|

市场调查报告书

商品编码

1755369

聚合物砂市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Polymeric Sand Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

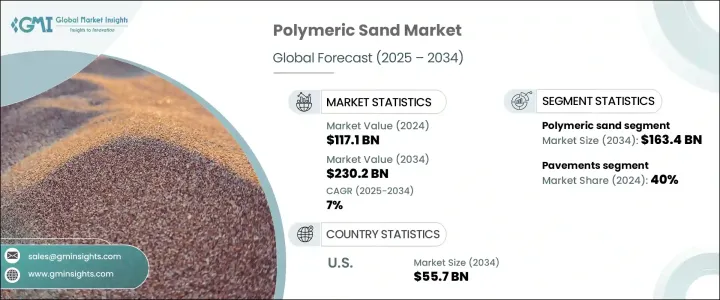

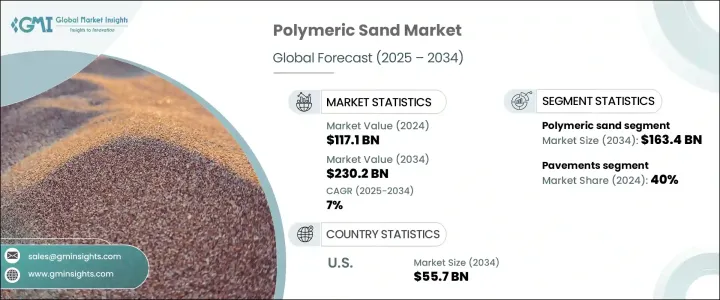

2024年,全球聚合物砂市场规模达1,171亿美元,预计到2034年将以7%的复合年增长率成长,达到2,302亿美元。推动这一增长的因素包括:建筑项目数量增加、城市发展持续推进以及消费者对耐用、低维护景观材料的偏好。聚合物砂因其能有效固定铺路砖、减少杂草生长、抵抗侵蚀和虫害等特性,已成为住宅和商业硬质景观的首选材料。其配方-细砂与聚合物添加剂结合-遇水硬化,增强了表面稳定性与耐用性。业主、承包商和市政当局在露台、车道、人行道和泳池甲板上使用聚合物砂,欣赏其卓越的性能和视觉吸引力。此外,聚合物砂拥有多种颜色可选,非常适合进行美学客製化。

随着发展中经济体优先考虑现代化和基础设施升级,而富裕地区则持续改善其公共和私人户外环境,聚合物砂日益被视为一种首选材料。其实实用优势——例如易于施工、耐侵蚀以及与各种气候环境的兼容性——使其成为不同地区的理想解决方案。专业景观设计师依赖其强度和效率,而房主则重视其减少维护和提升房屋吸引力的能力。此外,聚合物砂拥有多种颜色选择,使用户能够在铺路项目中实现功能性和美观性。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 1171亿美元 |

| 预测值 | 2302亿美元 |

| 复合年增长率 | 7% |

2024年,聚合物砂市场规模达822亿美元。它能够有效稳定铺路砖(石材、混凝土或砖块)之间的接缝,使其成为露台、车道和商业景观的首选。聚合物砂中的水活化黏合剂能够形成坚固而灵活的接缝,抵御环境磨损,帮助铺设路面保持多年。它特别适用于1/8至4英吋的接缝宽度,这在大多数铺路应用中都是标准宽度。住宅和商业领域继续推动成长,其长期性能和易于应用是其受欢迎的核心。

2024年,路面应用领域占40%的市场份额,预期复合年增长率为6.8%。包括城市人行道、花园小径和步行区在内的路面,依赖能够承受交通和天气影响的互锁式铺路砖和接缝材料。聚合物砂能够确保路面的长期耐用性,控制杂草生长,并保持路面表面的完整性,这对于人流量大的公共区域和注重美观的住宅环境至关重要。东南亚、北美和欧洲等地区的城市正在将聚合物砂应用于以美化和永续发展为重点的城市发展中,重视其排水效率、视觉凝聚力和维护效益。

2024年,美国聚合物砂市场规模达272亿美元,预计2034年将达557亿美元。户外生活日益普及,包括对露臺、泳池平台和人行道的投资,使得聚合物砂成为房主和专业人士的首选解决方案。它能够抵御各种气候条件——从严酷的冬季到潮湿的夏季——使其在广泛的地域范围内具有吸引力。零售通路的畅通以及消费者对聚合物砂安装的教育,尤其是透过DIY门市进行的培训,进一步支撑了市场的成长。公共部门对绿地和基础设施升级的投资也增加了商业需求,确保了该产品在该地区市场的地位。

