|

市场调查报告书

商品编码

1766163

牙科基质系统市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Dental Matrix Systems Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

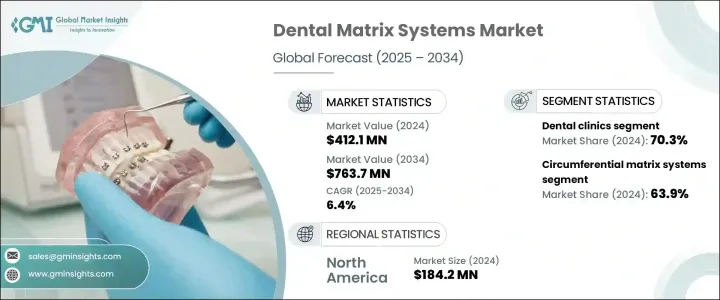

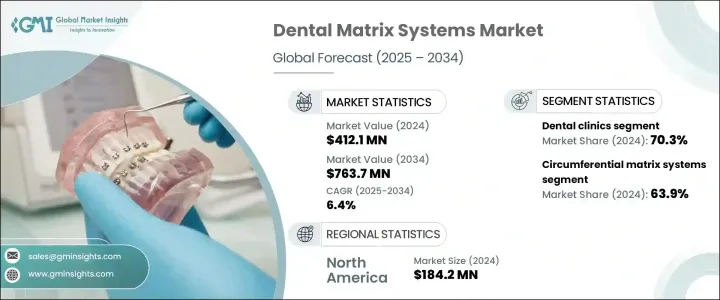

2024年,全球牙科基质系统市场规模达4.121亿美元,预计到2034年将以6.4%的复合年增长率成长,达到7.637亿美元。人们对美观和龋齿预防的日益关注,导緻美容和修復牙科手术的需求不断增长。基质系统在实现精准的牙齿轮廓塑造和邻面接触修復方面发挥着至关重要的作用。随着越来越多的患者选择美容治疗,对牙科基质系统的需求激增,以帮助患者获得更好的临床疗效并提高满意度。

产品开发的进步,例如预塑形带、分段式基质环和张紧工具,进一步提升了这些系统的功能性和可预测性,进一步推动了对这些系统的需求。此外,全球合格牙科专业人员数量的成长,尤其是在新兴市场,正在推动牙科诊所和服务链的成长。这反过来又促进了对牙科基质系统的需求成长。微创牙科的采用也不断增加,因为这些系统有助于尽可能少地去除牙齿结构,同时提供最佳的修復效果。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 4.121亿美元 |

| 预测值 | 7.637亿美元 |

| 复合年增长率 | 6.4% |

2024年,环形矩阵系统占最大份额,达63.9%。由于其易于使用且覆盖范围广泛,该系统广泛应用于儿童牙科和前牙修復。它们在儿科病例中尤其有效,因为儿科病例中,由于病例规模小且患者配合困难,分段系统难以实施。环形矩阵系统简单、经济实惠且易于使用,使其在发展中地区和成本敏感型市场尤其受欢迎,因为这些地区的诊所通常预算有限。由于其成本低、易于培训且功能多样,环形系统的需求依然旺盛,这进一步推动了其成长。

2024年,牙科诊所占据了70.3%的市场份额,占据了市场主导地位。这主要得益于牙齿修復、补牙和龋洞治疗的患者就诊量不断增长。随着患者对高效、精准和多功能矩阵系统的需求不断增长,牙科诊所越来越多地采用先进的矩阵系统来提高患者吞吐量和治疗效果。随着人们对精准和微创牙科手术的兴趣日益浓厚,牙科诊所正在利用矩阵系统进行全面修復,以满足患者的期望和临床需求。对有效修復方法的需求日益增长,进一步推动了牙科诊所对这些系统的需求。

预计到2034年,美国牙科基质系统市场规模将达到3.039亿美元。这一增长主要源于消费者对美容牙科服务的强烈偏好,尤其是那些提供与牙色相似且不易察觉的修復体的服务。此外,人口老化、龋齿的高发病率以及对复合材料修復体而非汞合金填充体的需求不断增长,也进一步推动了美国市场的成长。透过雇主和政府资助计画提供的牙科保险也扩大了修復治疗的可及性,并推动了患者就诊,从而增加了牙科基质系统的收入。

