|

市场调查报告书

商品编码

1755362

公用事业规模低压数位变电站市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Utility-Scale Low Voltage Digital Substation Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

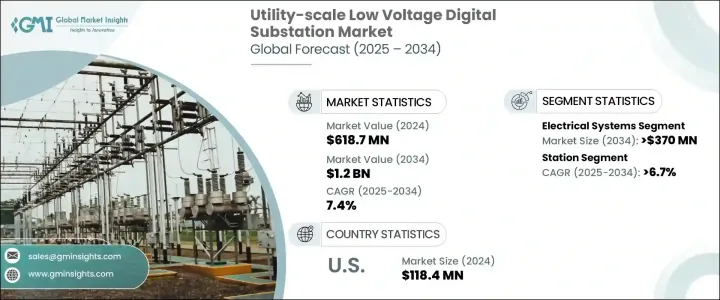

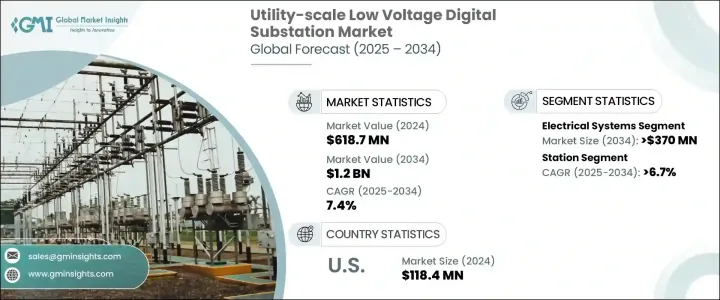

2024年,全球公用事业级低压数位化变电站市场规模达6.187亿美元,预计2034年将以7.4%的复合年增长率成长,达到12亿美元。这得归功于对能够适应波动能源输出的更智慧变电站日益增长的需求。这些先进的变电站透过无缝整合可变电源并提高整体营运效率,有助于稳定电网。智慧电网的兴起进一步加速了对即时监控、自动化控制系统和高精度故障检测的需求,而采用智慧电子设备和标准化通讯框架的数位化变电站则为这些需求提供了有效的支援。这项发展将协助打造反应更快、效率更高的电网基础设施。

数位化变电站中物联网感测器的即时资料使操作员能够持续追踪设备状况,从而获得以往透过传统方式无法获得的洞察。利用先进的人工智慧和资料分析技术,这些系统能够及早发现潜在问题,并在故障发生前及时启动干预措施。预测性维护可以减少非计划性停机时间,并帮助公用事业公司将资源集中在需要的地方,从而提高员工效率和系统效能。同时,在日益互联的能源格局中,强大的网路安全框架对于确保数位化变电站的安全运作至关重要。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 6.187亿美元 |

| 预测值 | 12亿美元 |

| 复合年增长率 | 7.4% |

预计2034年,在电网现代化的强劲推动下,站级架构的复合年增长率将达到6.7%。这些站级系统发挥核心作用,汇集了来自不同变电站层级的关键资料,从而实现即时控制和增强系统保护。随着数位基础设施的重要性日益凸显,全球投资流向更加重视站级升级,将这些枢纽定位为跨大都市和工业区域智慧、自动化和敏捷配电网路的关键推动者。随着公用事业公司更加重视弹性和反应能力,这一层面的数位化正获得强劲发展。

在公用事业规模的低压数位化变电站市场中,预计到2034年,电气系统细分市场将达到3.7亿美元,这主要受到影响全球公用事业营运的若干关键技术、营运和策略因素的推动。这些系统(包括开关设备、断路器、变压器、母线和保护继电器)是数位化变电站内电力传输和控制的核心功能部件。随着公用事业供应商对电网基础设施进行现代化改造,以提高效率、可靠性和自动化程度,对先进电气系统的需求正在激增。

2024年,美国公用事业级低压数位化变电站市场规模达1.184亿美元。这一稳定的成长轨迹反映了美国对电网现代化的投入及其完善的能源基础设施。在联邦政府和州政府的大量资金支持下,美国在智慧变电站技术部署方面继续保持领先地位,这些技术旨在提高公用事业级运营的电网可视性、弹性和性能。

产业领导者包括伊顿公司、通用电气、WAGO、Netcontrol Group、WEG、思科系统公司、鲍威尔工业、东芝能源系统与解决方案公司、日立能源、Larson & Toubro Limited、西门子、Hubbell、ABB 和施耐德电气。为加强市场地位,该产业的公司正在部署多项策略性措施。他们正大力投资研发,以推出符合不断发展的电网标准的可互通、网路安全的数位变电站解决方案。他们正在建立合作关係和合资企业,以利用互补技术并扩大市场范围。主要企业也在进入新的地理市场并扩大製造能力,以满足不断增长的全球需求。透过以客户为中心的创新和整合服务模式,这些公司加强了与公用事业和政府实体的长期合作伙伴关係,以保持竞争优势。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 监管格局

- 产业衝击力

- 成长动力

- 产业陷阱与挑战

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 战略仪表板

- 创新与永续发展格局

第五章:市场规模及预测:依组件划分,2021 - 2034 年

- 主要趋势

- 变电所自动化系统

- 通讯网路

- 电气系统

- 监控系统

- 其他的

第六章:市场规模及预测:依架构,2021 - 2034

- 主要趋势

- 过程

- 湾

- 车站

第七章:市场规模及预测:依安装量,2021 - 2034

- 主要趋势

- 新的

- 翻新

第八章:市场规模及预测:按地区,2021 - 2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 墨西哥

- 欧洲

- 英国

- 法国

- 德国

- 义大利

- 俄罗斯

- 西班牙

- 亚太地区

- 中国

- 澳洲

- 印度

- 日本

- 韩国

- 中东和非洲

- 沙乌地阿拉伯

- 阿联酋

- 土耳其

- 南非

- 埃及

- 拉丁美洲

- 巴西

- 阿根廷

第九章:公司简介

- ABB

- Cisco Systems, Inc.

