|

市场调查报告书

商品编码

1755317

穿戴式生物电子皮肤贴片市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Wearable Bioelectronic Skin Patches Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

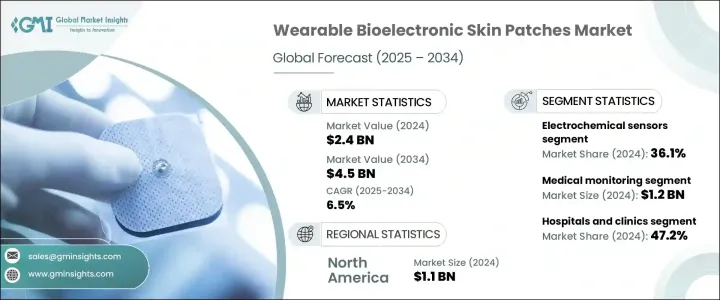

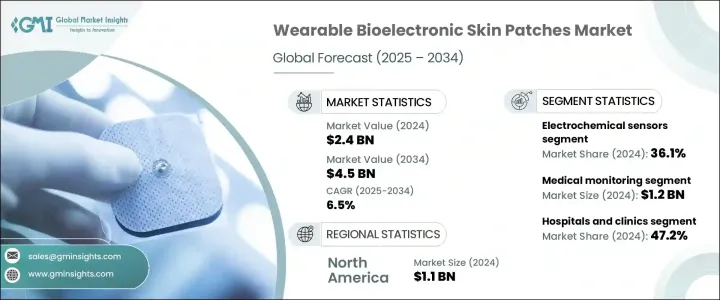

2024年,全球穿戴式生物电子皮肤贴片市场规模达24亿美元,预计到2034年将以6.5%的复合年增长率成长,达到45亿美元。这一增长源于对非侵入式即时健康监测解决方案日益增长的需求,这与全球医疗保健向更个人化和主动化的方向转变的目标相契合。随着人口老化和慢性病的日益普遍,对能够实现持续居家监测的技术的需求也日益增长。穿戴式生物电子皮肤贴片贴附在皮肤上,可以无痛地追踪生命征象、生化指标和其他生理资料,无需就医。

它们能够无线传输资料,为远距医疗、早期诊断和持续健康状况管理(尤其针对慢性病患者)打开了大门。这项转变与世界卫生组织(WHO)的《数位健康议程(2020-2025)》等国际策略高度契合,该议程倡导将科技融入医疗保健领域,以增强全民健康覆盖。这些贴片的先进特性——例如灵活性、更长的电池寿命和多感测器功能——使其成为临床和消费者健康应用的理想选择,并有望在健身和医疗保健等多个领域中广泛应用。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 24亿美元 |

| 预测值 | 45亿美元 |

| 复合年增长率 | 6.5% |

2024年,电化学感测器细分市场的份额为36.1%。随着糖尿病和心臟病等慢性疾病的盛行率不断上升,对持续性、非侵入性监测技术的需求也日益增长。电化学感测器使这些皮肤贴片能够检测各种生物标记物,从葡萄糖和乳酸到汗水和组织液中的电解质。这种持续监测为患者提供即时资料,使他们能够更有效地管理自身健康和病情。电化学感测器灵敏度高,能够及早发现和诊断健康问题,这是降低医院再入院率的重要因素。这一趋势标誌着家庭医疗保健管理方式的转变,有助于改善疾病控制和生活品质。

2024年,医院和诊所在穿戴式生物电子皮肤贴片市场的占有率为47.2%。这些贴片在医疗保健环境中的应用日益广泛,用于持续监测心率、体温和呼吸等生命征象。穿戴式贴片取代了传统的床边设备,能够更快地识别患者的变化并更及时地进行医疗干预。它们在重症监护病房和术后恢復区域非常有用,因为这些区域的持续监测至关重要。医院也正在使用穿戴式贴片来简化操作流程,减少文件错误,并减轻护理人员的负担,从而改善患者护理并提高工作效率。