推动全球聚合物砂市场发展的关键参与者包括 Gator Base、Euro Quarz、Pavestone Company、Quikrete、Alliance Designer Products、Sakrete、TCC Materials、Silpro Corporation、CEMEX、Techniseal、Polybind、Romex、SEK Surebond、SPEC MIX、Sable Marco、Ash GroveB.al.、Romex、SEK Surebond.为了巩固其在竞争激烈的聚合物砂市场中的地位,各公司将创新、永续性和客户教育放在首位。关键策略包括改进产品配方以提高耐候性和耐用性,提供环保产品以满足日益增长的环保期望,以及扩展产品线以提供多种颜色和纹理选择。许多公司利用数位平台透过视讯教学和行动工具与承包商和 DIY 消费者建立联繫。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 原料分析

- 重要新闻和倡议

- 监管格局

- 衝击力

- 成长动力

- 快速城市化

- 增加基础建设投资

- 日益增强的长期成本效益意识

- 城市美化和景观美化的趋势日益增长

- 产业陷阱与挑战

- 市场饱和

- 成长动力

- 成长潜力分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 竞争定位矩阵

- 战略展望矩阵

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 聚合物砂

- 聚合物粉尘

第六章:市场估计与预测:按应用,2021 - 2034 年

- 主要趋势

- 人行道

- 停车位

- 泳池甲板

- 辅助建筑空间

- 露臺

- 其他的

第七章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 住宅

- 商业的

- 工业的

- 市政

第八章:市场估计与预测:按配销通路,2021 - 2034 年

- 主要趋势

- 直接的

- 间接

第九章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 拉丁美洲其他地区

- MEA

- 沙乌地阿拉伯

- 阿联酋

- 南非

- MEA 其余地区

第十章:公司简介

- Alliance Designer Products

- Ash Grove Cement Company

- Basalite Concrete Products

- CEMEX

- Euro Quarz

- Gator Base

- Pavestone Company

- Polybind

- Quikrete

- Romex

- Sable Marco

- Sakrete

- SEK Surebond

- Silpro Corporation

- SPEC MIX

- SpecChem

- SRW Products

- TCC Materials

- Techniseal

- Tensar Corporation

The Global Polymeric Sand Market was valued at USD 117.1 billion in 2024 and is estimated to grow at a CAGR of 7% to reach USD 230.2 billion by 2034. The growth is fueled by a rise in construction projects, ongoing urban development, and consumer preference for durable, low-maintenance materials in landscaping. Polymeric sand has become a go-to material for residential and commercial hardscaping owing to locking pavers in place, reducing weed growth, and resisting erosion and insect damage. Its formulation-fine sand combined with polymer additives-hardens when activated by water, enhancing surface stability and durability. Homeowners, contractors, and municipalities use polymeric sand in patios, driveways, walkways, and pool decks, appreciating its performance and visual appeal. In addition, availability in a variety of colors makes it suitable for aesthetic customization.

As developing economies prioritize modernization and infrastructure upgrades, and wealthier regions continue enhancing their public and private outdoor environments, polymeric sand is increasingly seen as a go-to material. Its practical advantages-such as ease of application, resistance to erosion, and compatibility with various climates-make it an ideal solution across diverse geographies. Professional landscapers rely on it for its strength and efficiency, while homeowners value its ability to reduce maintenance and enhance curb appeal. Additionally, its wide availability in various color options allows users to achieve functional and aesthetic goals in paving projects.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $117.1 Billion |

| Forecast Value | $230.2 Billion |

| CAGR | 7% |

In 2024, the polymeric sand segment reached USD 82.2 billion. Its effectiveness in stabilizing joints between pavers- stone, concrete, or brick-has made it the preferred option for patios, driveways, and commercial landscapes. The water-activated bonding agents in polymeric sand form a solid yet flexible joint that resists environmental wear and tear, helping maintain paved surfaces for years. It works especially well in joint widths from 1/8 to 4 inches, which are standard in most paving applications. Both residential and commercial sectors continue to drive growth, with long-term performance and ease of application at the core of its popularity.

