- 3.3.1.3 Technological advancement in electronics

- 3.3.1.4 Geopolitical tensions & threat modernization

- 3.3.1.5 Growing adoption of digital twin & predictive analytics

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Limited forecasting tools

- 3.3.2.2 Intellectual property (IP) restrictions

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Solution Type, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Obsolescence monitoring & forecasting

- 5.3 Component lifetime buy & last-time buy (LTB)

- 5.4 Redesign & retrofit solutions

- 5.5 Emulation & simulation

- 5.6 Alternative sourcing (aftermarket, brokers)

- 5.7 Software & firmware updates

Chapter 6 Market Estimates and Forecast, By Platform, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Airborne

- 6.3 Naval

- 6.4 Land

- 6.5 Space

Chapter 7 Market Estimates and Forecast, By End Use, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Defense OEMs

- 7.3 MRO providers

- 7.4 Government & defense agencies

Chapter 8 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 AT Engine Controls

- 9.2 Bae Systems

- 9.3 Boeing Defense

- 9.4 L3Harris Technologies

- 9.5 Leonardo

- 9.6 Lockheed Martin

- 9.7 Lynx

- 9.8 Mercury Systems

- 9.9 Northrop Grumman

- 9.10 Rheinmetall

- 9.11 RTX

- 9.12 Saab RDS

- 9.13 SMT Corp

- 9.14 Teledyne Technologies

- 9.15 Thales Group

- 9.16 TT Electronics