|

市场调查报告书

商品编码

1755332

风机盘管市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Fan Coil Unit Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

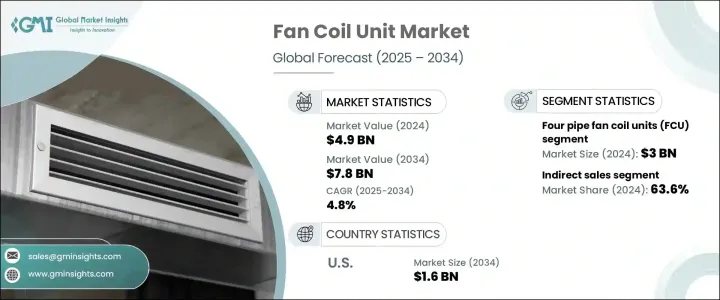

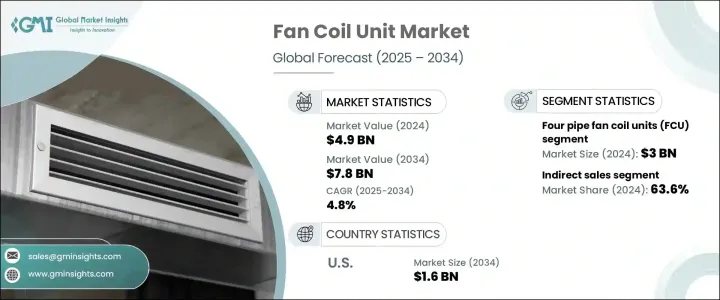

2024年,全球风机盘管市场规模达49亿美元,预计2034年将以4.8%的复合年增长率成长,达到78亿美元。这一增长主要源于人们对室内空气品质重要性的日益重视。随着人们大部分时间都待在住宅、办公室和其他封闭环境中,对空气污染和湿度控制的担忧也日益凸显。消费者如今寻求的空调解决方案不仅要能够製冷或製热,还要能够确保室内环境更清洁、更健康。配备高性能空气过滤和湿度调节功能的风扇盘管越来越受到住宅和商业买家的青睐。在办公室、学校和医疗保健等环境中,更好的室内空气品质与健康和生产力的提高密切相关,这进一步推动了其普及。

此外,为满足当代能源标准而对老化基础设施进行现代化改造的趋势,也催生了对节能暖通空调 (HVAC) 解决方案(例如 FCU)的强劲需求。由于建筑仍然是全球能源消耗的最大贡献者之一,整合高效的气候控制系统对于减少能源足迹至关重要。现代 FCU,尤其是整合智慧技术的 FCU,因其增强的控制和自动化功能而日益受到青睐。远端监控、基于占用率的设置以及与楼宇管理系统的集成,使 FCU 对设施管理人员和建筑业主更具吸引力。这些智慧系统有助于更有效地调节能源使用,优化性能,同时最大限度地降低营运成本。它们还能提供即时洞察,从而实现主动维护和性能调整,从而实现长期效率提升。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 49亿美元 |

| 预测值 | 78亿美元 |

| 复合年增长率 | 4.8% |

根据配置,风扇盘管市场可分为两管和四管两种类型。其中,四管类型占最大收益份额,2024 年价值约 30 亿美元,预计 2025 年至 2034 年的复合年增长率为 4.9%。四管系统能够同时提供暖气和冷气,这使其在不同区域具有不同气候控制需求的建筑中具有功能优势。这种灵活性使建筑业者能够根据特定空间定制精确的室内温度。这些系统尤其适用于需要在多个房间或部门保持一致舒适度的大型商业或机构设施。虽然初始安装和设备成本相对较高,但四管风机盘管卓越的热控制和适应性使其成为高级暖通空调设计的首选。

按配销通路评估时,市场分为直接销售和间接销售。间接销售部分在 2024 年占据主导地位,贡献了总收入的约 63.6%,预计在预测期内将以 4.9% 的复合年增长率增长。这一部门的优势在于其广泛的中间商网络,包括经销商、分销商和零售合作伙伴。这些管道帮助製造商扩大其在不同地理位置和客户群的影响力。与当地承包商、建筑商和最终用户建立的关係使销售週期更有效率、更有反应。此外,经销商提供的售后支援、安装和维护等增值服务进一步增强了该通路的吸引力。间接销售也受惠于在地化的行销策略和深入的市场知识,这有助于提升品牌在区域市场的知名度和客户信任度。

在美国,风机盘管市场规模在2024年超过10亿美元,预计2034年将达到16亿美元。日益转向节能可持续的建筑系统是推动这一成长的主要因素。风机盘管越来越多地被纳入绿色建筑设计,因为它们能够提供局部气候控制,与集中式暖通空调系统相比,可显着节省能源。透过优化房间温度控制,风扇盘管可以最大限度地减少能源浪费,并符合国家推广永续建筑实践的目标。这使得风机盘管成为推动环保基础设施升级的重要组成部分。