全球牙科基质系统市场的主要参与者包括 3M、Bioclear Matrix Systems、Dentsply Sirona、Kerr Dental、Garrison Dental Solutions、Polydentia (Lifco)、Denovo Dental、Clinician's Choice Dental Products、Premier Dental、Trytrix、Water Pental、Clinician's Choice Dental Products、Premier Dental、Trytrix、Water Pental、Clinician.Dental、Suppen、Smot、Mak、Dr.为了巩固其在牙科基质系统市场中的地位,各公司正专注于持续的产品创新,开发精度更高、更易于使用且能改善患者治疗效果的系统。许多公司正在透过提供新型牙科基质系统(例如预成型带和分段基质环)来扩展其产品组合,以满足更广泛的牙科治疗需求。此外,各公司正在与牙科诊所和医疗保健提供者建立策略合作伙伴关係,以提高产品的可及性,并将其係统融入日常牙科治疗中。公司还提供培训和教育计划,以确保牙科专业人员充分了解这些先进系统的优势和应用。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 影响价值链的因素

- 产业衝击力

- 成长动力

- 对美容和修復牙科手术的需求不断增长

- 口腔健康意识不断提高

- 牙科工具和材料的技术进步

- 牙科诊所扩建

- 产业陷阱与挑战

- 先进牙基质系统成本高

- 发展中国家缺乏熟练的专业人员

- 市场机会

- 微创修復的需求不断成长

- 矩阵系统与数位牙科工作流程的集成

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 报销场景

- 报销政策对市场成长的影响

- 专利态势

- 消费者行为分析

- 波特的分析

- PESTEL分析

第四章:竞争格局

- 介绍

- 竞争市占率分析

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依产品类型,2021 - 2034 年

- 主要趋势

- 圆週矩阵系统

- 分段矩阵系统

第六章:市场估计与预测:依最终用途,2021 - 2034 年

- 主要趋势

- 医院

- 牙医诊所

- 其他最终用途

第七章:市场估计与预测:按地区,2021 - 2034 年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 义大利

- 西班牙

- 荷兰

- 亚太地区

- 中国

- 日本

- 印度

- 澳洲

- 韩国

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

第八章:公司简介

- Bioclear Matrix Systems

- Clinician's Choice Dental Products

- Denovo Dental

- Dentsply Sirona

- Dr. Walser Dental

- Garrison Dental Solutions

- GoldenDent

- Kerr Dental

- Polydentia (Lifco)

- Premier Dental

- Pro-Matrix Dental

- Safco Dental Supply

- Trycare

- Water Pik

- 3M

The Global Dental Matrix Systems Market was valued at USD 412.1 million in 2024 and is estimated to grow at a CAGR of 6.4% to reach USD 763.7 million by 2034. The growing focus on aesthetics and the prevention of tooth decay has led to an increase in demand for both cosmetic and restorative dental procedures. Matrix systems play a vital role in achieving precise tooth contouring and interproximal contact restorations. As more patients opt for cosmetic treatments, there is a surge in demand for dental matrix systems to help achieve better clinical outcomes and improve patient satisfaction.

The demand for these systems is further boosted by advancements in product development, such as pre-contoured bands, sectional matrix rings, and tensioning tools, which enhance the functionality and predictability of these systems. Additionally, the rise in the number of qualified dental professionals globally, especially in emerging markets, is driving the growth of dental practices and service chains. This has, in turn, contributed to the increasing demand for dental matrix systems. The adoption of minimally invasive dentistry is also on the rise, as these systems help remove as little tooth structure as possible while providing optimal restoration results.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $412.1 Million |

| Forecast Value | $763.7 Million |

| CAGR | 6.4% |

The circumferential matrix systems segment accounted for the largest share of 63.9% in 2024. These systems are widely used in pediatric dentistry and anterior tooth restorations due to their ease of use and the holistic coverage they provide. They are particularly beneficial in pediatric cases, where small size and patient cooperation challenges make sectional systems harder to implement. The simplicity, affordability, and ease of use of circumferential matrix systems make them particularly popular in developing regions and cost-sensitive markets, where clinics often operate on limited budgets. The demand for circumferential systems remains high due to their low cost, ease of training, and versatility, which further drive their growth.