预计到 2034 年,美国穿戴式生物电子皮肤贴片市场规模将达到 18 亿美元。这一增长归因于糖尿病和高血压等慢性病发病率的上升,以及人口老化。随着慢性病日益普遍,穿戴式科技在医疗保健管理中发挥关键作用,尤其对于出院后患者或需要持续监测的老年人。美国医疗保险和医疗补助服务中心 (CMS) 扩大了远距患者监测技术的报销政策,这激励了穿戴式生物电子贴片的采用,使其成为慢性病管理不可或缺的一部分。远端监测特定计费代码的引入,进一步支持了医院和医疗机构使用穿戴式装置带来的市场成长。

全球穿戴式生物电子皮肤贴片市场的主要参与者包括雅培实验室、Biolinq、Epicore Biosystems、Feeligreen、GE医疗、Gentag、久光製药、Insulet、iRhythm Technologies、Kenzen、美敦力、Nemaura Medical、荷兰皇家飞利浦、VivaLNK 和 3M。为巩固市场地位,穿戴式生物电子皮肤贴片市场的公司正专注于几项关键策略。这些措施包括投资研发以提高感测器的准确性、灵活性和电池寿命,使贴片更加可靠且用户友好。公司正在与医疗保健提供者、保险公司和政府组织建立合作伙伴关係以渗透市场,特别是在慢性病管理和远距医疗服务领域。此外,该公司正在透过整合资料分析、人工智慧健康洞察以及与现有医疗保健平台的无缝整合等高级功能来增加其产品供应。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 对非侵入性和即时健康监测解决方案的需求不断增长

- 柔性和可拉伸电子产品的技术进步

- 慢性病盛行率不断上升

- 提高健康意识和健身意识

- 产业陷阱与挑战

- 开发和製造成本高

- 对资料隐私和安全的担忧

- 成长动力

- 成长潜力分析

- 技术格局

- 未来市场趋势

- 监管格局

- 专利分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 竞争市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:按类型,2021 年至 2034 年

- 主要趋势

- 电化学感测器

- ECG 感测器

- 温度感测器

- 肌电图感测器

- 其他类型

第六章:市场估计与预测:按应用,2021 年至 2034 年

- 主要趋势

- 健身与健康

- 医疗监护

- 其他应用

第七章:市场估计与预测:依最终用途,2021 年至 2034 年

- 主要趋势

- 医院和诊所

- 居家照护环境

- 其他最终用户

第八章:市场估计与预测:按地区,2021 年至 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 日本

- 中国

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第九章:公司简介

- Abbott Laboratories

- Biolinq

- Epicore Biosystems

- Feeligreen

- GE Healthcare

- Gentag

- Hisamitsu Pharmaceutical

- Insulet

- iRhythm Technologies

- Kenzen

- Medtronic

- Nemaura Medical

- Koninklijke Philips

- VivaLNK

- 3M

The Global Wearable Bioelectronic Skin Patches Market was valued at USD 2.4 billion in 2024 and is estimated to grow at a CAGR of 6.5% to reach USD 4.5 billion by 2034. This growth is driven by the increasing demand for non-invasive, real-time health monitoring solutions, aligning with global healthcare goals to shift toward more personalized and proactive approaches. As populations age and chronic diseases become more prevalent, there is a greater need for technologies that enable continuous, at-home monitoring. Wearable bioelectronic skin patches, which adhere to the skin, allow for tracking vital signs, biochemical markers, and other physiological data painlessly and without the need for hospital visits.

Their ability to wirelessly transmit data opens the door for remote healthcare, early diagnosis, and ongoing management of health conditions, especially in chronic patients. This shift is closely aligned with international strategies like the WHO's digital health agenda (2020-2025), which advocates for the integration of technology in healthcare to enhance universal health coverage. The advanced features of these patches-such as flexibility, extended battery life, and multi-sensor capabilities-make them ideal for both clinical and consumer wellness applications, fostering adoption across multiple sectors, including fitness and healthcare.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.4 Billion |

| Forecast Value | $4.5 Billion |

| CAGR | 6.5% |

The electrochemical sensor segment held a share of 36.1% in 2024. As the prevalence of chronic diseases such as diabetes and heart disease increases, the demand for continuous, non-invasive monitoring technologies is growing. Electrochemical sensors enable these skin patches to detect a wide range of biomarkers, from glucose and lactate to electrolytes in sweat and interstitial fluid. This continuous monitoring provides patients with real-time data, empowering them to manage their health and conditions more effectively. Electrochemical sensors offer high sensitivity, allowing for early detection and diagnosis of health issues, which is a significant factor in reducing hospital readmission rates. This trend marks a shift in how healthcare is managed at home, improving both disease control and quality of life.