全球FCU市场仍高度分散,许多区域性参与者在国际层面运作。这些公司合计约占总市场份额的10%至15%。本地公司通常会满足特定的区域需求,根据当地法规和建筑规范的要求客製化产品。他们还提供符合区域偏好的客製化解决方案。另一方面,全球品牌受益于大规模生产、成熟的国际网络和强大的市场信誉,使其能够在多个地区保持竞争力。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 影响价值链的因素

- 利润率分析

- 中断

- 未来展望

- 製造商

- 经销商

- 供应商格局

- 利润率分析

- 技术概述

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 提高对室内空气品质的认识

- 都市化进程加速

- 技术进步

- 产业陷阱与挑战

- 初始成本高

- 监理和合规问题

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:风机盘管市场估计与预测:依配置,2021 - 2032 年

- 主要趋势

- 双管制风机盘管机组

- 四管制风机盘管机组

第六章:风机盘管市场估计与预测:依方向,2021 - 2032 年

- 主要趋势

- 水平的

- 壁挂式

- 管道鼓风机类型

- 天花闆卡式

- 天花板暗装型

- 垂直(落地式)

第七章:风机盘管市场估计与预测:按风量,2021 - 2032 年

- 主要趋势

- 低于500立方米/小时

- 500 立方米/小时 - 1000 立方米/小时

- 1000 立方米/小时 - 1500 立方米/小时

- 1500 立方米/小时 - 2000 立方米/小时

- 2000 立方米/小时以上

第八章:风机盘管市场估计与预测:依最终用途,2021 - 2032 年

- 主要趋势

- 住宅

- 商业的

- 办公室空间

- 饭店

- 餐厅

- 医院

- 零售

- 超市

- 百货公司

- 品牌直营店

- 物流(仓库)

- 其他(製造业等)

- 工业的

第九章:风机盘管市场估计与预测:按配销通路,2021 - 2032 年

- 主要趋势

- 直销

- 间接销售

第十章:风机盘管市场估计与预测:按地区,2021 - 2032 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- MEA

- 南非

- 沙乌地阿拉伯

- 阿联酋

- MEA 其余地区

第 11 章:公司简介

- Aermec

- Carrier Global Corporation

- Daikin Industries

- Dunham-Bush

- Emerson Electric

- Fujitsu General Limited

- Gree Electric Appliances

- Honeywell International

- Johnson Controls International

- Lennox International

- LG Electronics

- Mitsubishi Electric Corporation

- Samsung Electronics

- Trane Technologies

- TROX

The Global Fan Coil Unit Market was valued at USD 4.9 billion in 2024 and is estimated to grow at a CAGR of 4.8% to reach USD 7.8 billion by 2034. This growth is primarily fueled by rising awareness about the importance of indoor air quality. As people spend a large portion of their time inside homes, offices, and other enclosed environments, concerns around air pollution and humidity control have become more prominent. Consumers are now looking for air conditioning solutions that not only cool or heat the air but also ensure cleaner, healthier indoor environments. FCUs equipped with high-performance air filtration and humidity regulation features are increasingly favored by both residential and commercial buyers. In environments such as offices, schools, and healthcare settings, better indoor air quality is closely linked with improved wellness and productivity, which further drives adoption.

Additionally, the trend of modernizing aging infrastructure to meet contemporary energy standards has created a strong demand for energy-efficient HVAC solutions like FCUs. As buildings remain one of the highest contributors to energy use globally, integrating efficient climate control systems has become essential for reducing energy footprints. Modern FCUs, particularly those integrated with smart technology, are gaining momentum as they offer enhanced control and automation features. Remote monitoring, occupancy-based settings, and integration with building management systems are making FCUs more attractive to facility managers and building owners. These intelligent systems help regulate energy usage more effectively, optimizing performance while minimizing operational expenses. They also offer real-time insights that allow for proactive maintenance and performance tuning, leading to long-term efficiency gains.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.9 Billion |

| Forecast Value | $7.8 Billion |

| CAGR | 4.8% |

By configuration, the fan coil unit market is segmented into two-pipe and four-pipe FCUs. Among these, the four-pipe segment accounted for the largest revenue share, valued at approximately USD 3 billion in 2024, and is expected to grow at a CAGR of 4.9% from 2025 to 2034. The ability of four-pipe systems to deliver both heating and cooling at the same time gives them a functional advantage in buildings with varied climate control needs across different zones. This flexibility enables building operators to maintain precise indoor temperatures tailored to specific spaces. These systems are particularly suitable for large-scale commercial or institutional facilities that require consistent comfort across multiple rooms or departments. Although the initial installation and equipment costs are relatively high, the superior thermal control and adaptability of four-pipe FCUs make them a preferred choice in advanced HVAC design.