The dental clinics segment dominated the market in 2024, with a 70.3% share. This dominance is due to the increasing number of patient visits for dental restorations, fillings, and cavity treatments. As patient demands rise for efficient, precise, and multifunctional matrix systems, dental clinics are increasingly adopting advanced matrix systems to improve patient throughput and treatment outcomes. With the growing interest in precision-based and minimally invasive dental procedures, dental clinics are utilizing matrix systems for complete restorations to meet patient expectations and clinical requirements. The increasing need for effective restoration methods further contributes to the demand for these systems in dental clinics.

U.S. Dental Matrix Systems Market is expected to reach USD 303.9 million by 2034. This growth is driven by a strong consumer preference for cosmetic dental services, particularly those that offer tooth-colored restorations with minimal visibility. Additionally, the aging population, the high prevalence of dental caries, and the increasing demand for composite restorations over amalgam fillings are further contributing to the growth in the U.S. market. The availability of dental insurance, both through employers and government-sponsored programs, is also expanding access to restorative treatments and driving patient visits to dental practices, leading to increased revenue for dental matrix systems.

Key players in the Global Dental Matrix Systems Market include 3M, Bioclear Matrix Systems, Dentsply Sirona, Kerr Dental, Garrison Dental Solutions, Polydentia (Lifco), Denovo Dental, Clinician's Choice Dental Products, Premier Dental, Trycare, Water Pik, Dr. Walser Dental, Safco Dental Supply, GoldenDent, and Pro-Matrix Dental. To enhance their position in the dental matrix systems market, companies are focusing on continuous product innovation, developing systems that offer greater precision, ease of use, and improved patient outcomes. Many companies are expanding their portfolios by offering new variations of dental matrix systems, such as pre-contoured bands and sectional matrix rings, to cater to a broader range of procedures. Additionally, companies are forming strategic partnerships with dental practices and healthcare providers to improve product accessibility and integrate their systems into everyday dental procedures. Training and educational programs are being offered to ensure that dental professionals fully understand the benefits and applications of these advanced systems.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Application

- 2.2.4 End use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Factor affecting the value chain

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing demand for aesthetic and restorative dental procedures

- 3.2.1.2 Rising awareness about oral health

- 3.2.1.3 Technological advancements in dental tools and materials

- 3.2.1.4 Expansion of dental clinics

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced dental matrix systems

- 3.2.2.2 Lack of skilled professionals in developing countries

- 3.2.3 Market opportunities

- 3.2.3.1 Increasing demand for minimally invasive restorations

- 3.2.3.2 Integration of matrix systems with digital dentistry workflows

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Price trends

- 3.5.1 By region

- 3.5.2 By product type

- 3.6 Future market trends

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Reimbursement scenario

- 3.8.1 Impact of reimbursement policies on market growth

- 3.9 Patent Landscape

- 3.10 Consumer behaviour analysis

- 3.11 Porter's analysis

- 3.12 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Competitive market share analysis

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Product Type, 2021 - 2034 ($ Mn)

- 5.1 Key trends

- 5.2 Circumferential matrix systems

- 5.3 Sectional matrix systems

Chapter 6 Market Estimates and Forecast, By End Use, 2021 - 2034 ($ Mn)

- 6.1 Key trends

- 6.2 Hospitals

- 6.3 Dental clinics

- 6.4 Other end use

Chapter 7 Market Estimates and Forecast, By Region, 2021 - 2034 ($ Mn)

- 7.1 Key trends

- 7.2 North America

- 7.2.1 U.S.

- 7.2.2 Canada

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 France

- 7.3.4 Italy

- 7.3.5 Spain

- 7.3.6 Netherlands

- 7.4 Asia Pacific

- 7.4.1 China

- 7.4.2 Japan

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 South Korea

- 7.5 Latin America

- 7.5.1 Brazil

- 7.5.2 Mexico

- 7.5.3 Argentina

- 7.6 Middle East and Africa

- 7.6.1 South Africa

- 7.6.2 Saudi Arabia

- 7.6.3 UAE

Chapter 8 Company Profiles

- 8.1 Bioclear Matrix Systems

- 8.2 Clinician's Choice Dental Products

- 8.3 Denovo Dental

- 8.4 Dentsply Sirona

- 8.5 Dr. Walser Dental

- 8.6 Garrison Dental Solutions

- 8.7 GoldenDent

- 8.8 Kerr Dental

- 8.9 Polydentia (Lifco)

- 8.10 Premier Dental

- 8.11 Pro-Matrix Dental

- 8.12 Safco Dental Supply

- 8.13 Trycare

- 8.14 Water Pik

- 8.15 3M