In 2024, the hospitals and clinics segment in the wearable bioelectronic skin patches market, accounting for 47.2%. These patches are increasingly being used in healthcare settings to continuously monitor vital signs such as heart rate, body temperature, and respiration. By eliminating the need for traditional bedside equipment, wearable patches enable quicker identification of patient changes and more timely medical interventions. They are useful in intensive care units and post-operative recovery areas, where continuous monitoring is essential. Hospitals are also using wearable patches to streamline operations, reduce documentation errors, and lessen the burden on nursing staff, allowing for improved patient care and efficiency.

United States Wearable Bioelectronic Skin Patches Market is expected to generate USD 1.8 billion by 2034. This growth is attributed to the increasing incidence of chronic diseases, such as diabetes and hypertension, coupled with an aging population. As chronic conditions become more common, wearable technology plays a key role in healthcare management, particularly for post-discharge patients or elderly individuals who require ongoing monitoring. The expansion of reimbursement policies by the Centers for Medicare and Medicaid Services (CMS) for remote patient monitoring technologies has incentivized the adoption of wearable bioelectronic patches, making them an integral part of chronic disease management. The introduction of specific billing codes for remote monitoring has further supported the market's growth through the use of wearable devices viable for hospitals and healthcare providers.

Key players in the Global Wearable Bioelectronic Skin Patches Market include Abbott Laboratories, Biolinq, Epicore Biosystems, Feeligreen, GE Healthcare, Gentag, Hisamitsu Pharmaceutical, Insulet, iRhythm Technologies, Kenzen, Medtronic, Nemaura Medical, Koninklijke Philips, VivaLNK, and 3M. To strengthen their market position, companies operating in the wearable bioelectronic skin patches market are focusing on several key strategies. These include investing in research and development to enhance sensor accuracy, flexibility, and battery life, making the patches more reliable and user-friendly. Partnerships with healthcare providers, insurance companies, and government organizations are being pursued for market penetration, especially in chronic care management and telehealth services. Additionally, companies are increasing their product offerings by incorporating advanced features such as data analytics, AI-powered health insights, and seamless integration with existing healthcare platforms.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for non-invasive and real-time health monitoring solutions

- 3.2.1.2 Technological advancements in flexible and stretchable electronics

- 3.2.1.3 Growing prevalence of chronic diseases

- 3.2.1.4 Increasing health awareness and fitness consciousness

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High development and manufacturing costs

- 3.2.2.2 Concerns regarding data privacy and the security

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Technology landscape

- 3.5 Future market trends

- 3.6 Regulatory landscape

- 3.7 Patent analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategic outlook matrix

Chapter 5 Market Estimates and Forecast, By Type, 2021 – 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Electrochemical sensors

- 5.3 ECG sensors

- 5.4 Temperature sensors

- 5.5 EMG sensors

- 5.6 Other types

Chapter 6 Market Estimates and Forecast, By Application, 2021 – 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Fitness and wellness

- 6.3 Medical monitoring

- 6.4 Other applications

Chapter 7 Market Estimates and Forecast, By End Use, 2021 – 2034 ($ Mn)

- 7.1 Key trends

- 7.2 Hospitals and clinics

- 7.3 Home care settings

- 7.4 Other end users

Chapter 8 Market Estimates and Forecast, By Region, 2021 – 2034 ($ Mn)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Netherlands

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.5 Latin America

- 8.5.1 Mexico

- 8.5.2 Brazil

- 8.5.3 Argentina

- 8.6 Middle East and Africa

- 8.6.1 South Africa

- 8.6.2 Saudi Arabia

- 8.6.3 UAE

Chapter 9 Company Profiles

- 9.1 Abbott Laboratories

- 9.2 Biolinq

- 9.3 Epicore Biosystems

- 9.4 Feeligreen

- 9.5 GE Healthcare

- 9.6 Gentag

- 9.7 Hisamitsu Pharmaceutical

- 9.8 Insulet

- 9.9 iRhythm Technologies

- 9.10 Kenzen

- 9.11 Medtronic

- 9.12 Nemaura Medical

- 9.13 Koninklijke Philips

- 9.14 VivaLNK

- 9.15 3M