When assessed by distribution channel, the market is divided into direct and indirect sales. The indirect sales segment held the dominant share in 2024, contributing roughly 63.6% of the overall revenue, and is forecasted to rise at a CAGR of 4.9% over the forecast period. The strength of this segment lies in its widespread network of intermediaries, including dealers, distributors, and retail partners. These channels help manufacturers expand their reach into diverse geographic locations and customer bases. Established relationships with local contractors, builders, and end-users make the sales cycle more efficient and responsive. Additionally, value-added services such as post-sale support, installation, and maintenance offered by distributors further enhance the attractiveness of this channel. Indirect sales also benefit from localized marketing strategies and in-depth market knowledge, which help boost brand visibility and customer trust in regional markets.

In the United States, the fan coil unit market surpassed USD 1 billion in value in 2024 and is projected to hit USD 1.6 billion by 2034. The increasing shift toward energy-efficient and sustainable building systems is a major factor behind this growth. FCUs are increasingly being incorporated into green building designs as they offer localized climate control, which contributes to significant energy savings compared to centralized HVAC systems. By optimizing temperature control at the room level, FCUs minimize energy waste and align with nationwide goals to promote sustainable building practices. This has made FCUs a vital component in the drive toward environmentally conscious infrastructure upgrades.

The global FCU market remains highly fragmented, with numerous regional players operating on an international level. Collectively, these companies account for approximately 10% to 15% of the total market share. Local firms often cater to specific regional demands, tailoring their offerings to meet local regulatory and building code requirements. They also provide customized solutions that appeal to regional preferences. On the other hand, global brands benefit from large-scale production, established international networks, and strong market credibility, enabling them to maintain competitiveness across multiple regions.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculations

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Factor affecting the value chain

- 3.1.2 Profit margin analysis

- 3.1.3 Disruptions

- 3.1.4 Future outlook

- 3.1.5 Manufacturers

- 3.1.6 Distributors

- 3.2 Supplier landscape

- 3.3 Profit margin analysis

- 3.4 Technological overview

- 3.5 Key news & initiatives

- 3.6 Regulatory landscape

- 3.7 Impact forces

- 3.7.1 Growth drivers

- 3.7.1.1 Increased awareness of indoor air quality

- 3.7.1.2 Rising urbanization

- 3.7.1.3 Technological advancements

- 3.7.2 Industry pitfalls & challenges

- 3.7.2.1 High initial costs

- 3.7.2.2 Regulatory and compliance issues

- 3.7.1 Growth drivers

- 3.8 Growth potential analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Fan Coil Unit Market Estimates & Forecast, By Configuration, 2021 - 2032 (USD Million) (Thousand Units)

- 5.1 Key trends

- 5.2 Two pipe fan coil unit

- 5.3 Four pipe fan coil unit

Chapter 6 Fan Coil Unit Market Estimates & Forecast, By Orientation, 2021 - 2032 (USD Million) (Thousand Units)

- 6.1 Key trends

- 6.2 Horizontal

- 6.2.1 Wall mounted

- 6.2.2 Ducted blower type

- 6.2.3 Ceiling cassette type

- 6.2.4 Ceiling concealed type

- 6.3 Vertical (floor mounted)

Chapter 7 Fan Coil Unit Market Estimates & Forecast, By Air Flow, 2021 - 2032 (USD Million) (Thousand Units)

- 7.1 Key trends

- 7.2 Below 500 m³/h

- 7.3 500 m³/h - 1000 m³/h

- 7.4 1000 m³/h - 1500 m³/h

- 7.5 1500 m³/h - 2000 m³/h

- 7.6 Above 2000 m³/h

Chapter 8 Fan Coil Unit Market Estimates & Forecast, By End Use, 2021 - 2032 (USD Million) (Thousand Units)

- 8.1 Key trends

- 8.2 Residential

- 8.3 Commercial

- 8.3.1 Office spaces

- 8.3.2 Hotels

- 8.3.3 Restaurants

- 8.3.4 Hospitals

- 8.3.5 Retail

- 8.3.5.1 Supermarkets

- 8.3.5.2 Departmental stores

- 8.3.5.3 Brand outlet stores

- 8.3.6 Logistics (warehouse)

- 8.3.7 Others (manufacturing, etc.)

- 8.4 Industrial

Chapter 9 Fan Coil Unit Market Estimates & Forecast, By Distribution Channel, 2021 - 2032 (USD Million) (Thousand Units)

- 9.1 Key trends

- 9.2 Direct sales

- 9.3 Indirect sales

Chapter 10 Fan Coil Unit Market Estimates & Forecast, By Region, 2021 - 2032 (USD Million) (Thousand Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Russia

- 10.3.7 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Rest of Latin America

- 10.6 MEA

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of MEA

Chapter 11 Company Profiles

- 11.1 Aermec

- 11.2 Carrier Global Corporation

- 11.3 Daikin Industries

- 11.4 Dunham-Bush

- 11.5 Emerson Electric

- 11.6 Fujitsu General Limited

- 11.7 Gree Electric Appliances

- 11.8 Honeywell International

- 11.9 Johnson Controls International

- 11.10 Lennox International

- 11.11 LG Electronics

- 11.12 Mitsubishi Electric Corporation

- 11.13 Samsung Electronics

- 11.14 Trane Technologies

- 11.15 TROX