|

市场调查报告书

商品编码

1755383

体脂测量市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Body Fat Measurement Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

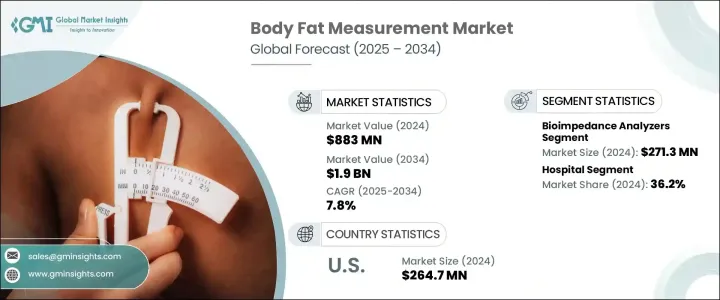

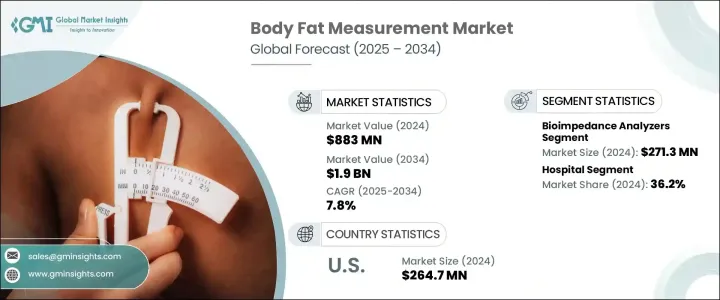

2024年,全球体脂测量市场规模达8.83亿美元,预计到2034年将以7.8%的复合年增长率增长,达到19亿美元,这得益于全球对健康、健身和早期疾病检测日益增长的关注。体脂测量在评估人体健康状况方面发挥着至关重要的作用,因为它有助于确定体内脂肪与瘦体重的比例。准确测量体脂肪对于控制肥胖、心血管疾病、糖尿病和代谢性疾病等疾病至关重要。这些疾病通常是由于荷尔蒙失衡和新陈代谢失调而导致脂肪异常堆积。此类疾病的发生率不断上升,对可靠的诊断工具的需求也日益增长。

技术进步,尤其是生物电阻抗分析领域的进步,进一步促进了市场的发展。这些设备提供了一种非侵入性、经济高效且准确的方法来追踪身体组成指标,例如脂肪百分比、水分含量和肌肉量。随着消费者意识和医疗保健体系的不断发展,全球对使用者友善且精准的脂肪测量解决方案的需求日益增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 8.83亿美元 |

| 预测值 | 19亿美元 |

| 复合年增长率 | 7.8% |

生物阻抗分析仪市场在2024年实现了2.713亿美元的收入,预计到2034年将以9.1%的复合年增长率快速成长。这类分析仪之所以受欢迎,源自于其价格实惠、易于使用和快速评估能力。随着全球肥胖危机加剧,尤其是在城市地区,常规的身体组成追踪已变得越来越普遍。这些分析仪现已成为临床、健身和健康领域不可或缺的一部分。整合多频扫描、蓝牙支援和智慧型手机应用程式等先进功能,提升了其功能性,提高了准确性,增强了用户参与度,预计将推动其在更广泛人群中的进一步普及。

2024年,医院细分市场收入达3.197亿美元,占36.2%,这得益于临床环境中对精准健康评估的持续需求。医院通常会投资双能量X射线吸收仪和空气置换体积描记法等高端技术,用于高阶身体组成分析,进而提高诊断准确性和病患管理水准。这些设施是大多数患者的初始护理点,并进行一般评估和术前评估,从而增加了脂肪测量程序的频率。

预计到2034年,北美体脂测量市场规模将达到6.084亿美元,其中美国将位居榜首,到2024年将达到2.647亿美元。全球肥胖水准的显着上升是加速采用先进诊断解决方案的主要因素。随着预防性医疗保健意识的不断提高,体脂分析越来越多地被纳入日常保健和临床工作流程中。美国高度重视技术创新和公共卫生计划,因此仍然是推动市场扩张的关键地区。

塑造全球体脂测量市场的关键产业参与者包括 InBody、AccuFitness、欧姆龙医疗、百利达株式会社、DMS Imaging、Hologic、COSMED、GE HealthCare Technologies、Maltron International、L'Acn Srl. 和 Beurer。为了提升市场地位,各公司纷纷采取创新驱动策略。许多公司正在投资研发,以开发结合人工智慧演算法和行动整合的更精准、更人性化的设备。製造商也拓展其产品组合,推出集脂肪测量、肌肉测量、水分监测和代谢监测于一体的多功能分析仪。与医疗机构和健康中心的策略合作,使产品在临床和消费者领域得到更广泛的应用。此外,各公司正在加强全球分销管道,并为专业人士提供培训项目,以增强用户信心并提高产品采用率。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 产业衝击力

- 成长动力

- 肥胖和代谢相关疾病的盛行率不断上升

- BIA 设备的准确度相当高

- 提高对体重管理的认识

- 产业陷阱与挑战

- 设备成本高

- 成长动力

- 成长潜力分析

- 监管格局

- 技术格局

- 未来市场趋势

- 差距分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 公司市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 策略仪表板

第五章:市场估计与预测:按产品,2021 - 2034 年

- 主要趋势

- 生物阻抗分析仪

- 卡钳

- 静水称重

- 空气置换体积描记法

- 双能量X射线吸收法

- 其他产品

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 健身中心

- 诊所

- 其他最终用途

第七章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 波兰

- 瑞士

- 瑞典

- 丹麦

- 荷兰

- 比利时

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 印尼

- 泰国

- 越南

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 智利

- 哥伦比亚

- 秘鲁

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 以色列

- 伊朗

第八章:公司简介

- AccuFitness

- Beurer

- COSMED

- DMS Imaging

- GE HealthCare Technologies

- Hologic

- InBody

- L'Acn Srl.