The pavement application segment held a 40% share in 2024 and is forecast to grow at a CAGR of 6.8%. Pavements, including urban walkways, garden paths, and pedestrian zones, rely on interlocking pavers and jointing materials that hold up under traffic and weather. Polymeric sand ensures long-term durability, controls weed growth and maintains surface integrity crucial in high-traffic public areas and aesthetically driven residential settings. Cities in regions like Southeast Asia, North America, and Europe are implementing polymeric sand in beautification and sustainability-focused urban development, valuing its drainage efficiency, visual cohesion, and maintenance benefits.

United States Polymeric Sand Market was valued at USD 27.2 billion in 2024 and is expected to generate USD 55.7 billion by 2034. The increasing popularity of outdoor living, including investments in patios, pool decks, and walkways, has made polymeric sand a preferred solution among homeowners and professionals. Its ability to withstand different climates-from harsh winters to humid summers-gives it broad geographic appeal. Retail availability and consumer education on installation, especially through DIY outlets, have further supported growth. Public sector investment in green spaces and infrastructure upgrades also adds to commercial demand, ensuring the product's stronghold in the region.

Key players driving the Global Polymeric Sand Market include Gator Base, Euro Quarz, Pavestone Company, Quikrete, Alliance Designer Products, Sakrete, TCC Materials, Silpro Corporation, CEMEX, Techniseal, Polybind, Romex, SEK Surebond, SPEC MIX, Sable Marco, Ash Grove Cement Company, SRW Products, Tensar Corporation, Basalite Concrete Products, and SpecChem. To reinforce their position in the competitive polymeric sand market, companies prioritize innovation, sustainability, and customer education. Key strategies include enhancing product formulations for better weather resistance and durability, offering eco-friendly variants to meet rising environmental expectations, and expanding product lines to include multiple color and texture options. Many firms leverage digital platforms to connect with contractors and DIY consumers through video tutorials and mobile tools.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope & definition

- 1.2 Base estimates & calculations

- 1.3 Forecast parameters

- 1.4 Data sources

- 1.4.1 Primary

- 1.4.2 Secondary

- 1.4.2.1 Paid sources

- 1.4.2.2 Public sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Raw material analysis

- 3.3 Key news and initiatives

- 3.4 Regulatory landscape

- 3.5 Impact forces

- 3.5.1 Growth drivers

- 3.5.1.1 Rapid urbanization

- 3.5.1.2 Increasing infrastructure investments

- 3.5.1.3 Growing awareness of long-term cost efficiency

- 3.5.1.4 Growing trend toward urban beautification and landscaping

- 3.5.2 Industry pitfalls & challenges

- 3.5.2.1 Market saturation

- 3.5.1 Growth drivers

- 3.6 Growth potential analysis

- 3.7 Porter's analysis

- 3.7.1 Supplier power

- 3.7.2 Buyer power

- 3.7.3 Threat of new entrants

- 3.7.4 Threat of substitutes

- 3.7.5 Industry rivalry

- 3.8 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Product Type, 2021 - 2034, (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Polymeric sand

- 5.3 Polymeric dust

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034, (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Pavements

- 6.3 Parking spaces

- 6.4 Pool decks

- 6.5 Auxiliary building spaces

- 6.6 Patios

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By End Use, 2021 - 2034, (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Residential

- 7.3 Commercial

- 7.4 Industrial

- 7.5 Municipal

Chapter 8 Market Estimates & Forecast, By Distribution Channel, 2021 - 2034, (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Direct

- 8.3 Indirect

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Rest of Latin America

- 9.6 MEA

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 South Africa

- 9.6.4 Rest of MEA

Chapter 10 Company Profiles

- 10.1 Alliance Designer Products

- 10.2 Ash Grove Cement Company

- 10.3 Basalite Concrete Products

- 10.4 CEMEX

- 10.5 Euro Quarz

- 10.6 Gator Base

- 10.7 Pavestone Company

- 10.8 Polybind

- 10.9 Quikrete

- 10.10 Romex

- 10.11 Sable Marco

- 10.12 Sakrete

- 10.13 SEK Surebond

- 10.14 Silpro Corporation

- 10.15 SPEC MIX

- 10.16 SpecChem

- 10.17 SRW Products

- 10.18 TCC Materials

- 10.19 Techniseal

- 10.20 Tensar Corporation