- Eaton Corporation

- General Electric

- Hitachi Energy

- Hubbell

- Larson & Toubro Limited

- Netcontrol Group

- Powell Industries

- Schneider Electric

- Siemens

- Toshiba Energy Systems & Solutions Corporation

- WEG

- WAGO

The Global Utility Scale Low Voltage Digital Substation Market was valued at USD 618.7 million in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 1.2 billion by 2034, driven by the increasing demand for more intelligent substations that can adapt to fluctuating energy outputs. These advanced substations help stabilize the grid by seamlessly integrating variable power sources and improving overall operational efficiency. The rise of smart grids is further accelerating the need for real-time monitoring, automated control systems, and high-accuracy fault detection, which are all effectively supported by digital substations that utilize intelligent electronic devices and standardized communication frameworks. This evolution supports a more responsive and efficient grid infrastructure.

Real-time data from IoT-enabled sensors in digital substations allows operators to track equipment conditions continuously, generating insights that were previously inaccessible through conventional means. Leveraging advanced AI and data analytics, these systems can identify potential issues early and trigger timely interventions before failures occur. Predictive maintenance reduces unplanned downtime and helps utilities focus resources where needed, enhancing workforce efficiency and system performance. In parallel, robust cybersecurity frameworks have become essential to ensure the secure operation of digital substations in an increasingly connected energy landscape.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $618.7 Million |

| Forecast Value | $1.2 Billion |

| CAGR | 7.4% |

The station-level architecture is forecasted to grow at a CAGR of 6.7% through 2034, driven by a strong push toward grid modernization. These station systems play a central role by aggregating critical data from various substation levels, allowing for real-time control and enhanced system protection. As digital infrastructure becomes more vital, global investment flows emphasize station-level upgrades, positioning these hubs as key enablers of smart, automated, and agile power distribution networks across metropolitan and industrial regions. With utilities focused on resilience and responsiveness, digitization at this level is gaining strong traction.

In the utility-scale low voltage digital substation market, the electrical systems segment is projected to reach USD 370 million by 2034, driven by several critical technological, operational, and strategic factors influencing global utility operations. These systems-including switchgear, circuit breakers, transformers, busbars, and protection relays-serve as the core functional components enabling the transmission and control of power within digital substations. As utility providers modernize grid infrastructure to enhance efficiency, reliability, and automation, the demand for advanced electrical systems is surging.

United States Utility-Scale Low Voltage Digital Substation Market reached USD 118.4 million in 2024. This steady growth trajectory reflects the nation's commitment to grid modernization and its well-established energy infrastructure. Backed by substantial federal and state-level funding, the U.S. continues to lead in deploying intelligent substation technologies that improve grid visibility, resilience, and performance across utility-scale operations.

Leading industry players include Eaton Corporation, General Electric, WAGO, Netcontrol Group, WEG, Cisco Systems, Inc., Powell Industries, Toshiba Energy Systems & Solutions Corporation, Hitachi Energy, Larson & Toubro Limited, Siemens, Hubbell, ABB, and Schneider Electric. To strengthen their market presence, companies in this sector are deploying multiple strategic initiatives. They are investing heavily in R&D to introduce interoperable, cyber-secure digital substation solutions that align with evolving grid standards. Collaborations and joint ventures are being formed to leverage complementary technologies and broaden market outreach. Key players are also entering new geographic markets and scaling manufacturing capabilities to meet rising global demand. Through customer-centric innovations and integrated service models, these companies reinforce long-term partnerships with utilities and government entities to sustain competitive advantage.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market definitions

- 1.2 Base estimates & calculations

- 1.3 Forecast calculation

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid

- 1.4.2.2 Public

Chapter 2 Executive Summary

- 2.1 Industry synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Porter's analysis

- 3.5.1 Bargaining power of suppliers

- 3.5.2 Bargaining power of buyers

- 3.5.3 Threat of new entrants

- 3.5.4 Threat of substitutes

- 3.6 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Strategic dashboard

- 4.2 Innovation & sustainability landscape

Chapter 5 Market Size and Forecast, By Component, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 Substation automation system

- 5.3 Communication network

- 5.4 Electrical system

- 5.5 Monitoring & control system

- 5.6 Others

Chapter 6 Market Size and Forecast, By Architecture, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Process

- 6.3 Bay

- 6.4 Station

Chapter 7 Market Size and Forecast, By Installation, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 New

- 7.3 Refurbished

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 UK

- 8.3.2 France

- 8.3.3 Germany

- 8.3.4 Italy

- 8.3.5 Russia

- 8.3.6 Spain

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 Australia

- 8.4.3 India

- 8.4.4 Japan

- 8.4.5 South Korea

- 8.5 Middle East & Africa

- 8.5.1 Saudi Arabia

- 8.5.2 UAE

- 8.5.3 Turkey

- 8.5.4 South Africa

- 8.5.5 Egypt

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Argentina

Chapter 9 Company Profiles

- 9.1 ABB

- 9.2 Cisco Systems, Inc.

- 9.3 Eaton Corporation

- 9.4 General Electric

- 9.5 Hitachi Energy

- 9.6 Hubbell

- 9.7 Larson & Toubro Limited

- 9.8 Netcontrol Group

- 9.9 Powell Industries

- 9.10 Schneider Electric

- 9.11 Siemens

- 9.12 Toshiba Energy Systems & Solutions Corporation

- 9.13 WEG

- 9.14 WAGO