- Maltron International

- Omron Healthcare

- Tanita Corporation

The Global Body Fat Measurement Market was valued at USD 883 million in 2024 and is estimated to grow at a CAGR of 7.8% to reach USD 1.9 billion by 2034, driven by the rising global focus on health, fitness, and early disease detection. Body fat measurement plays a crucial role in assessing a person's health, as it helps determine the ratio of fat to lean mass in the body. Accurate measurement of body fat is important for managing conditions such as obesity, cardiovascular disorders, diabetes, and metabolic diseases. These disorders often result in abnormal fat accumulation due to hormonal imbalances and disrupted metabolism. The increasing incidence of such conditions has created a consistent demand for reliable diagnostic tools.

Technological advancements, particularly in bioelectrical impedance analysis, have further contributed to the market's momentum. These devices offer a non-invasive, cost-effective, and accurate approach to tracking body composition metrics such as fat percentage, hydration levels, and muscle mass. As consumer awareness and healthcare systems evolve, the demand for user-friendly and precise fat measurement solutions rises globally.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $883 Million |

| Forecast Value | $1.9 Billion |

| CAGR | 7.8% |

The bioimpedance analyzers segment generated USD 271.3 million in 2024 and is expected to witness rapid growth at a CAGR of 9.1% through 2034. Their popularity stems from their affordability, ease of use, and quick assessment capabilities. With the global obesity crisis intensifying, especially in urban areas, routine tracking of body composition has become more common. These analyzers are now integral in clinical, fitness, and wellness environments. Integrating advanced features such as multi-frequency scanning, Bluetooth support, and smartphone apps has elevated their functionality, improving accuracy and enhancing user engagement is expected to drive further adoption across a wide demographic.

The hospitals segment generated USD 319.7 million in 2024 and captured a 36.2% share supported by the consistent demand for precise health assessments in clinical settings. Hospitals typically invest in high-end technologies like dual-energy X-ray absorptiometry and air displacement plethysmography for advanced body composition analysis, improving diagnostic accuracy and patient management. These facilities act as the initial point of care for most patients and conduct general and preoperative evaluations, increasing the frequency of fat measurement procedures.

North America Body Fat Measurement Market is projected to hit USD 608.4 million by 2034, with the U.S. leading at USD 264.7 million in 2024. The significant rise in obesity levels globally is a primary factor accelerating the adoption of advanced diagnostic solutions. As awareness around preventive healthcare continues to rise, body fat analysis is increasingly incorporated into wellness routines and clinical workflows. With a strong focus on technological innovation and public health initiatives, the U.S. remains a critical region contributing to market expansion.

Key industry players shaping the Global Body Fat Measurement Market include InBody, AccuFitness, Omron Healthcare, Tanita Corporation, DMS Imaging, Hologic, COSMED, GE HealthCare Technologies, Maltron International, L'Acn Srl., and Beurer. To enhance their market position, companies are embracing innovation-driven strategies. Many are investing in R&D to develop more accurate and user-friendly devices incorporating AI algorithms and mobile integration. Manufacturers are also broadening their product portfolios to include multi-functional analyzers that combine fat measurement with muscle, hydration, and metabolic tracking. Strategic collaborations with healthcare providers and wellness centers allow broader product adoption across clinical and consumer segments. Additionally, firms are strengthening global distribution channels and offering training programs for professionals to boost user confidence and drive adoption rates.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising prevalence of obesity and metabolism related disorders

- 3.2.1.2 Considerable accuracy of BIA devices

- 3.2.1.3 Increasing awareness regarding body weight management

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of devices

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.5 Technological landscape

- 3.6 Future market trends

- 3.7 Gap analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Strategy dashboard

Chapter 5 Market Estimates and Forecast, By Product, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Bioimpedance analyzers

- 5.3 Calipers

- 5.4 Hydrostatic weighing

- 5.5 Air-displacement plethysmography

- 5.6 Dual-energy X-ray absorptiometry

- 5.7 Other products

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Fitness centers

- 6.4 Clinics

- 6.5 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Poland

- 7.3.7 Switzerland

- 7.3.8 Sweden

- 7.3.9 Denmark

- 7.3.10 Netherlands

- 7.3.11 Belgium

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.4.6 Indonesia

- 7.4.7 Thailand

- 7.4.8 Vietnam

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.5.4 Chile

- 7.5.5 Colombia

- 7.5.6 Peru

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

- 7.6.4 Israel

- 7.6.5 Iran

Chapter 8 Company Profiles

- 8.1 AccuFitness

- 8.2 Beurer

- 8.3 COSMED

- 8.4 DMS Imaging

- 8.5 GE HealthCare Technologies

- 8.6 Hologic

- 8.7 InBody

- 8.8 L'Acn Srl.

- 8.9 Maltron International

- 8.10 Omron Healthcare

- 8.11 Tanita Corporation